- demand for nickel to double to 6 million tonnes by 2040

- use of nickel in electric batteries growing from 7% in 2021 to 40% by 2040

- Indonesia forecast to account for 60% of global nickel production by 2030

- markets will remain volatile for the next few years, and then the price could significantly

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Demand for nickel is set to double by 2030 to supply electric battery manufacturers and the energy transition, but markets have still not priced in the difficult for supply to keep up.

There are two major problems: mining capacity, and the environmental credentials of those mines.

Why are markets so comfortable?

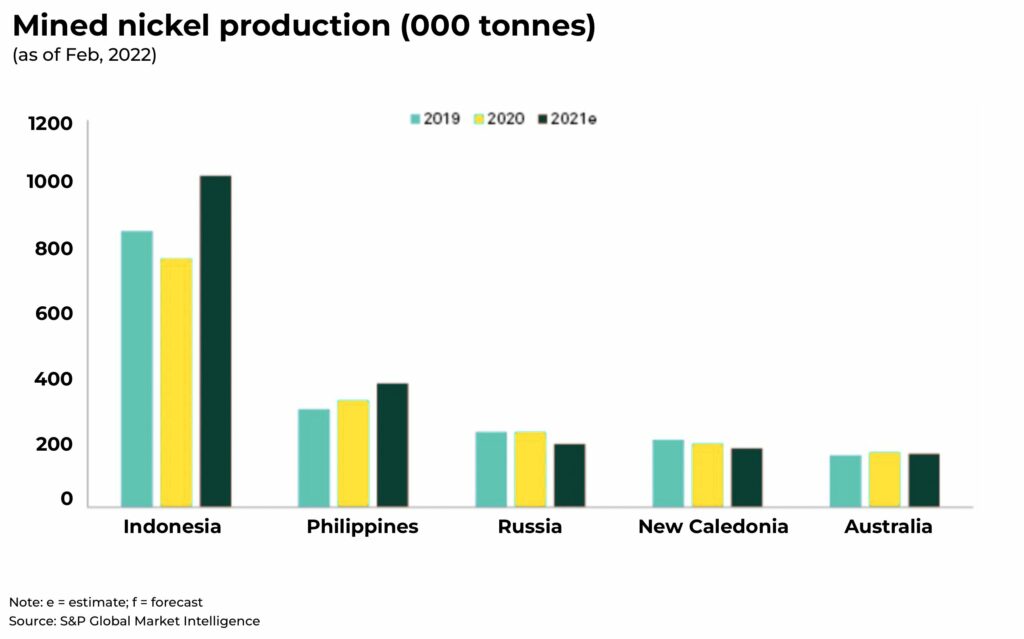

Indonesia accounts for 47% of global output this year, up from 38% in the first seven months of 2021, and may rise as high as 60% by 2030.

Production rose 41% from Jan-August 2022, compared to 2021, pushing up global production by 14%. From a deficit of 146,000 tonnes of nickel last year, there is now a forecast global surplus of 29,000 tonnes for 2022.

This growth in production has been fueled by billions of dollars of investment by China in Indonesia’s nickel mining industry. The latest investment, signed just last month, is a new $1.8 billion agreement signed between nickel miner PT Vale Indonesia and China’s Zhejiang Huayou Cobalt to build a new plant to produce nickel for use in electric batteries.

In the Philippines, the world’s second largest nickel exporter, nickel production rose 17% from 2020-2021, the highest in six years. And, up to twelve new mines, mostly nickel, are coming online this year alone.

And, as nickel production ramps up in the short-term, economic concerns in the US and Europe, as well as the ongoing policy of zero-Covid and lockdowns in China, have helped suppress economic activity and demand.

Demand is about to rise significantly

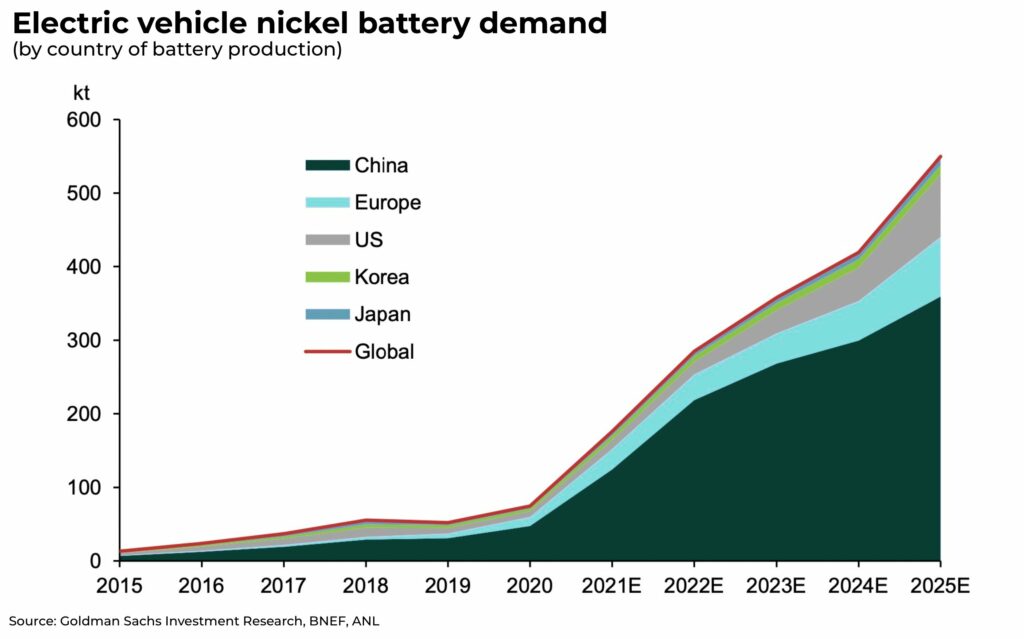

In the long-term, demand for nickel is forecast to double to six million tonnes by 2040, with the use of nickel in the production of electric batteries growing from a share of 7% in 2021 to 40% by 2040. But this rise could happen much faster, with Goldman Sachs estimating, electric batteries will represent 32% of global nickel demand by 2030.

The main driver for this soaring demand is government legislation to ban internal combustion engine vehicles across the world to meet net zero targets. The market for electric vehicles is forecast to grow 6x, with annual sales rising from 6.5million in 2021 to 40 million in 2030. 200 battery gigafactories would be needed, in addition to the 130 gigafactories that already exist, to meet that demand.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Supply is tightening

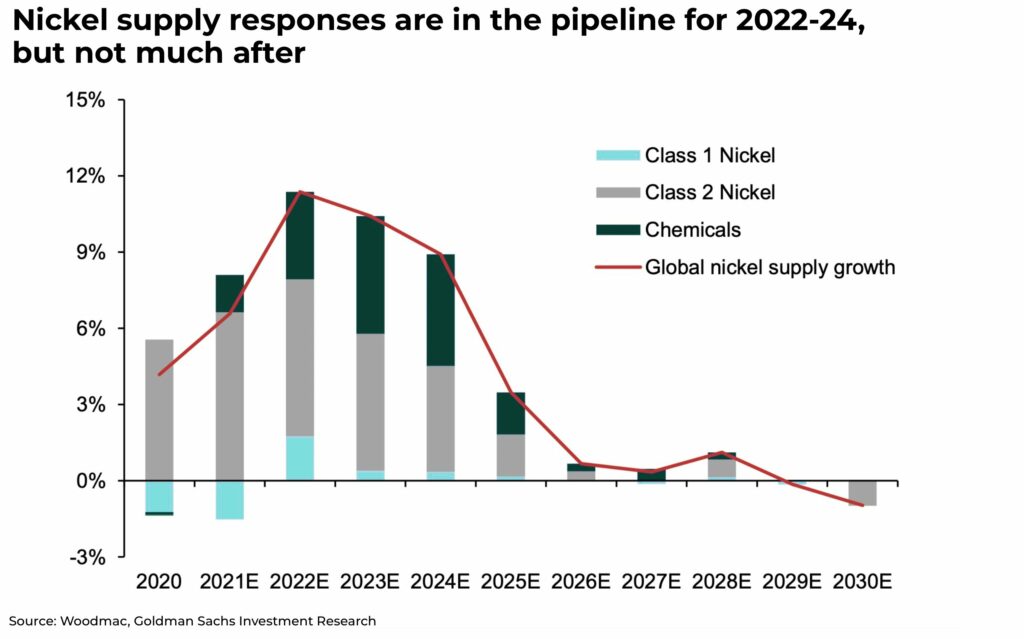

And there is very little new global nickel production capacity coming online before 2030. The problem is cost.

Estimates for new nickel mines, depending on their size and location, are costed on average at approximately US$2 billion but, especially in the West, capital expenditure can over run significantly.

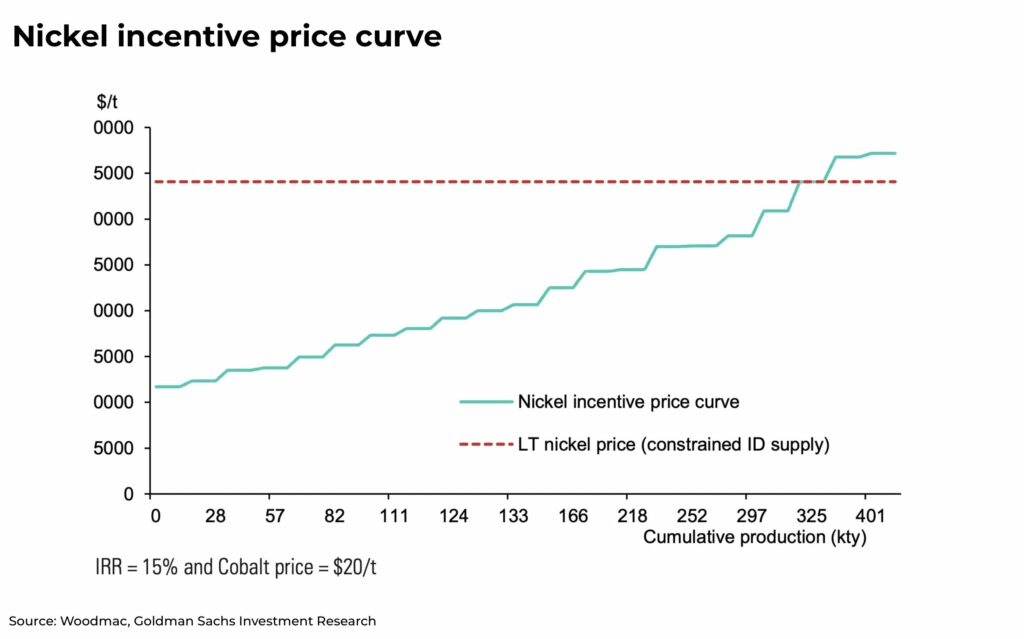

Consistent nickel prices of at least US$34,000 per metric ton are estimated to be needed to encourage the investment in new mines. The cost to ensure supply of nickel and copper keep up with demand is estimated as much as US$350 billion.

And, even if this financing was found today, it can take up to ten years for a nickel mine to be permitted, built and operational.

There are currently 22 costed projects outside of Indonesia, but McKinsey estimates 30% of new annual capacity is at risk in North America because of delays.

And, although nickel from Russia, the world’s third-largest nickel producer, has not yet been targeted by sanctions, many buyers are cautious —especially as the London Metal Exchange considers a metals ban, putting 6% of global supply at risk.

(for further reading, our analysis on whether the West can compete with China’s metal might)

Absent significant fundamental adjustment, the nickel market will not be able to supply the units required for the electrification of the global road transport sector… In its current fundamental gearing, the nickel market is woefully unprepared for the green demand acceleration that lies ahead.

— Goldman Sachs, Green Metals Nickel’s class divide

Class I only

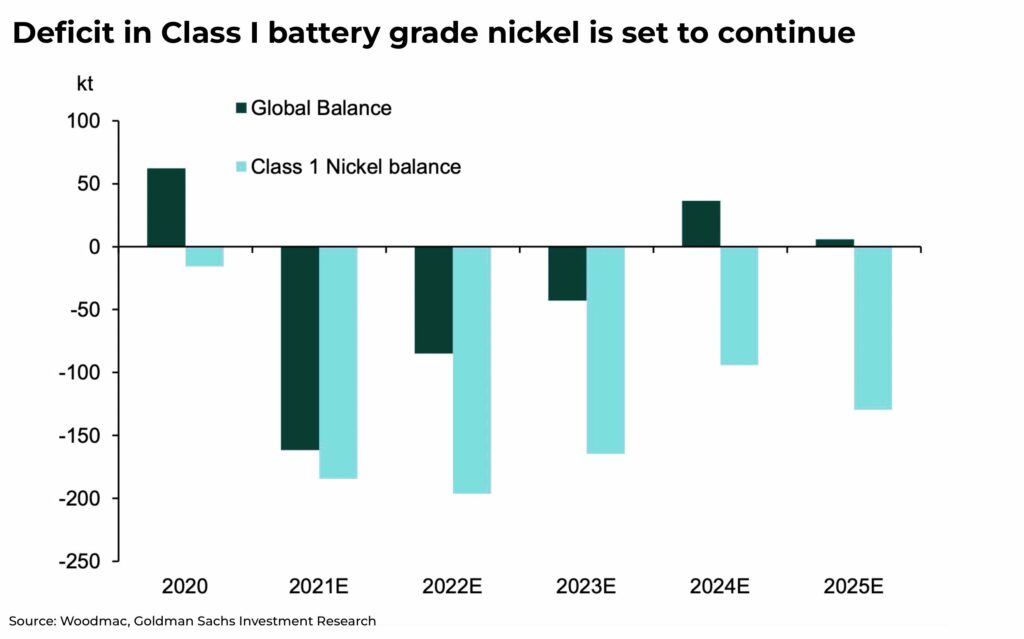

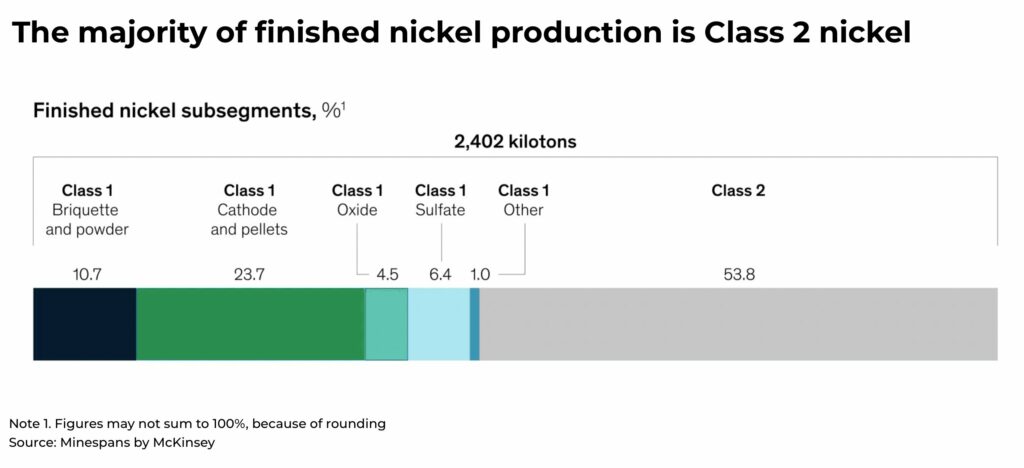

Further limiting supply’s capacity to keep up with demand: there are two types of nickel, Class I and II.

Only Class I can be directly used in electric batteries, and only certain types of Class I. This means that up to 46% of current global nickel production can be used for battery production.

Class I only comes from sulfide and lateritic limonite deposits. Class II in the form of NPI or FeNi is produced from saprolite layer of laterites, which is typically mined below the limonite layer.

Technology exists to turn Class II into Class I, however this technology is more energy intensive and also requires additional processing compared to direct production of Class I nickel from sulphide or limonite ores.

Environmental-friendly supply

Electric vehicle and battery manufacturers are working to buy their nickel from sources that are ESG-friendly as scrutiny on their environmental creditentials grows. Probably best highlighted by Elon Musk’s recent call: “Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

The challenge is to produce nickel that meets environmental, social and corporate governance (ESG) criteria with one of the most notoriously difficult metals to process — each mine must be unique to the ore deposit type — whilst also trying to double supply.

This does not just affect future mines, but existing mines as well.

For example, Indonesia’s climate actions are described as “insufficient” by the Climate Action Tracker. In particular, the High-Pressure Acid Leaching (HPAL) extraction technique used in the country involves sulfuric acid that can have a bit impact on the local environment if not treated and disposed of properly. The government has not yet banned the disposal of waste, so-called tailings, in the ocean.

(read our analysis on a realistic path for improved carbon performance in mining)

Without slack in the system (such as strategic stockpiles and overcapacity), the industry will not be able to absorb short-term (less than five to seven years) exponential growth

— McKinsey, The Raw Materials Challenge

Recycling

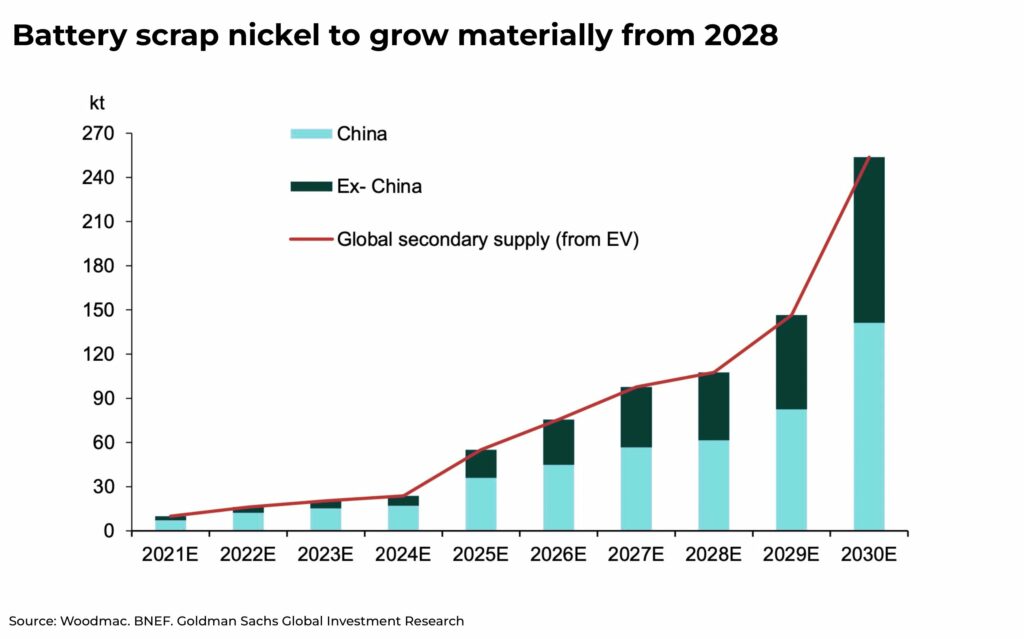

As the price of nickel rises, so too will capacity of recycling to support supply. Estimates forecast that this secondary supply will reach 7% of global nickel supply by 2030.

But it will take time to scale to the quantities needed and even that the projected 254,000 tonnes is still insufficient to make up for the deficit.

And it’s unlikely to have any significant impact until at least 2028 when sufficient electric batteries are in the market and near the end of their lifespan.

Slowly, then all at once

Markets will remain volatile for the next few years, and then — unless any major global legislative changes on net zero targets — the price could significantly, until new mines are operational, and that could take years even if mines are fast-tracked today.

The Oregon Group will be watching this market closely, stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.