Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

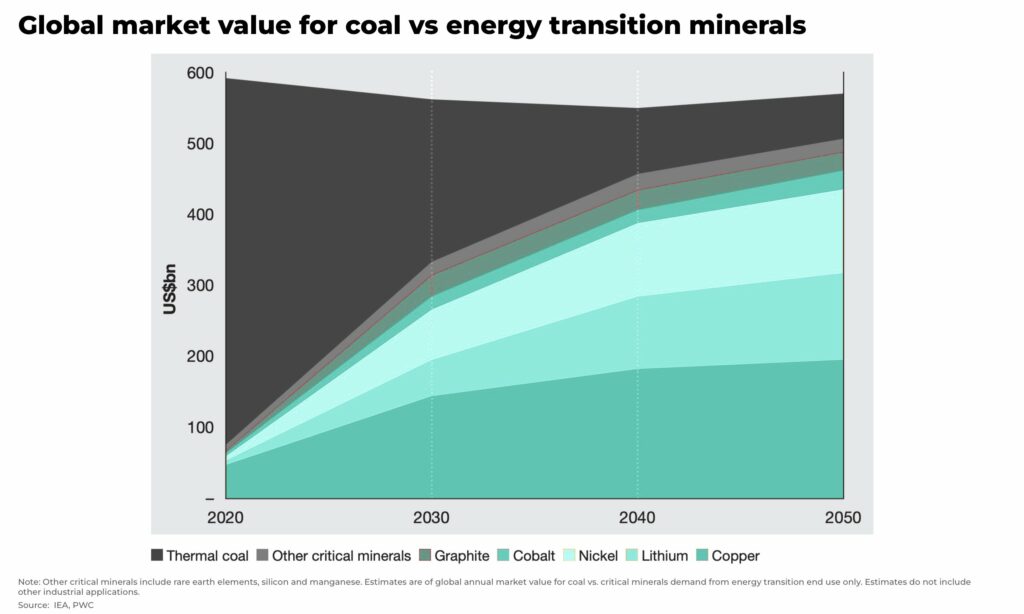

- demand for critical minerals could rise six times by 2040

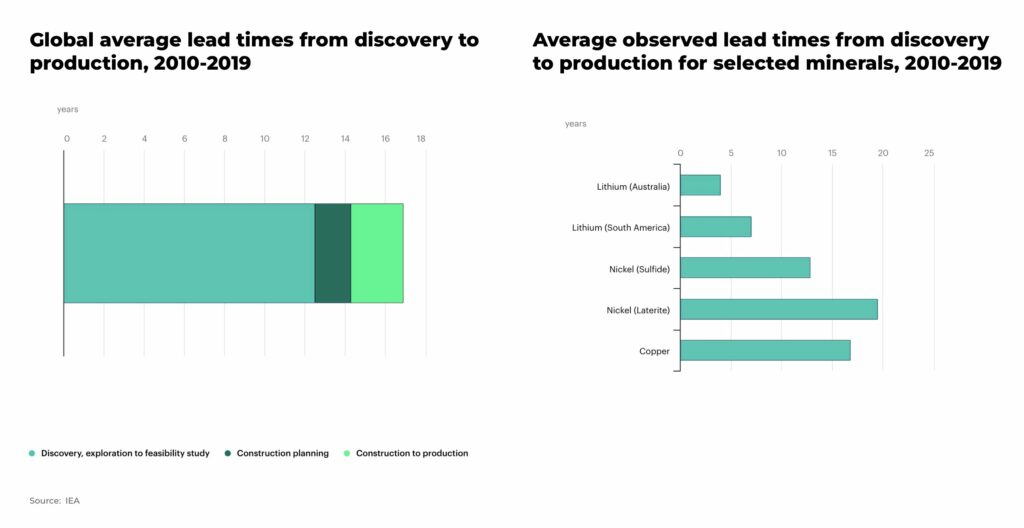

- on average it takes 16 years for a new mine to be approved

- financial premium benefits for ESG mines higher than “traditional” mines

- governments in the West promising to speed up permit approval process

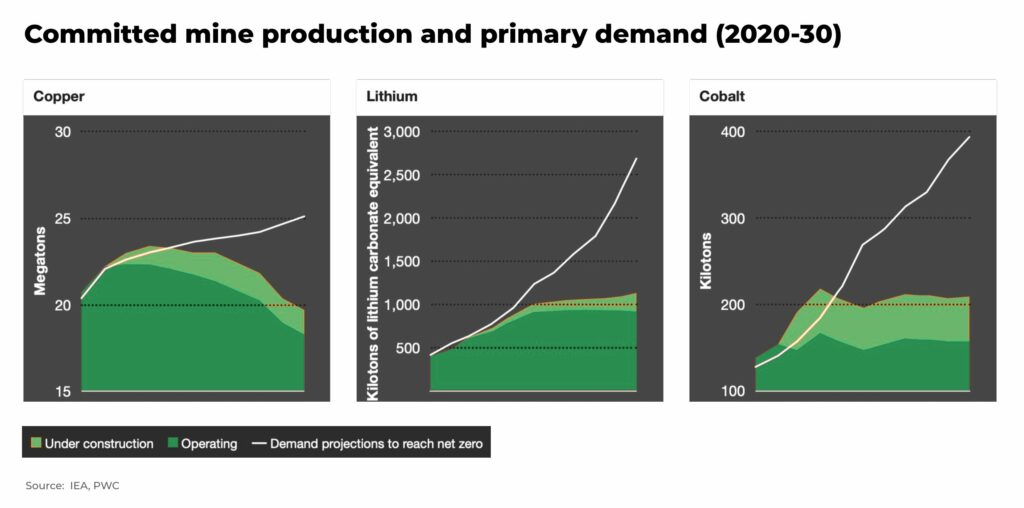

Demand for critical minerals is forecast to increase four times by 2040 to supply the global clean energy transition. A faster transition, to hit net-zero globally by 2050, would require six times more minerals than today.

Such an increase in supply would be historic, and there are numerous challenges in the way — in particular, as ore grades in existing mines deteriorates over time, permitting of new mines and processing plants.

“The production of a solar farm requires three times more mineral resources than a similar-sized coal plant, and constructing a wind farm needs 13 times as much as a comparable gas-fired plant”

— PWC, Mine 2022, A Critical Transition

On average it can take more than 16 years to develop a mine, from discovery to first production.

It’s 2023 now, so on that timescale, 2040 is only 17 years away. Yet, forecasts suggest the current investment in mines under construction is not enough.

And the world, especially the West, is in a hurry.

For example, US President Biden has set a new target for the US to reduce it’s greenhouse gas emissions from 2005 levels by 50-52% by 2030; in the UK, the sale of petrol and diesel cars will be banned by 2030, in California a similar ban will be enforced in 2035; the EU plans to cut greenhouse gas emissions by at least 55% by 2030, and become climate neutral by 2050.

But it’s not just the fight against climate change driving this growth.

The West is also looking to diversify and secure it’s supply of critical metals after its dependency on concentrated, vulnerable supply chains was exposed during the economic lockdowns during the Covid pandemic and Russia’s invasion of Ukraine.

To grow, diversify and secure supply, the West will need to build new mines.

Can it be done?

The timescales can differ, depending on the mineral, location and type of mine to be built, but the 16 years it takes on average to build a mine can be approximately be broken down into: 12 years for exploration, feasibility studies and permitting; and 4 years for construction.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Permitting is key, especially in the US where it can take much longer than Canada or Australia.

Some of the major challenges to getting permits and building new mines include:

- environmental regulation

- community support

- local and national governance laws (eg in the US from Department of Natural Resources, MSHA, and the EPA)

Permitting issues are particularly acute for companies in the West where environmental law is not only stricter than the developing world, but also scrutiny by both government and investors — driven by consumer sentiment — is increasing on any corporate environmentally-friendly operating claims.

“83% of mining and metals CEOs see meeting customer expectations as an influential factor that supports meeting their net-zero commitment”

— PwC’s 25th Annual Global CEO survey

In Serbia, last month, the government cancelled a US$2.4 billion investment with Anglo-American in a new lithium mine, after protests by environmental groups.

China’s investment in its major nickel mining and processing industry in Indonesia, for example, faced significantly less of these challenges.

But fast and cheap mining is not an area where the West can beat China and other developing countries — and neither do we think it needs to.

(As highlighted in our latest nickel analysis, environmental challenges offer an opportunity to the West)

This means, for the West, it can take longer to build a mine and therefore the initial investment is likely to be higher. Estimates suggest an increase in investments could increase between US$100 million – US$130 million for a 25 million metric ton run-of-mine facility.

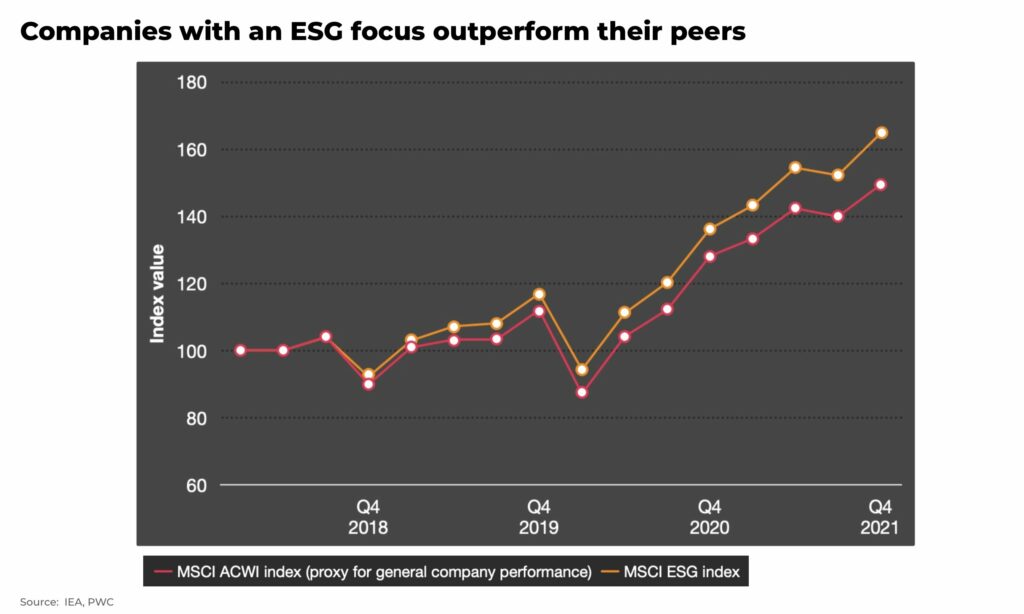

But the rewards could be significant:

- companies with ESG focus have outperformed their peers

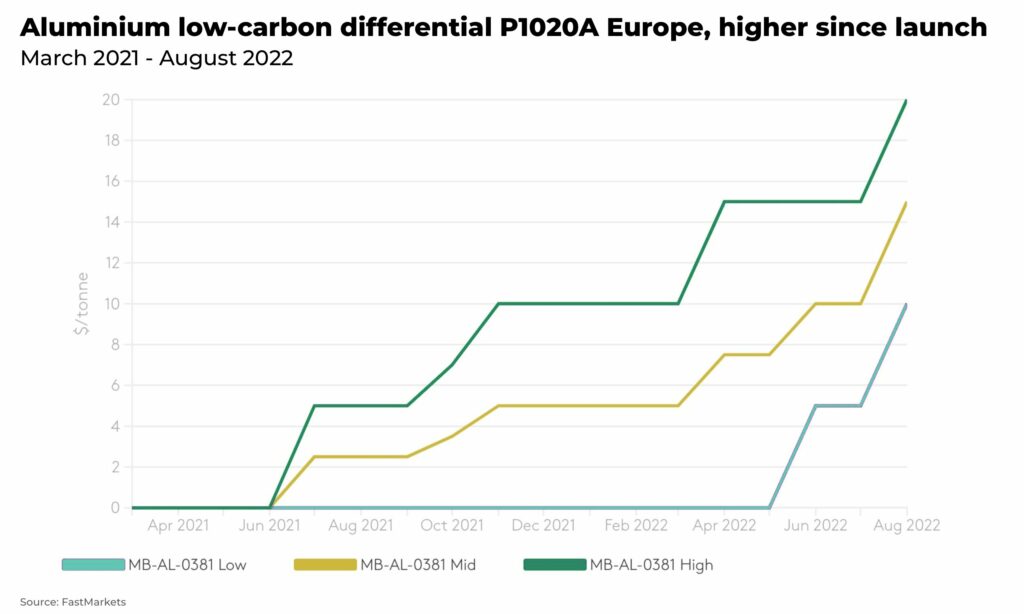

- and the premium on “green” metals, such as aluminium and nickel, shows companies are willing to pay more for metals from low carbon sources (in 2021, S&P Global’s ‘green aluminium’ pricing index showed customers willing to pay an extra US$10–$15 per tonne for aluminium made sustainably)

There are two reasons for the rise in returns:

- there’s not enough supply coming online to meet expected demand, so prices rise

- and companies are desperate for renewably-sourced raw materials to offset greenhouse gas emissions from their operating costs. Mining is a significant part of that equation

For a typical electric vehicle, greenhouse gas emissions are roughly half of a car with an internal combustion engine. This has the potential to be reduced even further with “green” mining efficiencies.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The coming crisis

All the environmentally-friendly operating processes still do not necessarily speed up the problem of a very lengthy permitting process — and the sharply rising demand for metals.

Governments now appear to be working on ways to speed up these delays, including:

- the Biden Administration has invoked the Defense Production Act to provide support for the mining of critical metals and announced a series of acts to support critical mineral supply chains, as well as the Inflation Reduction Act with tax breaks and credits for mining companies; the Republicans, now in charge of the House, have also announced a plan to cut mining permitting review time in half

- Canada is looking to streamline it’s permitting processes for critical metals

- the UK has announced it’s first-ever critical minerals strategy

- and arguably the most prominent example — although not a mine — is the new LNG terminal installed in record time in Germany as the country manages the crisis of natural gas being shut off from Russia. There’s nothing like a crisis to focus minds

(We would also suggest that there needs to be better resourcing of regulators to ensure applications are fast-tracked)

How should investors position their portfolio

Investors need to look beyond public relations when investing in mining companies:

- what concrete actions are the mining companies taking to be environmentally-friendly, for example, Rio Tinto is working to produce carbon-free aluminium on scale and already started selling it to Apple for product manufacturing; or BHP has started to supply nickel sulphate to Tesla, Toyota and Panasonic to make more efficient electric batteries

- companies that are developing new technologies to produce minerals more efficiently and sustainably

- look for companies signed up to transparent initiatives such as Initiative for Responsible Mining Assurance, Copper Mark, or Transition Pathway Initiative

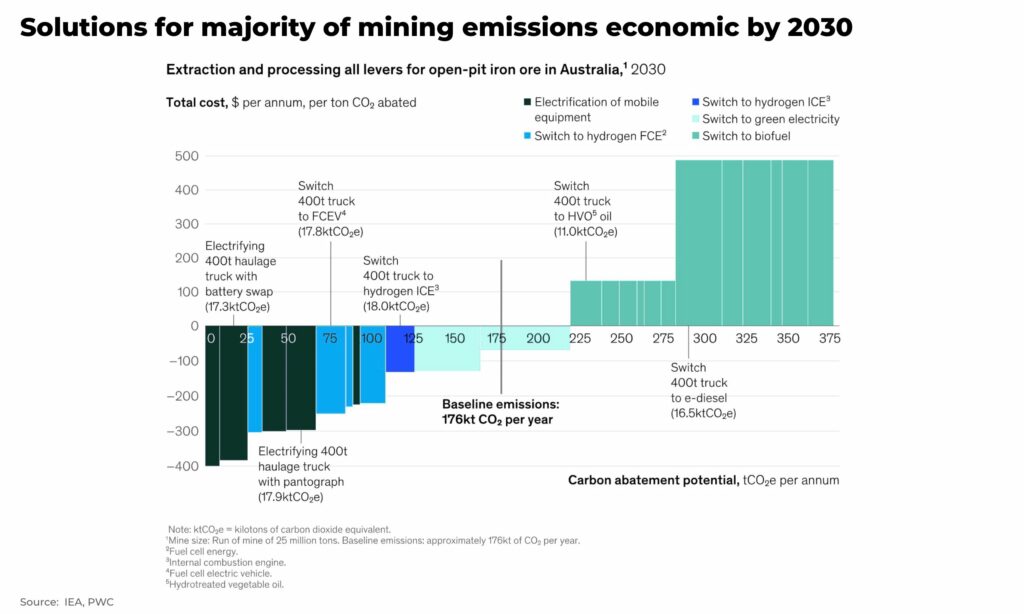

- companies setting up long-term investment in operating processes that reduce greenhouse gas emissions, such as the decarbonization of haulage trucks (which has potential to reduce a mine’s emissions by 25%), use of synthetic fuels and biofuels, building out green hydrogen capacity, and carbon capture

- there are also funds, such as BlackRock — the world’s biggest asset manager, which oversees around $8 trillion for investors — that remains committed to their call for ESG-only investing

By leveraging the potential of “green” metals and solving the timeline issue for permits, investors can benefit, not only the growing demand for environmentally-friendly metals to take on climate change, but also their own portfolio.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.