- global hydrogen demand could increase 7-fold under global net zero by 2050 scenario

- natural gas prices currently priced at US$6-12/MMBtu in Europe, green hydrogen could be produced for US$1/MMBtu by 2030

- US to invest US$9.5 billion in green hydrogen development; EU to invest US$14 billion

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The global market for hydrogen generation has the potential to double to US$250 billion by 2030 and over US$1 trillion by 2050 — significantly decarbonizing vast swathes of global energy production.

There has been plenty of hype and false starts for hydrogen power, while alternatives such as solar, wind and lithium-ion batteries successfully hit their commercial stride and, in the case of the battery market, have been a roaring success for green tech investors.

“We believe that this is not another false start for hydrogen”

— Goldman Sachs, “The clean hydrogen revolution” (2022)

However, hydrogen’s future is starting to look a lot more secure, which is good news for investors, as well as commodities and carbon offsets.

What is hydrogen? What is it used for?

Hydrogen is the most simple, common and lightest element. And, most importantly for the fight against climate change, it releases significant amounts of energy when it combusts, and it does so without releasing carbon dioxide or other toxic emissions.

The element comes in a variety of “color” types, including:

- Green hydrogen, made via electrolysis which splits water into hydrogen and oxygen using renewable energy, such as solar or wind, so the entire production cycle is carbon neutral

- Grey hydrogen, made using natural gas or methane which releases carbon dioxide into the atmosphere

- Blue hydrogen, also made from fossil fuels, but any carbon emissions released are captured and stored

As things stand today, hydrogen’s climate change creds are far from ideal. Only 1-2% of hydrogen produced in 2019 was green hydrogen. Currently, most of the 70 million tons of both grey and blue hydrogen currently produced is used to create fertilizer, emitting over 800 million tons of carbon dioxide — the same emissions as the UK and Indonesia combined.

But almost all future growth is likely to be green hydrogen that will provide clean energy for industry and transportation, as governments and business try to meet their net-zero targets.

The heat from hydrogen combustion creates enough energy to replace coal in heating steel-making furnaces (the heat created from many renewables cannot create such high temperatures and so is highly reliant on coal), helping to offset carbon emissions from industry, estimated at 25% of all global emissions in 2020.

Hydrogen can recharge a vehicle as fast as gasoline, unlike the longer charging times for lithium-ion batteries. Releasing only heat and water, hydrogen can help alleviate carbon emissions emitted by global transport.

And, any excess energy from renewable power, for example, from solar on a sunny day, can also be transformed into hydrogen and stored for a cloudy day when power output is down.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The growth potential

Because of such potential, Goldman Sachs estimates global demand for hydrogen could increase 7-fold to >500 Mt H2 pa under a global net zero by 2050 scenario.

Over 30 countries have now released national hydrogen strategies, including the US, China, Canada, UK, Japan, France, Germany and Australia.

In its US$1 trillion infrastructure bill, passed in 2021, the US set out a hydrogen roadmap with US$9.5 billion of government funding for green hydrogen development with at least four regional hydrogen hubs; and, this year, the European Union has thrown its weight behind a US$14 billion hydrogen power project that includes 10 gigawatts of electrolyzers. There are now at least 990 hydrogen projects in development.

The challenge for the widespread use of green hydrogen has been the cost and capacity of renewable energy in the electrolysis process. But costs for solar and wind have fallen over 70% in the last 10 years, and expected to fall further; the costs of alkaline electrolyzers made in the US and Europe fell by 40% between 2014-2019; and with new government funding, capacity is also ramping up fast.

But, with natural gas prices after the Russian invasion of Ukraine currently priced between US$6-12/MMBtu in Europe, a unique opportunity for hydrogen has opened, with estimates suggesting green hydrogen could be produced for as low as US$1/kg by 2030.

As the West takes on the challenge of a new energy crisis and record inflation, green hydrogen offers not only growth but security.

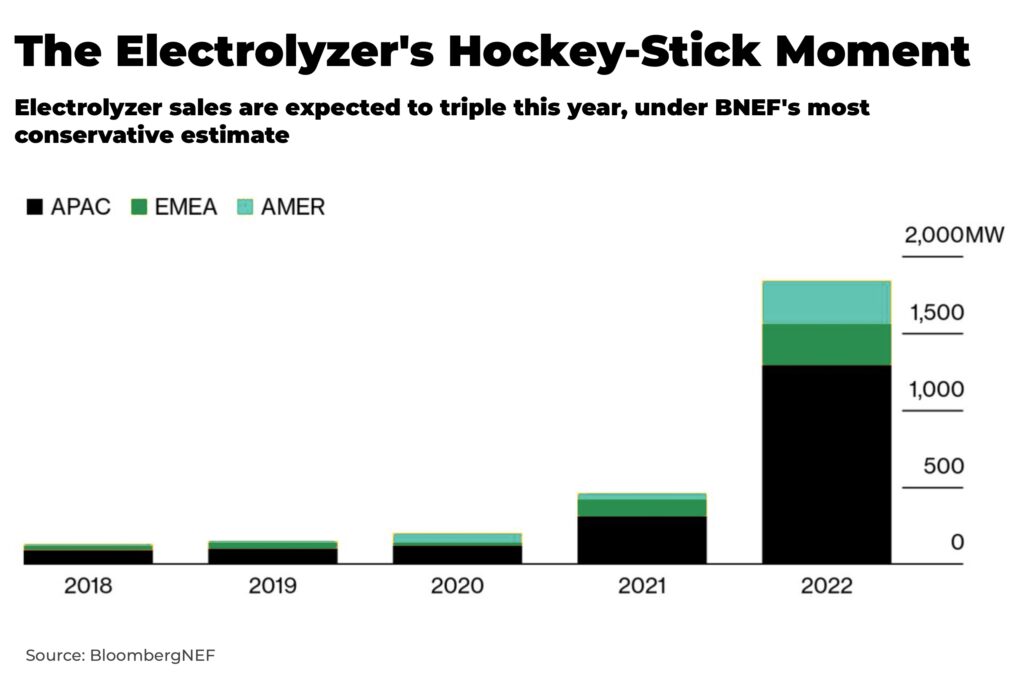

The total installed capacity for the process of electrolysis in 2020 was only 0.3GW, but current investment means this capacity is projected to reach 80GW by 2030. Europe has 40% of global electrolysis capacity, the largest in the world, and is expected to remain the industry leader until at least 2030.

In transportation, hydrogen has been overtaken by lithium-ion battery powered electric vehicles, but because of its fast, high-energy refuelling time and light weight, it is ideal for long-haul, heavy transport vehicles such as trucks, ships and, maybe, airplanes. Volvo Trucks has announced a new zero-emissions truck that claims “an operational range comparable to many diesel trucks – up to 1,000 km – and a refuelling time of less than 15 minutes.”

So where can you as an investor get exposure to hydrogen?

Electrolyzers are the critical building block for creating green hydrogen. And according to BloombergNEF, worldwide sales are expected to triple this year.

The competition between the West and China to lead in this market means we would certainly recommend looking at the companies responsible for these developments, whether early stage research companies increasing electrolysis efficiency and reducing cost, or processing companies.

“It may be the kind of hockey-stick moment solar power experienced a decade ago.”

— BloombergNEF

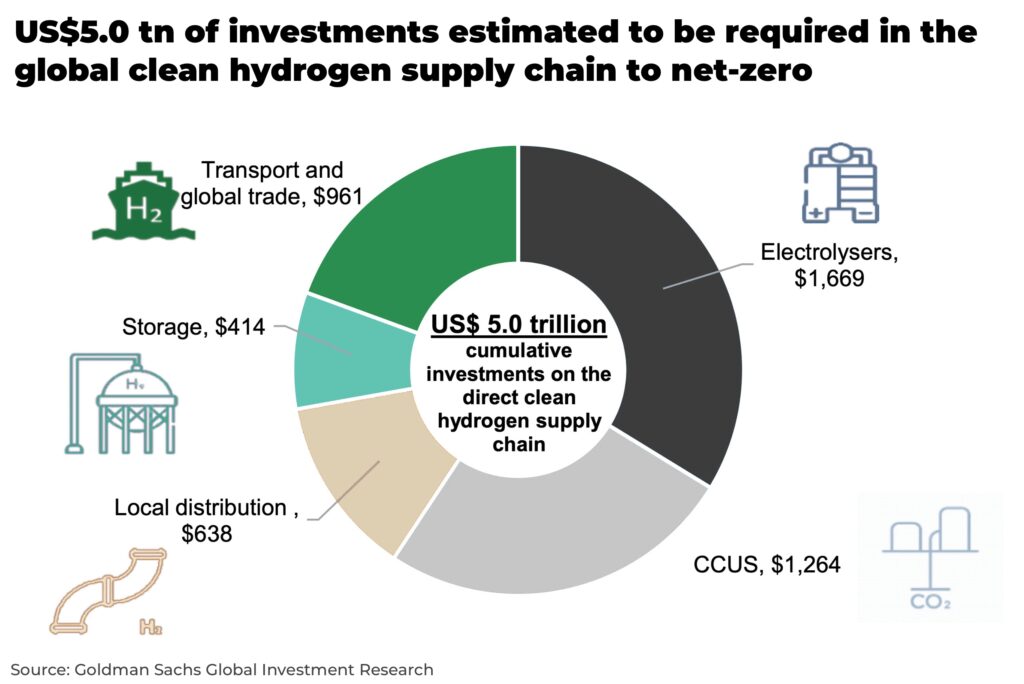

The infrastructure required to transport green hydrogen also needs to be built from the ground up, in particular storage and transport.

Hydrogen pipelines can have significant upfront costs, often more expensive than gas pipelines, due to the thicker walls needed to stop leakage of the light element. But estimates suggest global pipeline length will need to quadruple to at least 20,000km to meet net-zero targets and, once built, act as a catalyst to capacity build out.

The key commodity, apart from water, is nickel, with 39 thousand tonnes of extra global demand expected. Although this represents only a small percentage of current global nickel demand, it will be significant as a market mover as demand for electric cars rises and the market tightens.

Carbon credits via the voluntary carbon credit markets also offer investors an opportunity for exposure. Hydrogen must be manufactured, unlike fossil fuels which can be extracted, so is always likely to be baseline more expensive. As governments try to meet the Climate Change Paris Agreements, a carbon price on emissions allows hydrogen to compete, therefore helping to push up carbon credit prices.

Much of the focus is on the potential of green hydrogen, but blue hydrogen (produced mostly from natural gas split into hydrogen and carbon dioxide) is cheaper and according to some estimates, forecast to grow at a faster pace. This will mean more investment in carbon capture and storage, essential to ensuring blue hydrogen is “clean.”

Hydrogen has been through cycles of high expectations before, but with new, large-scale government support, falling processing costs, net-zero deadlines, as well as high fossil fuel prices, this is a space we will be watching closely.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.