Investment Insights. Stay Ahead.

US plans $2.7 billion investment to restore uranium enrichment

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

- US Department of Energy awards $2.7 billion to restart domestic uranium enrichment after decades of decline

- the move targets HALEU fuel, now critical for next-generation nuclear reactors and defense applications

- US currently relies heavily on Russia-linked enrichment services

- enrichment capacity, not uranium mining, is now the tightest bottleneck in the US nuclear fuel cycle

The US US Department of Energy has awarded US$2.7 billion to restore American uranium enrichment capacity, largely abandoned three decades ago, aiming to reduce reliance on foreign — and increasingly adversarial — suppliers.

The funding will support commercial-scale enrichment, early deployment of advanced centrifuge technology, and the production of high-assay low-enriched uranium (HALEU) — fuel enriched between 5% and 20% U-235. HALEU is essential for most advanced reactor designs now backed by US policy and capital.

Why enrichment is the weak link in the uranium supply chain

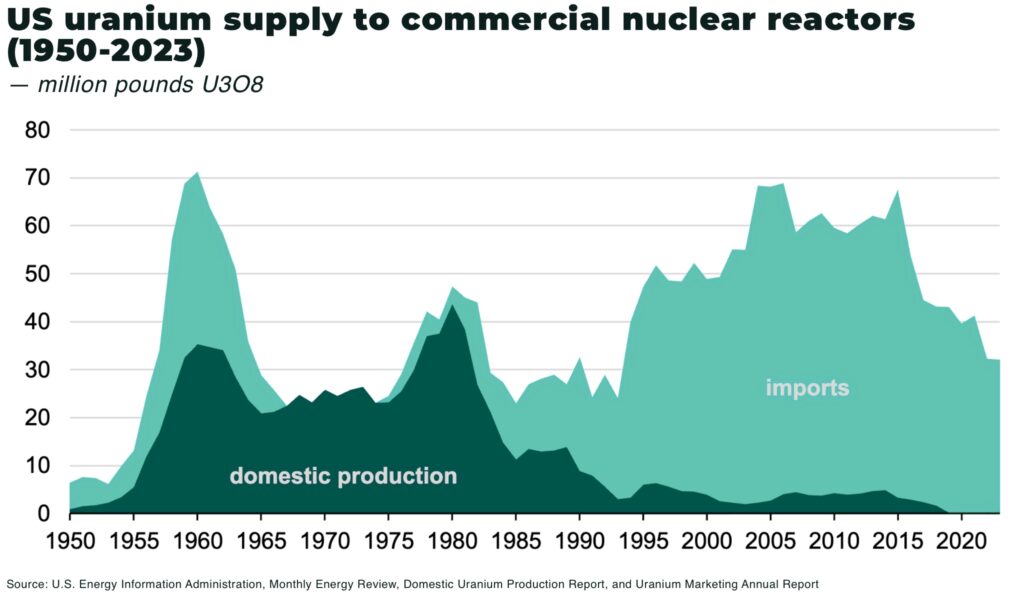

The US once dominated uranium enrichment. That system collapsed in the 1990s as cheap Russian supply flooded global markets under the “Megatons to Megawatts” program. Today, the US has no commercial HALEU enrichment capacity and only limited conventional enrichment, according to the DOE.

Globally, enrichment is concentrated. Russia’s state-owned Rosatom controls an estimated 40% of global enrichment capacity. The United States imports 20-25% of its enriched uranium from Russia. Even after sanctions following the invasion of Ukraine, Russian material continues to flow into Western fuel cycles under waivers and exemptions.

For the US, that dependence has become untenable. Advanced reactors backed by federal loan guarantees, Pentagon contracts, and Big Tech power purchase agreements cannot proceed without assured domestic fuel supply.

“President Trump is catalyzing a resurgence in the nation’s nuclear energy sector to strengthen American security and prosperity,” said US Secretary of Energy, Chris Wright. “Today’s awards show that this Administration is committed to restoring a secure domestic nuclear fuel supply chain capable of producing the nuclear fuels needed to power the reactors of today and the advanced reactors of tomorrow.”

What Is HALEU — and why it matters now

HALEU is not a niche product. The majority of next-generation reactors — including small modular reactors (SMRs), microreactors, and fast reactors — require it. The DOE estimates initial US demand for HALEU could reach tens of tonnes per year by the early 2030s, scaling sharply thereafter.

Projects from companies like TerraPower and X-energy are already delayed by fuel availability. Without domestic enrichment, the US would be forced to source HALEU from Russia — the only commercial supplier today — or delay reactor deployment indefinitely.

Inside the DOE plan — rebuilding the fuel cycle

The US$2.7 billion award is part of a broader effort to rebuild the entire US nuclear fuel supply chain — from conversion and enrichment to fabrication. The DOE’s HALEU programs support:

- commercial-scale centrifuge enrichment

- demonstration of advanced enrichment technologies

- long-term contracts to anchor private investment

The following companies were awarded task orders totaling $2.7 billion to provide enrichment services for LEU and HALEU:

- American Centrifuge Operating ($900 million) to create domestic HALEU enrichment capacity

- General Matter ($900 million) to create domestic HALEU enrichment capacity

- Orano Federal Services ($900 million) to expand U.S. domestic LEU enrichment capacity

The strategy mirrors earlier US interventions in semiconductors and rare earths: public capital to de-risk infrastructure the market cannot rebuild alone.

Crucially, this funding is structured to catalyze private capital, not replace it. Enrichment is capital-intensive, regulated, and politically sensitive. Without government support, the economics simply do not clear.

Why this fits the bigger nuclear reset

The enrichment push sits within a wider nuclear revival. Global nuclear capacity is set to expand as governments chase firm, low-carbon power. The US alone has committed billions in loan guarantees, tax credits, and direct support for reactors, fuel, and supply chains.

As previously outlined in our Nuclear Energy Is Back analysis the bottleneck is no longer demand. It is execution — and fuel availability is at the center of that challenge.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

How tokenization could transform investments and industries

The last decade brought crypto, which fundamentally changed how we think about money and settlement. Now, the next great shift—tokenization—is upon us.

Digital wallets, which are already routine for many of us, are paving the way. Bank of America recently reported that by 2026, more than 5.3 billion people will use digital wallets—over half of the global population. That sheer scale is why I see wallets not just as a payment convenience, but as the infrastructure layer for tokenized assets, including commodities and equities.

From everyday payments to tokenized value

The pandemic accelerated a shift that had been building for years. Consumers who once resisted digital payments began using wallets. Now, nearly 90% of smartphone owners send or receive money through wallet-enabled apps, according to Bank of America.

Tokenization sits at the core of this technology. Digital wallets transmit secure aliases, or tokens, instead of sensitive account numbers. That same process, which today makes paying for coffee safer, will soon support tokenized assets—whether that’s a share of stock, gold, a carbon credit, or a royalty or stream.

In other words, digital wallets are teaching billions of people how to interact with tokenized value, and are becoming the user interface for the tokenized economy. Here are four major ways tokenization will transform investments and industries.

US-backed $7.4bn smelter escalates critical minerals decoupling from China

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

- US has backed a $7.4bn critical minerals smelter to be built by Korea Zinc, the world’s largest zinc smelter

- facility, planned for Tennessee, will process antimony, gallium, germanium, zinc, copper, lead, precious metals, and rare earths

- commercial production expected to ramp between 2027 and 2029

The US has thrown its weight behind a US$7.4bn critical minerals processing plant to be built by Korea Zinc, underscoring how refining and smelting — not just mining — have become a key strategic battleground in the global minerals race.

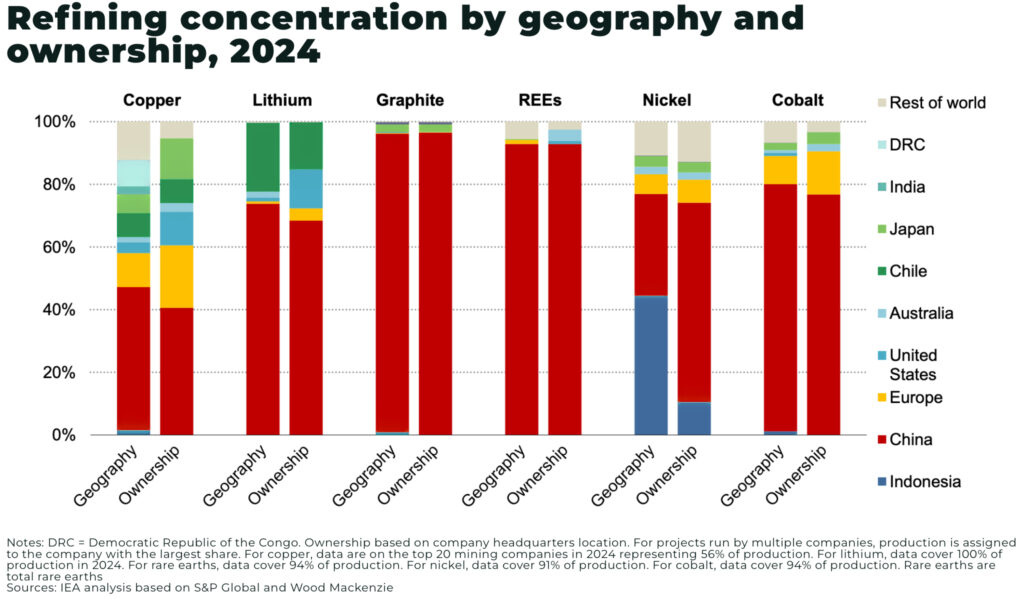

Korea Zinc confirmed that the US government requested the facility to address mounting supply-chain risks for metals essential to industries ranging from automotive and electronics to defence systems. The move comes as Washington steps up efforts to counter China’s dominance across downstream processing, where Beijing controls large shares of global refining capacity for multiple strategic metals.

This is not a marginal project. It is one of the largest foreign investments in US critical minerals infrastructure to date—and a clear signal that the US is now willing to deploy capital, policy tools, and allies to rebuild industrial capacity it allowed to atrophy for decades.

Crucially: China accounts for approximately 85% of global critical mineral processing capacity.

What will the smelter produce — and why it matters

According to regulatory filings and disclosures, the Tennessee facility will produce a wide slate of materials, including antimony, gallium, and germanium, alongside zinc, copper, lead, precious metals such as gold and silver, and rare earth elements.

As have highlighted in our analysis, these are not niche metals:

- antimony is critical for flame retardants, ammunition, and military alloys

- gallium and germanium are essential inputs for semiconductors, power electronics, radar systems, and infrared optics

- zinc and copper underpin everything from grid infrastructure to EV charging networks

China currently dominates the processing of many of these materials and has placed strict export controls on several, including germanium and gallium, over the past two years. That reality has forced US policymakers to confront an uncomfortable truth: domestic mining means little without secure downstream capacity.

Project structure: public capital, private execution

Korea Zinc’s board has approved the formation of a foreign joint venture that will include the US government, an unusually direct level of state involvement for a metals processing project.

The JV is expected to raise around $2bn, with the remainder of funding coming from a mix of US government loans, grants, and capital contributions from Korea Zinc. The company plans to acquire and redevelop a Nyrstar-owned smelting site in Tennessee, upgrading it to produce 13 different metals and sulphuric acid used in chipmaking.

Target output levels are substantial:

- 300,000 tonnes of zinc per year

- 35,000 tonnes of copper

- 200,000 tonnes of lead

- 5,100 tonnes of rare earths annually

Commercial operations are expected to begin gradually between 2027 and 2029, placing the project squarely within the window when analysts expect structural deficits in multiple critical minerals to intensify.

Why Korea Zinc — and why now?

Korea Zinc is the world’s largest zinc smelter and a producer of several materials already under Chinese export controls, including antimony, indium, tellurium, cadmium, and germanium.

The project also follows a broader South Korea–US economic realignment. In late October, Seoul agreed to invest US$350bn in the US as part of a trade deal aimed at reducing tariffs and strengthening strategic supply chains. Korea Zinc’s chair was part of a senior South Korean business delegation to Washington earlier this year, highlighting the political weight behind the investment.

Markets reacted quickly. Korea Zinc shares jumped as much as 27% following local media reports of the agreement, reflecting investor recognition that state-aligned processing assets now command strategic premiums.

The Bigger Picture: From Mining Security to Industrial Sovereignty

This project reinforces a critical shift in US policy thinking. The focus is no longer just on securing upstream supply, but on rebuilding industrial sovereignty across the entire value chain.

Smelters are expensive, politically sensitive, environmentally complex, and slow to permit — precisely why China dominates them. By underwriting a $7.4bn facility with an allied operator, the US is signalling that processing capacity is now a national-security asset, not just an industrial one.

Find out more from our analysis on how refining is the chokepoint:

(Photo credit: Korea Zinc)

How Tokenization Is Changing Commodity Valuation Models

Tokenization is reshaping conversations about access, liquidity and transparency in the commodity markets. In a previous article, I explored why this shift matters strategically, who should participate and how.

But I think what has received less attention is its impact on valuation itself. When the underlying market mechanics of commodities evolve, the very way investors price those commodities must evolve too.

Tether Gold, a token, now reportedly owns nearly $12 billion in gold. With gold sitting at or near all-time highs, you have to wonder what the impact of this and similar gold tokens has had on the physical market and what it means for the tokenization of other commodities.

Liquidity As A Valuation Variable

Traditional commodity valuation models assume illiquidity as a constant. Oil, copper or nickel may trade on exchanges, but physical ownership—warehouse receipts, offtake contracts or royalties—does not. Investors demand an “illiquidity discount” for holding real assets that are difficult to sell, finance or verify.

Tokenization collapses that discount. When a physical asset can be represented by a compliant, verifiable token and traded frictionlessly across global markets, the cost of liquidity declines and valuations rise accordingly.

Consider how this played out with Real Estate Investment Trusts (REITs) or Exchange Traded Funds (ETFs). Once an asset became easy to own and sell, investors paid a premium for convenience and accessibility. Tokenized commodities should follow the same trajectory, with liquidity itself becoming a driver of return.

Price Discovery In Continuous Markets

Commodities have historically been priced through centralized exchanges and bilateral contracts—systems that close each afternoon and reopen the next day. Tokenized assets, however, never sleep.

A 24/7 market means price discovery becomes continuous. A nickel token held in wallets across Asia, Europe and North America could trade in real time based on regional demand, foreign exchange shifts or even social sentiment. That constant feedback loop compresses arbitrage opportunities, making prices more reflective of global supply and demand conditions.

For portfolio managers, this creates both a challenge and an opportunity. The challenge: Volatility will increase as markets digest information around the clock. The opportunity: Price accuracy improves. The “closing price” becomes less meaningful than the aggregated digital footprint of trades across geographies and time zones.

The next energy shock won’t be oil — it’ll be critical minerals, warns IEA

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Key takeaways

- China refines 70% of 20 strategic energy minerals and leads production in 19 of them

- Half of all strategic minerals now subject to export controls, up sharply since 2023

- Copper faces a 30% supply shortfall by 2035, even as nickel and cobalt supply catches up

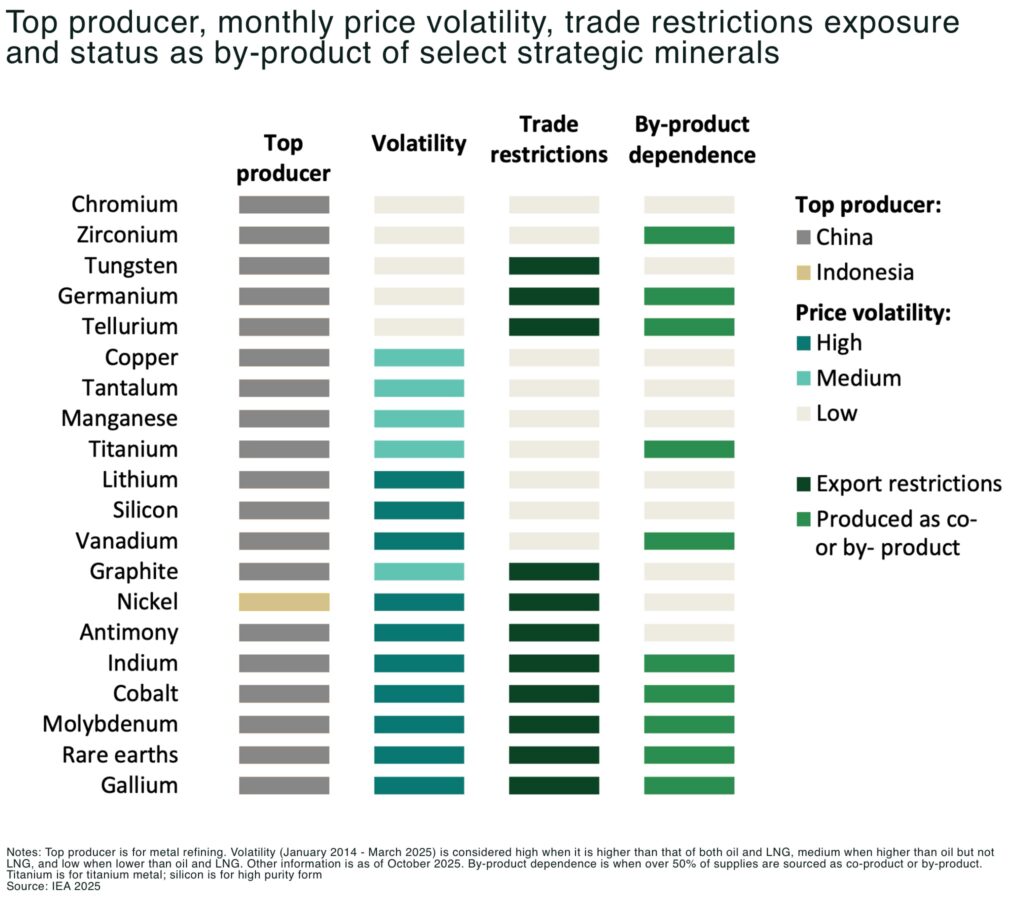

- Price volatility for three-quarters of critical minerals now exceeds that of crude oil

The International Energy Agency’s World Energy Outlook 2025 redefines energy security for the electric age: not oil or gas, but critical minerals are now the system’s fault line. The report’s central message is clear — the energy transition’s raw material foundation is dangerously concentrated, geopolitically exposed, and still tightening.

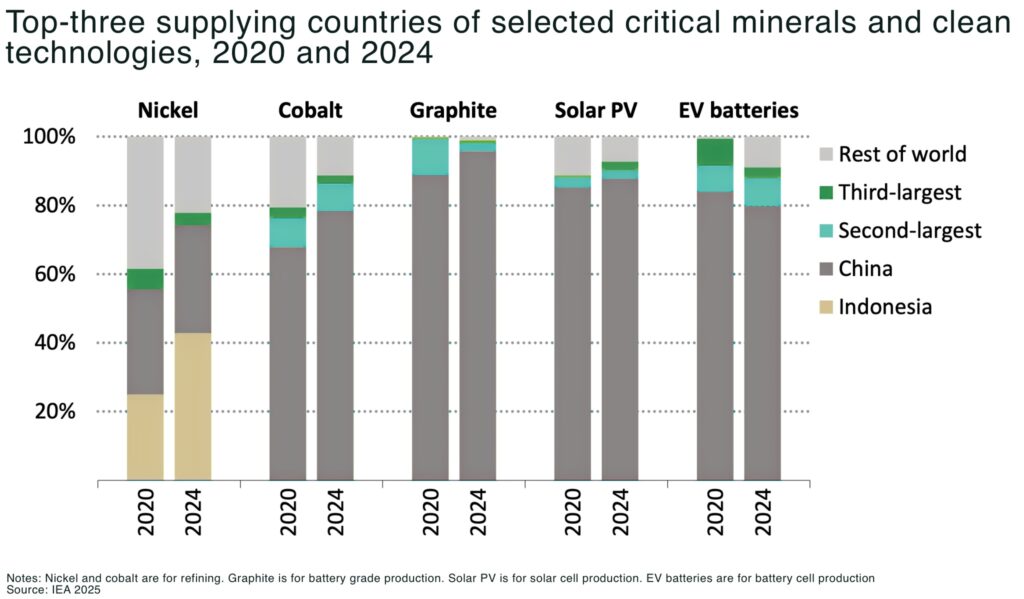

Concentration worsens despite global push for diversification

Refining of critical minerals has become more concentrated since 2020, not less, according to the IEA:

- the top three refining nations now control 86% of global capacity, up from 82% four years ago

- China the dominant refiner for 19 out of 20 energy related strategic minerals, with an average market share of around 70%

- and China holds over 80% of global battery supply chain capacity across every stage, from anodes to cells

Even under the IEA’s Stated Policies Scenario (STEPS), concentration barely improves by 2035, declining only to 82%, effectively back to 2020 levels. This means diversification efforts remain mostly symbolic without significant new refining investment outside Asia.

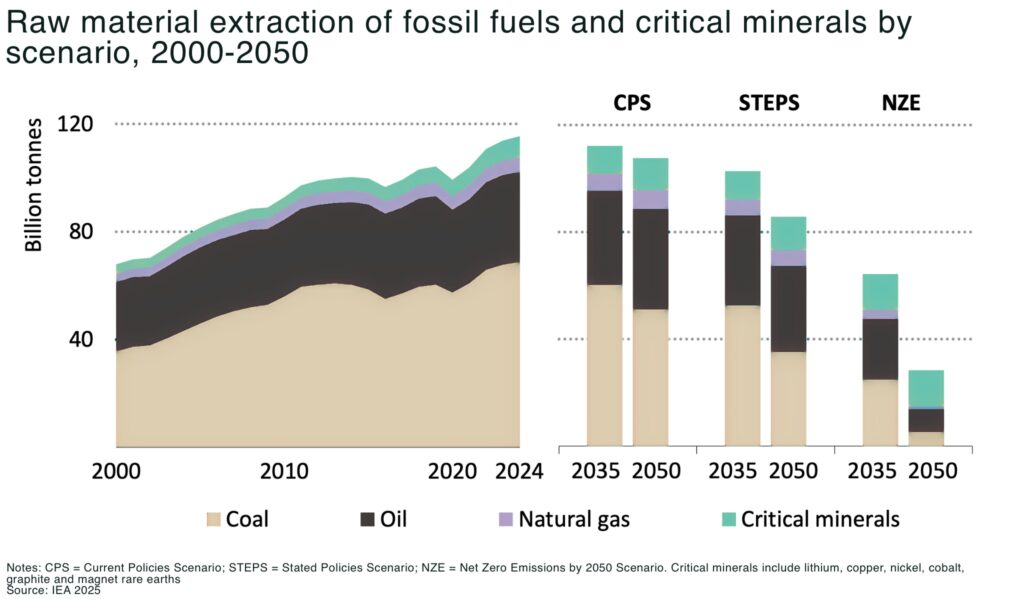

The global energy system requires the extraction of vast quantities of materials from fossil fuels to critical minerals. The total weight of useful products for the energy system was estimated at 17 billion tonnes in 2024. Even larger quantities of material are extracted to deliver these useful products.

The minerals in question are vital for power grids, batteries and electric vehicles (EVs), but they also play a crucial role in AI chips, jet engines, defence systems and other strategic industries.

Export controls are the new geopolitical leverage

The IEA identifies 2025 as the turning point when “the risks that we identified in 2021 are no longer a theoretical concern; they have become a hard reality.”

By November 2025, more than half of all strategic minerals were under some form of export control.

China’s moves were pivotal:

- April 2025: export controls on seven heavy rare earths and compounds

- October 2025: expanded to include five more elements and even assemblies or products containing Chinese-sourced materials. These restrictions triggered a 75% drop in rare earth magnet exports in Q2 2025, forcing automakers in the US and EU to idle production and sending European rare earth prices to six times higher than China’s domestic levels

“Many countries are turning to more diversified or home-grown energy sources to reduce exposure to geopolitical risk. At the same time, energy and material exports are increasingly being used as instruments of foreign policy. Alongside the expansion of global trade, there has been a notable rise in the use of trade measures as geopolitical tools, including restrictions on materials and access to technologies” — IEA, World Energy Outlook 2025

Impact Snapshot:

A 10% disruption in Chinese rare earth exports could halt production of 6.2 million cars or 650 AI data centers, the IEA warns.

Copper and lithium shortfalls loom

While new projects have improved medium-term supply for lithium, nickel, and cobalt, the IEA highlights copper as the critical bottleneck.

Under current policy settings, the world faces a 30% copper supply shortfall by 2035, driven by declining ore grades, long permitting timelines, and limited new discoveries.

Lithium remains better positioned with strong project pipelines in Australia, Chile, and North America, but refining remains highly concentrated. China refines 75% of purified phosphoric acid and 95% of manganese sulphate, two key inputs for next-generation LFP and manganese-rich batteries.

Key 2035 supply risks

- copper: –30% shortfall

- lithium: Tight but improving supply

- cobalt/Nickel: Stable if projects proceed

- graphite/rare earths: Severely exposed to supply shocks

Price volatility and “By-Product Dependence” create structural fragility

Three-quarters of the 20 minerals tracked by the IEA are now more volatile than crude oil, with half exceeding even natural gas volatility.

For many — such as tantalum, titanium, vanadium, and indium — production is tied to by-products from other mining streams, limiting flexibility to meet rising demand.

That means when supply is disrupted, new capacity can’t simply be ramped up — and substitution options are limited or technologically unproven.

Investment response

The United States is emerging as the most aggressive in addressing these supply chain vulnerabilities, according to the IEA. The Department of Energy and Defense are deploying loan guarantees and offtake-backed financing under the Defense Production Act and Supply Chain Resiliency Initiative.

Recent deals include the Pentagon’s long-term offtake and price floor agreement with MP Materials, aiming to anchor a domestic rare earth magnet supply chain. Still, global refining and midstream investment remain far below what’s required. The IEA warns that “market forces alone will not deliver diversification.”

Why it matters

The IEA’s message is unmistakable: the next phase of the energy transition won’t be defined by the speed of renewable buildout but by the availability of the metals that make it possible.

If current trends persist, even a minor supply disruption could trigger battery price spikes of 40–50%, undermining EV economics and slowing the global decarbonisation agenda.

“While the market sizes for these strategic minerals are relatively small compared with bulk materials, disruptions in their supply can nevertheless have outsized economic impacts. For example, a 10% disruption in rare earth magnet exports could affect the production of 6.2 million conventional cars, or almost 1 million industrial motors, or 230 000 civilian aircraft, or the construction of over 650 hyper-scale AI data centres” — IEA, World Energy Outlook 2025

- the IEA forecasts USD$900 billion clean tech market (batteries, solar, wind, EVs)

- disruptions in metal supply could wipe out years of cost reductions

- supply diversification projects, especially in North America, Australia, and Africa, are set to attract a surge of capital seeking geopolitical hedges

Conclusion

The World Energy Outlook 2025 reframes energy security as mineral security.

Copper, lithium, rare earths, and graphite now play the role oil once did in the 1970s, strategic resources vulnerable to coercion and shock.

The IEA’s call is blunt: without deliberate policy coordination, strategic stockpiles, and diversified refining, the next energy crisis will be measured not in barrels, but in tonnes of minerals.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

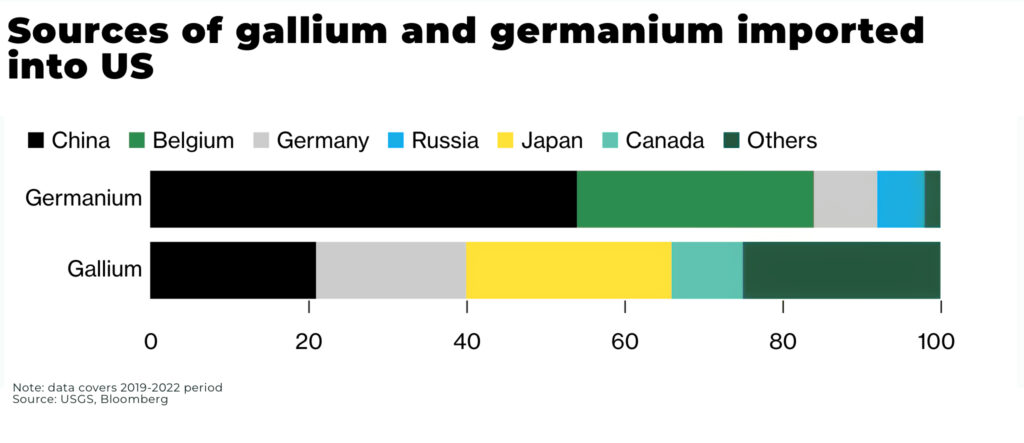

China lifts export ban gallium, germanium, antimony

- China suspends export ban on three critical minerals — gallium, germanium and antimony

- Beijing frames controls as national-security licensing, not a permanent ban, signalling strategic flexibility rather than supply-chain guarantee

China has suspended the export ban on gallium, germanium and antimony to US until November 27, 2026. Exports will now be managed under licensing until 27 November 2026, but the clause banning exports to military end-users remains in effect.

The move comes after a wider trade truce between China and the US after a meeting between US President Donald Trump and President Xi on November 1.

Chinese state-media commentary emphasises that export controls are normal regulatory practice for dual-use items and the re-opening is aligned with international norms.

In December 2024, China’s Ministry of Commerce of the People’s Republic of China (MOFCOM) announced that “in principle” exports of gallium, germanium, antimony and super-hard materials to the US would not be permitted. The ban was a direct retaliation to US semiconductor export restrictions and a signal of Beijing’s willingness to use critical‐mineral control as leverage.

China dominates the production and processing the gallium, germanium and antimony:

- total global antimony mine production in 2023 was approximately 83,000 tonnes. The largest producer, by far, is China

- and, China enjoys a near monopoly on global supply of both gallium and germanium: gallium: 94%, germanium: 83%

Why it matters for critical-minerals supply chains

A report, released in November, by the US Geological Survey, warned there could be a US$3.4 to 9 billion decrease in US GDP if China implements a total ban on exports of gallium and germanium, minerals used in some semiconductors and other high-tech manufacturing:

- gallium is used in high-frequency semiconductors, 5G, LEDs and photovoltaics

- germanium is critical for fibre optics, infrared sensors and advanced chips

- antimony is deployed in flame retardants, batteries, aerospace, and defence alloys

While the ban is suspended, export licensing remains, and the military‐end-use ban stays active. That means Beijing retains the ability to re-activate stricter controls. Chinese media explicitly say export controls are lawful regulatory tools, not ad-hoc trade weapons.

What remains unresolved and what to watch

- licensing volumes and destinations: How many shipments are approved under the new regime, and to which end-users? Transparent data is limited

- duration and durability: the suspension runs until 27 Nov 2026, after which Beijing can flip the switch again. Markets should price for optionality, not certainty

- broader export-control architecture: China’s rare-earth export mechanism (eg, heavy rare earths, downstream alloys) remains only partly eased; full liberalisation has not occurred

- sSmuggling/enforcement risk: as noted by Chinese authorities, trans-shipment and third-country routing are expanding — enforcement and licensing transparency will matter

This decision marks a tactical thaw in one of the most acute chokepoints of global critical-minerals supply chains. However, the strategic dependency remains: China still retains the upstream leverage.

In conclusion: the ban’s suspension is meaningful — but it isn’t a guarantee of open supply. The upstream remains tilted toward China; investors and policymakers should view the move as a reprieve, not a resolution.

US-backed $7.4bn smelter escalates critical minerals decoupling from China

How Tokenization Is Changing Commodity Valuation Models

The next energy shock won’t be oil — it’ll be critical minerals, warns IEA

China lifts export ban gallium, germanium, antimony

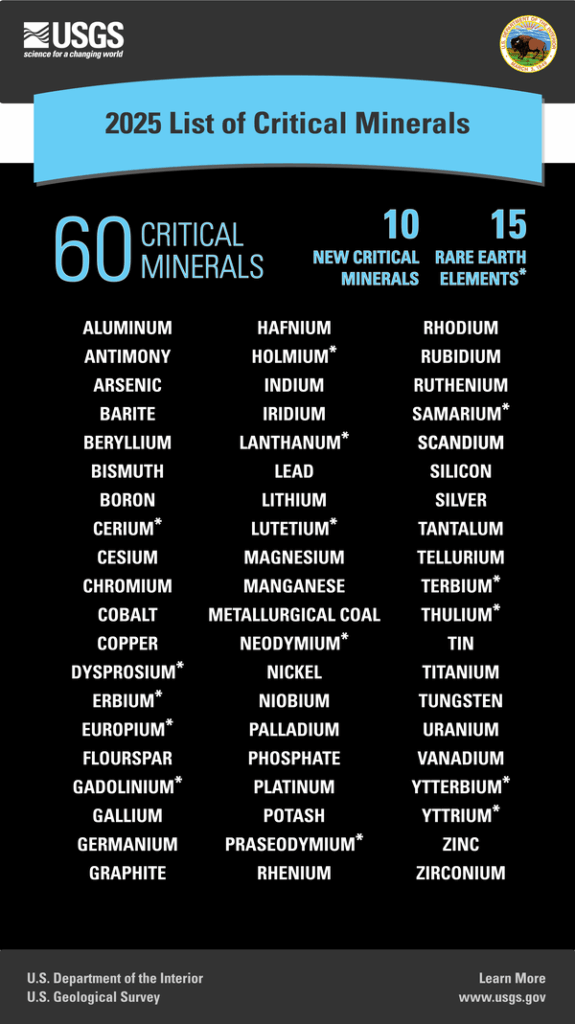

US adds copper, silver, uranium to 2025 critical minerals list

- US adds copper and silver to its 2025 critical minerals list, joining uranium among top national-security priorities

- the list now covers 60 minerals, up from 50 in 2022, signalling a broader definition of “strategic” materials

- policy support for copper, silver and uranium is likely to accelerate permitting, investment incentives, and new midstream infrastructure

- move aligns resource policy with industrial re-shoring, electrification, and nuclear revival goals

The US government has expanded its 2025 list of critical minerals, officially adding copper and silver and long-standing strategic elements such as uranium — a move that redraws the map for mining investment and supply-chain security.

The updated list, published this week by the US Geological Survey (USGS), raises the total number of designated critical minerals to 60, up from 50 in 2022.

The Trump administration framed the update as a “supply-chain sovereignty” push: extending national-security status beyond EV metals to the backbone materials of the energy system — copper for electrification, silver for solar, and uranium for baseload power.

Copper: from base metal to strategic backbone

Copper’s inclusion marks a turning point. The world’s most versatile conductor is now officially recognised as critical to US economic and national security.

Demand is surging: global copper consumption is expected to rise 35% by 2035, driven by EVs, grid expansion, data centres and renewable infrastructure. Yet new mine supply is tightening. Wood Mackenzie estimates the global copper shortfall could hit 6 million tonnes annually by 2030, even before factoring in US re-shoring targets.

By designating copper as critical, the US opens access to Defense Production Act funding, tax incentives, and faster permitting — effectively elevating the metal into the same strategic tier as lithium and rare earths.

Silver: from precious metal to industry workhorse

Silver’s addition reflects its growing role in solar panels, EV electronics, and semiconductors. Photovoltaic demand alone accounts for nearly 30% of global silver consumption and is rising fast.

The Silver Institute expects a fourth consecutive annual market deficit in 2025, driven by record solar installations in China, India and the US. US domestic output is modest — under 1,000 tonnes a year, concentrated in Nevada and Alaska — leaving over 70% of supply dependent on imports.

Policy recognition could stimulate domestic exploration and refining capacity, particularly for polymetallic mines where silver is a by-product of gold or base-metal operations.

Uranium: reinforced as strategic power fuel

While copper and silver are the newcomers, uranium remains the cornerstone of US energy security. Its continued inclusion underscores the administration’s commitment to nuclear expansion.

The Department of Energy (DOE) has called for tripling domestic uranium production by 2030 to feed new small modular reactors (SMRs) and replenish national reserves. Spot prices have surged above $90/lb, the highest since 2007, as US utilities rush to lock in contracts.

Washington has already launched a Strategic Uranium Reserve, backed by a $1.4 billion budget, and secured domestic supply deals with companies like Energy Fuels, Cameco, and Uranium Energy Corp.

A broader industrial strategy

The new list signals that Washington is redefining “criticality”, from a narrow focus on green tech to a wider industrial-security framework.

USGS says the updated list “reflects both economic vulnerability and the expanding scope of essential technologies.”

For investors, it’s a clear policy signal: the next wave of US resource investment will not just be about batteries, but about the entire energy ecosystem.

Conclusion

Copper, silver, and uranium now sit at the heart of US critical-minerals policy. The 2025 list cements their status as cornerstones of a secure, electrified, and nuclear-powered economy.

For miners and investors, the opportunity is structural: Washington has tied industrial strategy to resource policy. Projects producing these three metals are now riding the same wave — national security meets the energy transition.

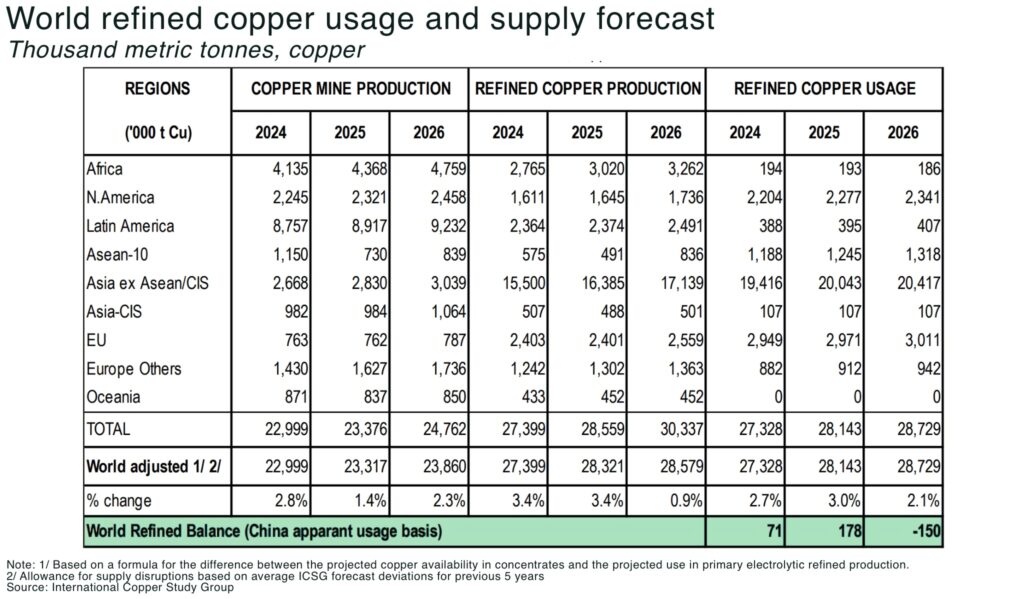

International Copper Study Group warns of 150,000t deficit in 2026

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

- ICSG forecasts mine-supply growth of just 1.4 % in 2025, down from 2.3 % earlier

- the surplus expected for 2025 has been trimmed to ~178,000 t, and the market is projected to swing into a 150,000 t deficit in 2026

The latest forecast from the International Copper Study Group expects global mine production growth of just 1.4 % in 2025 — a sharp downshift from its earlier 2.3 % forecast. The modest rate comes alongside a refined-production growth forecast of 3.4 % for 2025, which then collapses to 0.9 % in 2026 as concentrate availability becomes a bottleneck.

The market is shifting from surplus to shortage with a surplus of 178,000 t for 2025 is expected to flip to a 150,000 t deficit in 2026.

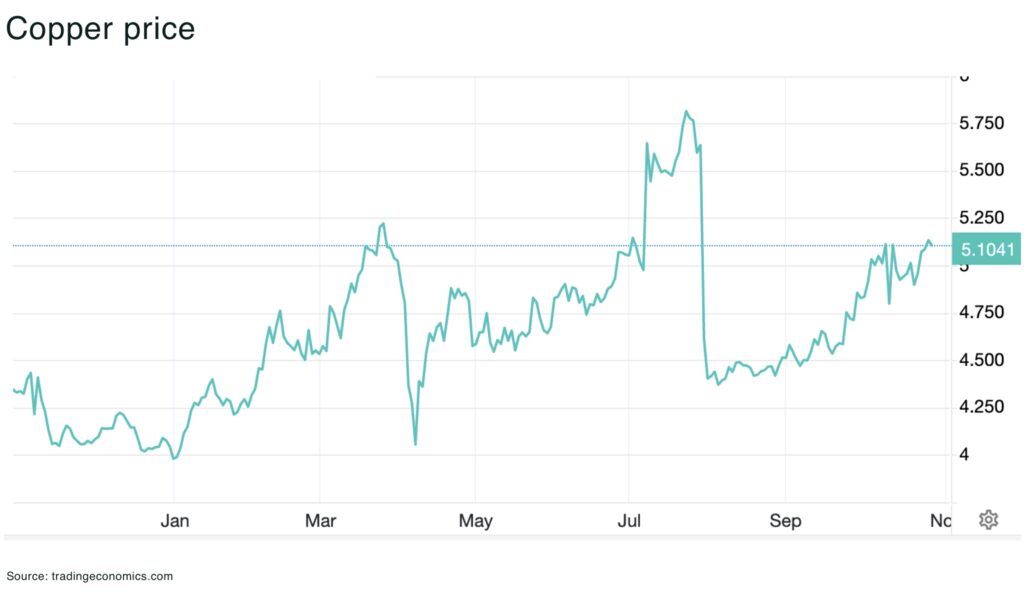

At the same time, copper prices are nearing record highs. LME contracts recently hit US$11,094/t as supply concerns collided with hopes of a US–China trade deal unlocking demand. For investors, this signals the old “plenty of copper” narrative is giving way to one of structural constraint.

Why growth is stumbling

Several factors are conspiring to slow supply growth:

• Mine disruptions: A series of accidents at tier-1 copper mines — including the mud-inflow at Indonesia’s Grasberg Mine — have knocked concentrate feed and pushed the ICSG to cut its growth forecast

• Concentrate vs smelter imbalance: Even when mine output rises, refined production is constrained because smelters lack concentrates. The ICSG notes this gap as the key brake

• Demand-side softness masking structural tightness: Although usage growth is modest (2.1 % in 2026) and demand from regions outside Asia remains weak, the lack of new supply projects means that a small bump in demand or additional disruption could trigger tightness quickly

Demand: steady, but not spectacular

Global refined-usage growth is forecast at 2.1 % in 2026, down from faster growth in prior years. China, which accounts for approx 58 % of global copper usage, is forecast to see demand growth decelerate markedly. On the surface this demand number appears modest, but the key implication is that supply must now carry the burden of tightness rather than demand spikes driving the story.

In short: demand remains supportive but unexceptional. The upside for copper now resides in supply constraints, not a demand explosion.

Conclusion

The ICSG’s latest outlook highlights the pivot for copper: from surplus to structural tightness. With mine-growth trimmed and concentrate bottlenecks looming, the industry faces a 150,000-ton deficit in 2026. That tightness is already pricing in, as reflected in near-record prices. For investors in critical minerals and mining, the signal is clear: supply reliability matters more than ever. Companies that navigate the bottlenecks, not just dig more rock, will capture the value in the immediate-term.

Our report on the expected demand for copper from Artificial Intelligence and data centers:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

US and Australia sign $8.5 billion rare earths deal

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

- US and Australia agreed to provide at least US $1 billion each within six months for raw-and‐processed critical-minerals projects

- the joint framework explicitly targets mining, separation and processing of critical minerals and rare earths, not just raw extraction

- includes new mechanisms: price-floors, permitting streamlining, strategic asset-sale review, recycling mandates as part of securing supply chains

On 20 October 2025, Donald Trump and Anthony Albanese signed the United States–Australia Framework for Securing of Supply in the Mining and Processing of Critical Minerals and Rare Earths at the White House. The framework commits both countries to accelerate supply-chain resilience through coordinated investment and policy instruments.

- US and Australia to invest more than US$3 billion together in critical mineral projects in the next six months, with recoverable resources in the projects estimated to be worth $53 billion

- the Export-Import Bank of the United States is issuing seven Letters of Interest for more than US$2.2 billion in financing, unlocking up to $5 billion of total investment, to advance critical minerals and supply-chain security projects between our two countries

- the US Department of War will invest in the construction of a 100 metric ton-per-year advanced gallium refinery in Western Australia, further advancing self-reliance in critical minerals processing

“This is an $8.5 billion pipeline that we have ready to go” — Anthony Albanese, Australia Prime Minister

“We’re doing a real job on rare earth and many other things” — Donald Trump, US President

Under Section I of the agreement, the two governments pledged to mobilize government and private support via guarantees, loans or equity; jointly identify projects of interest; and provide at least US$1 billion in financing in each country within six months to projects expected to deliver end-products to US and Australian buyers.

The move is described by The White House as a model for global supply-chain cooperation, placing critical minerals and rare earths firmly in the national-security/infrastructure category.

Key policy instruments in the deal include:

- permitting acceleration: streamlining domestic regulatory approvals for mining, separation and processing

- price-mechanism guardrails: exploring price-floors and standards-based trading systems to protect domestic markets from unfair practices

- asset-sale controls: strengthening authorities to review or deter strategic sales of critical-minerals assets on national-security grounds

- recycling support and geological mapping: commitments to invest in mineral-scrap processing and map resource bases in both countries

Why it matters: strategic supply-chain pivot

China’s dominance remains the benchmark

China processes roughly 90% of rare-earth oxides and most finished magnets used in defence and high-tech manufacturing. With Beijing tightening rare earth export controls in 2025, the US-Australia pact is a direct response to a shifting risk-landscape.

From raw mining to processing-value capture

Historically, many Western players stopped at raw ore export. This framework makes clear the next phase is downstream: separation, refining, magnet-making and recycling. That shift expands the investor opportunity beyond traditional mining.

Policy tools join the cap-ex

This is not just about raising capital. The framework integrates regulatory reforms, strategic stockpiling (Australia’s reserve), and trade-defence tools. That signals critical minerals are now treated as infrastructure.

Key risks to monitor

- execution time-lag: projects take years to build; the window of risk remains high

- policy drift: the deal hinges on actual follow-through (financing, permitting, offtakes) not just signaling

- China’s counter-moves: Beijing may respond with further export controls or trade pressure, offsetting part of the benefit of diversification

- commodity price and cost risk: as new entrants emerge, margins may compress and high-cost producers may struggle

Conclusion

The US–Australia critical-minerals framework marks a structural realignment. It elevates rare earths from niche mining assets to strategic infrastructure. The pipeline is not just about new mines — it’s about processing, manufacturing and resilient allied supply-chain ecosystems.

The deal signals that critical minerals are now treated like defence assets. The real value likely comes with processing and manufacturing, not simply digging the ore out of the ground.

It’s part of a strategic pivot by Australia we highlighted back in 2023

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

US weighs price floors for critical minerals to counter China

The United States is weighing price floors and “forward-buying” for critical minerals such as rare earths and graphite to counter China’s use of below-cost exports to control global supply chains, according to statements from President Trump adviser Scott Bessent.

The policy under consideration would reportedly set minimum guaranteed prices for producers of strategically important minerals to prevent market collapses triggered by Chinese oversupply. It would mark the most direct US intervention in mineral markets since wartime stockpiling programs and comes alongside plans for expanded US government equity stakes in mining and processing companies.

The move comes after Bessent after President Trump threatened an additional 100% tariff on Chinese goods in response to Beijing tightened rare earth exports, reducing the flow of batteries, magnets and semiconductors to the US.

“I think things can de-escalate. We have things that are more powerful than the rare earth export controls that the Chinese want to put on — and to be clear, this is China versus the world… If China wants to be an unreliable partner to the world, then the world will have to decouple,” — US Treasury Secretary Scott Bessent

Basically, a price floor would work something like this: if rare earth or graphite prices fall below a minimum level, the US government compensates producers for the gap or purchases material into a strategic stockpile. Variants already exist in agriculture and oil, and it appears mining may now enter into a similar system.

Trump’s planned Oct. 29 meeting with Chinese President Xi Jinping remains on the schedule — despite the US president’s threat to cancel the summit.

Find out more on our analysis on why America’s critical mineral strategy threatens disaster: