Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

- record US$82 billion investment announced for electric vehicle supply chain in US

- so far, investment and capacity build out in domestic mining has been modest

- US military reportedly soliciting Canadian mining projects via Defense Production Act

America’s Battery Belt is booming. A record US$82 billion of investment to build 96 electric vehicle (EV), electric battery, and battery recycling plants across the country has been announced — and much more is expected in the next few years.

The investment comes as the US overtakes Germany to become the second largest electric vehicle market in the world, after China.

Growth of this new domestic industry is being driven by economics and national security concerns as the US invests to bring the energy transition home.

But, importantly for investors, it’s still missing one essential piece of the puzzle right at the start of the supply chain. Critical minerals.

America’s Battery Belt

The US “Battery Belt” stretches from the north east of the country to the south east.

The recent surge in investment has been kickstarted by new federal laws: from the Bipartisan Infrastructure Law in 2021 to the Inflation Reduction Act (IRA) in 2022.

The new laws offer billions in tax credits and grants to manufacturers and buyers of electric vehicles — only if specific components used in the batteries have not been “extracted, processed, or recycled by a foreign entity of concern,” including China and Russia.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

For example:

- $35 per kilowatt hour tax credit on US-produced battery cells, about 35% of the current average battery cell’s production cost

- $10 per kilowatt hour credit for US-produced battery modules, roughly 33% of the cost of assembling an EV battery pack

- US$20 billion in loans available for building new factories

- US$2 billion in grants for retooling existing US auto plants

The US government is leveraging its enormous financial heft to ensure it stays competitive in the EV market. Credit Suisse forecasts public spending enabled by the IRA could eventually reach US$800 billon, and US$1.7 trillion once the private spending generated by the loans and grants is included.

US lithium-ion battery capacity is forecast to increase more than x5 from 2021-2026. This is expected to expand another 86% by 2031.

For example:

- Ford plans to invest at least US$50 billion through to 2025

- General Motors plans to invest US$35 billion from 2020-2025 in EV and autonomous vehicle (AV) development, exceeding their gas and diesel investment

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

China

America is in a hurry because China is working hard to secure a dominant position across the electric battery and vehicle supply chain.

China’s production capacity is expected to increase 486% from 2021-2031.

Now Chinese companies are also looking to invest in the US battery belt.

For example, China’s Contemporary Amperex Technology Co, the world’s largest producer or lithium batteries, is partnering with Ford to supply technology for a $3.5 billion electric vehicle battery plant in Michigan.

Europe

To put the scale of the shift into perspective, Europe is now concerned about the impact of the manufacturing boost for the America’s battery belt on their own economic future.

Tesla has started building battery systems in its new plant in Germany but has recently announced they will focus battery cell production in the US

“The focus of Tesla’s cell production is currently in the United States due to the framework created by the United States Inflation Reduction Act (IRA)” — Tesla

You can read more on our analysis on how America is seizing an historic opportunity to make this the next American century.

What about mining

The pace of EV production in the US is quickly outpacing the ability of domestic mining and processing to keep up — across lithium, graphite, nickel, copper, cobalt, etc — with China again dominating the marketplace.

To try and stay competitive and secure supply chains, the new US legislation includes support for US mines and critical metals.

For example:

- tax credits for building new mines, as well as tax credits to battery producers tied to requirements for sourcing critical minerals from the US or allied nations — by 2029, only EVs with 80% of minerals sourced from the US or partner nations and 100% North American built components will qualify for the full tax credit

- subsidies prohibit the use of metals, materials or other components from “foreign entities of concern,” which includes Russia and China. The critical minerals ban takes effect in 2025 and components ban in 2024

- invoking the Defense Production Act to secure American production of critical minerals

- launching a mining reform effort and Permitting Action Plan to review and (hopefully) improve existing permitting processes

- in October last year, the Department of Energy announced US$2.8 billion in grants from the Bipartisan Infrastructure Law for 20 companies working to produce and process critical minerals in America

- the administration announced the “American Battery Materials Initiative”, in an effort to “mobilize the entire government in securing a reliable and sustainable supply of critical minerals used for power, electricity, and electric vehicles (EVs).”

“The goal of the program is really to onshore and reshore the supply chain for the automotive sector as we decarbonize here in this country”

— Jigar Shah, director of the loan programs office, US Department of Energy

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

This support for mining and minerals has not been seen for decades in the US and offers a unique opportunity for investors.

We have discussed the role of these acts, as well as the challenges, in helping to promote the mining sector in America:

- Can America’s old copper mines meet this century’s copper demand?

- Unlocking the opportunity in mining permits

- Nickel’s environmental challenge offers opportunity for the West

So far, investment and capacity build out in domestic mining has been modest. This is particularly because developing and permitting a mine, especially in the US, takes time.

But, with the significant development of the downstream production chain for electric batteries, interest in the upstream sector is rising quickly.

The North America puzzle

So far we’ve been concentrating on America. But investors need to think bigger picture.

This is a North American battery belt, stretching from Canada to Mexico.

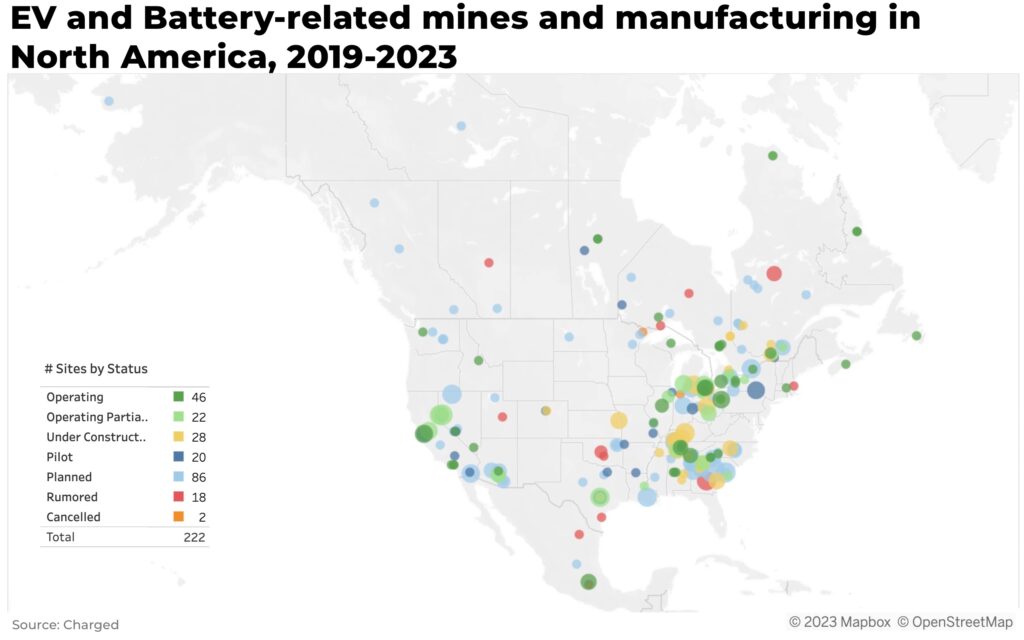

Below is a map of electric battery-related mining projects planned, operating across North America. Note the concentration of mines in Quebec and Ontario.

Now, let’s overlay the EV and battery-related manufacturing and processing plants operating and planned.

The arc stretches all the way down the east coast.

As part of this development, Canada has recently restricted foreign owned investments in the critical minerals sector, particularly affecting Chinese investments. The provinces are also looking into ways to shorten permitting times.

(Read our analysis of the latest mining takeaways from PDAC)

And the US military is reportedly soliciting for applications from Canadian mining projects that could qualify for funding through the Defense Production Act. Canadian officials have presented the US with a list of 70 projects that could warrant funding.

That’s on top of Canada’s own strategy and support for critical mining investments.

The pieces of the puzzle are almost in place.

We’re watching the legislation and investment across this region closely. Stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.