A quiet revolution is underway in the bedrock of the global economy. The mining and processing of critical minerals — from lithium to rare earths, titanium to graphite — that form the physical basis of the energy transition, advanced computing, and modern defense, are poised for a disruptive shift reminiscent of the US shale oil boom.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

In 2006, just two decades ago, oil imports into the US peaked at 60% of consumption. Then, technological breakthroughs in horizontal drilling and fracking, turned previously uneconomic shale formations into a source of energy independence, economic expansion and geopolitical leverage.

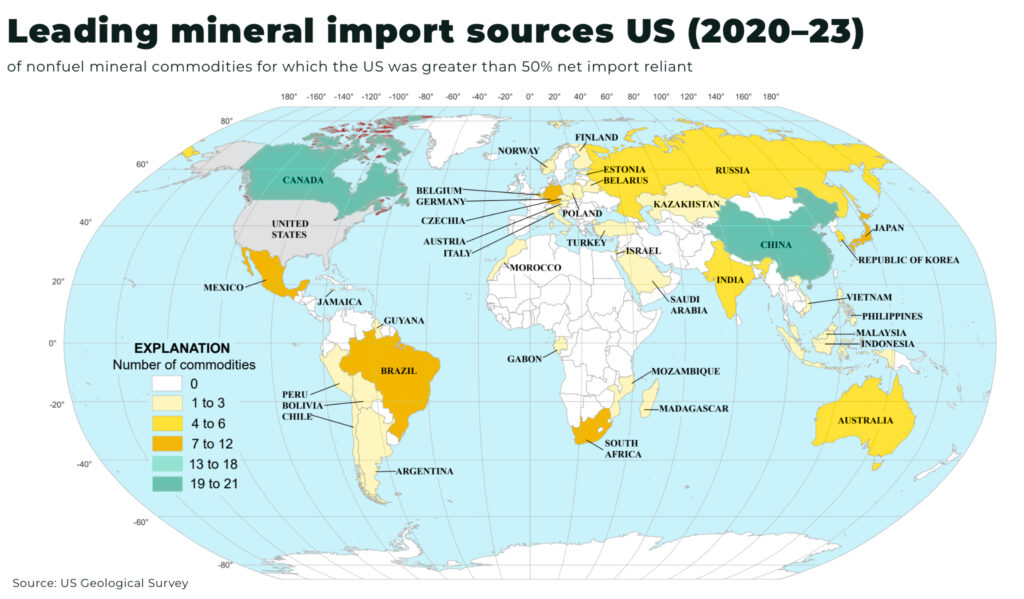

Today, the US is 100% net import dependent on 12 of the 50 critical minerals listed by the US Geological Survey, and a net import reliance greater than 50% of apparent consumption on 31 others.

But, is a new, similar “shale revolution” underway, not for fossil fuels, but for critical minerals across America — to power advanced weapon systems, energy infrastructure, AI hardware and much more.

The common denominator is breakthrough technologies that have the potential change the economics, speed, and geography of extraction and processing of critical minerals.

While the public discourse often centers on mining projects and geopolitical supply chains, arguably one of the most important catalysts across the industry is next generation technology.

The Shale blueprint: technology as the multiplier

The shale boom wasn’t about discovering new oil. It was about unlocking vast known resources that had been economically out of reach. Two innovations — hydraulic fracturing and horizontal drilling — cut costs, raised output, and compressed timelines. The transformation was driven by US know-how, public R&D, and private capital scaling technology that had been quietly developing for decades — and enabled by unique American advantages such as landowner mineral rights, flexible permitting.

As we’ve warned in our analysis, America’s current critical mineral strategy threatens disaster, with concerns playing out with China’s rare earth restrictions helping to force the US to the negotiating table over tariffs.

The US has abundant domestic reserves of lithium, rare earths, titanium, nickel, and other critical minerals. But most remain un-mined or unprocessed because traditional methods are slow, costly, environmentally risky, or outsourced entirely (often to China which subsidising/undercuts production costs in the West).

This time, the opportunity for the US isn’t in discovery — it’s in extraction innovation.

To note, the technologies being research and developed across the West is a very wide range, so rather than cover them all, we’ve focused on those with the strongest momentum — technically, financially, and politically — including:

- Direct lithium extraction (DLE): pilot projects in the US, Canada, and Europe are scaling technology to pull lithium from brines with higher recovery rates and lower water use

- Rare earth separation without solvents: companies are testing ion-exchange membranes, electrochemical separation, and bioleaching to replace traditional solvent extraction that has high environmental costs

- Titanium and nickel processing breakthroughs: plasma reduction, additive manufacturing feedstocks, and alternative anodes are reducing cost and energy needs

- Mine-waste and tailings recovery: earth MRI and USGS programs are mapping waste streams and legacy mine sites for potential recovery of cobalt, rare earths, titanium, and other minerals

Also, we won’t go through the demand / supply crisis across every critical mineral, but the chart below should provide a clear idea on where the US stands vs China.

Policy accelerants

In shale, policy support mattered: research funding from DOE labs, tax structures, and the ability of private landowners to sign drilling rights sped the boom. The critical minerals arena is now seeing its own accelerants:

- Defense Production Act (DPA): Invoked to support rare earths, lithium, and battery supply chains with federal procurement guarantees

- Permitting reform efforts: aimed at reducing timelines for mine development through executive orders and reforms to streamline the process

- Stockpiling and procurement: the Department of Defense and DOE are actively stockpiling rare earths, titanium, and cobalt

And now, with the draft US Critical Minerals List released in August 2025 (adding copper, potash, silicon, silver, rhenium, and lead — and removing arsenic and tellurium) with the updated strategy driven by a focus on identifying and recovering critical minerals from mine waste, especially tailings, using advanced analytical technologies.

Tailings

The US govt and mining companies are increasingly focused on reprocessing tailings (waste from previous mining operations) as a way to secure critical mineral supply chains, including:

- streamlining regulations for mine waste extraction

- updating guidance to make mine waste recovery projects eligible for federal funding

- review of plans to recover uranium and other minerals from abandoned mines

- US Geological Society to map and inventory federal mine waste sites

For example, the Coeur d’Alene silver mining site in Idaho contains approximately $2.5 billion worth of precious minerals, including antimony and arsenic.

And advances in technology, such as improved grinding, leaching methods, and mapping, are making it possible to recover valuable metals from these legacy waste streams, including bio-extraction technologies, like Allonnia’s D-Solve, which uses microbes to selectively remove impurities and boost metal recovery rates; artificial intelligence is also being deployed to optimize processing, predict equipment maintenance, and improve operational efficiency.

US copper producer Freeport-McMoRan has partnered with consultancy group McKinsey to use AI to boost production at its North American operations with data engineering to allow for real-time adjustments to processing rates. When AI was trialled at the Baghdad mine in Arizona, it led to a 5% to 10% increase in copper production. Rolling it out across the company’s other American operations is projected to lift output by 90,000 tonnes each year, according to Reuters.

“By unlocking the potential of our mine waste, we are not only recovering valuable critical minerals essential for our economy and national security, but we are also leveraging groundbreaking research from the U.S. Geological Survey that identifies promising sources of these minerals,” said Doug Burgum, US Secretary of the Interior.

Direct Lithium Extraction (DLE): lithium’s fracking moment

Traditional lithium production from brine involves solar evaporation ponds, taking 12–18 months, with recovery rates under 50%. It’s land and water-intensive, unsuitable for much of the US.

Direct Lithium Extraction (DLE) has the potential to change all that: it uses chemical sorbents, membranes, or electrochemical methods, to selectively extract lithium from brines in hours, with over 80–90% recovery rates. Water can be recycled and processing footprints shrink by at least 90%. Critically, DLE enables lithium production in places previously deemed marginal — like oilfield brines, geothermal fluids, and shallow basins with no evaporation suitability.

After recent pilot plants in Nevada and California, commercial versions of DLE systems are starting to be rolled out. In particular, energy tech company, SLB, has reported 96% lithium recovery at 500x the speed of conventional methods — a shale-style performance jump. Others, such as Standard Lithium, who have just finalized a US$225-million US Department of Energy grant, are scaling modular units to integrate extraction and conversion at the source.

The analogy to shale is direct: large, untapped brine basins under US soil become viable as new technology unlocks mining and processing in an economic and environmentally-viable way.

Lithium from clay: unlocking a new ore class

Claystone lithium deposits, especially in the western US (for example, at Lithium America’s Thacker Pass), represent one of the largest undeveloped resources globally. Historically, lithium has only been commercially extracted from hard rock (spodumene) and brine. Clay has been considered too difficult, too impure, too expensive.

That barrier is breaking. Acid leaching, combined with on-site purification technology, is now being used to turn lithium-bearing claystone into battery-grade lithium carbonate or hydroxide. Several large projects are underway in Nevada, with automaker General Motors acquiring a 38% interest in Thacker Pass for US$625 million, based on process viability.

Rare Earth Elements (REE): separation without China

The US has significant known rare earth elements (REEs) but has lacked the ability to process them efficiently or at scale. Even America’s only rare earth mine, MP Materials in California, only stopped shipping the majority of its rare earths to China for processing after the imposition of China increase import tariffs to 125%.

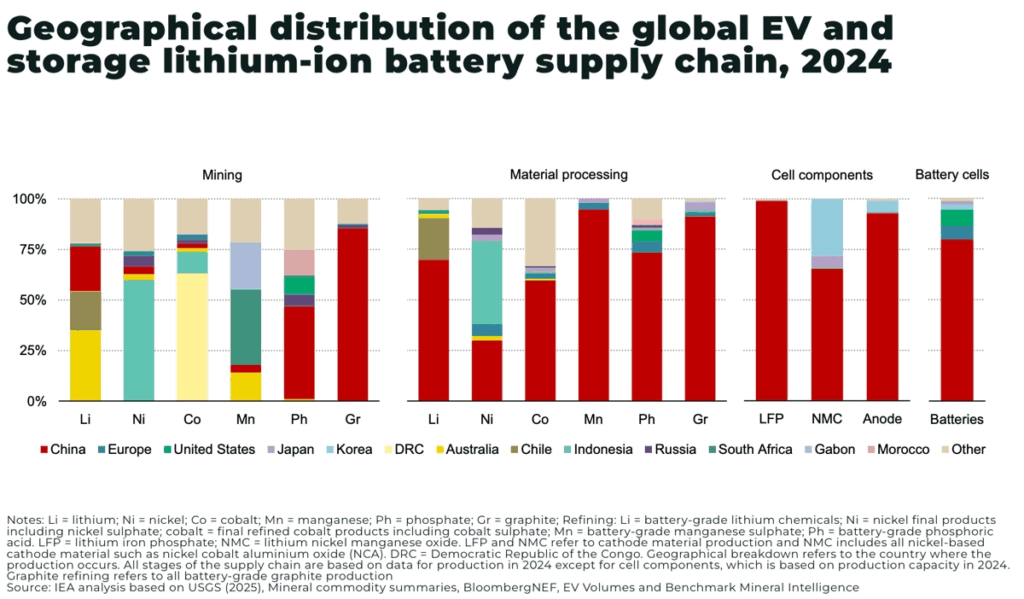

China’s dominance (over 85% of global REE refining) is rooted not just in resource access, but in its control over complex solvent-based separation and magnet production.

New technologies hope to break this bottleneck. One US-based process, dubbed RapidSX, mimics solvent extraction but x3 time faster, with less chemical waste, and at lower cost. It also enables modular, domestic refining of light and heavy rare earths — historically a significant pain point.

Other efforts at efficiency and cost gains in rare earth processing are using molecular recognition, ion exchange resins, or even bioleaching with microbes to separate REEs from ore or e-waste. These alternatives are being piloted across North America with federal funding.

What horizontal drilling was to shale, efficient separation hopes to be to rare earths.

Titanium: beyond the 1940s Kroll Process

Titanium metal is essential across aerospace and defense, yet the dominant production method — the Kroll process — was developed in 1940. It’s slow, energy-intensive, and heavily concentrated in China, Japan, and Russia.

IperionX, in North Carolina, is now working to commercialize HAMR (Hydrogen Assisted Metallothermic Reduction), which replaces the Kroll process with a cleaner, faster, modular method. In August 2024, they successfully tested their new titanium furnace production run. It produces titanium powder directly from ore with up to 50% less energy and dramatically lower cost. Combined with additive manufacturing (3D printing), HAMR enables just-in-time, near-site production of titanium parts, from mined concentrate to final component.

The Department of Defense has awarded IperionX multiple contracts worth more than US$140million to support both titanium supply chain development and direct component supply for US defense applications.

Like fracking, HAMR shifts the cost curve and localizes production. It has military backing and real industrial-scale deployment scheduled in the US.

Graphite and anode materials: breaking China’s 90% grip

China processes over 90% of the world’s natural graphite into anode-ready material for lithium-ion batteries. Western nations have significant raw graphite reserves, or can synthesize it, but have historically lacked the chemical purification and coating steps.

This is now changing: new pyrolysis-based methods and proprietary purification systems are enabling low-emission, US-based production of battery-grade anodes. And these technologies also have government backing, including:

- the Department of Energy (DOE) providing Syrah Technologies a US$107 million loan to expand its Vidalia facility, enabling it to process natural graphite into active anode material for EV batteries domestically

- as of December 2024, the DOE agreed to a $755 million loan for Novonix’s facility in Tennessee, which will be the first large‑scale synthetic graphite plant in North America. US Energy Department sources and Novonix estimate its synthetic graphite output will reduce emissions by around 60% versus traditional Chinese method

- Anovion Technologies was awarded a US$117 million DOE grant to support the build out of a US$800 million synthetic graphite anode plant in Southwest Georgia

Why this matters: graphite makes up ~28% of an EV battery by weight. Without a local source of anode material, the battery supply chain remains incomplete. These new methods provide the missing midstream, just as shale drillers needed midstream pipeline buildout to scale.

Artificial Intelligence

While less physically visible than new extraction tech, AI-driven exploration and mine modelling is starting to have a significant impact how projects are discovered, scoped, and operated across North America.

For example, new software uses satellite imagery, geological data, and machine learning to locate viable mineral deposits faster than traditional fieldwork. Once a project is underway, “digital twins” simulate mine operations in real time, optimizing throughput, water use, and emissions. These systems are now standard at modern pilot sites and will scale as permitting accelerates.

The range of applications of AI for efficiency gains across mining and processing are considerable, including:

- mineral exploration optimization

- predictive maintenance and autonomous equipment

- health and safety enhancements

- environmental and operational efficiency

- autonomous and tele‑operated machinery

- digital twins and geospatial mapping

- AI-backed funding and strategic advantage

As with fracking, where real-time pressure monitoring and drill data changed productivity, data is now a mineral asset. It allows for leaner, smarter, and more sustainable extraction across the board.

Companies include Terra AI, which claims a 40% reduction in drilling campaign time and cost, as well as securing investment worth more than $100m for partners.

Just hype? How feasible?

Not every innovation will succeed. Technologies like DLE or HAMR still face scale-up risks. Some promising processes will fall short on cost or reliability. And China, Indonesia and other major producers will continue to fight for significant market share by undercutting prices.

For example,

- many DLE project have failed to scale successfully to commercial output. Selectivity, membrane fouling, and reagent degradation are recurring technical issues

- no clay-to-lithium operation has yet reached commercial output

- rare earth solvent extraction alternatives require multi-stage scaling and precise chemistry

- the HAMR process is not yet proven at industrial volumes

- US synthetic graphite plants still have high energy and labor costs

- AI models depend on high-quality geological data, which is often lacking or proprietary

But the same was true of early fracking technologies.

What ties all these technologies together is that many are at or near commercial scale, not academic experiments. Pilot plants are complete and production is starting to ramp up throughout 2025. In many cases, technology readiness aligns with policy incentives, government funding, and market offtake agreements.

Let’s take the recent (wonderful) profile of Oklahoma, by Ernest Scheyder for Reuters, as America’s answer to China’s critical mineral dominance:

The country’s only nickel refinery, its largest lithium refinery, two lithium-ion battery recycling plants, a rare earths magnet facility, and several electronic waste collection facilities are under construction or in operation in the State – more than in any other state. This includes:

- Westwin Elements is now building the only machine in the United States capable of refining nickel

- Stardust Power, Inc. is building a massive lithium refinery

- USA Rare Earth, Inc. is also headed for Oklahoma to build a rare earth magnet complex

Much like shale in the mid-2000s, this is a moment of convergence in the US for:

- technology de-risks once-inaccessible resources

- policy accelerates capital deployment

- industry commits to long-term offtake to secure supply

Crucially, these technologies don’t just reduce foreign dependence — they cut cost, lower emissions, shorten supply chains, and create jobs. They are enablers of industrial resilience, not just inputs for batteries.

The US shale revolution took 15 years to go from pilot to peak. The critical minerals shift is earlier in that curve, but it is the political momentum is real, they are financially funded, and now moving beyond demonstration.

Conclusion

The story of shale wasn’t about geology, it was about engineering, financing and politics. The same is true for critical minerals today.

China not standing still, but for the first time neither is America.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.