Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

This year at the world’s leading mining and mineral convention — PDAC — despite low prices across many critical commodities such as nickel, lithium, cobalt, copper and others, the mood was enthusiastic and upbeat. Why?

We suggest two main reasons:

- many critical mineral mining companies are taking the view that momentum is on their side

- government funding and support to mining companies is now starting to come online

Let’s start with the money

In the words of Jakob Stausholm, chief executive of Rio Tinto, when asked at the conference if capital markets are rewarding the mining sector in the decarbonization process, the simple answer is: “no.”

As most people on the conference floor and forums are all to aware of, a cheap supply of minerals from China (nickel, lithium, rare earths, etc) are flooding the market and suppressing prices, as well as high interest rates and rising capital costs, have meant the investment community has been reluctant to get involved in financing new mines.

“Canada is producing less critical minerals than before Covid… We are in a catch-22 situation. We want to onshore our critical mineral supply chains but China is the only source of investment”

— Heather Exner-Pirot, Senior Fellow and Director of Natural Resources, Energy and Environment at Macdonald-Laurier Institute (MLI)

The strategy proposed by governments to manage this problem is to provide state support to help mine development in domestic jurisdictions through a combination of financing, tariffs and tax credits to secure supply from any “foreign entity of concern“, in particular, China.

For example:

- the US Inflation Reduction Act

- the Canadian Critical Minerals Strategy

- the EU’s Critical Raw Materials Act

Last year, we noted how the mining sector at PDAC was going long on (cautious) optimism as governments and automakers were starting to pay attention to miners concerns.

And this year that optimism seems to be paying off — at least, for some.

Across the spectrum of critical minerals we spoke to a range of companies who had applied for government support, both in the first round in 2022-23 and this year’s second round.

The applications are intensive, “It wasn’t easy, I’m not going to lie”, one company told us.

The requests for the second round have not yet been approved (confirmations are expected around August, before the 2024 presidential election), but many of the companies discussed the support received by authorities in submitting their application and are confident in the result.

Of course, any government financial support does not mean immediate access to money, with more reporting requirements, environmental reviews, etc.

But right now that doesn’t matter, as one lithium company made clear to us, “There is goodwill that I have not seen in my whole career, and if the market is down, I’m not worried.”

The promise of significant government financial support will help companies raise money — as another senior investor relations manager explained, “It’s all about the press release.”

However, not everyone is happy, with government support appearing to be focused on what Manganese X Energy Corp calls a “group of six” metals: lithium, graphite, nickel, cobalt, copper and rare earths.

Manganese X Energy Corp has put out a statement advocating for government to expand their support to a “group of seven”, including manganese (which, as we have warned, faces tightening supply). They are not the only company with concerns.

We have outlined what we see as significant challenges to the West’s current critical mineral strategy in our recent post — America’s current critical mineral strategy threatens disaster — but anything to get more supply into the market for the anticipated demand to meet net-zero targets, we believe is a good thing.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Which brings us to momentum

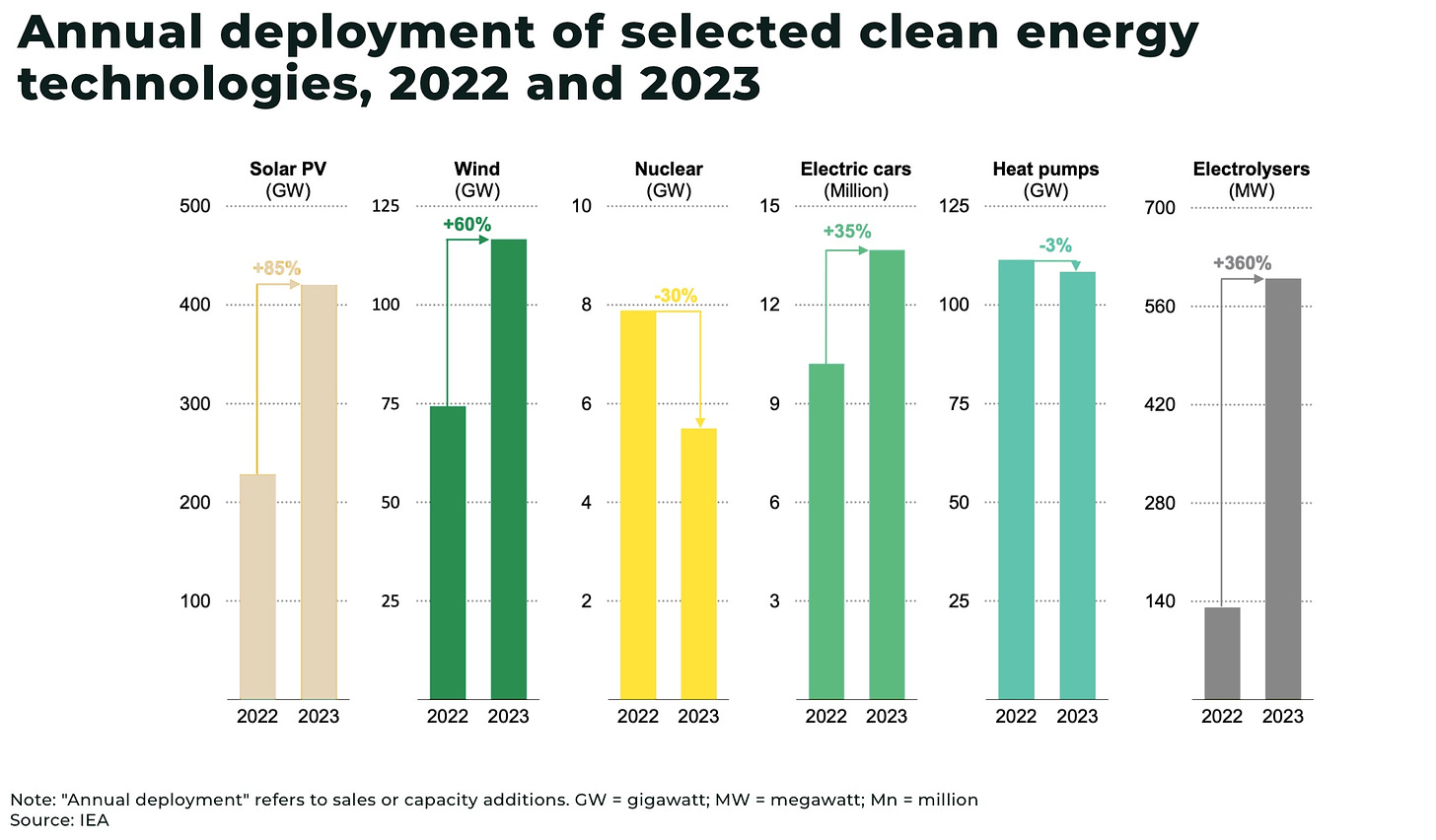

Clean energy, from electric vehicles to solar power, has grown at double the rate of fossil fuels since 2019. As we have warned, this growth is now being disrupted, particularly with high interest rates and rising capital costs — but political and investment momentum is still on the side of net-zero deadlines by 2050.

Commodity prices may be low now and energy transition industries undergoing a period of retrenchment, but the mining sector understands cycles and is accustomed to thinking long-term (the average time to open a new mine, from discovery to production, is 16.9 years).

So, despite the prevailing low prices of various commodities, there remains optimism regarding the upside in the trajectory ahead.

Very significant challenges remain to secure supply chains, but talking to both government officials and major think tanks in the sector, it was obvious these challenges are no longer being ignored. They may not have all the answers to what is a very complex situation, but they are working on it.

As one top Canadian official told us:

“China is not going to stop flooding the market. We have to work together.”

Arguably US President Ronald Reagan’s most famous quote is: “The nine most terrifying words in the English language are: I’m from the Government, and I’m here to help.”

PDAC 2024 is a sign of changing times. The mining industry is not terrified, quite the opposite.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.