Critical Minerals and Energy Intelligence

Lithium

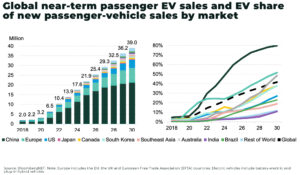

Demand for lithium is forecast to increase up to x40 times between 2022 – 2040, driven by global sales of electric cars and batteries.

The top three lithium producing countries are currently Australia, Chile and China, accounting for over 90% of global production.

Investment in exploration outside of the “lithium triangle” — Chile, Bolivia, Argentina — which holds roughly 85% of the world’s lithium reserves, is finding significant new hard rock opportunities for investors.

Lithium Insights

Industry lithium report

The supply of lithium, essential for electric vehicles, is expected to face twenty years of rapid growth, according to our new report. The Oregon Group forecasts lithium’s dominant demand segment — electric batteries and vehicles (EVs) — is also it’s fastest growing, a dynamic rarely encountered even in bull markets.

Report: Inside the accelerating global race for lithium

Latest infographics on lithium:

Lithium (Li)

Lithium, atomic number 3, is a soft, silvery-white alkali metal renowned for its exceptional energy density, low weight, and reactivity. With a melting point of 180.5°C, lithium is the lightest solid element and plays a foundational role in the global shift toward electrification and decarbonization.

As demand for electric vehicles (EVs), renewable energy storage, and portable electronics accelerates, lithium’s status as a critical mineral is firmly established—powering the batteries that drive the clean energy transition.

Why lithium matters: strategic applications

Electrification and energy storage

Lithium is indispensable in the transition to sustainable energy due to its unique electrochemical properties:

electric vehicles (EVs): Lithium-ion batteries are the standard for EVs, offering high energy density and long cycle life. Global EV adoption is projected to drive lithium demand up 84–174% from 2025 to 2030, and as much as 289% by 2035 in growth scenarios

renewable energy storage: Lithium-based batteries are critical for grid-scale storage, enabling reliable integration of intermittent solar and wind power and ensuring energy availability around the clock

consumer electronics: Smartphones, laptops, and tablets rely on lithium-ion batteries for lightweight, long-lasting power

Industrial and specialty uses

aerospace alloys: Lithium is alloyed with aluminum, copper, and manganese to produce strong, lightweight materials for aircraft and advanced manufacturing

glass and ceramics: Lithium compounds improve thermal shock resistance in specialty glass and ceramics

lubricants and greases: Lithium hydroxide is a key thickening agent in high-performance lubricants and greases for industrial machinery

Supply and demand dynamics

Demand drivers

EV and battery growth: The rapid expansion of EVs and stationary energy storage is the dominant force behind surging lithium demand

technology innovation: Larger battery packs and next-generation battery chemistries are increasing lithium intensity per unit, amplifying demand

global policy: Ambitious climate targets and government incentives for clean transportation and energy storage are accelerating lithium adoption worldwide

Supply challenges

production bottlenecks: After years of oversupply, the lithium market is tightening in 2025 due to production cuts, shifting demand, and geopolitical tensions

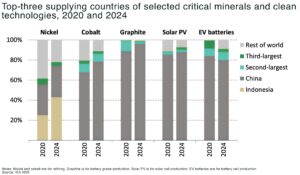

resource concentration: The lithium supply chain is highly concentrated, with Australia, Chile, and China dominating global production and refining

environmental and social concerns: Water-intensive extraction, especially from South American brines, and community opposition in key mining regions pose ongoing risks to supply growth

Major producers

Albemarle Corporation (USA): the world’s largest lithium producer, with operations in North America, Chile, and Australia

SQM (Chile): a leader in South American brine extraction and lithium processing

Ganfeng Lithium (China): a vertically integrated producer with global mining and refining assets

Tianqi Lithium (China/Australia): a major player with interests in the world’s largest hard-rock lithium mine

Market trends shaping lithium’s future

clean energy transition: lithium demand will continue to surge as countries invest in EVs, grid storage, and renewable energy infrastructure, cementing its role as the backbone of the battery supply chain

recycling growth: Lithium-ion battery recycling is expanding rapidly, with North America and Europe scaling up capacity to recover critical materials and reduce reliance on primary supply

geopolitical dynamics: Trade policies, resource nationalism, and environmental regulations are reshaping the global lithium market, with countries seeking to secure domestic supply chains and maximize economic benefits

Lithium’s unmatched energy storage capabilities make it essential for electrification, renewable energy systems, and advanced manufacturing. As the world pivots toward sustainability and technological innovation, robust lithium demand will persist—solidifying its position as a cornerstone of the modern energy economy.

Can lithium hit $30,000 in 2026?

Lithium prices have staged a remarkable comeback in early 2026, surging over 100% from their 2025 lows to more than US$16,000 per tonne in January

US launches $12 billion strategic minerals stockpile

The US will establish a US$12 billion strategic minerals stockpile, marking its most direct intervention yet in critical mineral markets as competition with China intensifies.

The next energy shock won’t be oil — it’ll be critical minerals, warns IEA

Key takeaways The International Energy Agency’s World Energy Outlook 2025 redefines energy security for the electric age: not oil or gas, but critical minerals are

US Government takes 5% stake in Lithium Americas’ Nevada project

The US government will take a 5% equity stake in Lithium Americas’ joint venture with General Motors, tightening its grip on strategic minerals and marking

Why the US fails to secure critical mineral supply — and how it can be fixed

An inside look into what’s gone wrong in Washington — and how to fix it In December 2024, China banned exports of gallium, germanium, and antimony

Is this the “shale moment” for critical mineral mining in the US?

A quiet revolution is underway in the bedrock of the global economy. The mining and processing of critical minerals — from lithium to rare earths,