Back in 2019, I wrote a post on the burgeoning growth of the energy storage sector. The main highlights from that post were:

- Deployment of energy storage installations in the US alone doubled in 2018, with 2019 set for another doubling of deployed capacity.

- 80% year-on-year jump in deployed storage capacity to 777 megawatt-hours (MWh) of capacity in 2018, with the forecast calling for 1,681MWh of grid-connected storage to be deployed in the US alone in 2019.

- US residential storage market quadrupled in 2018 year-over-year.

With the number of major power outages hitting the U.S. in recent months, the spotlight is now on grid resiliency. You see, renewable energy is a critical part of decarbonization, however, it plays havoc with power grids which are designed to rely on baseload energy from traditional sources of power generation. That’s where energy storage facilities come.

So, in the two years since I last wrote about this area, what’s happened?

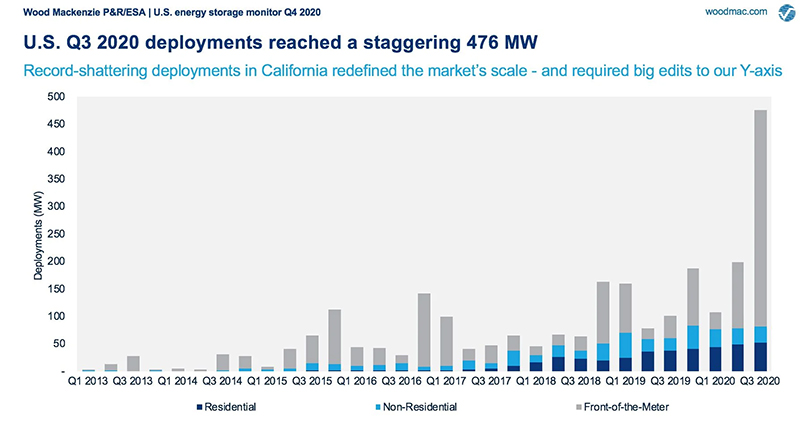

The short answer is: a lot of growth. According to Wood Mackenzie, in 2020 the US energy storage industry crushed its previous quarterly installation records in two successive quarters. Annual deployments more than doubled in the year and are expected to nearly triple in 2021.

All of this is happening despite the global pandemic. Wood Mac’s Energy storage director, Daniel Finn-Foley, went as far as to say “It’s the hockey stick that we’ve long expected, and it’s finally being realized.”

(Source: Wood Mackenzie / ESA U.S. Energy Storage Monitor)

Just as I’d highlighted in my 2018 post, the robust growth in the battery storage sector bodes well for key metals such as lithium, cobalt, graphite and of course nickel, all of which are needed to make lithium-ion batteries – which remains the current, undisputed leader as the commercial technology of choice for grid storage.

Of course, there are other battery technologies such as vanadium-flow batteries in the running, however, lithium-ion batteries will continue to dominate the grid-storage mix for at least the next decade, and almost certainly longer, given vast investments flowing into lithium-ion battery mega-factory build-outs worldwide.