Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

President Donald Trump has signed a sweeping executive order accelerating deep sea mining permits and licenses in areas beyond national jurisdiction under the Deep Seabed Hard Mineral Resources Act.

The order marks a significant escalation in US efforts to secure domestic supplies of key metals and counter China’s dominance in the sector through deep-sea mining, as well as a boost for America’s offshore critical minerals industry.

Over 10 years, a seabed mineral extraction industry could yield 100,000 jobs and hundreds of billions of dollars in economic benefits, one of the White House officials said.

The order calls offshore critical minerals a core national security and economic priority, citing the US need for reliable supplies of nickel, cobalt, copper, manganese, titanium, rare earth elements, and other critical minerals.

The executive order mandates immediate action to:

- accelerate exploration, characterization, and collection of seabed mineral resources, including polymetallic nodules, crusts, and coastal deposits, through streamlined permitting processes while maintaining environmental and transparency standards

- support investment in deep-sea science, mapping, and technology to quantify the nation’s offshore mineral endowment and advance extraction and processing capabilities

- enhance interagency coordination and create a robust domestic supply chain for critical minerals, including new processing infrastructure

- sStrengthen partnerships with allies and industry to counter China’s influence and support responsible seabed mineral development in allied Exclusive Economic Zones (EEZs)

Within 60 days, the Secretaries of Commerce, Interior, Energy, and Defense must deliver reports on private sector interest, permitting frameworks, processing capacity, and the feasibility of using the National Defense Stockpile for nodule-derived minerals.

The order also calls for a plan to map priority seabed areas and engage with international partners on benefit-sharing mechanisms for resources found beyond national jurisdiction.

The move has sparked sharp criticism from environmental groups, who warn that deep-sea mining could cause irreversible harm to marine ecosystems and biodiversity.

Internationally, the US push for mining in areas beyond national jurisdiction may heighten tensions, as global standards for deep-sea mining remain under negotiation at the International Seabed Authority—a body the U.S. has not formally joined.

The executive order comes amid escalating trade and resource competition with China, which has tightened exports of rare earths and other critical minerals in response to U.S. tariffs and technology controls.

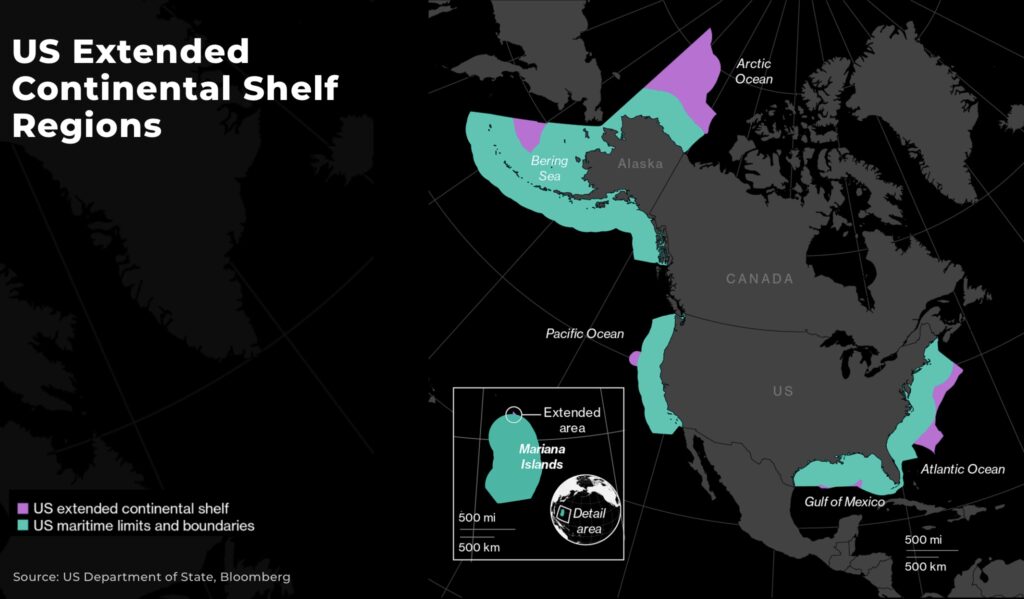

The executive order also builds on the policy direction set by the previous Biden administration, under which, in December 2023, the US claimed one million square kilometers, an area about twice the size of California, to its land territory under the sea.

Our analysis on what is deep-sea mining and how deep-sea mining is coming, whether the environmental lobby like it or not:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.