The US Commerce Department has imposed a 93.5% anti-dumping tariff on Chinese synthetic graphite anode materials — a key electric battery mineral — and may go higher warns the American Active Anode Material Producers (AAAMP).

The effective tariff rate for active anode material is now 160%, when adding in countervailing duty (CVD) tariffs of 11.5% placed by Commerce in May, President Trump’s blanket 30% tariffs on goods from China, and 25% Section 301 tariffs implemented by USTR last year.

The ruling follows a formal petition by the American Association of Anode Manufacturers and Processors (AAAMP) and signals a major escalation in U.S. efforts to protect its emerging battery supply chain from Chinese trade practices.

“This is an important ruling for North American graphite producers. Commerce’s determination proves that China is selling AAM at less than fair value into the domestic market. Dumping is a malicious trade practice used by China to undercut competition and wield geopolitical influence. It is all made possible by a concerted combination of massive subsidies and other state-sponsored policies”

— said Erik Olson, American Active Anode Material Producers (AAAMP) spokesperson

It is one of the most aggressive US critical mineral trade actions against to date, in an attempt to diversify domestic supply.

The new duties will add to existing rates, making the effective tariff 160%, according to the American Active Anode Material Producers, the trade group that filed the original complaint asking for investigations in Chinese companies violating anti-dumping laws.

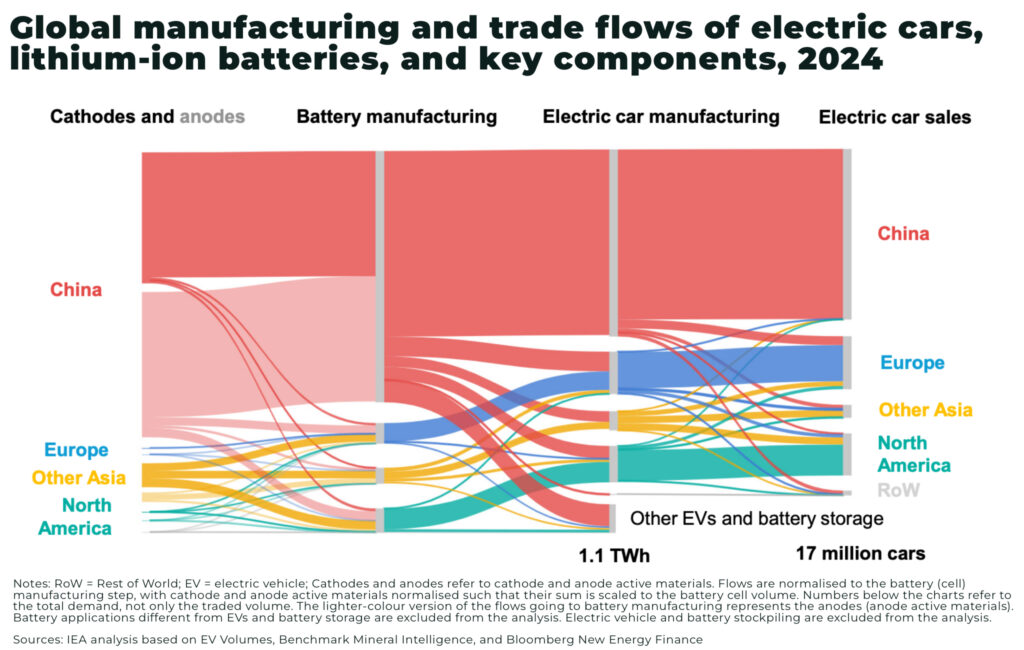

Synthetic graphite anodes are essential to lithium-ion batteries used in electric vehicles and grid-scale energy storage. China’s share of production accounts for 85% of global cathode active material and over 90% of the anode active material production.

The 93.5% tariff is aimed at countering what Washington describes as illegal dumping — selling graphite into the US below cost to undercut domestic producers. The Commerce Department’s final determination follows months of investigation into pricing practices by key Chinese firms including Shanghai Shanshan, BTR, and China Carbon Graphite Group.

This tariff, combined with earlier duties on natural graphite imports from China, will significantly raise costs for EV battery makers sourcing from Chinese suppliers—and could accelerate diversification efforts into South Korea, Japan, the US, and Africa.

“Now that the preliminary determinations have been issued, Commerce will continue its investigation. The final determinations for both the AD and CVD investigations – which could result in higher tariffs – will be issued around December 5th, 2025. Further tariffs could be added to graphite AAM imports at a yet to be determined date because of an unrelated Section 232 investigation Commerce is conducting”

— AAAMP Welcomes Commerce Ruling That China Is Wrongfully Dumping Graphite Into US

The tariff comes amid mounting tensions and concerns that China could retaliate by further tightening its own export controls — an option Beijing has already exercised in 2023 when it introduced a licensing regime for graphite exports, as well as recent rare earth restrictions.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.