Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The Pentagon’s Defense Logistics Agency (DLA) has issued a five-year tender for up to 7,500 t of alloy-grade cobalt, its first cobalt purchase since 1990, seeking to spend between US$2 million and US$500 million to rebuild the nation’s strategic stockpile and cut reliance on Chinese-dominated processing.

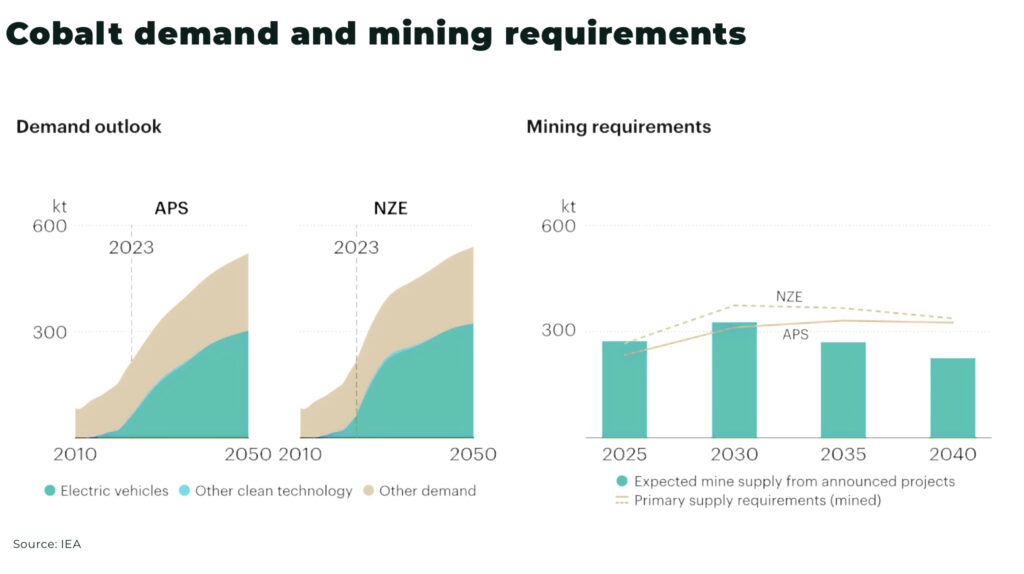

Cobalt is a hard, heat-resistant metal used in super-alloys for jet-engine blades, armour-piercing munitions and high-strength magnets in landing-gear systems. Demand has climbed with battery growth, yet China controls most refining capacity and has its own state reserves.

The DLA’s move would absorb about one-sixth of global non-Chinese alloy-grade output, tightening supply for aerospace and defence manufacturers.

Washington’s buying spree follows new authority in the 2024 National Defense Authorization Act, which guarantees the DLA US$1 billion per year and lets it sign long-term contracts without case-by-case congressional approval. The cobalt solicitation is one of more than six critical-mineral tenders—covering niobium, graphite and antimony—published since 30 July as the agency deploys US$2 billion in spending power authorised under 2023 tax-and-spend legislation.

Five-Year Tender at a Glance

- Volume: up to 7,500 t alloy-grade cobalt (min. 1 t lots)

- Budget: US$2 m–US$500 m

- Suppliers Invited: Vale (Canada), Sumitomo Metal Mining (Japan), Glencore’s Nikkelverk (Norway)

- Contract Term: delivery through FY 2030

- Pricing: fixed-price offers requested

Traders say alloy-grade prices, a niche within the broader cobalt market, could rise further after jumping 42 % this year on a Democratic Republic of Congo export ban. “With only a handful of qualifying smelters, meeting 7,500 t will be challenging,” said a London-based metal broker, predicting premiums for aerospace-quality units. The DLA’s specification excludes feedstock from China, Indonesia and the DRC, forcing buyers toward higher-cost Western smelters.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.