Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Key takeaways

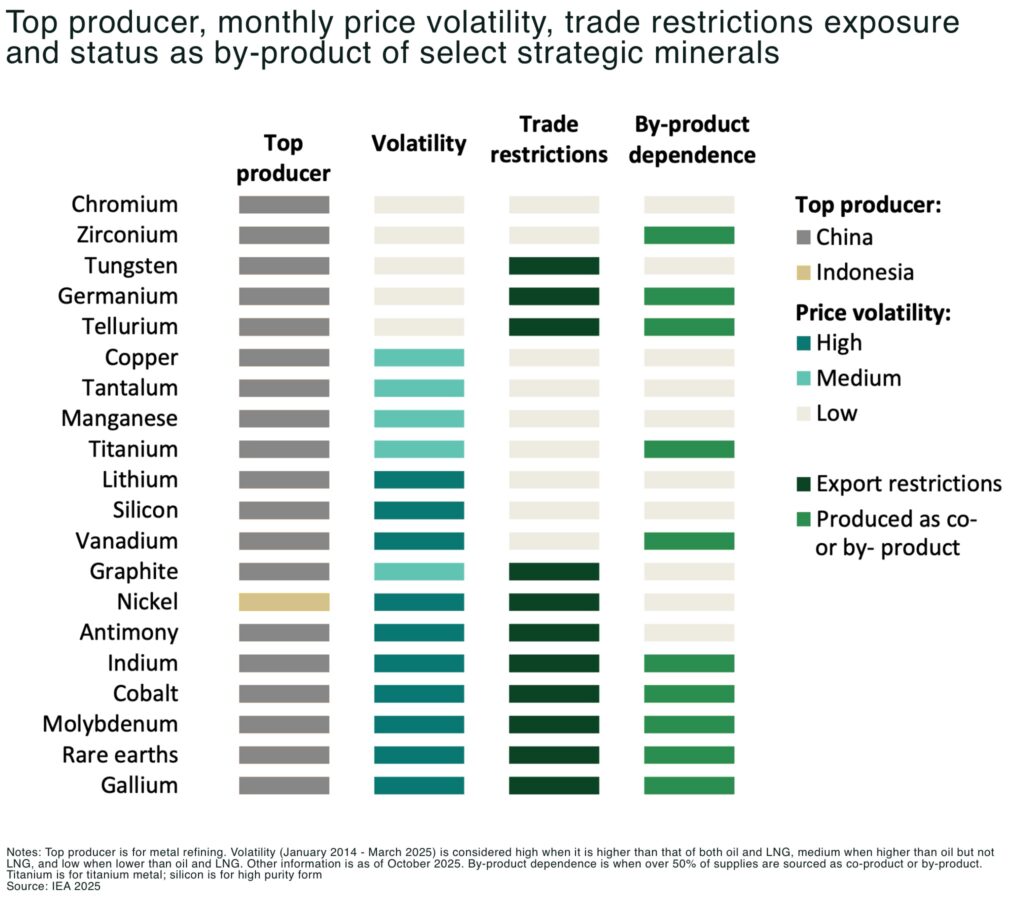

- China refines 70% of 20 strategic energy minerals and leads production in 19 of them

- Half of all strategic minerals now subject to export controls, up sharply since 2023

- Copper faces a 30% supply shortfall by 2035, even as nickel and cobalt supply catches up

- Price volatility for three-quarters of critical minerals now exceeds that of crude oil

The International Energy Agency’s World Energy Outlook 2025 redefines energy security for the electric age: not oil or gas, but critical minerals are now the system’s fault line. The report’s central message is clear — the energy transition’s raw material foundation is dangerously concentrated, geopolitically exposed, and still tightening.

Concentration worsens despite global push for diversification

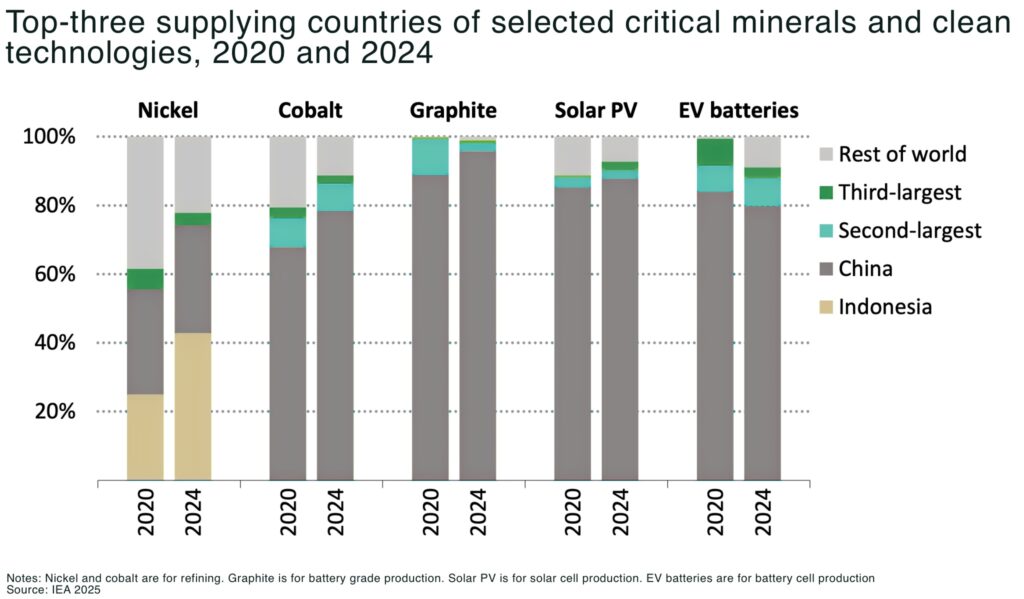

Refining of critical minerals has become more concentrated since 2020, not less, according to the IEA:

- the top three refining nations now control 86% of global capacity, up from 82% four years ago

- China the dominant refiner for 19 out of 20 energy related strategic minerals, with an average market share of around 70%

- and China holds over 80% of global battery supply chain capacity across every stage, from anodes to cells

Even under the IEA’s Stated Policies Scenario (STEPS), concentration barely improves by 2035, declining only to 82%, effectively back to 2020 levels. This means diversification efforts remain mostly symbolic without significant new refining investment outside Asia.

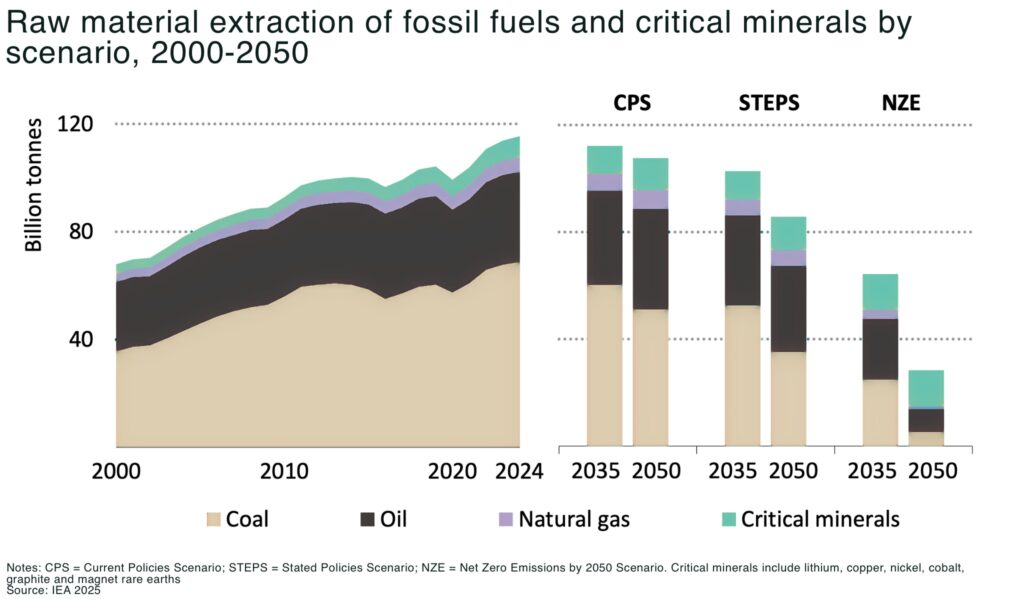

The global energy system requires the extraction of vast quantities of materials from fossil fuels to critical minerals. The total weight of useful products for the energy system was estimated at 17 billion tonnes in 2024. Even larger quantities of material are extracted to deliver these useful products.

The minerals in question are vital for power grids, batteries and electric vehicles (EVs), but they also play a crucial role in AI chips, jet engines, defence systems and other strategic industries.

Export controls are the new geopolitical leverage

The IEA identifies 2025 as the turning point when “the risks that we identified in 2021 are no longer a theoretical concern; they have become a hard reality.”

By November 2025, more than half of all strategic minerals were under some form of export control.

China’s moves were pivotal:

- April 2025: export controls on seven heavy rare earths and compounds

- October 2025: expanded to include five more elements and even assemblies or products containing Chinese-sourced materials. These restrictions triggered a 75% drop in rare earth magnet exports in Q2 2025, forcing automakers in the US and EU to idle production and sending European rare earth prices to six times higher than China’s domestic levels

“Many countries are turning to more diversified or home-grown energy sources to reduce exposure to geopolitical risk. At the same time, energy and material exports are increasingly being used as instruments of foreign policy. Alongside the expansion of global trade, there has been a notable rise in the use of trade measures as geopolitical tools, including restrictions on materials and access to technologies” — IEA, World Energy Outlook 2025

Impact Snapshot:

A 10% disruption in Chinese rare earth exports could halt production of 6.2 million cars or 650 AI data centers, the IEA warns.

Copper and lithium shortfalls loom

While new projects have improved medium-term supply for lithium, nickel, and cobalt, the IEA highlights copper as the critical bottleneck.

Under current policy settings, the world faces a 30% copper supply shortfall by 2035, driven by declining ore grades, long permitting timelines, and limited new discoveries.

Lithium remains better positioned with strong project pipelines in Australia, Chile, and North America, but refining remains highly concentrated. China refines 75% of purified phosphoric acid and 95% of manganese sulphate, two key inputs for next-generation LFP and manganese-rich batteries.

Key 2035 supply risks

- copper: –30% shortfall

- lithium: Tight but improving supply

- cobalt/Nickel: Stable if projects proceed

- graphite/rare earths: Severely exposed to supply shocks

Price volatility and “By-Product Dependence” create structural fragility

Three-quarters of the 20 minerals tracked by the IEA are now more volatile than crude oil, with half exceeding even natural gas volatility.

For many — such as tantalum, titanium, vanadium, and indium — production is tied to by-products from other mining streams, limiting flexibility to meet rising demand.

That means when supply is disrupted, new capacity can’t simply be ramped up — and substitution options are limited or technologically unproven.

Investment response

The United States is emerging as the most aggressive in addressing these supply chain vulnerabilities, according to the IEA. The Department of Energy and Defense are deploying loan guarantees and offtake-backed financing under the Defense Production Act and Supply Chain Resiliency Initiative.

Recent deals include the Pentagon’s long-term offtake and price floor agreement with MP Materials, aiming to anchor a domestic rare earth magnet supply chain. Still, global refining and midstream investment remain far below what’s required. The IEA warns that “market forces alone will not deliver diversification.”

Why it matters

The IEA’s message is unmistakable: the next phase of the energy transition won’t be defined by the speed of renewable buildout but by the availability of the metals that make it possible.

If current trends persist, even a minor supply disruption could trigger battery price spikes of 40–50%, undermining EV economics and slowing the global decarbonisation agenda.

“While the market sizes for these strategic minerals are relatively small compared with bulk materials, disruptions in their supply can nevertheless have outsized economic impacts. For example, a 10% disruption in rare earth magnet exports could affect the production of 6.2 million conventional cars, or almost 1 million industrial motors, or 230 000 civilian aircraft, or the construction of over 650 hyper-scale AI data centres” — IEA, World Energy Outlook 2025

- the IEA forecasts USD$900 billion clean tech market (batteries, solar, wind, EVs)

- disruptions in metal supply could wipe out years of cost reductions

- supply diversification projects, especially in North America, Australia, and Africa, are set to attract a surge of capital seeking geopolitical hedges

Conclusion

The World Energy Outlook 2025 reframes energy security as mineral security.

Copper, lithium, rare earths, and graphite now play the role oil once did in the 1970s, strategic resources vulnerable to coercion and shock.

The IEA’s call is blunt: without deliberate policy coordination, strategic stockpiles, and diversified refining, the next energy crisis will be measured not in barrels, but in tonnes of minerals.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.