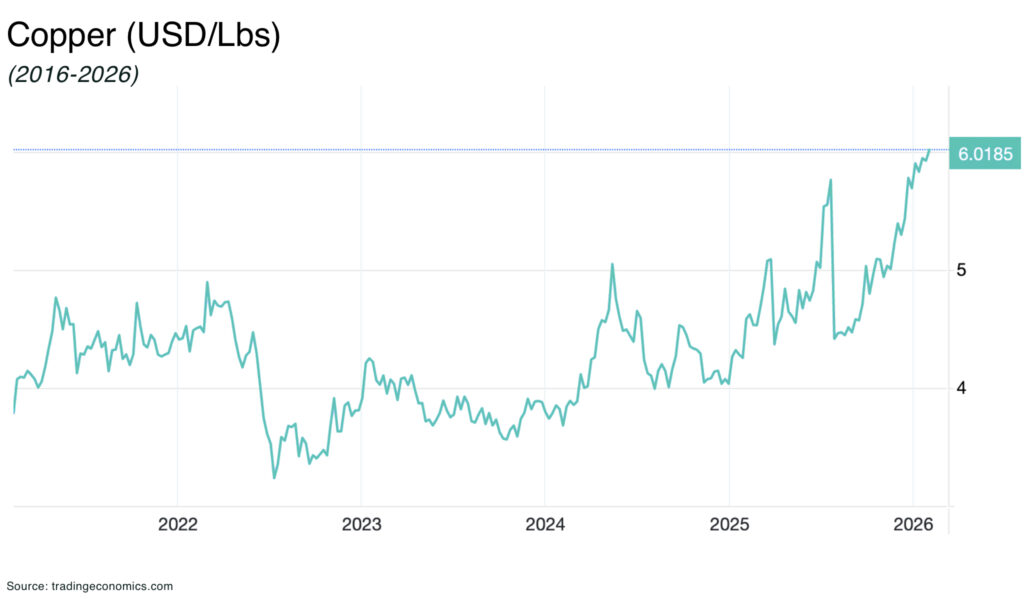

- LME cash copper prices hit an all-time high of $13,300 per metric ton on January 6, 2026, marking a 50% year-on-year increase

- The International Copper Study Group (ICSG) projects a 150,000-ton refined copper deficit for 2026, while J.P. Morgan estimates a deficit of 330,000 tons

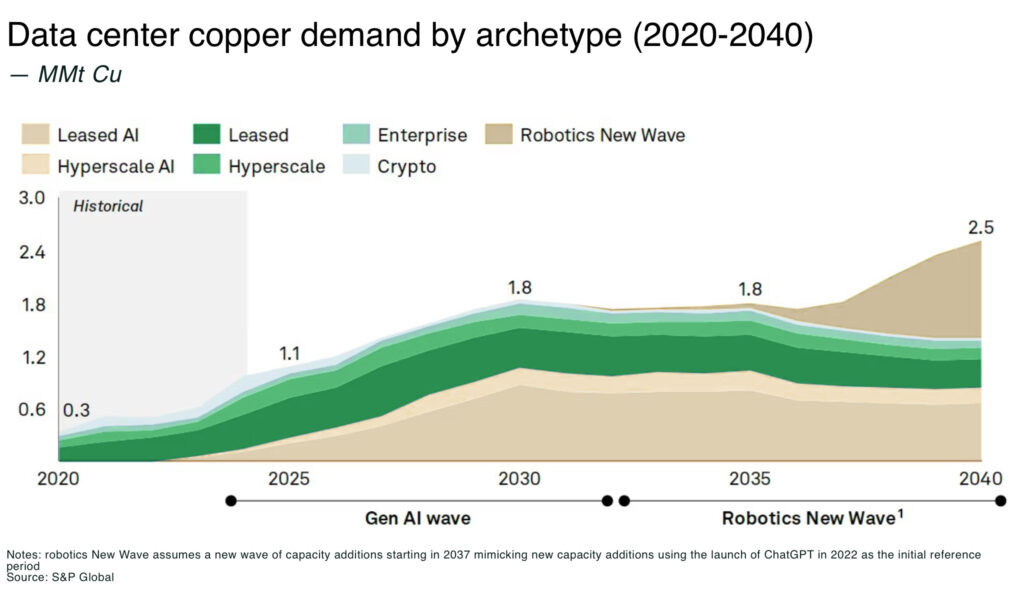

- AI data centers are projected to consume 500,000 metric tons annually by 2030, driven by mega-projects like the $500 billion OpenAI Stargate initiative

- production at Codelco, the world’s largest producer, stagnated at 1.332 million tons in 2025, a marginal 0.3% increase following deep-level mining accidents

Benchmark copper prices on the London Metal Exchange (LME) breached $13,000 per metric ton on January 5, 2026 — with a 16% rise alone just since start of December 2025.

The record rally follows structural supply shortfalls and a surge in AI-driven infrastructure demand that has outpaced global mining output, as well as an institutional rotation from precious metals into base metals essential for digital and energy infrastructure.

Can it hit US$15,000 in 2026?

While gold and silver reached record levels in 2025, copper has also emerged as a primary focus for funds seeking exposure to the “gigascale” build-out of AI factories, defence buildout, and the ongoing energy tranasition.

There’s good reason why copper made it onto America’s updated list of critical minerals in 2025.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Primary demand drivers: sector breakdown

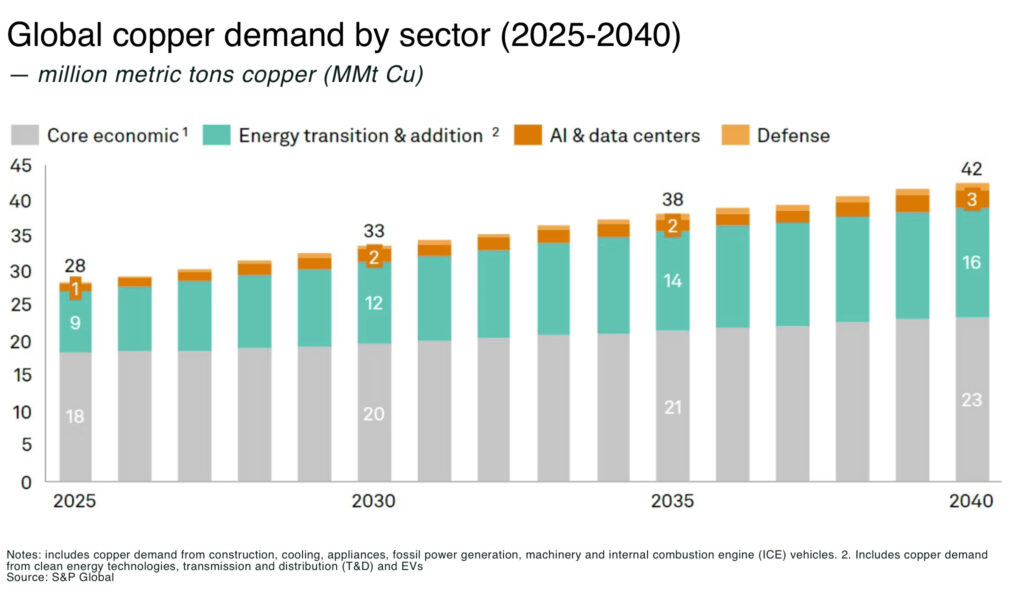

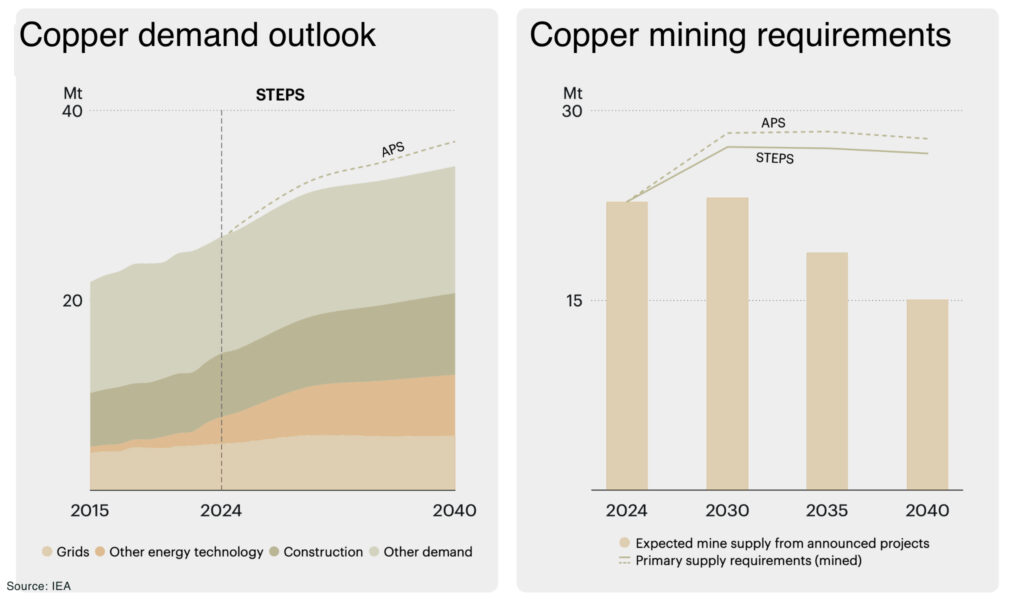

Global copper consumption is projected to increase by 8.2 million metric tons annually by 2035, driven by four primary disruptors: the energy transition, AI-driven data centers, defense spending, and rapid (re-)industrialization.

1. AI and data centers

Data center demand is the fastest expanding demand sector for copper, with, for example, a hyperscale data center, built to run artificial intelligence (AI), requiring up to 50,000 tons of copper per facility.

Copper demand for data centers is forecast to increase from 1.1 million metric tons in 2025 to 2.5 million metric tons by 2040

2. Construction and industrial

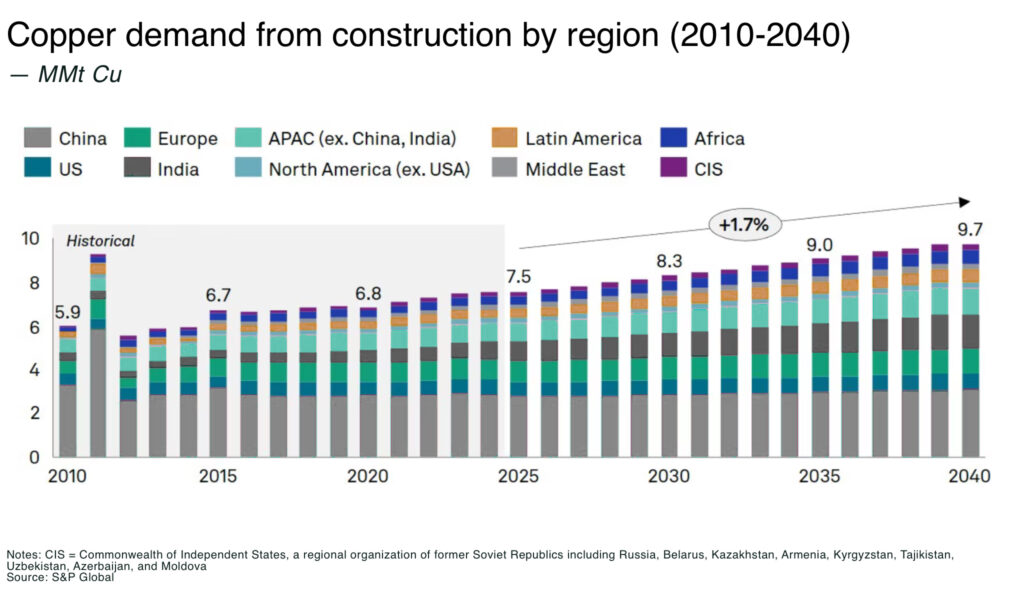

Equipment manufacturing, followed by construction and infrastructure, are the largest end-uses for copper. Global use of refined copper rose from 10Mt in the late 1980s to 26.5Mt in 2023 as Asia became the largest consumer with a 70% share of consumption.

Core economic demand globally is forecast to increase by 2% annually, from 18 million metric tons in 2025 to 23 million metric tons by 2040. For example:

- rapid urban expansion in Southeast Asia and India is projected to add 3.3 million metric tons of demand by 2035

- copper demand is expected to grow annually by 4.5% for refrigerators, 2.4% for washing machines, and 2.4% for TVs between 2025 and 2040, reaching a total of 1.5 million metric tons

3. Energy Transition

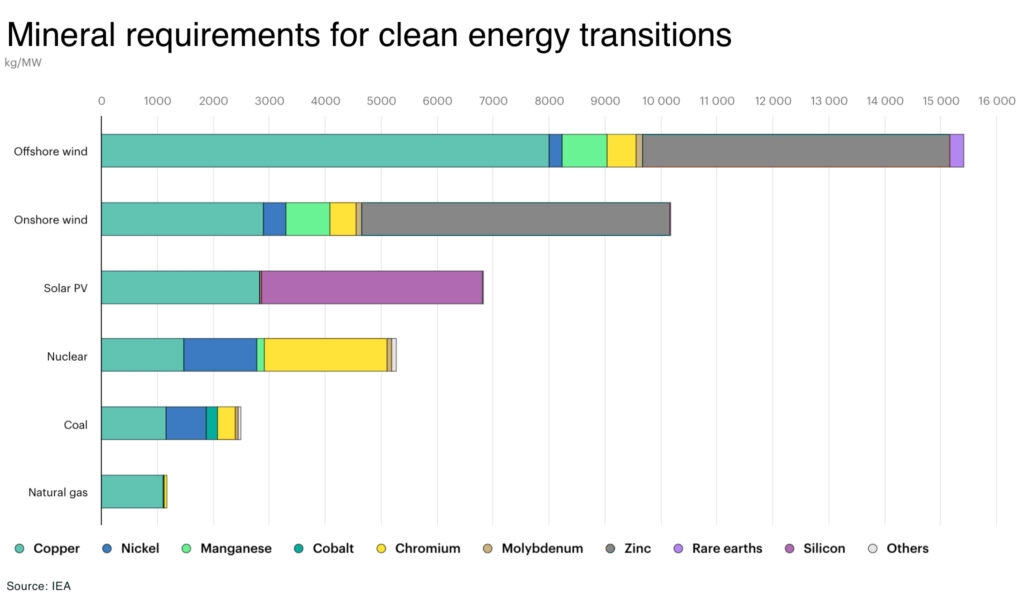

Despite recent setbacks across the renewable energy sector, the shift to clean energy continues, and is estimated to add 7.1Mt of annual copper demand by 2040:

- electric vehicles: a battery-electric car requires 183 lbs of copper, x3.6 the intensity of internal-combustion models. EV-related demand is forecast to double by 2035, reaching 4.3 million metric tons annually

- renewable power: wind and solar are all more copper intensive than fossil fuel energy sources, with an estimated 8,000kg of copper per MW for offshore wind turbines

- grid expansion: 152 million km global electricity grid is forecast to be needed to meet net-zero targets by 2050 (double the size of grid today) needing around 427 million metric tons of the red metal between now and 2050

4. Defense

In 2022, Russia’s 11 million shells fired against Ukraine contained the same amount of copper as 10% of UK’s total wind turbine capacity.

And, across the world, production of copper-containing 1550millimeter shells are ramping up with, for example, the US planning to increase from 93,000 to 1.2million in 2025; Germany’s Rheinmetall will soon be able to produce 1.5 million 155mm artillery shells a year, more than the combined US defense industry.

And that’s just shells. Copper is critical across a range of defence technologies, from missiles to munitions and navy platforms. Although quantities of copper used by militaries are state secrets (although Simon Hunt Strategic Services estimates global military demand accounts for nearly 9% of refined copper output in 2021 and is growing at 14% per year through 2026), to give some perspective: in 2024, global military expenditure reached $2.718 trillion, an increase of 9.4% from 2023 — the steepest one-year surge since the Cold War.

5. Robots

And potentially robots will add a fifth demand driver. Although we are far from mass market adoption, the 10 billion humanoid robots that Elon Musk has suggested will be in the world by 2040 would need about 1.6 million tonnes of copper a year, or roughly 6% of current global consumption.

Supply constraints

The (big) challenge is supply.

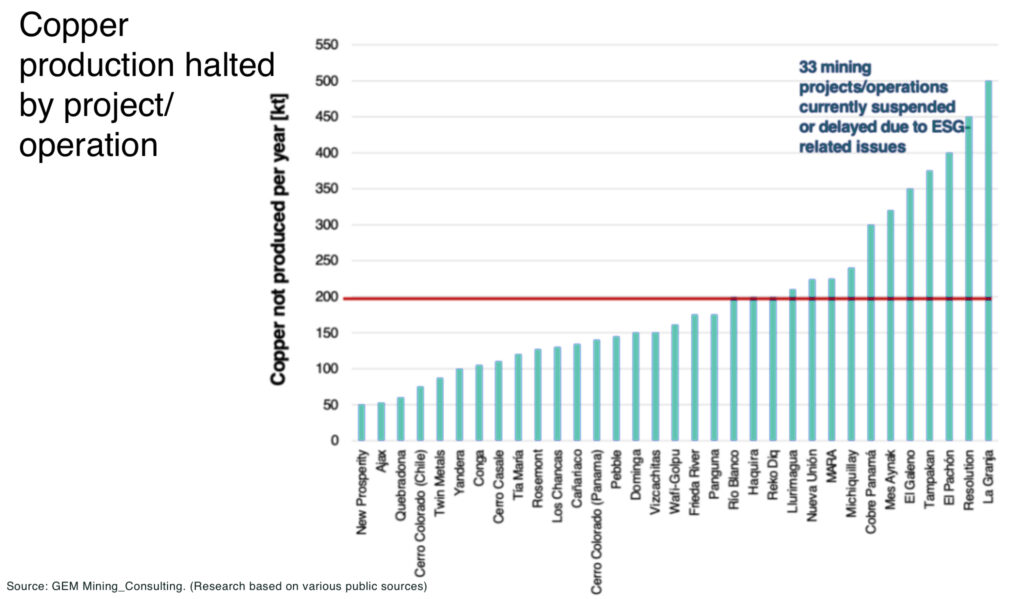

As demand scales, supply growth remains constrained by declining ore grades and recurring disruptions in key producing regions. For example, Chile and Peru — which together account for roughly one-third of global mined copper — are struggling not only to grow output, but to sustain current levels.

- Chile: Codelco (the state-owned mine and largest copper producer in the world) production reached 1.332 million tons in 2025, a marginal 0.3% increase over 2024, and hopes to lift output by 10,000 tons in 2026. However, average copper grades have fallen from 1.02% in 2022 to 0.66% in 2025 across the company’s aging portfolio. The net impact is higher costs and rising capital intensity to maintain output.

And then there’s the immediate-term disruptions, such as the rock burst at the El Teniente mine in July 2025 also caused 48,000 tons of lost production in 2025 and is expected to cut an additional 25,000 tons in 2026; or, in January 2026, contract-workers in Chile blockaded access roads to Escondida and Zaldivar (the world’s largest and a top-10 mine) delaying shifts and transport; and a three-week labor strike in January 2026, that halted production at Capstone Copper’s Mantoverde copper and gold mine in northern Chile - Peru: output from the world’s third-largest copper producer saw a sharp 12% year-on-year decline in 2025, with monthly production falling to 216,152 metric tons. A lack of major new projects coming online, as well as persistent social conflicts, continue to threaten long-term production, eg with the Las Bambas mine having faced over 700 days of blockades throughout its history

- Indonesia: the Grasberg mine, the world’s second largest copper mine formerly responsible for 3% of global mined copper, remains under force majeure after a catastrophic mudslide in 2025 that killed seven workers. The accident is expected to result in approximately 500,000 tons of lost copper over 12–15 months. Operator Freeport-McMoRan plans a phased restart in Q2 2026, but targeting only 85% of normal capacity by the second half of the year, ensuring tight supply remains a factor through the medium term

- Democratic Republic of Congo: the Kamoa-Kakula complex achieved its 388,838-ton guidance in 2025, but has been forced to push its 500,000-ton annual target back to 2027. The delay follows seismic-induced flooding in May 2025 that halted mining for weeks.

- Zambia: Africa’s second-largest producer saw output rise 8% to 890,346 metric tons in 2025, yet missed its 1-million-ton government target. Growth at Mopani and Konkola was offset by a tailings dam collapse in February 2025 and an 18% production decline at the Trident mine due to lower grades. The country aims for 3 million tons by 2031, but current operational hurdles highlight the difficulty of scaling in high-risk jurisdictions

In total, an estimated 6.4 million tonnes of copper production capacity, equal to more than 25% of global mine output, is stalled or suspended due to environmental, social, and governance (ESG) issues, a recent study by GEM Mining Consulting reveals.

And geopolitics and trade policy is not helping either:

US COMEX inventories hit a record 503,400 metric tons on January 20, 2026, as traders built stocks ahead of expectations that the Trump administration may introduce a tariff on refined metal — potentially leaving the rest of the world short as miners struggle to boost output.

“Inventories used to act as a buffer, but now they’re locked in the US,” Li Xuezhi, head of research at Chaos Ternary Futures Co., told Bloomberg. “So the buffer is gone and everyone will have to scramble.”

Also, as major currenies (especially the dollar and Yuan) face sustained debasement pressures, investors are rotating towards scarce, strategic, policy-supported assets. Copper may not be a monetary asset but is increasingly treated as part of the wider “safe-haven” trade.

In a macro environment defined by structurally higher fiscal deficits, aggressive industrial policy, and persistent geopolitical friction, copper stands apart from many other investments.

Troilus Mining: leverage to copper scarcity, with permitting and financing momentum

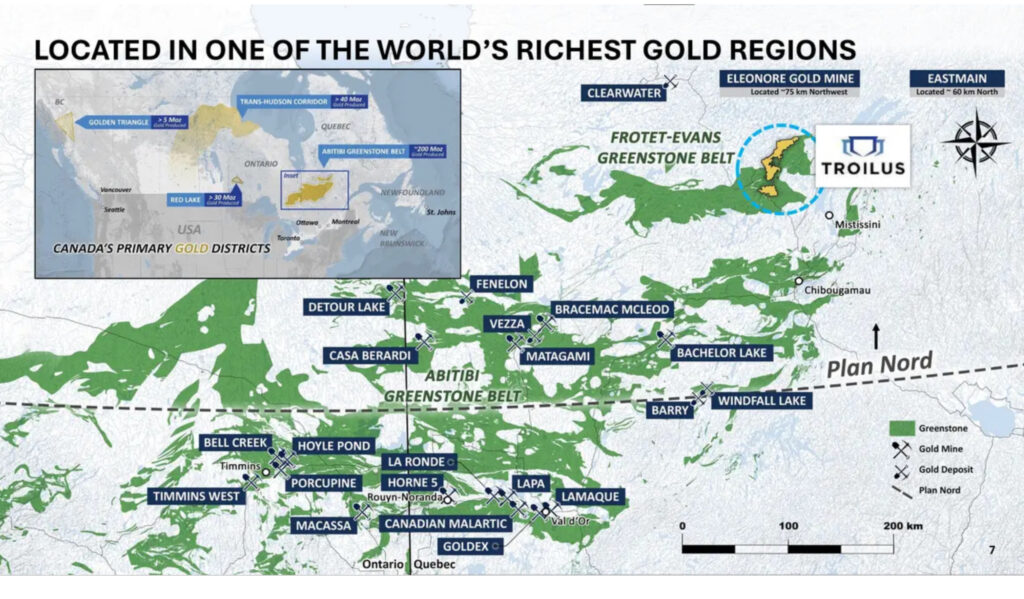

Troilus Mining Corporation (TSX: TLG; OTC: CHXMF) sits against this backdrop of structurally constrained copper supply, offers scale and near-term production in a Tier-1 jurisdiction.

The company’s flagship copper-gold Troilus Project in Quebec, Canada, is one of the largest undeveloped gold-copper systems in North America, with 13.0Moz AuEq of resources and 7.3Moz AuEq of reserves, underpinned by a 22-year mine life and expected average production of >300koz AuEq per year.

Just as the copper provides the strategic upside, linking Troilus directly to electrification, grid expansion, and industrial policy in North America and Europe, so the gold matters in an environment of elevated fiscal deficits and currency debasement.

Crucially, Troilus is no longer an early-stage optionality story. Basic engineering is complete, detailed engineering is advancing, and the ESIA has been submitted at both federal and provincial levels, with permits expected in H2 2026. The company has secured indicative LOIs totalling US$1.3bn from export credit agencies, mandated a syndicate led by Société Générale, KfW IPEX-Bank and Export Development Canada to arrange up to US$1bn in senior project debt, and established preliminary long-term concentrate offtake terms with Aurubis and Boliden.

Troilus sits squarely at the intersection of copper scarcity, electrification demand, and Western industrial policy.

This is not to say there might be headwinds.

For example, Goldman Sachs Research’s base case is that a 15% tariff will be announced in mid-2026 and implemented in 2027, but any delay in either its announcement or implementation could dramatically impact the direction of copper prices this year.

“We do not expect the price above $13,000 to be sustained,” says Goldman Sachs Research analyst Eoin Dinsmore.

On a fundamental basis, Goldman Sachs Research estimates that copper’s price will average around $11,500 per tonne, close to their price forecast of $11,200 per tonne for the fourth quarter of 2026.

However, while $13,000-$15,000 per tonne generates record earnings for established players (for example, Southern Copper reporting operating margins exceeding 60%, in January 2025), the range easily exceeds BlackRocks estiamted incentive price of $12,000 for new mines.

Structural deficits: outlook for 2026-2040

The copper market is shifting into a period of structural deficit as current mine production peaks and secondary supply (recycling) fails to close the gap. Some estimates suggest the world needs 80 new, sizable copper mines by 2040.

Demand growth is now largely policy-driven, tied to national security and massive electrification projects, making it difficult to reverse regardless of economic cycles. Conversely, new supply is capital-intensive, slow to scale, and increasingly politically constrained by resource nationalism.

As traditionally copper-rich nations like Chile and Peru struggle with production plateaus, their constraints have created a multi-billion-dollar opportunity. And the path to US$15,000 copper is now paved with these structural constraints, transforming the metal from a cyclical commodity into a long-term tech-enabled premium asset.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.