Namibia’s Strategic Ascent in the Global Uranium Supply Chain

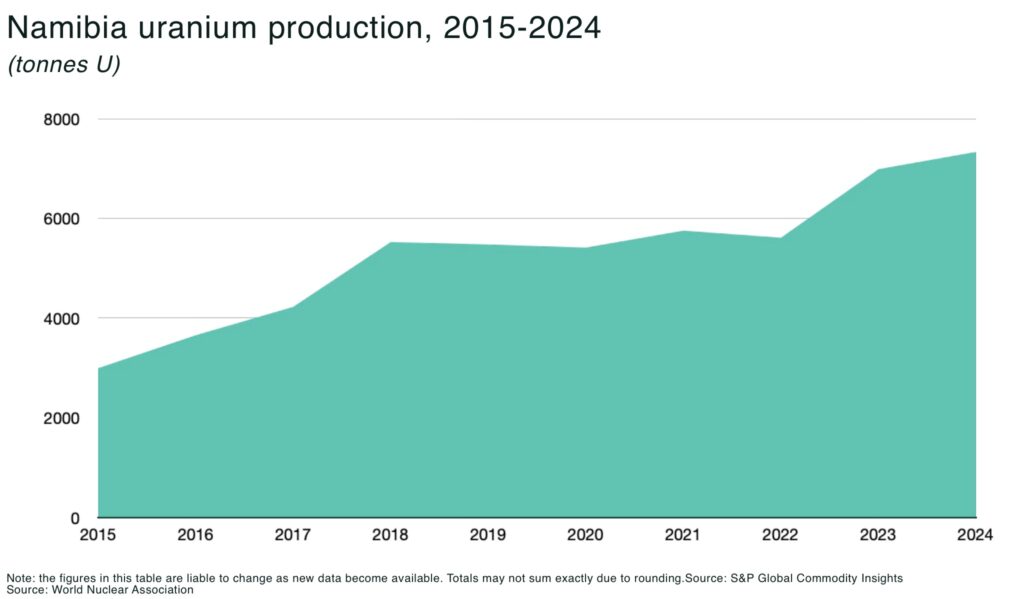

Can you name the world’s three largest uranium producers? Kazakhstan, Canada… Australia, you say? Nope, it’s Namibia, with 7,333 tonnes of uranium production in 2024, providing an estimated 10% of global supply.

And in 2024, Namibia hit its highest ever uranium production, the majority of which is exported to China (more than 77% in 2023). Now, the country wants to position itself as a secure supplier to both Asia and Western nuclear fleets as demand climbs.

As nations worldwide re-embrace nuclear power to meet energy security needs, Namibia’s uranium sector is emerging as a strategic lynchpin in global supply chains.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Namibia: established uranium mines + competitive edge

Namibia’s credibility in uranium markets rests on three well established operations in the arid Erongo region, near Swakopmund, which collectively anchor its production capacity:

- Husab mine: a massive open-pit mine operated by Swakop Uranium (majority-owned by China General Nuclear). Since commissioning in 2016, Husab has produced 4,000–4,500 tonnes of U₃O₈ per year, making it Namibia’s largest uranium producer and one of the biggest uranium mines globally. Husab’s output (over 5,000 t in recent years) constitutes the backbone of Namibia’s uranium industry

- Rössing mine: in operation since 1976, Rössing is one of the world’s longest-running open-pit uranium mines. Now majority-owned by China National Nuclear Corporation (CNNC), Rössing consistently produces 2,200–2,500 tonnes of U₃O₈ annually. In 2023 it delivered 2,920 tU (6.4 Mlbs U₃O₈) and has secured an extension of its mine life to 2036. Rössing’s steady output remains a cornerstone of Namibia’s exports, and ongoing investments aim to sustain production into the 2030s

- Langer Heinrich mine: idled in 2018 due to low prices, this mine (75% owned by Paladin Energy) resumed production in 2024 with the uranium price rally. By mid-2024 it had produced 235 tonnes U₃O₈ during ramp-up, and is expected to ramp to 1,300–1,600 tonnes per year in 2025. With Langer Heinrich back online, Namibia’s uranium output hit a record high in 2024

For 2025, estimates suggest Namibia’s production will hit 8,000–9,000t, solidifying its hold as the number three global producer.

Namibia’s uranium operations benefit from well-developed infrastructure, including:

- regional power grid

- desalinated water supply (via pipeline from the coast) support mining in the Namib Desert

- the deep-water Port of Walvis Bay provides an Atlantic shipping gateway to export yellowcake to converters in North America, Europe, and Asia. In particular, the port’s Atlantic location is logistically favorable for supplying European and North American customers (a key advantage over landlocked Kazakhstan or Niger)

- skilled local workforce with decades of experience in uranium mining; and local regulators and communities are familiar with the safe handling of radioactive materials, giving projects a smoother path in areas like environmental permitting and community acceptance

- pro-mining regulatory regime (eg the state’s mining company Epangelo has taken only minority stakes in new ventures (so no resource nationalism overhang)

- a new US$59 million sulfuric acid plant under construction near Walvis Bay will support both uranium and other critical mineral operations

This stable, mining-friendly jurisdiction enables Namibia to operate complex uranium projects at scale — and, last year, Namibia achieved it’s highest-ever Fraser Institute mining attractiveness ranking in 2024 (30th globally), reflecting investor confidence.

Geopolitical alignment and market access

Unlike some major uranium producers that are closely tied to Russia or China, Namibia maintains a neutral and investor-friendly stance — it has actively courted both Western and Asian partners: for example, in July 2025, hosting India’s Prime Minister in mid-2025 to discuss deepening strategic ties on uranium and other critical minerals; it has signed a strategic partnership on raw materials with the EU; and, in the US List of Critical Minerals 2025, Namibia is also listed in their “Critical Mineral Atlas“.

Namibia’s resource depth and development

In addition to current operations, Namibia’s uranium resource base is among the world’s largest. According to the World Nuclear Association, the country’s identified uranium resources are about 5% of the world’s known total, with those recoverable at up to $130/kg are about 275,000tU.

In other words, geology can support sustained uranium output well into the future, underpinned by ongoing exploration success.

A global demand-supply squeeze

And global uranium markets are tightening fast.

Nuclear fuel requirements already reportedly exceed primary mine production by roughly 40–50 million pounds U₃O₈ each year, forcing utilities to draw on dwindling above-ground inventories to bridge the gap. Secondary supply, once a reliable buffer of government stockpiles, reprocessed fuel and enrichment underfeeding, is being steadily reduced as demand rises, leaving less slack in the system.

At the same time, demand is accelerating. More than 70 reactors are currently under construction, with a further 110 planned and over 300 proposed as countries turn back to nuclear for energy security and decarbonisation. Forecasts from the latest World Nuclear Association fuel report show uranium requirements at approx 68,920 tU in 2025 rising to beyond 204,000 tU by 2040 under its upper growth scenario — a near-threefold increase in just 15 years.

The supply side is ill-prepared for that surge. The two largest producers — Kazatomprom and Cameco — have openly warned they will fall short of planned output as they battle declining grades, operational delays and under-investment that has persisted since the last cycle downturn.

Rising geopolitical stress is tightening supply further. For example, China has been locking in long-term supply across Africa and Kazakhstan, while sanctions and political instability have created uncertainty into production from Russia and Niger.

The World Nuclear Association warns that output from existing mines could halve after 2030 if new projects are not urgently brought forward.

The conclusion is unavoidable: the world needs more uranium, from jurisdictions that can deliver scale, stability and export capacity.

That is why Namibia’s position, already a top-three global producer, in a geopolitical strategic location, with multiple advanced projects poised to enter the market, is drawing increasing attention. As the supply deficit deepens over the coming decade, Namibia is one of the few countries positioned to step up in time.

Namibia’s new uranium projects poised to boost supply

Namibia’s next growth chapter will be driven by new uranium projects nearing development, and several large deposits discovered in the last two decades are now moving toward production. Analysts project that if planned projects proceed, Namibia’s uranium output could grow by 30–40% in the next decade.

Key developments in the pipeline include:

Etango-8 (Bannerman Energy): a globally significant uranium project with a completed definitive feasibility study. Located near Rössing, Etango-8 is designed as an 8 million tonne-per-year open pit mine (a scaled initial phase of the larger Etango resource). It targets roughly 3–4 million pounds U₃O₈ (1,400–1,800 t) of annual production. Early construction works are already underway, with Bannerman securing power/water infrastructure agreements and completing two A$85 million placements in 2025 to advance the project. A Final Investment Decision (FID) is expected by end-2025, potentially paving the way for first production by 2027

Tumas Project (Deep Yellow):a sandstone-hosted uranium project on Namibia’s “Alaskite Alley” trend, Tumas has a completed feasibility study and substantial reserves. It is expected to produce approx 3 million lbs U₃O₈ per year (approx 1,360 t) at full output. Development was initially slated to follow an FID in 2024, but Deep Yellow has temporarily delayed FID pending firm long-term offtake prices. Despite delays, Tumas remains one of most advanced potential new uranium mines globally, and could come online around 2026–2027

Norasa (Forsys Metals): an integrated project combining the Valencia and Namibplaas deposits, Norasa holds a large uranium resource base (over 77,000 tU in reserves/resources) and a completed feasibility study. It envisions production on the order of 5–6 million lbs U₃O₈ per year (approx 2,300 t), which would rival Rössing’s scale. Permits, including a mining license, are reportedly in place; the project awaits a development decision and financing

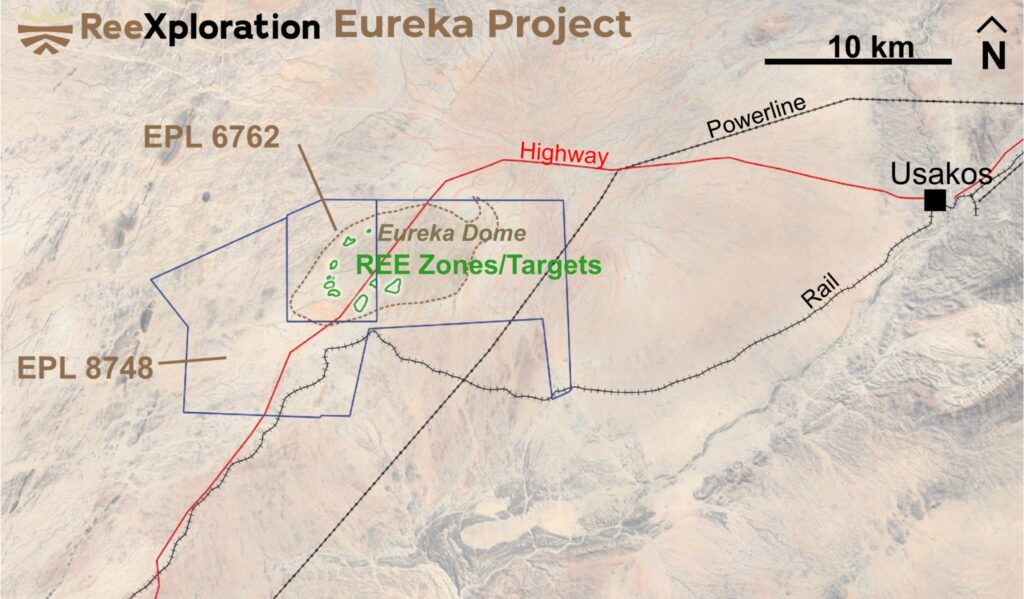

ReeXploration Inc. (TSX.V:REE FSE:K2i): in 2025, Canada-listed ReeXploration announced a major uranium target at its Eureka Uranium project.

Airborne radiometric surveys over Eureka defined a 6.5 × 3.5 km zone with high uranium counts and low thorium, a signature of primary uranium mineralization. This anomaly sits in the same prolific “Alaskite Alley” structural corridor as Rössing, Husab, Etango, Omahola and Norasa deposits — and hosts a classic signature of primary alaskite-hosted uranium mineralizationn, the same host-rock environment that has delivered decades of production at Rössing and Husab — which collectively contain >1 billion lbs U₃O₈ resources. Early ground-truthing has already confirmed uranium mineralization at surface, with scintillometer readings reportedly reaching 1,500 counts per second and portable XRF values up to 853 ppm U, according to management commentary.

Follow-up field work at Eureka has confirmed uranium at surface. ReeXploration’s CEO has described the target as “Rössing-style”, underlining the geological and strategic logic behind the play.

Importantly, Eureka’s uranium discovery also adds a compelling diversification angle to ReeXploration’s rare earths portfolio for critical minerals markets.

Conclusion

The global uranium supply gap left by years of underinvestment needs to be filled urgently to avoid a post-2030 supply crunch — and Namibia is one of the few jurisdictions with shovel-ready projects to fill it.

If the current series of projects are developed, Namibia’s uranium production in the 2030s could reach 14,000–15,000 tU/yr, rivaling the current production of Canada, firmly entrenching it as the top producer in Africa and a critical supplier globally.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.