- voluntary carbon credit market to grow hundred times by 2050

- two-thirds of companies in S&P500 have set targets to reduce emissions

- voluntary carbon credit markets hit record US$1 billion in transactions in 2021

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

When a big, new carbon credit deal grabs the headlines, it’s in the voluntary carbon credit market. Afterall, this is a market forecast to grow 15x by 2030 and a whopping 100x by 2050. Sounds like an obvious area to invest in, but it’s not without pitfalls.

Let’s have a look at some of the basics.

Firstly, what is a carbon credit? Well, every carbon credit is one metric ton of avoided or removed CO₂ or equivalent Greenhouse Gases.

The carbon markets themselves come in two flavours: compliance and voluntary. The compliance markets are heavily regulated, cap-and-trade affairs, which currently have a market value of approximately $851billion. Carbon emitters inside certain jurisdictions, such as California or the EU, are required to offset their carbon footprint by law and so enter these government-run markets to purchase carbon credits. Retail investors can gain exposure to these regulated carbon markets through investing in the companies themselves or ETFs which act as a proxy for the regulated markets. The concept for governments running these markets is simple: over time they will increase the price of these credits. As this happens, emitters will be increasingly incentivized to reduce their emissions.

The voluntary markets are for businesses and individuals to who want to voluntarily offset their carbon emissions by buying carbon credits. For instance, when a big corporation announces they plan to be net zero by 2030, they’re choosing to voluntarily offset their carbon footprint. They will naturally try to reduce their footprint with operational changes but eventually most will reach a point at which the only way to reach that net zero level is by purchasing carbon credits. Unlike the compliance markets, in which the regulators set the price of carbon, for the voluntary sector, it is the market that sets the price. That means a more volatile scenario and, for investors, represents greater opportunity.

Another difference between compliance and voluntary is the way credits are issued. Government organizations handle the former. However, for the voluntary markets, credits are generated by carbon offset projects after a lengthy (up to five years or more) verification process governed by carbon registries like VERRA or Gold Standard. Once generated, the credits are sold by the project operator – bringing much needed funding for these carbon reducing projects. Admittedly, working for up to five years before the money comes in may sound onerous for the carbon offset project developers, but the strict validation process enables credit purchasers to understand and feel secure about the value of their purchase. Beware anyone selling credits that are unregistered.

And that brings us to the factors that are impacting supply and demand.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

I’ll start with a short explanation of The Paris Agreement. Sometimes called the Paris Climate Accords, this agreement was adopted in 2015 by 193 nation states. It covers a variety of climate change issues and set a target for countries to limit global warming below a temperature rise of 1.5°C. To meet this goal, carbon markets, which came into existence in the 1990’s, are seen by governments and corporations alike, as an important tool to fund carbon reduction projects, and cost-effectively reduce carbon emissions.

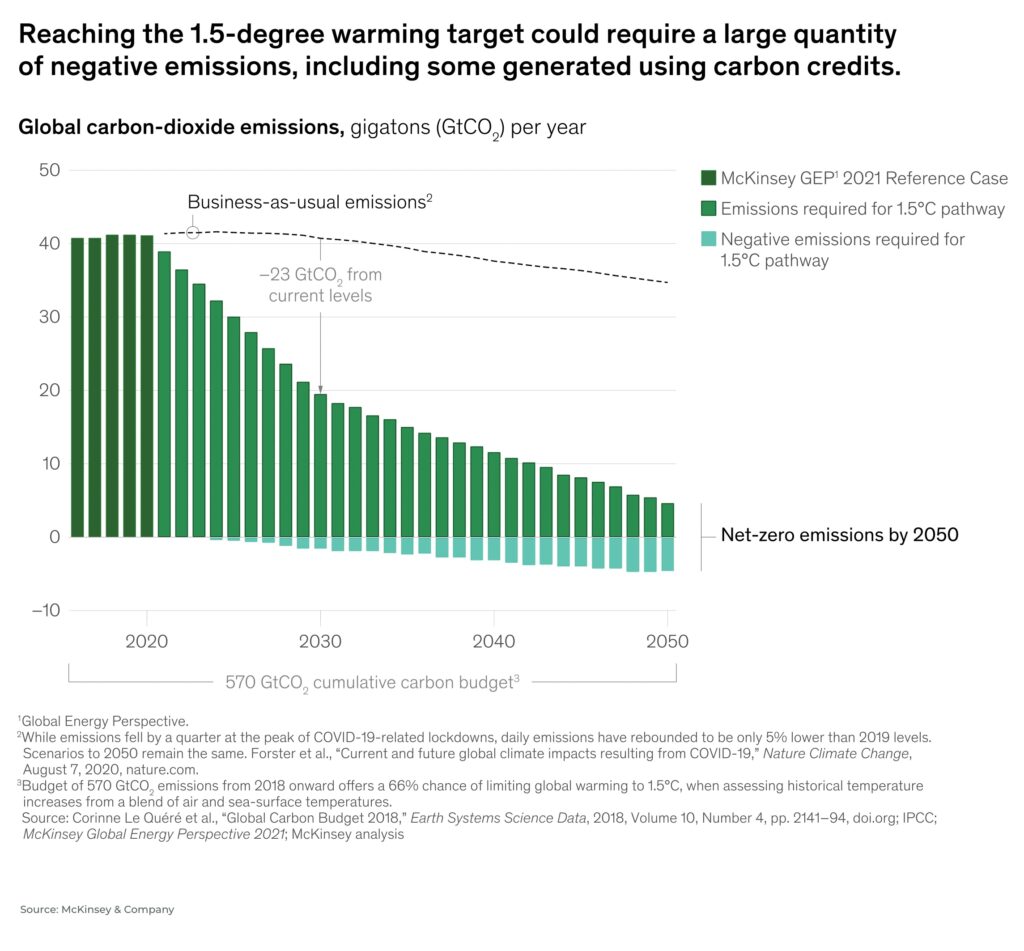

1.5C… sounds like a small number but it is in fact a herculean target for humanity when it comes to limiting the rise in temperatures.

Carbon credits have an important role to play in helping the global society to reach that crucial target. But to do so, some serious growth is required. The Taskforce on Scaling Voluntary Carbon Markets, a private sector initiative headed up by the renowned Mark Carney, estimates voluntary carbon markets will need to grow by more than 15 times by 2030 to meaningfully support such a 1.5C pathway.

And, last year, at the COP26 meeting in Glasgow, a consensus was reached on Article 6 of the Paris Agreement to establish and facilitate international carbon market mechanisms and investments, standardizing the international exchange of carbon credits.

As discussed, pricing in the voluntary markets is largely determined by supply and demand. There are exceptions, and it is not unusual to see carbon credits from the same registry trade at different prices. This is largely due to premiums. The most important premium, at the moment, is a carbon credit’s marketing value. Companies increasingly want carbon credits that can be used for public relations. So, for example, if the credit has stopped deforestation for palm oil in Indonesia, while also protecting water supply and employing numerous local community members, that has a good marketing premium.

Investors take note: these premiums change, for example, blue carbon credits (carbon capture and storage in coastal and oceans ecosystems) have a big premium right now, but the premium may move to another type of credit next year.

But premiums aside, supply and demand is still the biggest price setter, and that’s a good thing for a couple of reasons.

Firstly, over two-thirds of companies in the S&P500 have set targets to reduce emissions and, in March 2022, the US Securities and Exchange Commission proposed rule changes requiring companies to disclose their greenhouse gas emissions which will have a serious impact on companies net-zero targets.

Secondly, supply is struggling to keep up. The lengthy verification process, a major lack of environmental workers and project teams, and the nature of many projects themselves (trees don’t grow overnight) means the market is headed towards a supply crunch.

The voluntary markets already hit a record US$1 billion in transactions in 2021. They took a hit when Russia invaded Ukraine but has already seen a significant rebound. We believe we are still in the early stages of growth in the voluntary markets and expect an upwards trend over the coming years.

I’m going to round this off with a comment about the raison d’etre for this market. Carbon credits are not an end in themselves but are a means to an end: to simultaneously fund the projects that are fighting climate change, while helping companies to net zero. But that end is still many years and many billions of metric tonnes of carbon away.

Welcome to the carbon credit markets.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.