- demand for cobalt forecast to double by 2030, with supply deficit of 32%

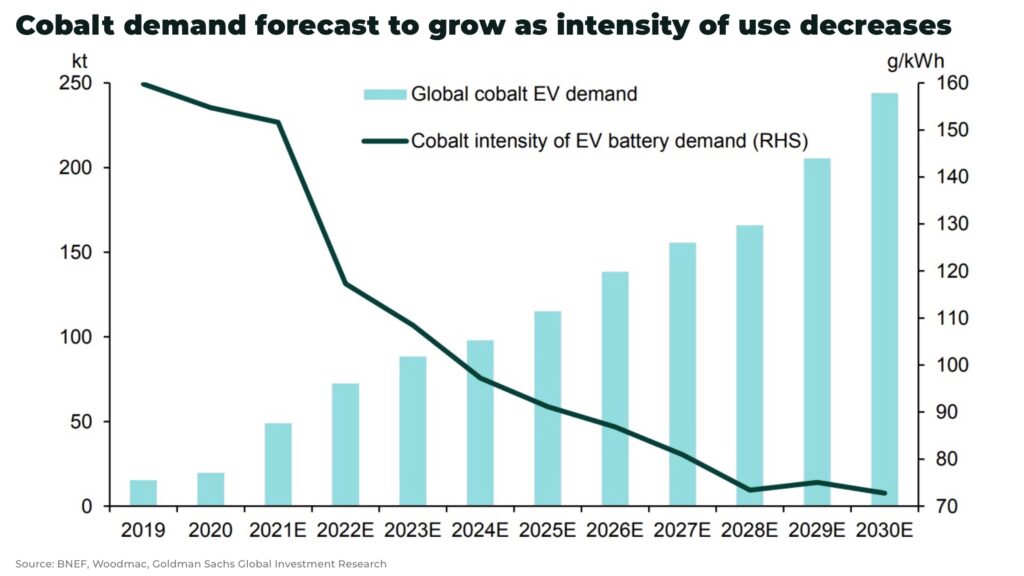

- cobalt demand forecast to increase as EV demand expected to grow 127%

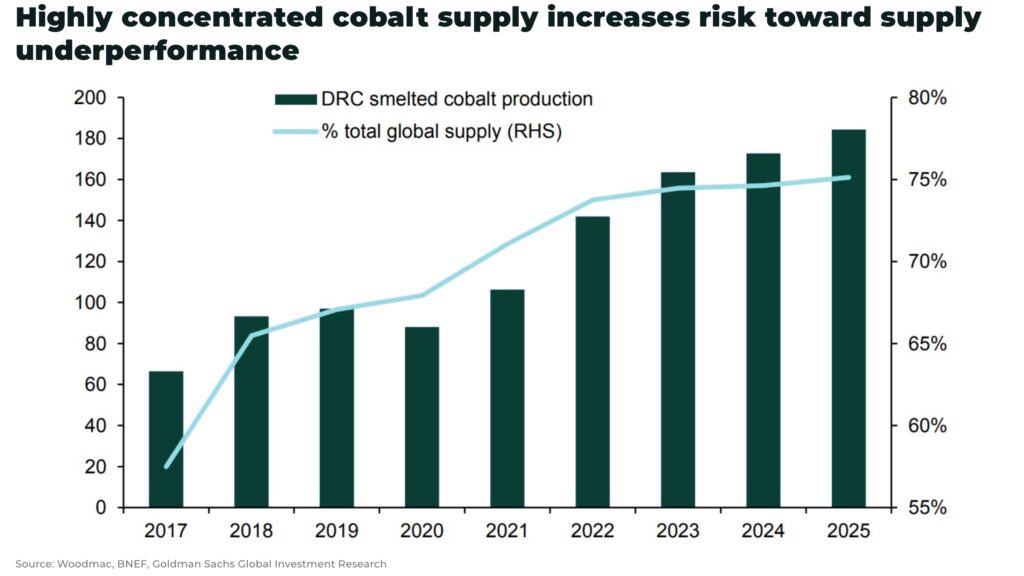

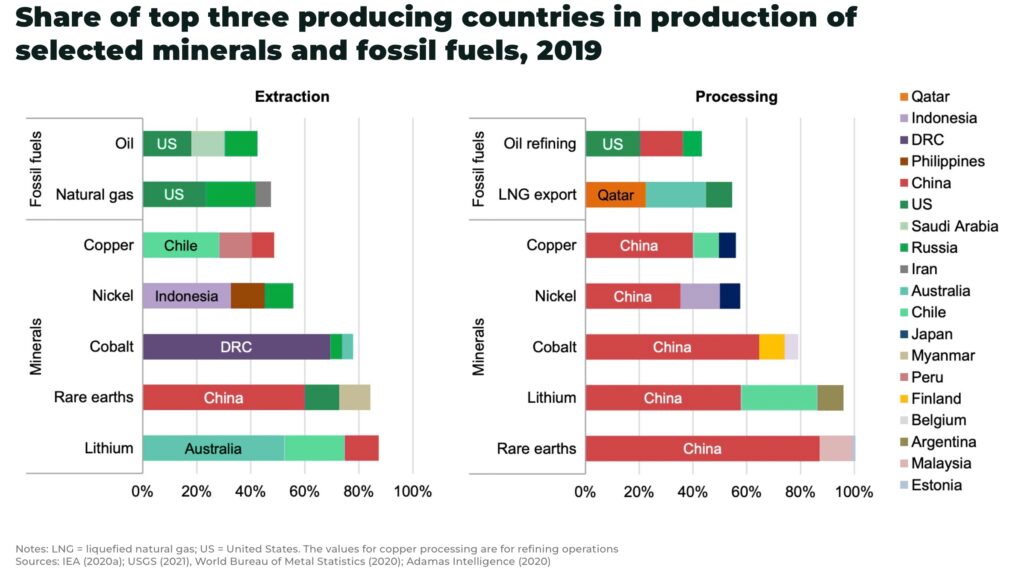

- concentrated supply chain from Congo and China poses risk

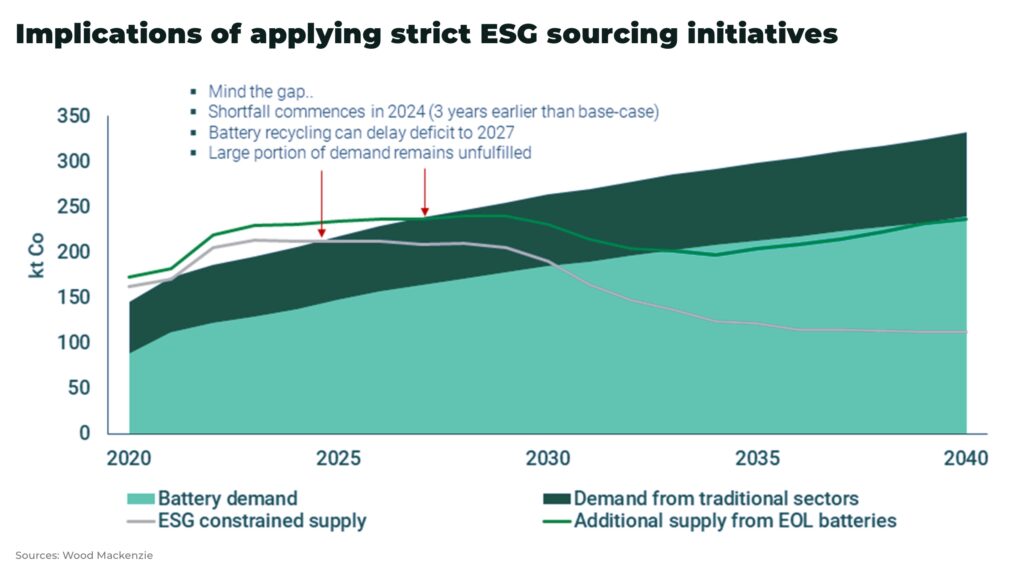

- in ESG constrained supply scenario, shortfall in cobalt could emerge in 2024

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Global demand for cobalt is forecast to double by 2030 — with a deficit in supply of 32%.

You wouldn’t know that from the price today.

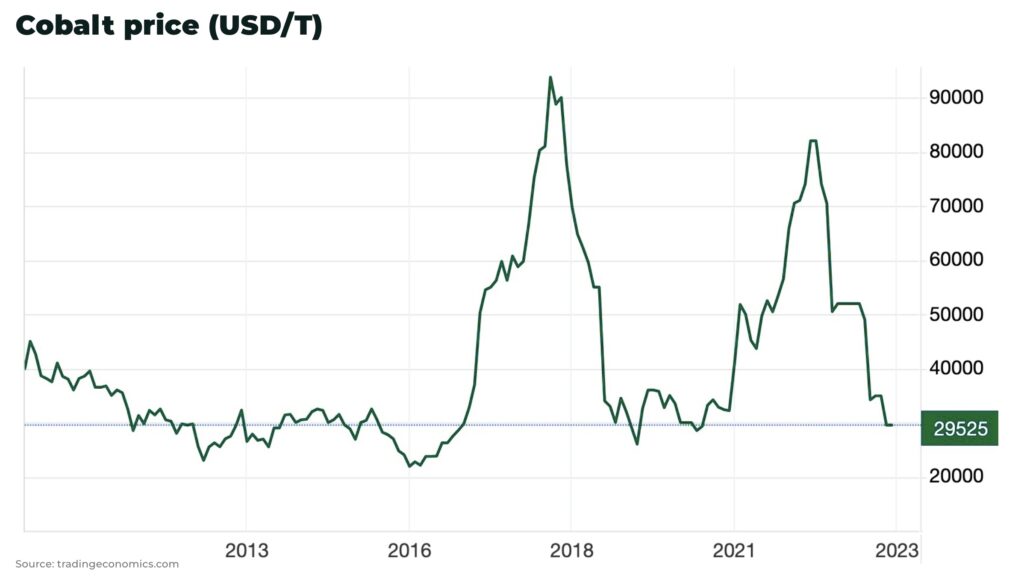

Cobalt is no longer the breakout metal it was in 2017 or 2021 with ample supply and changing electric battery chemistries impacting demand. But that does not mean that investors should count cobalt out just yet.

Boom-and-bust(-and boom?)

The recent fall from its second price spike in the last 10 years is due to oversupply and weak demand. The major reasons include:

- an agreement has been reached between China’s CMOC and the Democratic Republic of Congo’s (DRC) state miner over royalties, allowing the resumption of cobalt exports after they were stopped in 2022 and a significant stock built up

- EV sales have slowed in China, the world’s largest market, after tax credits were recently stopped

- a faster than anticipated drop in the use of cobalt in electric vehicle batteries, as automakers shift to lithium iron phosphate (LFP) batteries — that do not use cobalt — as a cheaper and ESG-friendly alternative

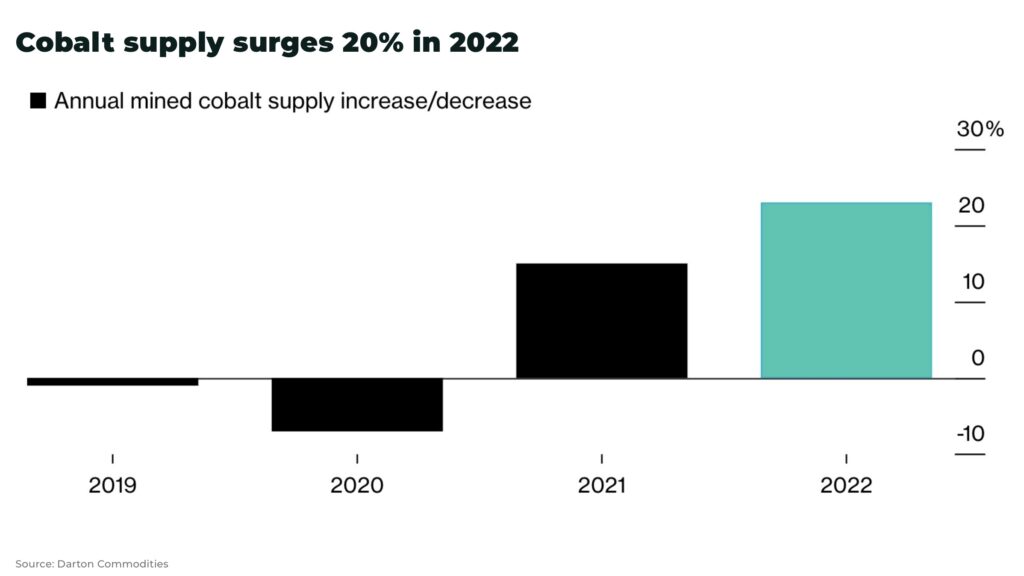

According to Darton Commodities, a cobalt market specialist, mined cobalt supply increased 23% in 2022, wiping out the deficit built up the year earlier. Fastmarkets’ research suggests this oversupply could rise to 4,000 tonnes in 2023.

But long-term, for investors, the fundamentals underpinning cobalt remain well-positioned.

“We have a bullish outlook for cobalt in the long-term. Despite concerns, it is unlikely cobalt will be engineered out of the electric battery supply chain in the next 10 years. But, short-term a surplus will weigh on the market as copper-cobalt capacity is brought back online and expanded in the Congo and nicked-cobalt capacity is added in from Indonesia”

– William Adams, FastMarkets Battery Raw Materials Analyst

Electric vehicles and cobalt

In 2022, battery chemistries that use cobalt made up over 68% of the market (lithium nickel manganese cobalt oxide (NMC) made up 60%, and 8% for nickel cobalt aluminum oxide (NCA)). LFP made up just under 30% globally.

As Goldman Sachs points out:

“The heightened price volatility and ESG concerns around the cobalt supply chain has started to convince battery manufacturers to move away from cobalt-intensive batteries. However, the magnitude of this demand adjustment should not be overstated. The decoupling from the current supply chain takes time and strong demand from NMC batteries along with the recovery in the electronics sector has still kept cobalt demand growth strong in 2022E”

— Goldman Sachs, Battery Metals Watch

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

And with the price falling, this “decoupling” will likely take longer, especially outside of the Chinese automotive industry where LFP accounts for 60% of all electric batteries.

Meanwhile, demand for EVs is surging.

Global annual passenger plug-in EV demand is expected to grow 127% to nearly 22 million vehicles by 2026, compared to 9.7 million anticipated sales in 2022.

This rise will likely significantly offset the expected decline in cobalt demand due to changing battery chemistry.

A risk-on metal

Cobalt mining and refining supply chains are concentrated in regions that present substantial environmental, social and corporate governance (ESG) risks.

Congo accounted for 73% of global cobalt supply in 2022.

The vulnerability of such a concentrated sources of cobalt supply was highlighted after the Congo government stopped one company’s exports in 2022 — and prices spiked, while cobalt was stockpiled within the country. And, despite an agreement to resume these exports, they are only expected to resume later this year when logistical and transportation issues are resolved.

In the meantime, a new report from Reuters suggests Congo wants to increase it’s share in a cobalt and copper joint venture with Chinese firms to 70%, up from 32%.

Congo also presents companies with the challenging labour practices for local communities.

The next section of the cobalt supply chain, China, accounts for 75% of global cobalt refining capacity in 2022, and it will be no small task for the US and the EU to develop their own integrated supply chains.

For the US and many other Western governments, this represents a challenge as they seek to secure their supply chains of critical minerals.

This tension has the potential to drive significant investment in cobalt, led by the US with the Inflation Reduction Act and the EU’s Green Deal Investment Plan, where cobalt is listed as a critical mineral.

(see our analysis on the arms industry and critical minerals)

For example, in January 2023, the US and Congo (and Zambia) signed a Memorandum of Understanding to strengthen the electric vehicle battery value chain between the two countries.

“These resources, and this commitment to cooperation, are crucial components of the urgently needed global energy transition. The plan to develop an electric battery supply chain opens the door for open and transparent investment to build value-added and sustainable industry in Africa”

— the United States Releases Signed Memorandum of Understanding with the Democratic Republic of Congo and Zambia to Strengthen Electric Vehicle Battery Value Chain

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Cobalt as a by-product

98% of refined cobalt comes as a by-product of copper and nickel production, not direct cobalt supply.

And, as global copper mine output suggests it’s reaching a peak in the next few years, Goldman Sachs forecasts a “relatively modest downward path” for standard grade cobalt prices.

How to invest in cobalt

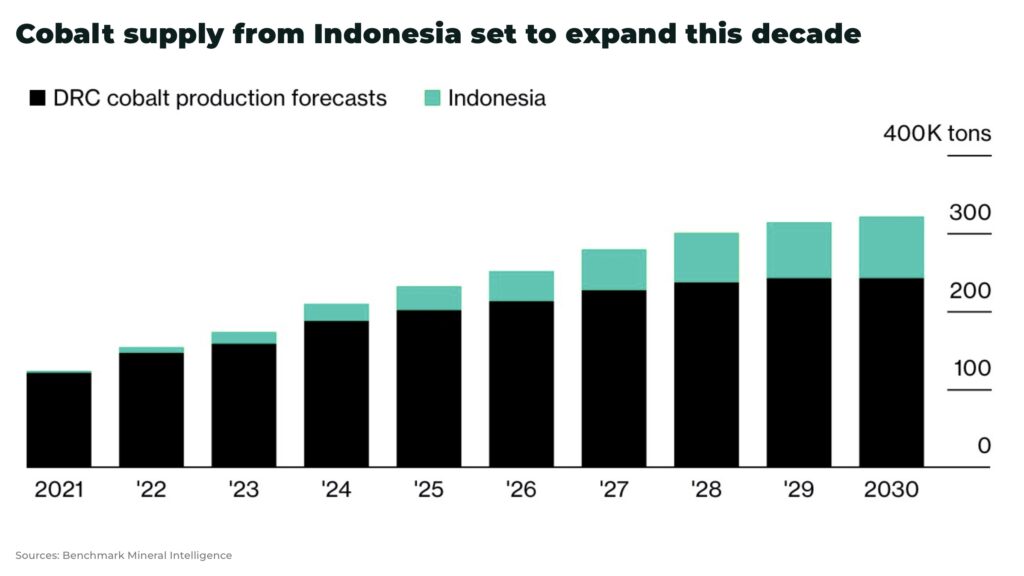

This year, Indonesia became the second largest global exporter of cobalt, accounting for 5% of supply in 2022, with the potential to increase supply by 2030, making it the fastest growth cobalt market in the next decade.

And Western companies have taken notice with, for example, Ford reaching a US$4.5 billion agreement with PT Vale Indonesia and China’s Zhejiang Huayou Cobalt over a nickel processing plant in the country.

However, despite some efforts in Indonesia to use alternatives to coal to power their processing plants, environmental concerns over coal and tailings will remain a challenge for Western companies needing ESG-friendly metals.

(read our analysis: Nickel’s environmental challenge offers opportunity for the West)

Elon Musk has recently announced that Tesla will conduct a third-party audit on it’s battery material suppliers.

“Even for the small amount of cobalt that we do use we will make sure that no child labor is being exploited” — Elon Musk, CEO of Twitter

Automakers and the energy transition will still need cobalt in the short and medium-term, but we expect a continued fall in the use of cobalt, especially from high ESG-risk regions, over the long-term.

In an ‘ESG constrained supply’ scenario, Wood Mackenzie estimates a shortfall in the cobalt market could emerge as early as 2024. This implies that virgin cobalt materials will remain critical to meet the surging demand.

This would put a premium on ESG-friendly sourced cobalt.

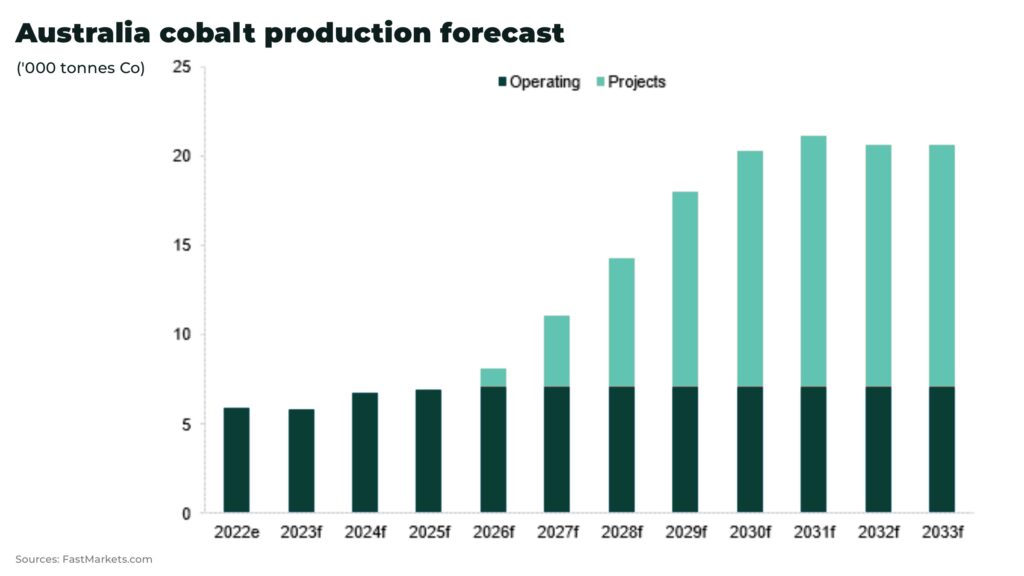

And so, investors should look to differentiate their portfolio supply risks, with a focus on ESG-friendly supply investments.

This includes in countries such as Australia, or regions with limited cobalt operations, including Europe and North America, with significant government subsidies to encourage investment; as well as concentrating on mining companies that are using advanced technology to improve mining practices.

Stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.