Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

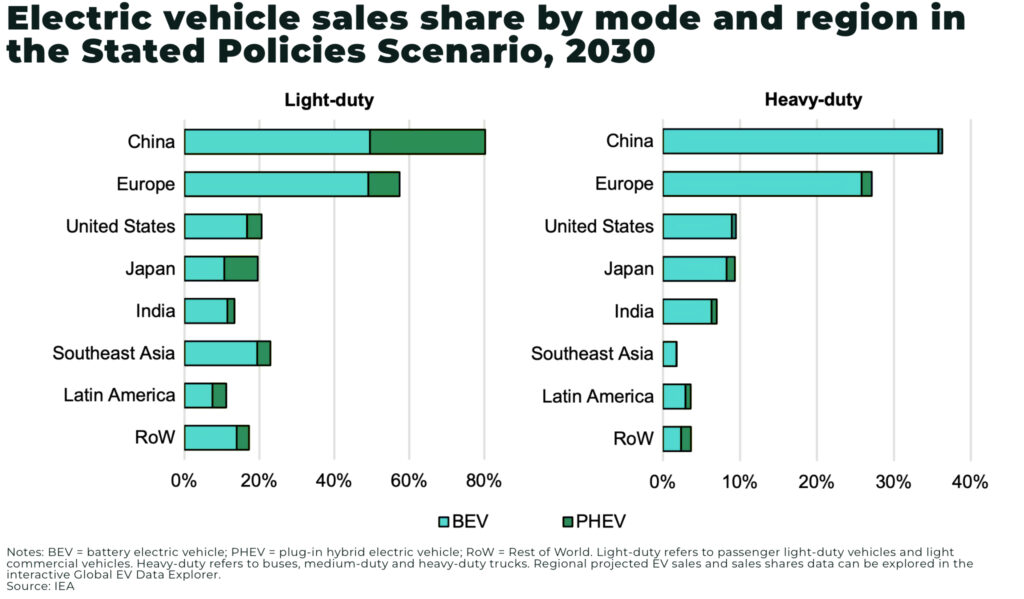

The global electric vehicle (EV) fleet is projected to hit 250 million vehicles by 2030 — excluding two- and three-wheelers (2/3Ws) — marking a x4 increase from the end of 2024, according to the IEA’s Global EV Outlook 2025.

This will mean a significant increase in demand for electric battery metals, including lithium, cobalt, nickel, and fluorspar.

However, this growth, averaging 25% annually, represents a deceleration from the 2018–2024 period, when annual EV stock growth averaged nearly twice as fast. China’s dominance of global EV stock is also expected to ease. From a 70% share in 2024, China’s portion of global EVs is set to decline to around 55% by 2030, as adoption increase in markets like the EU, US, and Southeast Asia.

Challenges to the EV market include:

- US tariffs, in particular, an additional 25% tariff on all imported automobiles (including EVs) in March 2025, as well as on batteries and raw materials may increase prices

- lower international GDP growth could add pressure on already-strained government budgets, which, in turn, could lead to governments downscaling or terminating incentive schemes for EVs ahead of schedule

- high energy prices and low oil prices may also de-incentivise consumers to making the move to electric vehicles

The data underscores a maturing EV market where the growth story is shifting, from volume surges led by early adopters, to broader market penetration and infrastructure buildout across a wider range of vehicle classes.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.