Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The US Department of Energy has announced plans to deploy nearly US$1 billion in new funding opportunities to build out America’s domestic critical minerals supply chain, marking the most expansive federal investment to date in US-based extraction, processing, and manufacturing technologies.

The move follows through on President Trump’s executive orders aimed at “unleashing American energy,” but its scope goes well beyond mining. The Department is targeting industrial waste streams, byproducts, and battery recycling, while also seeding downstream processing capacity for materials like rare earths, gallium, lithium, and silicon carbide — all essential to defense, electrification, and semiconductor industries.

“For too long, the United States has relied on foreign actors to supply and process the critical materials that are essential to modern life and our national security… The Energy Department will play a leading role in reshoring the processing of critical materials and expanding our domestic supply of these indispensable resources” — said DOE Secretary Chris Wright.

Five programs, one goal: mineral sovereignty

The proposed Notices of Funding Opportunity (NOFOs) span five major initiatives:

- CMM Accelerator – US$50M: Supports rare earth magnet refining, direct lithium extraction, and co-product recovery from mining and industrial waste streams. Targets mid-stage technologies ready for commercialization

- Mines and Metals Capacity Expansion – US$250M: Funds pilot-scale recovery of critical minerals from existing US industrial facilities, including coal byproducts and metal-rich waste. Focus is on derisking cost and scale

- Rare Earth Demonstration Facility – US$135M: Supports domestic rare earth refining from tailings, scrap, and deleterious ores. Requires a 50% private cost-share and an academic partner—signaling urgency and near-term deployment

- Battery Materials and Recycling – US$500M: Funds construction of commercial-scale recycling and processing facilities for battery-grade lithium, nickel, graphite, and rare earth elements. Emphasis on circular supply chains

- ARPA-E RECOVER – US$40M: Targets extraction of critical minerals from industrial wastewater streams—a novel source with high potential volume but low public visibility

Together, these programs reflect a deliberate shift in US policy—from raw material dependence to technological leverage over waste, byproducts, and recycling.

The strategic context: mining alone won’t bridge the gap

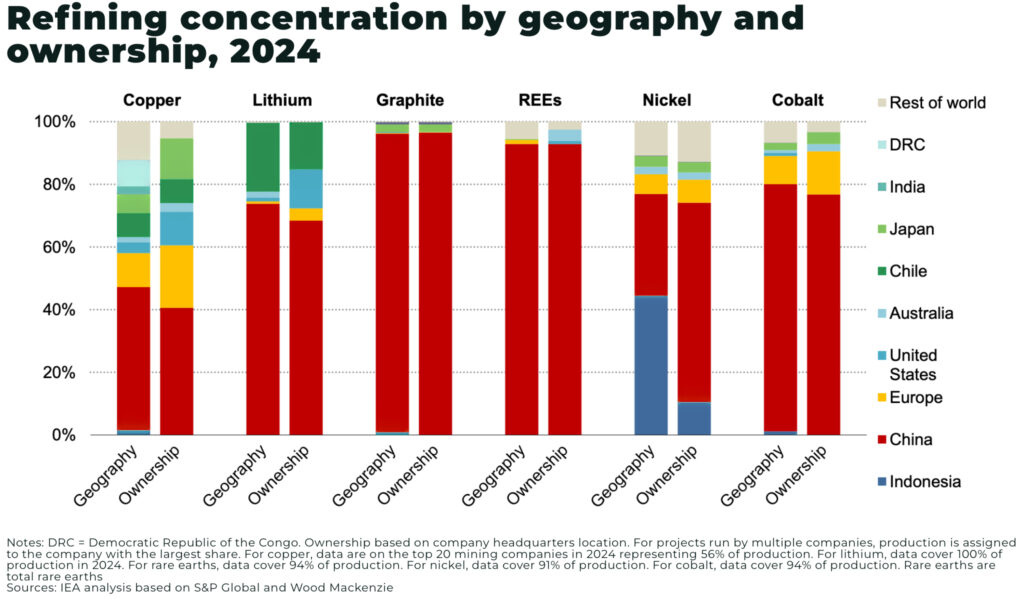

With over 90% of rare earth magnet production and majority control of gallium, germanium, and battery metals refining still held by China, the US remains exposed across every link of the critical mineral value chain.

Even as new US mines progress slowly through permitting, the DOE is signaling that domestic growth will hinge on extracting value from what’s already here — in scrap, tailings, industrial water, and underutilized facilities.

Industry implications: advantage to tech-enabled miners and midstream players

DOE’s cost-share structure and emphasis on near-commercial deployment favors technology-integrated players that can move quickly. Potential beneficiaries include:

- Rare earth recyclers and magnet manufacturers with pilot-stage chemical separation capacity

- Coal plant operators with mineral-rich ash and waste recovery potential

- Battery recycling companies positioned to scale lithium, nickel, and graphite output domestically

- Midstream processors in gallium, germanium, and silicon carbide—now critical to both semiconductors and defense

The new funding will also accelerate public-private collaborations and joint ventures—especially those that can bridge waste sources with domestic reprocessing hubs.

Conclusion

The DOE’s $1 billion funding plan marks a strategic pivot in the US critical minerals agenda: away from a narrow focus on new mining and toward a full-spectrum, circular, and tech-enabled industrial base.

For investors, this means the next decade of supply growth may come less from new pits—and more from waste streams, industrial byproducts, and integrated processing infrastructure.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.