Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Global demand for battery metals is forecast to x4 over the next 15 years, even as near-term growth moderates, according to BloombergNEF’s latest Electric Vehicle Outlook 2025.

The report forecasts that the mass of metals used in lithium-ion batteries will climb from 12 million tons in 2025 to 53 million tons by 2040 to meet net-zero targets by mid-century.

Copper, aluminum and lithium form the largest part of this total by weight. In 2040, the lithium-ion battery industry requires:

- 15 million tons of copper under the net-zero scenario

- 7 million tons of lithium

- and 12 million tons of aluminum

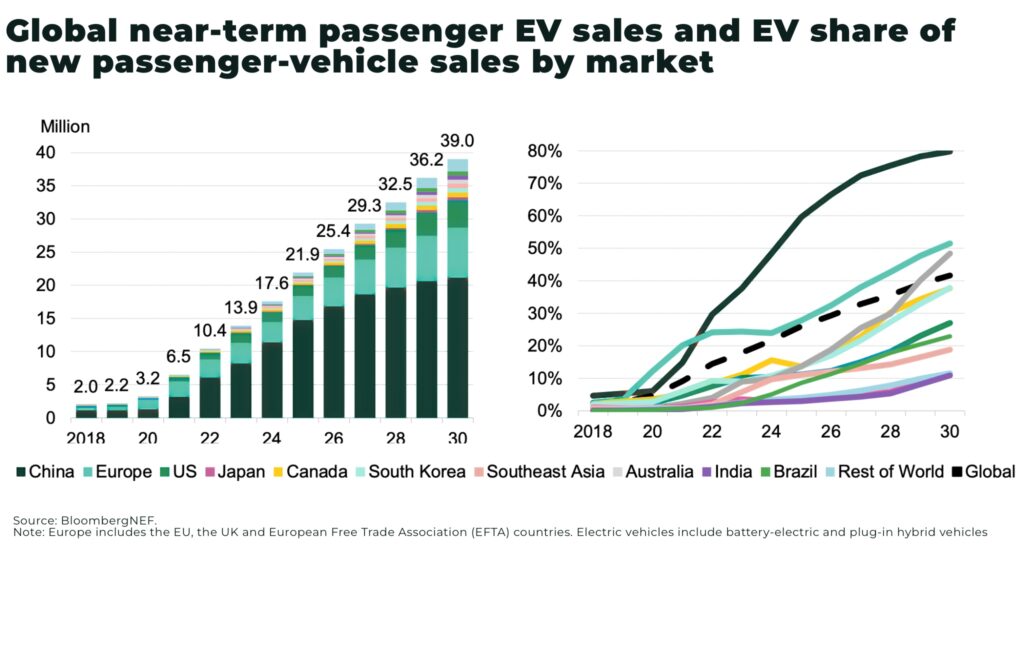

BloombergNEF projects that global passenger EV sales will approach 22 million units in 2025, up 25% from 2024. By 2030, annual sales are expected to surpass 39 million vehicles. China is set to remain the dominant market, accounting for nearly two-thirds of global EV sales, with Europe and the US trailing at 17% and 7%, respectively.

While the pace of demand growth for battery metals has slowed in the short term — largely due to a temporary pullback in EV sales forecasts for the United States and Europe — the long-term trajectory remains robust.

“While demand growth has slowed in the near-term, the long-term growth for battery metals remains strong. Overall battery metals demand increases significantly as electric vehicles are adopted more quickly across all segments.” — BloombergNEF, Electric Vehicle Outlook 2025

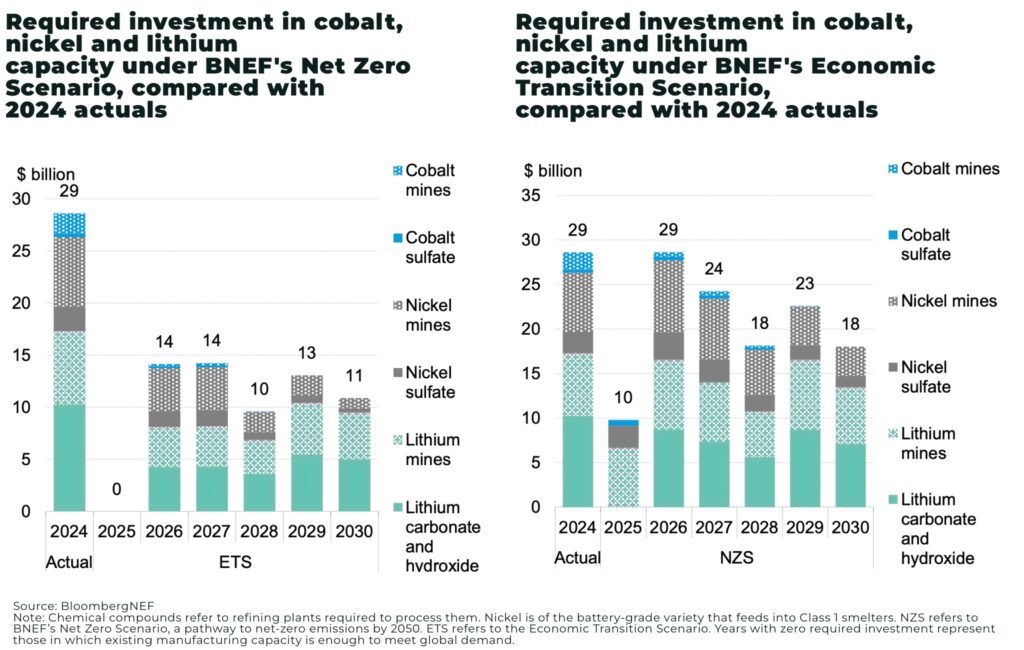

In 2024, investment in battery metal mines and refineries jumped 80% year-on-year, reaching $29 billion—the highest annual total on record.

Despite these efforts, the industry faces persistent risks around permitting, geopolitical tensions, and fluctuating commodity prices. Copper, in particular, has emerged as a bottleneck, with analysts warning that supply growth may lag demand as new mines become harder to develop. Lithium and aluminum markets are also expected to tighten, especially if EV adoption outpaces current forecasts.

China vs USA

China’s dominance in both EV sales and battery production continues to shape global market dynamics. The country is the only major market where EVs are, on average, cheaper than internal combustion engine vehicles, giving domestic automakers a competitive edge. Chinese firms have also expanded aggressively into emerging markets, further boosting demand for battery inputs.

In contrast, the US market faces headwinds from policy rollbacks and reduced federal support for EVs. BloombergNEF has downgraded its US passenger EV sales outlook, projecting 4.1 million units in 2030—significantly lower than previous forecasts. Europe, meanwhile, is expected to see steady growth, led by the UK and Nordic countries.

Emerging economies such as Thailand and Brazil are showing rapid uptake, with adoption rates in some cases surpassing those of wealthier nations. This trend is likely to diversify demand for battery metals, with supply chains increasingly spanning multiple continents.

Price Pressures and Overcapacity Risks

While long-term demand fundamentals remain strong, the battery industry is currently grappling with overcapacity. In China, average utilization of battery plants has fallen below 50%, and global battery prices dropped sharply in 2024 amid fierce competition and lower input costs. Analysts expect moderate price declines in the coming years, which could temporarily ease pressure on automakers and battery producers.

However, the underlying supply-demand balance for metals is expected to tighten as the decade progresses. The transition to next-generation battery chemistries, including solid-state technologies, may alter demand patterns, but copper, lithium, and aluminum are expected to remain critical components through at least 2040.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.