- copper listed as critical mineral in EU, China, India, Canada, South Australia, US

- global copper demand forecast to double by 2035

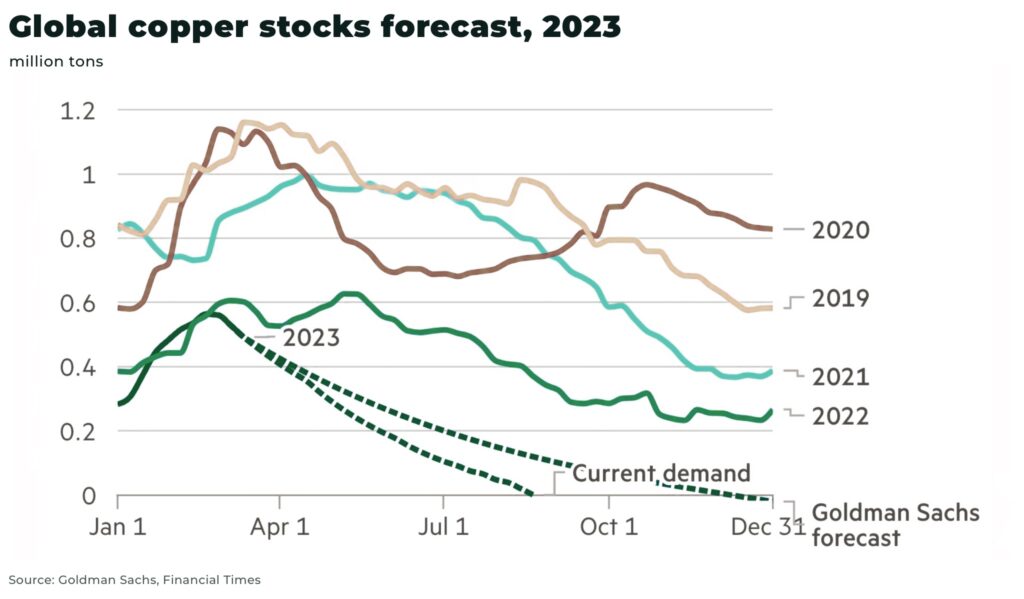

- copper stockpiles already dangerously low and supply tightening

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Copper is now listed as a critical mineral in the EU, China, India, Canada, Southern Australia — and, from this year, the US as well.

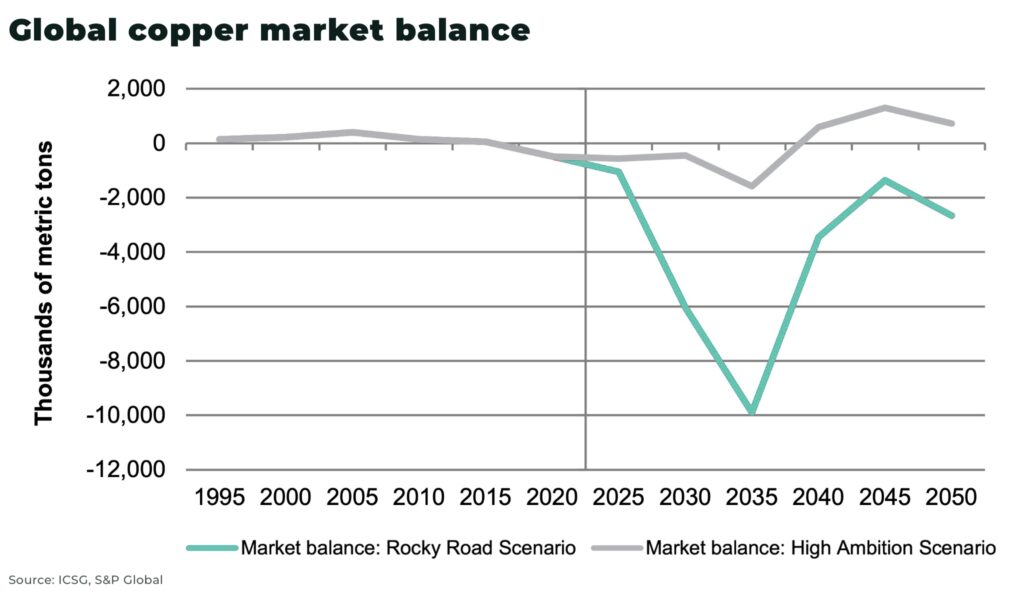

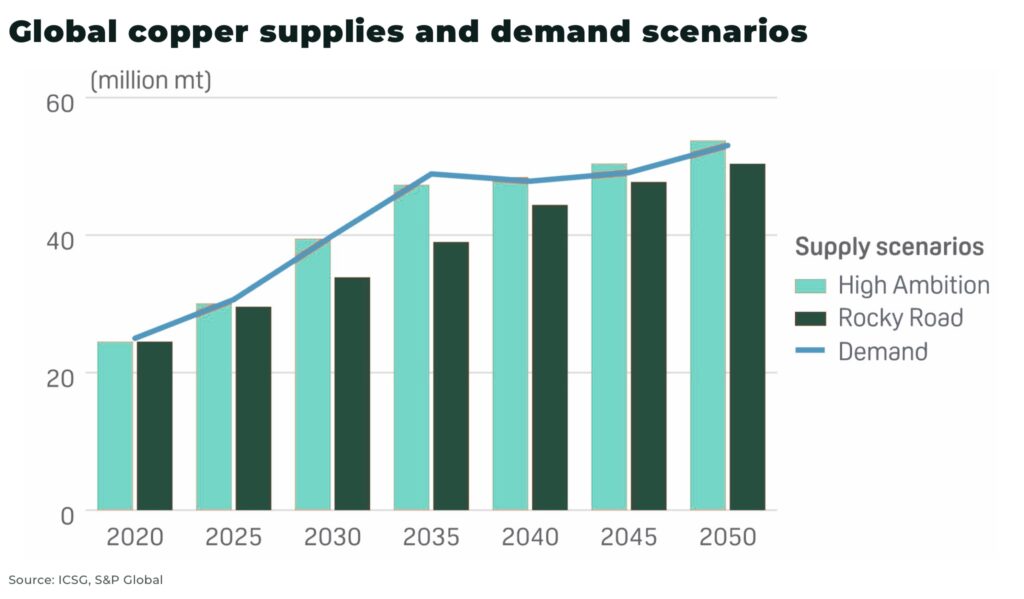

The reason is that demand for copper, especially to build out the global energy transition, is expected to reach historic highs. S&P, in their latest report, forecast demand to double by 2035, from 25 million metric tons in 2023 to 50 million metric tons by 2035.

This will be matched by “unprecedented and untenable shortfalls in supply” — up to 10 million metric tons deficit by 2035 — equivalent to 20% of the projected demand required to reach 2050 net-zero targets.

The listing of copper by the US Department of Energy as a critical mineral is a first step, but it’s too late to secure copper supply in the next few years, maybe decades.

Copper, what is it good for?

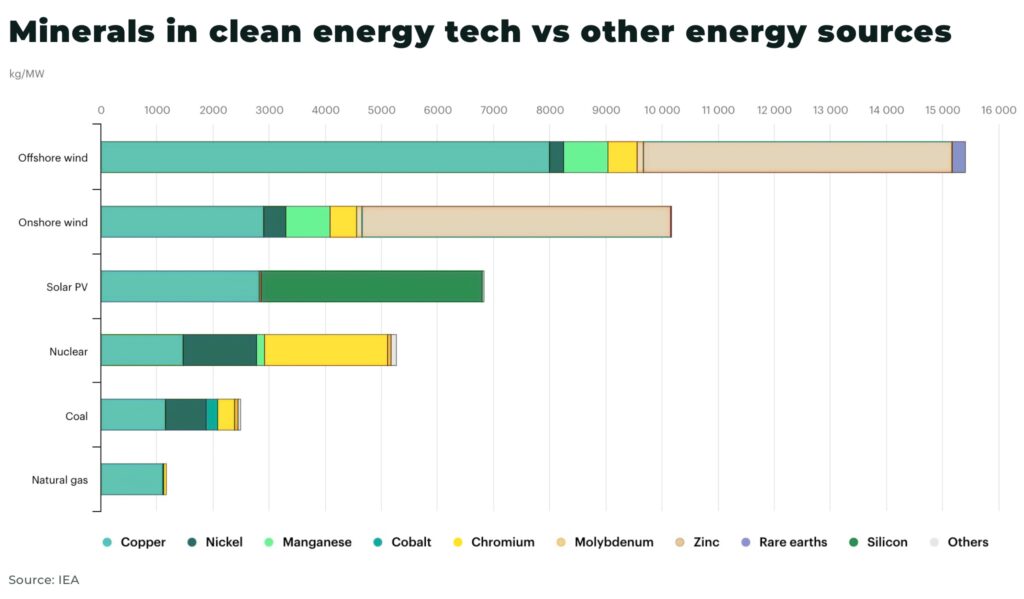

Copper has the second highest electrical conductivity, after silver, and therefore essential for the electrification of the global economy, and transition away from fossil fuels.

For example, a conventional power plant needs approximately 1 ton of copper per x1 MW, while:

- an offshore wind turbine uses 10 tons of copper per x1 MW

- a solar power system can use up to 5 tons of copper per x1 MW

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

But copper is also essential for everything from data centers to clean water pipes, machine parts to cell phones.

We recommend our recent analysis to understand the scale of the challenge ahead: A lot more copper needed to expand the global electricity grid.

“Copper is a major contributor to U.S. economic and national security… The nation would be defenceless without electricity and copper’s vital role in its generation, transmission, and distribution. The U.S. should do all it can to protect and promote our domestic copper industry”

— Andrew G. Kireta, Jr., president and CEO, Copper Development Association

The copper supply challenge

There are a series of serious concerns over the security and growth of global copper supply, including, for example:

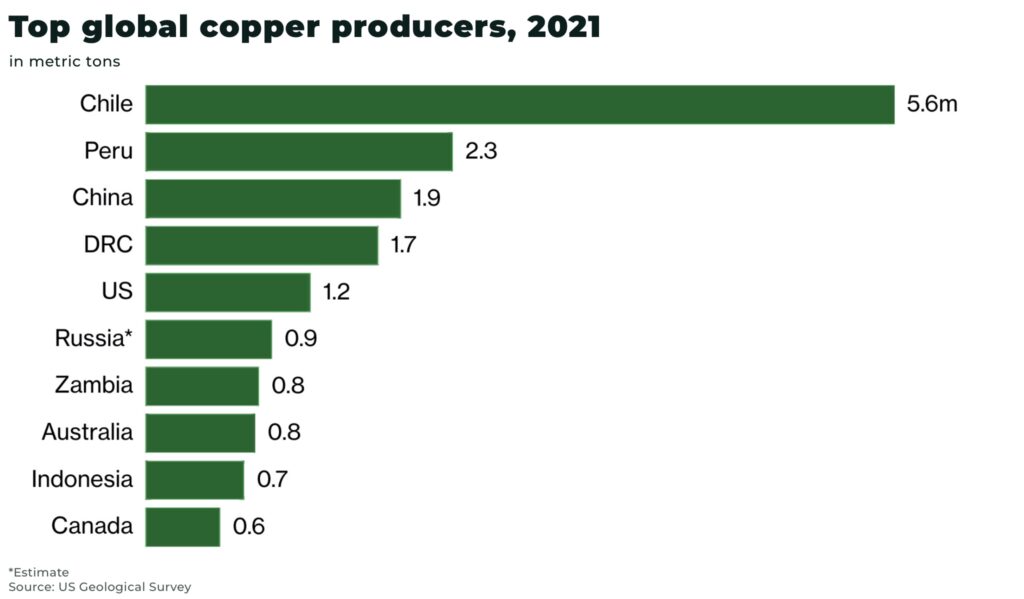

- falling copper production and ore quality from Chile, the world’s largest copper producer with 27% of global production, with production at the state-owned Codelco down by about 20% from only 6 years ago

- political unrest in Peru, the world’s second largest copper producer with nearly 10% of global production, stopped 20% of its supply earlier this year

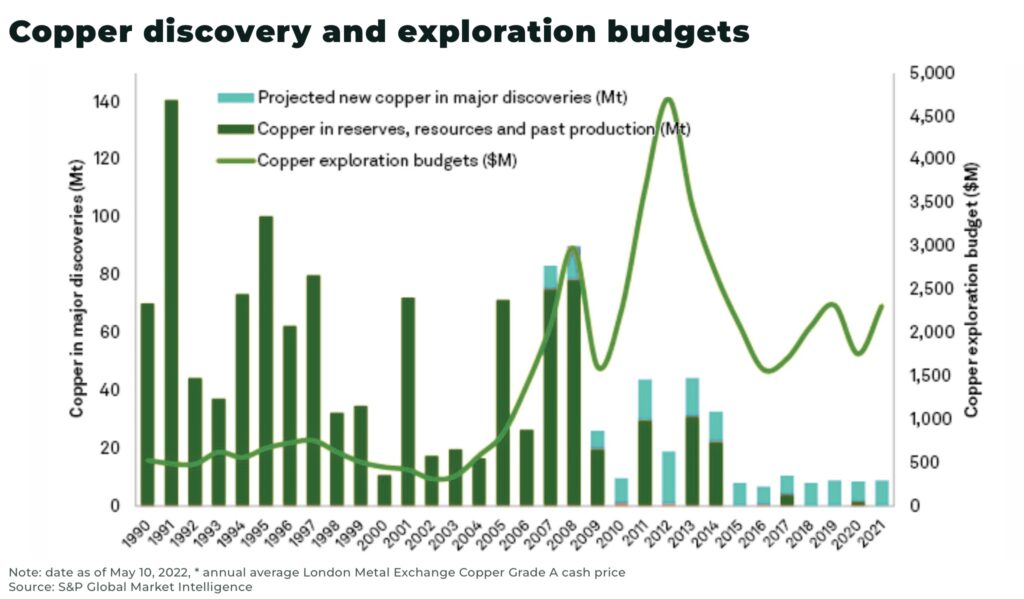

- a decline in new global discoveries; 228 copper deposits were discovered between 1990-2021, but only 3 were made in the past 5 years

- declining global copper grades, with the volume of ore sent to concentrators increasing by 1.1 billion metric tons, 44% growth, over last 10 years

- only two major copper mines — Kamoa Kakula mine in Congo and Quellaveco mine in Peru — have been brought online between 2017-2021

- China holds a leading position in copper smelting (47%), refining (42%), and usage (54%)

After the Covid economic lockdowns and the war in Ukraine exposed the vulnerability of Western supply chains, the US and its allies have looked to secure new supply chains for copper.

The challenge, is from where and how quickly can new supply be brought online.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Copper, a critical mineral

And so, we come full circle to the listing of copper as a critical mineral.

The latest critical listing is by the Department of Energy (DoE). This ensures copper is now eligible for tax credits under the Inflation Reduction Act 48C, specifically for processing, refining, or recycling of the mineral. The DoE has already announced US$4 billion in tax credits for the project.

However, the US Geological Survey (USGS), has so far rejected calls to put copper on their official critical minerals list.

This is important as it means copper mining is still not eligible for significant electric vehicle tax credits, inclusion onto the US Permitting Dashboard, as well as other permitting reforms.

The next USGS critical mineral list update is expected in 2025, but individual minerals can be added earlier.

“CDA calls upon Members of congress to not accept USGS’ decision lightly and to undertake all means and measures to address this ill-conceived and unfounded decision”

— Copper Development Association

Copper deficit chronology

The copper deficit is already an acute problem.

Copper stockpiles have already been running dangerously low, with headline LME copper stocks falling from 100,100 tons to 77,050 tons in June 2023. The International Copper Study Group expects a deficit of about 114,000 tons for 2023, after 431,000 ton deficit last year.

And in the long-term? A brief, potential timeline:

The US has set 2050 as its deadline to be net-zero.

Development of a new copper mine can take more than 12 years and can cost tens of billions of dollars to build.

Estimates vary but, to meet the forecast copper demand, we will need approximately 10-20 new, large copper mines; or three fast-tracked tier-one copper mines, each with a capacity to produce 300,000 metric tons a year, every year per year, for the next 29 years.

This would be almost unprecedented.

But, let’s stick with the timeline.

2023 (this year) + 12 years to build enough mines (if we start today on all of them) = 2035 (enough copper supply ready to meet expected demand)

That leaves 15 years to rollout and decarbonize the economy.

“We’re heading for a train wreck here“

— Robert Friedland, founder and executive co-chairman of Ivanhoe Mines

Call us cynics, but unless there are significant changes — whether changes to mining permitting procedures in many parts around the world, government investment support, technological advances, a severe economic downturn or delays to net zero targets — the critical mineral listing for copper is too late.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Exposure

To find exposure to this potentially historic opportunity, options for investors include:

- investing in the global mining majors, especially the companies with significant, direct exposure to copper (eg FreePort-McMoRan, BHP, Rio Tinto)

- there are a variety of copper ETFs that also offer exposure to a variable baskets of copper stocks

- copper futures offer investors an opportunity to speculate and buy/sell copper at a specific price and date in the future

- micro cap stocks offer higher risk, but potentially higher returns, so we recommend doing your due diligence

When looking at these opportunities, especially micro cap stocks, there are a variety of factors at play. We would highlight in particular the issue of location, which will play a key role in which copper plays can be finalized.

For example,

- new copper mines are being developed in Congo and Zambia — where permitting is easier than many other global jurisdictions — with copper exports from Congo totaling 2.3 million metric tons in 2022, up from 1.8 million metric tons in 2021

- the US has estimated copper reserves of over 70 million metric tons, equivalent to about 20 years of US demand. Permitting processes and regulatory complications in developing new mines are a hurdle to new greenfield sights, but there are a variety of brownfield investment opportunities that represent less risk

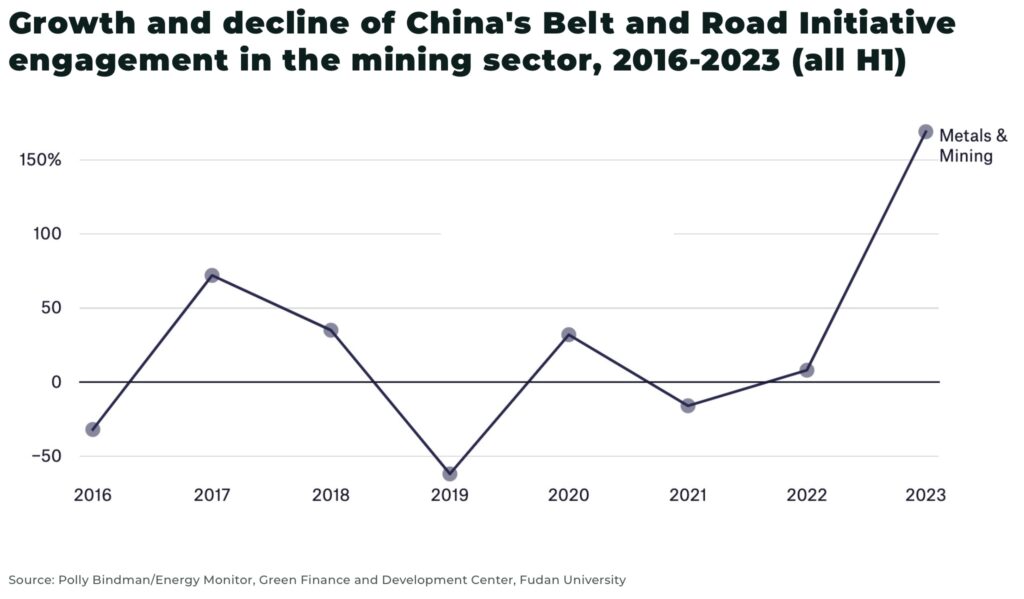

- and, China continues to expand its global mining industry — including copper — along its Belt and Road Initiative. In H1 2023, new Chinese investments topped US$10 billion, more than the total investment of 2022

The critical mineral listing may be too late to secure supply, but it’s still early for interested investors.

Subscribe to stay ahead.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.