800,000 metric tons of wet material surged into Freeport’s Grasberg Block Cave in Papua, Indonesia. The mud rush overwhelmed mine workings, reaching a service level where crews were working. Two employees were killed, five remain missing, and operations across the district have been suspended pending investigation.

Freeport described the event as unprecedented in Grasberg’s block cave history. Management has declared force majeure under supply contracts, halting deliveries to customers.

Freeport now expects Q3 2025 consolidated copper sales to be 4% lower than July guidance and gold sales down 6% (Reuters).

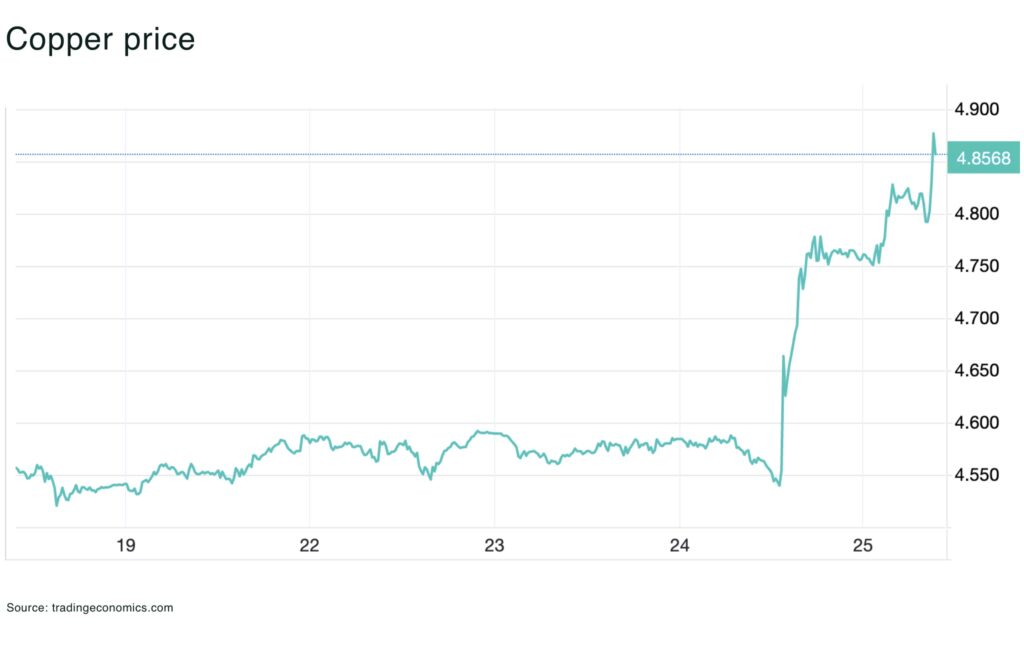

News of the force majeure sent copper prices up 3–4% on September 24. Shanghai futures hit a six-month high, reflecting expectations of a tighter global market.

Why does the Grasberg Block Cave disruption matter so much?

Grasberg Block Cave holds around 50% of PT Freeport Indonesia’s reserves and accounts for 70% of its projected output through 2029. With early forecasts pointing to a 35% cut in 2026 production, the incident directly reshapes both Freeport’s portfolio and global copper supply expectations.

What has been the immediate market reaction to Grasberg’s force majeure?

Copper prices spiked 3–4% in a single session. Goldman Sachs now forecasts a 525,000-ton supply shortfall across 2025–26, flipping the 2025 outlook from a small surplus to a global deficit.

The company plans a phased restart. Big Gossan and Deep MLZ, two unaffected underground mines, could resume later in Q4. Ramp-up at Grasberg Block Cave will take longer, with partial recovery expected in 2026 and full restoration possible by 2027.

Goldman Sachs cut its global mine supply forecast, estimating Grasberg disruptions will remove 250,000–260,000 tonnes of copper production annually in 2025 and 2026. That shifts the 2025 outlook from a projected surplus to a 55,500-ton deficit.

Grasberg’s suspension underlines how concentrated risks in a single operation can ripple across global markets. For Freeport, which relies on its Americas mines for ~60% of copper output, the event highlights the importance of geographic diversification.

For the wider industry, the shock comes as demand for copper accelerates from electrification and AI-driven power infrastructure. With limited new projects advancing, supply risks heighten price volatility and strengthen the investment case for upstream development in stable jurisdictions.

Contract disputes and insurance claims may follow from the force majeure, adding financial risk to operational delays.

The timeline for Grasberg’s phased restart and findings from the ongoing investigation will determine how deeply the disruption reshapes supply forecasts. If copper prices sustain momentum above $10,000 per tonne, producers elsewhere may accelerate development.

The Grasberg crisis has underscored copper’s vulnerability: a single mud rush has tipped the balance of global supply, with long-term consequences for prices, producers, and policymakers.