- gold price reaching record highs, with strong fundamentals for higher growth

- central banks bought over 700 tonnes by November 2022

- gold mining exploration is up, but development of new mines has stalled

- the great gold rush of 2023 is upon us

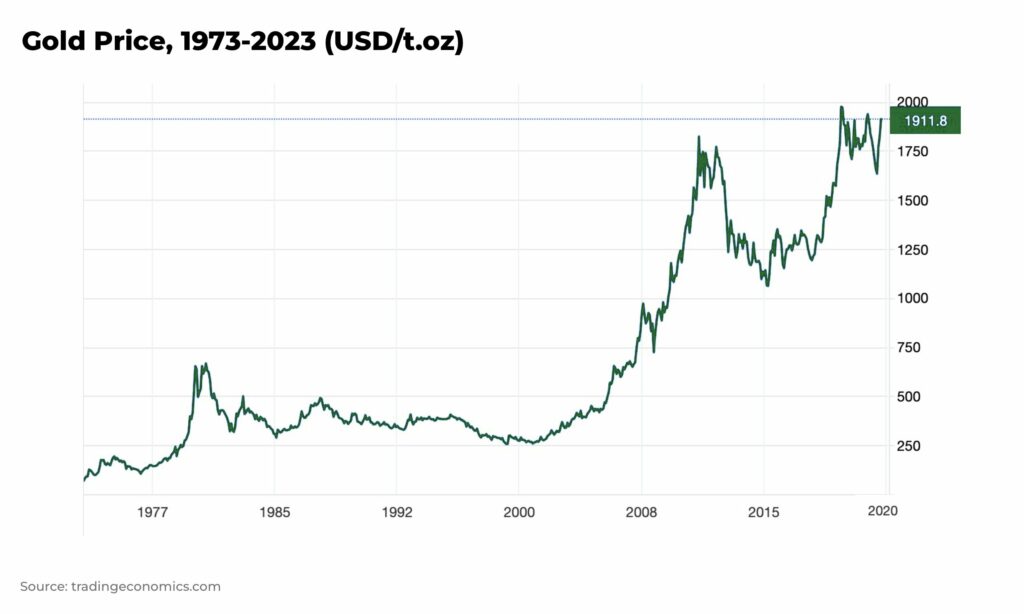

The price of gold is reaching record highs, and the factors driving growth look set to push it higher in 2023.

So, what’s going on and what should investors look out for.

Central banks and the gold price

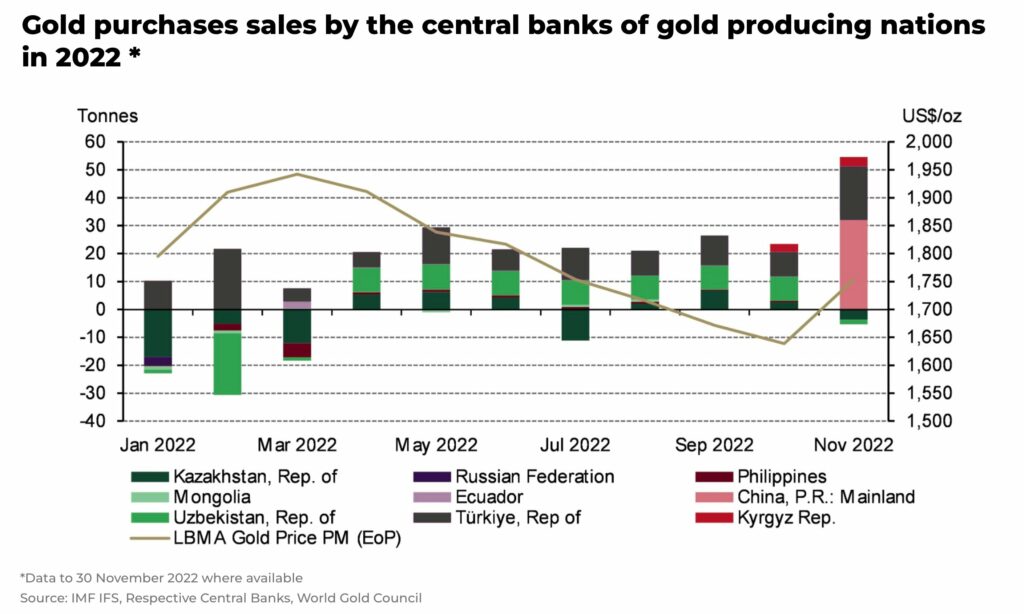

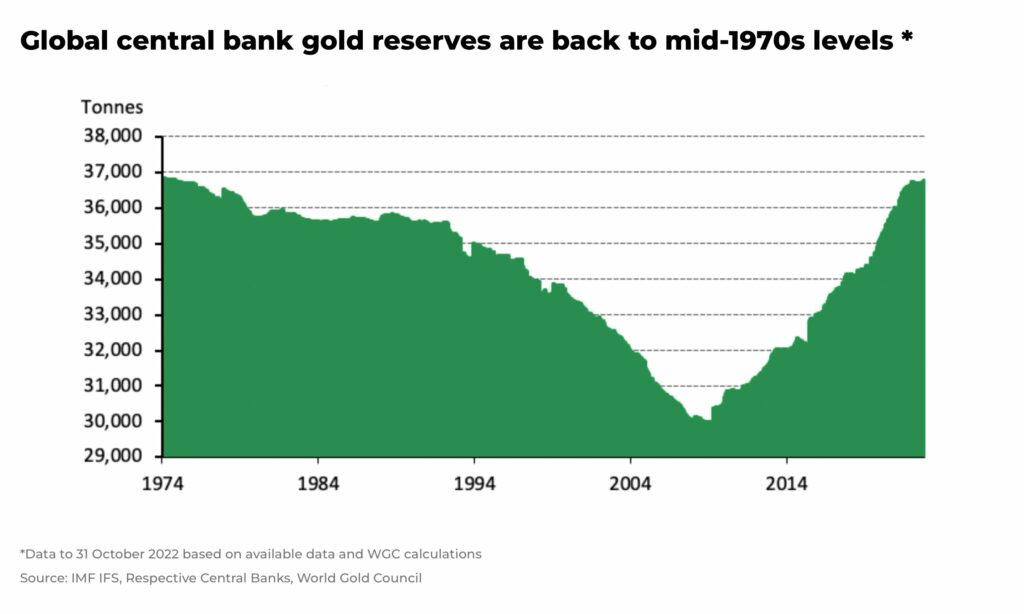

The biggest driving force behind the latest rise in prices are central banks.

An historical high of 673 tons of gold was bought by central banks around the world by the end of Q3 2022. It’s the eight consecutive quarter of net purchases and, in November 2022, they bought a further 50 tonnes, a 47% increase from 34 tons in October.*

(update: the latest report from the World Gold Council revealed gold demand hit 4,741t, an 18% y-o-y increase, the highest annual total since 2011)

There is some mystery over who exactly is buying so much, although the most likely suspects are China and Russia, as well as the big public buyers Turkey, Uzbekistan, Japan, India and Qatar.

These big central bank gold purchases are likely driven by a desire to diversify foreign exchange holdings, reduce their dependence on the US dollar, as well as a hedge against record inflation. Basically, national gold reserves are typically used as an insurance against a financial or geopolitical crisis.

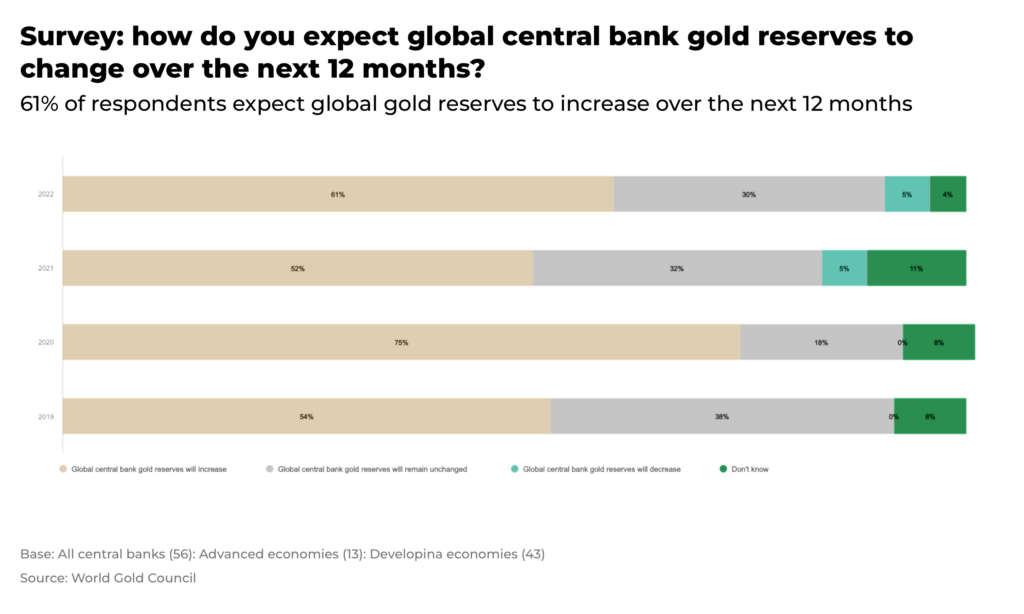

These economic and geopolitical drivers are unlikely to abate in 2023. According to the 2022 Central Bank Gold Reserves (CBGR) survey, 25% of respondents say they have plans to increase their gold reserves, up from 21% last year.

“The continued trend of official sector demand for gold corroborates findings from our 2022 annual central bank survey, in which one-quarter of respondents stated their intention to increase gold reserves in the next 12 months (up from one-fifth in in 2021)”

— World Gold Council, Gold Demand Trends report

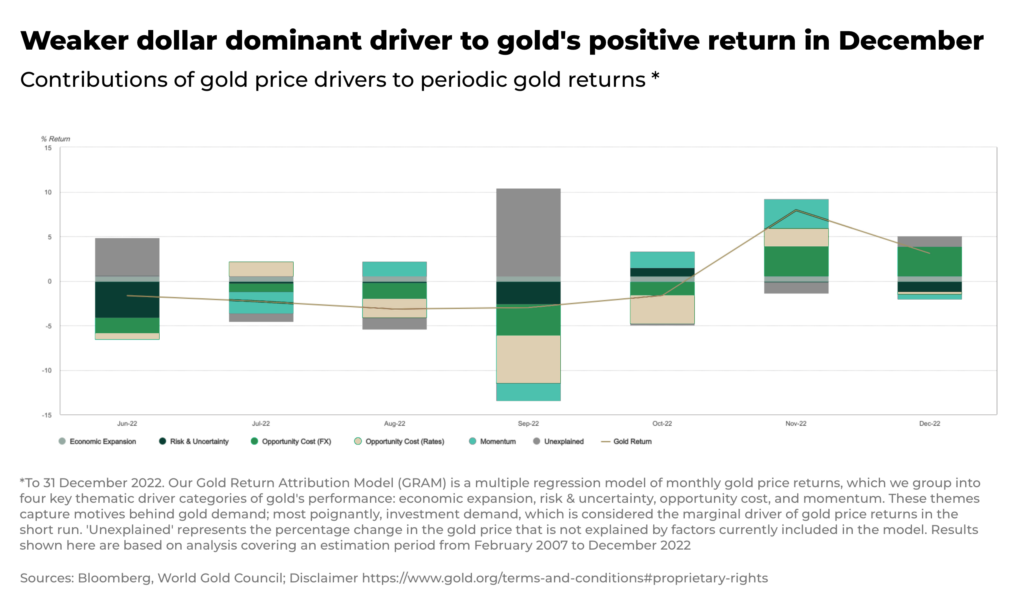

The dollar, Quantitative Tightening, and the price of gold

The rise in the gold price unusually coincided last year with higher interest rates and a strong US dollar, both of which often work as a counter to gold’s traditional use as a safe haven (it doesn’t pay interest and a strong dollar can act as a haven in it’s own right).

But when the US dollar weakened and inflation “softened” earlier this year, so gold strengthened significantly.

We’re not making predictions on when or if the Fed will hold or reduce interest rates, but if they do, it will likely impact the price of gold to the positive.

It will be the same if central banks begin to reverse Quantitative Tightening and ease monetary policy, which will weaken the dollar, once again.

But Quantitative Tightening has also been key in the gold price’s recent comeback.

The sheer scale of Quantitative Easing and “cheap” money, globalization and cheap labour over the last decade has meant that gold’s traditional role as a safe haven was eroded and debt encouraged, especially among the younger generations, who turned instead to platforms such as crypto and Bitcoin as a theoretical replacement to fiat currency.

Interest rate rises across the developed world, the end of Quantitative Easing, the war in Ukraine, as well as commodity prices rising, meant in 2022 the crypto industry lost over US$2 trillion in value. Goldman Sachs now expects gold to outperform bitcoin in the long term.

Instead we are now faced with fears of a recession: the IMF estimates one-third of the world to be in recession in 2023.

“Tighter liquidity should be a smaller drag on gold, which is more exposed to real demand drivers… Moreover, gold may benefit from structurally higher macro volatility and a need to diversify equity exposure”

— Goldman Sachs

As the price of stocks, bonds and property goes down, so many investors buy gold as a hedge against risk. And, with the price rising, it seems people are fast remembering gold’s historical record as a safe haven — retail investor demand for gold in Q3 2022 was at an eight-year high.

(also, check out our analysis on navigating commodity investing during a recession)

January, in particular, often sees an increase in the buying of gold — since 2012, gold prices have ended January higher than December— as investors look for some insurance on the year ahead.

It’s not just central banks.

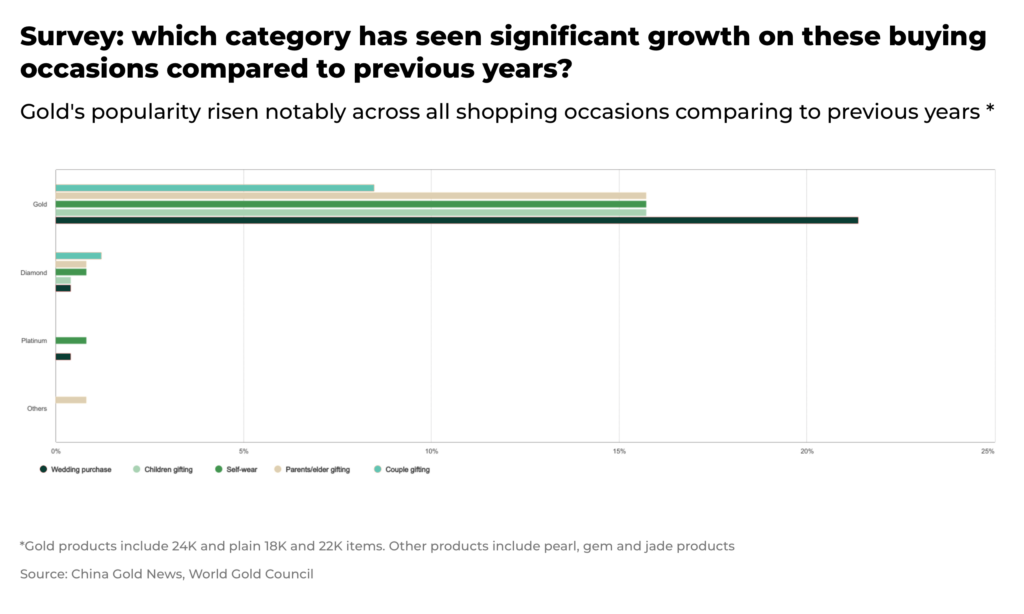

Gold jewelry

Gold jewelry demand is up 10% in Q3 2022, year-on-year, reaching 523 tons.

This is expected to increase this year as China, relaxes it’s zero Covid restrictions and opens up it’s economy. China and India account for over 50% of the world’s gold jewelry markets.

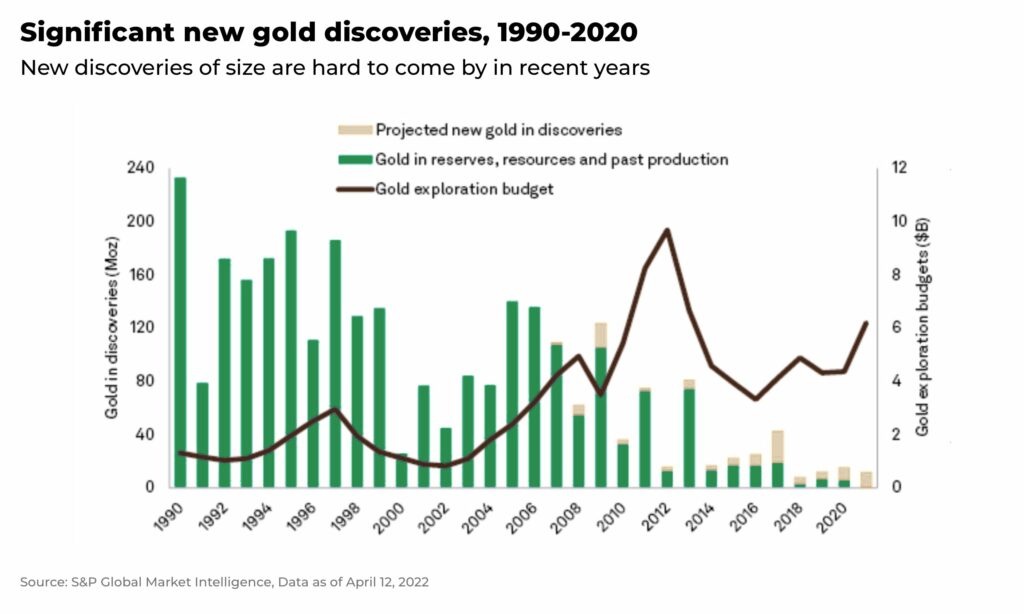

Gold mining

Gold mining accounts for about 75% of the annual gold supply, so the availability of gold is largely dependent on mining output. However, global mine production has been stagnant in recent years and appears to have peaked in 2018.

Finding high-grade, profitable gold projects is becoming increasingly difficult, and the economic feasibility of gold projects is also being challenged by rising inflation, which increases the costs of building and operating a mine.

And, as this demand increases, supply is tightening.

Total global gold supply increased slightly to 1,215 tons by Q3 2022, but that is only a 1% year-on-year increase — and “substantial new discoveries are increasingly rare”, according to the World Gold Council.

This is a problem because roughly 75% of the annual gold supply comes from mining.

The steady increase in the price of gold has led to an increase in exploration budgets, but only 28 of 341 significant deposits (containing over 2 Moz of gold) discovered between 1990-2021 were discovered in the last decade, containing 171.8 million ounces, or 6% of all gold discovered since 1990. By comparison, 1990 alone has 233.1 Moz of gold in 10 deposits.

Investor attention has turned to other metals, particularly those used in the energy transition, so the industry has diverted resources and attention away from risk-on gold exploration to known deposits and operating mines.

And gold mines, once discovered, like so many other metal mines we cover on The Oregon Group, can also be subject to long development times, from feasibility studies to permitting, meaning there is decreasing new supply, just as old mines are aging with lower quality ore.

Portfolio exposure to the price of gold

Throughout 2023 there are a variety of macro push-pull factors that will significantly influence the price of gold, including:

- interest rates, whether they hike or lower them

- the strength of the US dollar

- the (perceived) risk of a recession, financial crisis, or heightened/lowered geopolitical risk

- the price of gold too will impact investors appetite to buy, but also the ability of the jewelry markets, especially in countries like India, to buy. High prices may actually dampen demand

If you want to invest in gold, there are two main options:

- directly, including gold bars, jewelry and coins

- indirectly, including shares in gold mining companies or gold funds and ETFs that offer exposure to the gold price

The gold rush of 2023 is upon us. Stay subscribed the Oregon Group for our Investment Insights where we will be keeping an eye on the warnings and opportunities ahead in the gold market.