- America became the world’s largest LNG exporter in 2022

- demand for US LNG forecast to double by 2030

- exports to France increased over 300%, Italy over 350%, Spain nearly 400%

- US has 16 facilities approved for construction

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

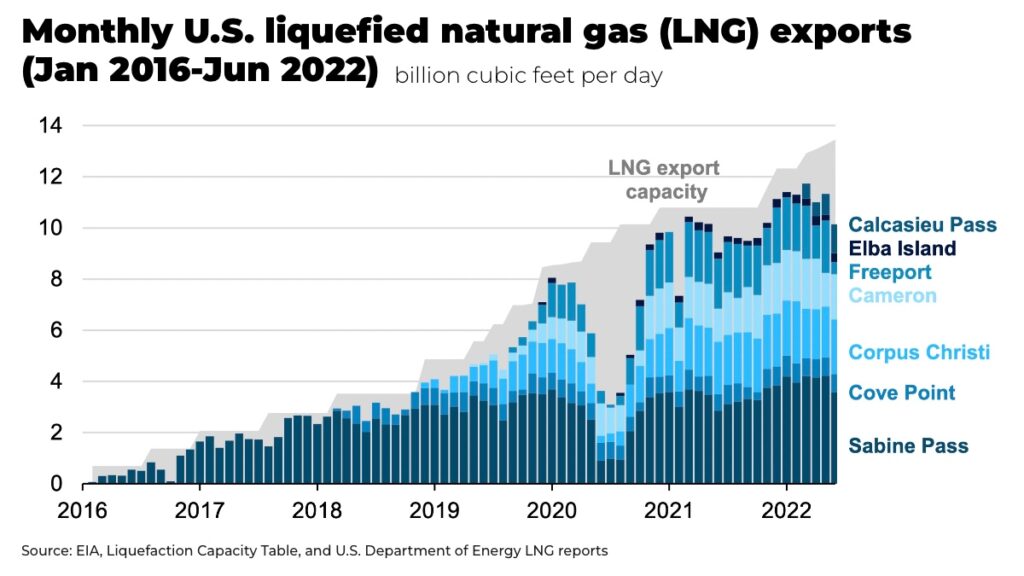

In 2022, America became the world’s largest exporter of liquified natural gas (LNG), with exports increasing 12% on the first half of 2021. This at a time when natural gas prices in Europe are at record highs — prices are 400% higher than last year — as Russia shuts down its gas pipelines in retaliation for western sanctions after it invaded Ukraine.

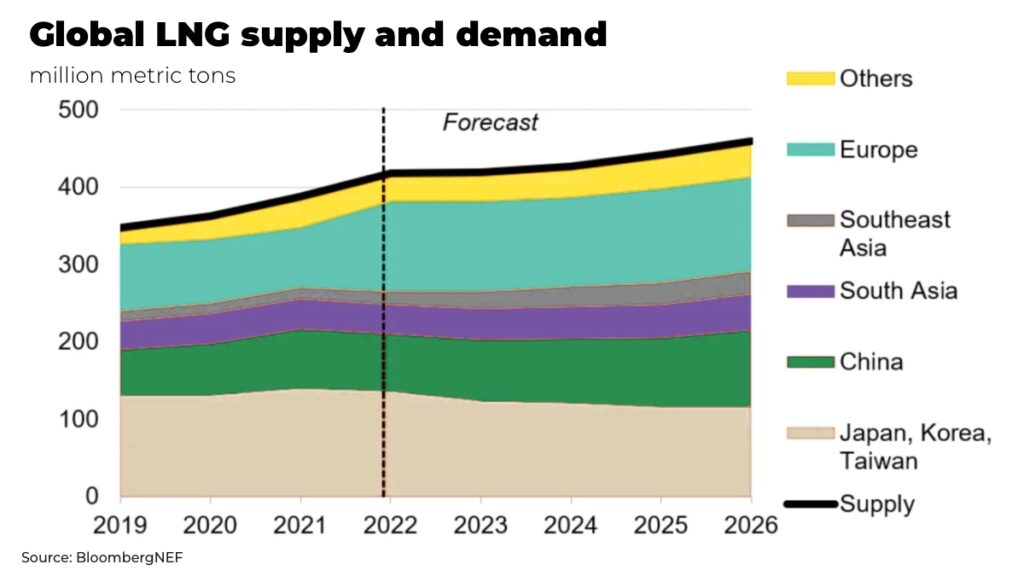

It is a unique opportunity for investors, with demand for US LNG forecast to more than double by 2030 as global demand is expected to rise nearly 60%.

LNG is natural gas that has been cooled to –260°F (–162°C), turning it into a liquid state that is roughly 600 times more dense than as a gas. This makes it more economical to store and transport to places that a gas pipeline cannot reach, for example, by tanker from the US to Europe, where it is offloaded at purpose-built terminals.

Supply was already tight in January 2022. Prices had slumped during the Covid pandemic and subsequent lockdowns, depressing investment in projects that need significant and long-term investment. When the global economy bounced back as countries lifted their lockdowns prices had started rising. Then Russia invaded Ukraine.

(You can read more on how the global gas network is being overhauled in our analysis.)

This year, Europe is dominating demand for LNG, pushing prices to record levels, as governments try to make up for the shortfall of Russian gas to stop industries from shutting down and homes going cold in winter.

In June 2022, the top five destinations of US LNG exports were: France, Netherlands, Spain, Argentina and South Korea.

In comparison, at the start of last year, the top five destinations were: Japan, China, South Korea, United Kingdom and Brazil.

Exports to France increased over 300% from 2021, exports to Italy over 350%, exports to Spain nearly 400%, exports to the Netherlands nearly 200%, and German energy giant Uniper was reportedly considering swapping its supply of LNG from Australia’s Woodside for imports from the US.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

All of this has the US government’s support with President Biden making a commitment to supply an extra 15 billion cubic meters (bcm) to Europe, which the US is already on track to exceed.

According to Goldman Sachs Research, demand for LNG imports in Europe will remain high for the next two decades as the continent shifts its energy strategy to renewables — especially after, earlier this year, the European Commission labelled natural gas energy investment as “green.”

“Natural gas remains key to Europe’s energy supply for the next two decades and we believe it is in Europe’s interest to sign up to an additional 40 mtpa of 15-yr LNG contracts, and potentially up to another 50 mtpa of 10-yr LNG contracts, to improve security of supply and drive a new cycle of LNG construction. We identify 15 new LNG projects for a total of 155 mtpa that can deliver gas to Europe at <$12/mcf” — Goldman Sachs, Re-imagining Europe’s Energy System

Despite this longterm demand, the energy strategy of major European governments — that natural gas is a transition energy that needs to be supplanted by renewables as soon as possible — means they are reluctant to sign long-term contracts of ten or more years. This means they will continue to pay premium prices to compete against governments that are signing longterm contracts, for example, with Asia.

Demand for LNG in Asia remains high, especially in China which became the world’s largest importer of LNG in 2021.

In the short-term, the high price of gas, heatwaves in China shutting down industry, as well as demand from Europe, has knocked back LNG imports to Asia where governments are reverting back to coal. But it’s expected that demand will increase again as winter approaches and people need to heat their homes.

In the long-term, Asia is set to remain the world’s largest energy-consuming region with more than US$350 billion invested to expand regional LNG terminals, gas pipelines and power plants. If all the projects go ahead, it is estimated global LNG importing capacity would double. China’s LNG imports alone are forecast to grow with a compound annual growth rate of 5% over the next five years.

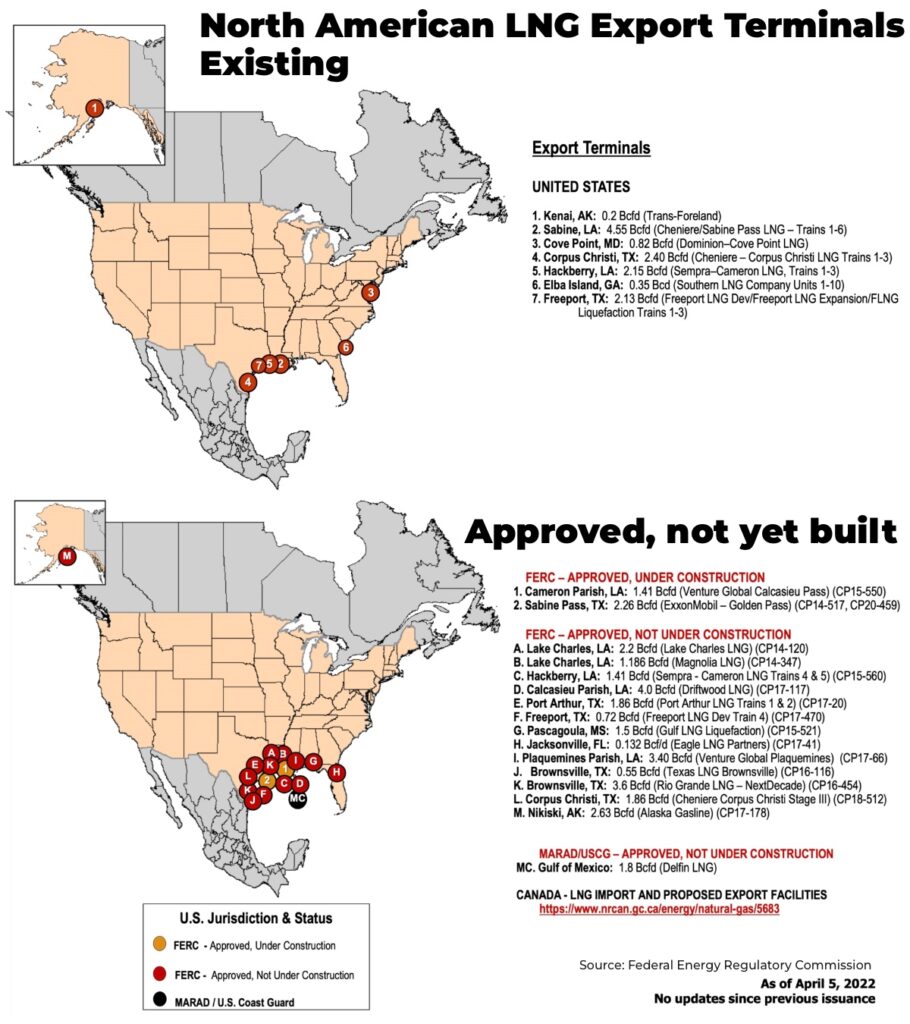

To meet the growing demand, the US has 7 existing LNG export terminals and another 16 facilities approved for construction.

In the America market, there are challenges that will keep natural gas and LNG price high:

For example, America’s Freeport LNG natural gas liquefaction plant in Texas shutdown after a fire in June, reducing US exports by 17%. It’s not expected to return to full service until later in the year.

Hurricane season is approaching with the possibility of severe weather threatening the closure of terminals and shipments across the Atlantic.

Many of the proposed new facilities will take years to build out and, although approved, may be subject to (mostly environmental) court cases before they are able to go ahead. In America’s largest natural gas producing region, the Appalachian Basin, the construction of pipelines has been slowed by environmental groups.

All of this means supply will continue to be tight just as demand is soaring. So where can investors get exposure to the growth of the US LNG market?

“Supply will continue to be tight, just as demand is soaring.”

— Anthony Milewski, The Oregon Group

Gas prices are the first place to start. Whether it’s through ETFs (for example, UNL, UNG, GAZ are the main three in the US), buying futures contracts or investing in stocks for natural gas. We expect they will remain high but with considerable volatility, heavily dependent on geopolitics, the severity of upcoming winter months, and the possibility of further disruption and accidents that will impact supply.

The leading American LNG producer and exporter is Cheniere Energy (NYSE: LNG). The first company to export LNG from America, in 2022 Q2 it announced revenues of US$8 billion, a surge of 165% from US$3billion last year, primarily due to soaring LNG sales.

EQT Corporation (EQT:NYSE) is the largest natural gas producer in the US, with adjusted operating revenue in 2022 Q2 up to US$1,612 million from US$997 million from 2021 Q2. In particular, they are focused on decarbonization which sets them up well for the longterm legislation issues.

Or companies like Tellurian (TELL:NYSE) offer a speculative play as it has only just started building their first facility in Louisiana and not expected to ship LNG gas until 2026. They are projecting US$4 billion in cash flow per year when Phase 1 is complete, and up to US$11 billion when construction is complete.

The Oregon Group will be watching this market closely, stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.