- global nickel demand set to double to 6 million tonnes by 2040

- nickel industry in West struggling with “go big” strategy to meet investor expectations

- Chinese strategy in Indonesia started small and now global powerhouse

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Chinese investment in Indonesia turned the region’s small-time nickel industry in the early 1990’s into the leading global nickel producing powerhouse it is today.

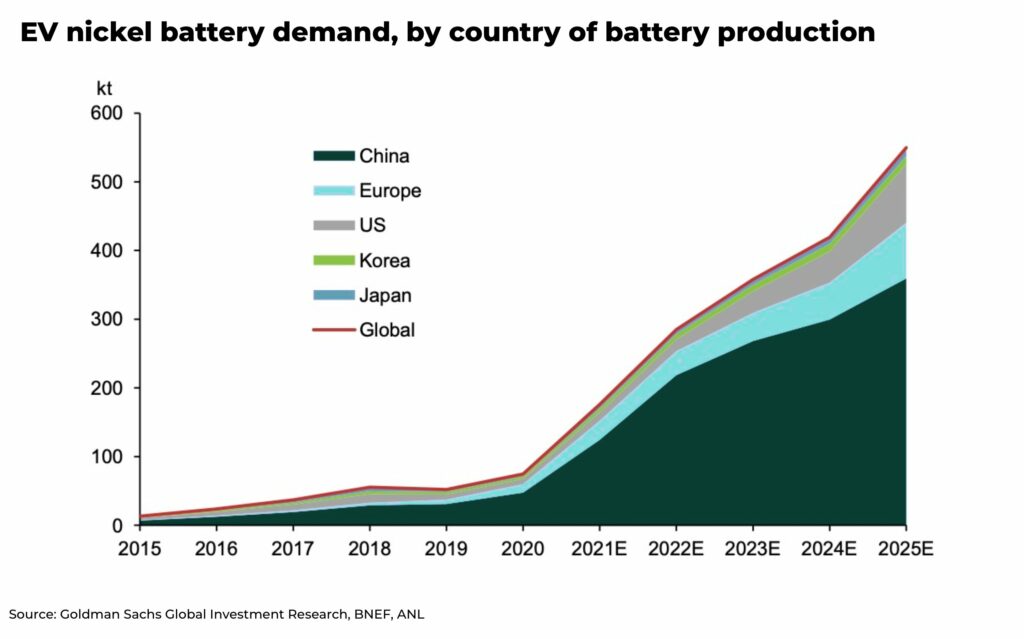

It’s a key part of China’s strategy to dominate the electric battery market, by controlling supply chains, from the nickel mines to the manufacturing of electric batteries and vehicles.

And the market is forecast for dramatic growth. A few key stats:

- demand for nickel to double to 6 million tonnes by 2030

- use of nickel in electric batteries expected to grow from 7% in 2021 to 40% by 2040

This is a problem for Western governments who have raised the alarm over dependency on China. They’re pushing to diverge their supply chains (read more of our analysis on deglobalization) — but coming up against challenges in building financially and environmentally sustainable mines and gigafactories.

Four high profile examples of projects in the West that have struggled to meet investor expectations:

- Koniambo project, with SMSP (51%) and Glencore Xstrata (49%), has capacity for 60,000 tonnes of nickel in ferronickel a year. It cost over US$7 billion and has been beset with problems

- Goro mine, originally owned by Brazilian company Vale, cost over $US6 billion and, opened after delays, only to also be beset with financial and maintenance issues

- Ambatovy mine in Madagascar, originally owned by Sherritt International, Sumitomo Corporation of Japan and KORES (Korea Resources) has a capacity of 60,000 tonnes of nickel in briquettes per year, cost over US$5 billion to complete and has never achieved more than 45,000 tonnes of production and has also been beset with problems

- Murrin Murrin mine developed in 1999 in Western Australia experienced significant problems and delays in the design, construction and commissioning of the ore process plant, failed to achieve the original design capacity and was also beset with significant problems in its first decade of operation

(Read more on the nickel supply challenge in our analysis on why the markets are too comfortable with the supply of nickel)

In comparison, the Chinese nickel mine Ramu in Papua New Guinea cost US$2.1billion and has been running relatively smoothly since being commissioned in 2016.

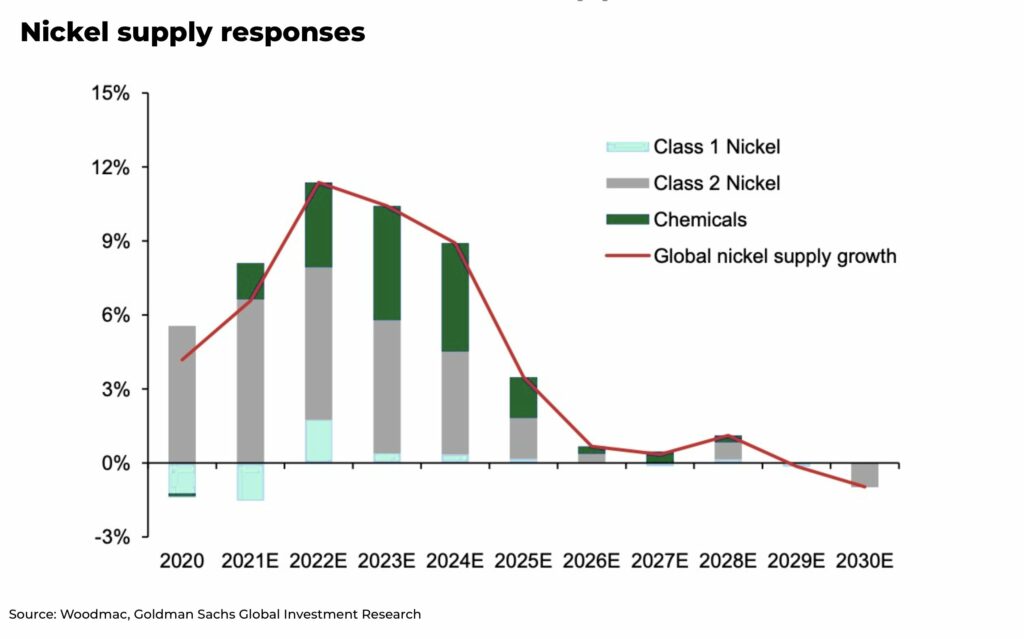

This means, as demand is rising, supply is tightening.

So, what’s the best way forward for the West’s nickel industry?

The Chinese nickel industry began with small-scale nickel facilities with investments often based in warehouses costing below US$10million. This was decades ago.

Then, the industry began to fine-tune their mines and processing plants, and scaling up to meet increasing demand as the government began to invest much larger sums.

In 2007, China looked for an alternative source of nickel so they would not be so dependent on Class I nickel from the London Metal Exchange (LME) to supply their booming stainless steel industry. They turned to the raw materials in Indonesia and the Philippines.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

But, instead of starting from scratch, the companies began to process the ore in obsolete furnaces that were used in their steel industry — called blast furnaces — to make nickel pig iron, a cheaper substitute used to supplement the stainless steel industry.

Each furnace design across Indonesia was largely a replica of the design that worked most efficiently with subtle improvements for each iteration. So, Chinese nickel giant Tsingshan Holding Group does not have the world’s largest nickel furnace, but instead has become one of the world’s largest nickel producers.

It took decades but Indonesia now produces 814,000 tonnes, accounting for 47% of global production, up from 38% in 2021, according the International Nickel Study Group.

Why does the West “go big” with their nickel facilities?

Initial Rate of Return (IRR) on big nickel investments in the US can be as high as 15%.

This is why many projects “go big”, as it takes scale to repay the massive investment required to meet the IRR hurdles demanded by investors and lenders. The prime example of this is Ambatovy, the 60,000 tpy design capacity was not set because of engineering efficiencies, it was set because that was the scale where it was deemed economic enough to repay the massive initial debt of US$2 billion at a rate acceptable to the investment community.

The Chinese government has been less concerned with companies paying back financing for nickel projects in such a tight timeframe — and loans can often be forgiven if they are operational and supplying “China Inc.” with the necessary raw materials needed for other industries.

North American financing does not operate this way.

There are many projects in North America that are viable from an operating costs point of view. The challenge is paying back the initial capital debts, especially if there is volatility in the nickel price.

“Over the medium term, we estimate that the nickel price will need to trade on average close to $30,000/t as a necessary incentive on supply investment to solve the forwards shortfalls”

— Goldman Sachs, Nickel’s class divide

So, the reason so many projects “go big” in the West is that they’re trying to overcome the financial hurdles imposed by banks, lenders and governments. In China, companies deemed critical often don’t have the same restrictions.

A change in the West’s nickel policy is coming

In America, the Inflation Reduction Act, signed by President Biden this year, will give tax relief to projects where critical materials listed in the bill will qualify for a tax credit equivalent to 10% of the cost of production for that mineral.

In Canada, the government is setting up a new critical minerals strategy, including possibly providing financial grants and assistance, as well as starting to block Chinese investment in the country’s mines.

The EU has also introduced a new proposal, the European Critical Raw Material Act, to secure supply chains of critical metals

But more can be done.

In particular, governments can provide support for infrastructure, which according to our estimates, can often cost as much as 25% of initial capital in big nickel projects. For example, roads and power-lines.

Building such roads and energy supply would be beneficial, not only for the project, but for local communities, ie good politics.

But mines have to play their part to be prepared to meet the forecasted demand.

We recommend future designs go “small and repetitive” with their processing and furnace designs. Make it work and then scale up.

One example of a company headed in this direction is Giga Metals approach to the Turnagain nickel deposit. In their latest Preliminary Economic Assessment (PEA), the project is presented in a phased approach with Phase 1 being approximately 20,000 tpy of nickel production (in concentrate) and then doubling in Phase 2.

The majority of the investment (US$1.5 billion) is in Phase 1, with Phase 2 only being US$500 million. Why the disparity? It is because Phase 1 requires significant investment in infrastructure (road, hydro-electric power, tailings facility and ancillary facilities). Once the initial investment is in place, doubling or even tripling capacity becomes less capital intensive.

This is a similar approach to that of Tsingshan’s investment in Indonesia’s Morowali park.

If you look at the economics of Turnagain’s development on a 20,000 tpy Ni capacity, they can never overcome the IRR hurdles required, and so they are presenting the project as a two phased build.

By building small at the beginning, Giga Metals are attempting to avoid the problems besieging many other nickel projects for the previous two decades.

We will be analyzing the impact of ESG on nickel mining and how investors should position themselves in our next report.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.