Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

UPDATE: the Sprott Physical Uranium Trust announced its US$100 million bought-deal financing has been amended to US$200 million due to strong investor demand.

Sprott Physical Uranium Trust has announced a US $100 million bought‑deal to finance additional physical uranium purchases — U₃O₈ and UF₆ — expanding the Trust’s holdings.

Financing will be led by Canaccord Genuity, issuing 5.8 million units at US $17.25 each. Delivery is expected around June 20, 2025, pending regulatory approvals.

Who is Sprott and why it matters

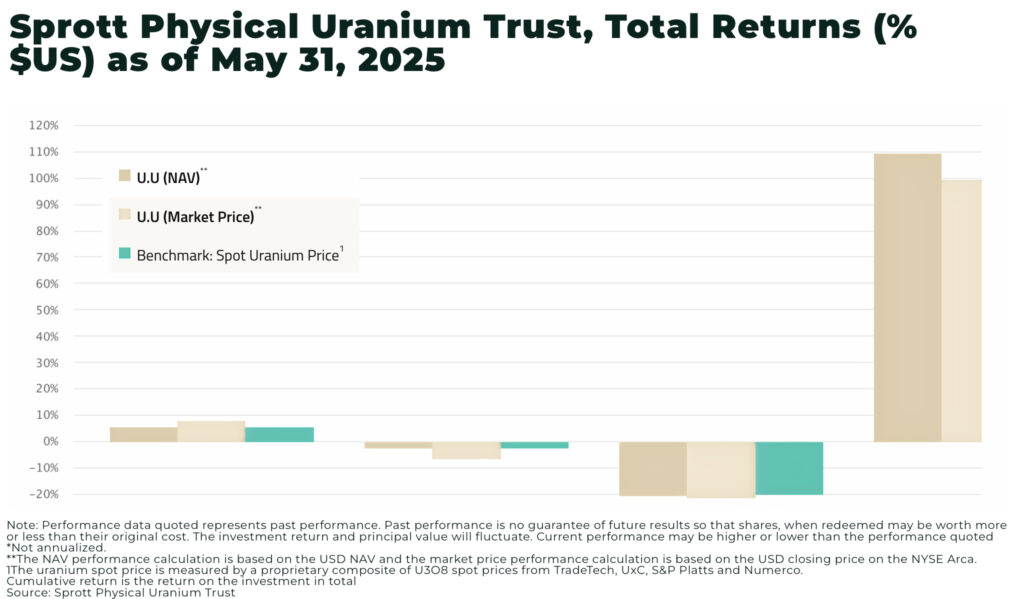

The Sprott Physical Uranium Trust, launched in July 2021 through Sprott Asset Management LP’s acquisition of Uranium Participation Corp., has become a dominant “whale” in the uranium markat and is now the world’s largest physical uranium fund with over 66 million pounds of U₃O₈ valued at approximately US $4.6 billion.

At the start of the year, Sprott CEO, John Ciampaglia, sounded very bullish on the uranium trends.

“The trend is your friend, so to speak. The price has been going up steadily, and that’s because we’re seeing demand signals and those demand signals are from reactors that are getting life extensions, reactors that are restarting, shuttered reactors being announced, that are going to restart, and then obviously all the reactors that places like China are building, et cetera. That’s creating a lot of future demand, and those signals are there, and the price has increased”

— John Ciampaglia, Sprott CEO, January 2025

The long-term trends driving the uranium price include:

- supply plateau amid rising demand

- nuclear reactor build-out, restarts and life-extensions underway

- geolpolitical and supply chain shifts

- price fundamentals firm

This US $100 million capital raise is more than financing, it’s strategic positioning in a structurally tightening uranium market. Sprott’s scale and market influence reinforce its role as a price-setter. By stockpiling large volumes ahead of shortages, Sprott’s influence to shapes market dynamics increases.

Our recent report — The Great Nuclear Disconnect — on how new nuclear reactor builds, reactor life extensions and longer term fleet expansions, mean the path has been laid for robust growth of nuclear energy from now through the coming decades.

Over the long term, the market cannot escape the fundamentals of supply and demand, and so The Oregon Group predicts the longer the disconnect between prices and demand, the greater the pressure for price growth beyond the levels we saw in 2024.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.