Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

- long-term uranium contracting sharply up as utilities hedge against future supply shocks; eg Cameco Corporation reports approx 119 million pounds of uranium were placed under long‑term contracts by utilities in 2024

- US partnership with Brookfield, Cameco, and Westinghouse to deploy US$80 billion in reactors for AI‑driven power demand, reinforcing utilities’ shift to long‑term fuel security

- Spot prices remain tight, but long-term procurement is now driving the market

- the Fukushima-era inventory overhang is gone, and Western utilities are pivoting away from Russian supply

How important are utilities in the uranium market?

Utilities contracts are the greatest source of demand for uranium.

Most uranium is bought through 3–15 year term contracts, where producers sell directly to utilities at prices above spot prices in exchange for security of supply.

Since 2008, only about 25% of supply has traded in the spot market, and utilities and producers account for an estimated 30-40% of spot trading (with traders and financiers adding liquidity).

Long-term procurement strategies by utilities, driven by predictable reactor fuel needs and low elasticity to short‑term price swings, anchor the market. This stable, forward‑contracted demand underpins investment decisions, mine restarts, and the timing of new supply entering the system.

The uranium market remains opaque, with most long-term contracts negotiated privately and undisclosed. However, as the rising long-term and spot price reveals, utilities are buying and supply is tight.

US nuclear build‑out accelerates utility term demand

A major new policy‑anchored demand signal has emerged in the US: Brookfield Asset Management, Cameco, and Westinghouse Electric have launched a strategic partnership with the US Government to construct at least US$80 billion of new nuclear reactors nationwide, explicitly to meet the power needs of rapidly expanding AI infrastructure. The program will deploy Westinghouse technology (AP1000 large pressurized water reactors and the AP300 small modular reactor) while streamlining licensing and fuel supply.

This matters for utilities because AI‑driven load growth is long‑dated and non‑interruptible. Securing baseload through nuclear build‑outs increases forward fuel requirements and pushes procurement toward multi‑year term contracts rather than opportunistic spot buying—exactly the dynamic we’re now seeing in the rising term price and volumes. In effect, policy and load growth are amplifying the “Great Refill.”

“This historic partnership with America’s leading nuclear company will help unleash President Trump’s grand vision to fully energize America and win the global AI race” — Chris Wright, US Department of Energy

For producers and developers, this reinforces the thesis: as utilities lock in future delivery, capital flows to restart mines and advance Tier‑1 projects in allied jurisdictions—particularly Canada’s Athabasca Basin—accelerate. The $80 billion commitment is not a spot‑market story; it is a long‑term contracting story.

Utilities start to rebuild their inventories

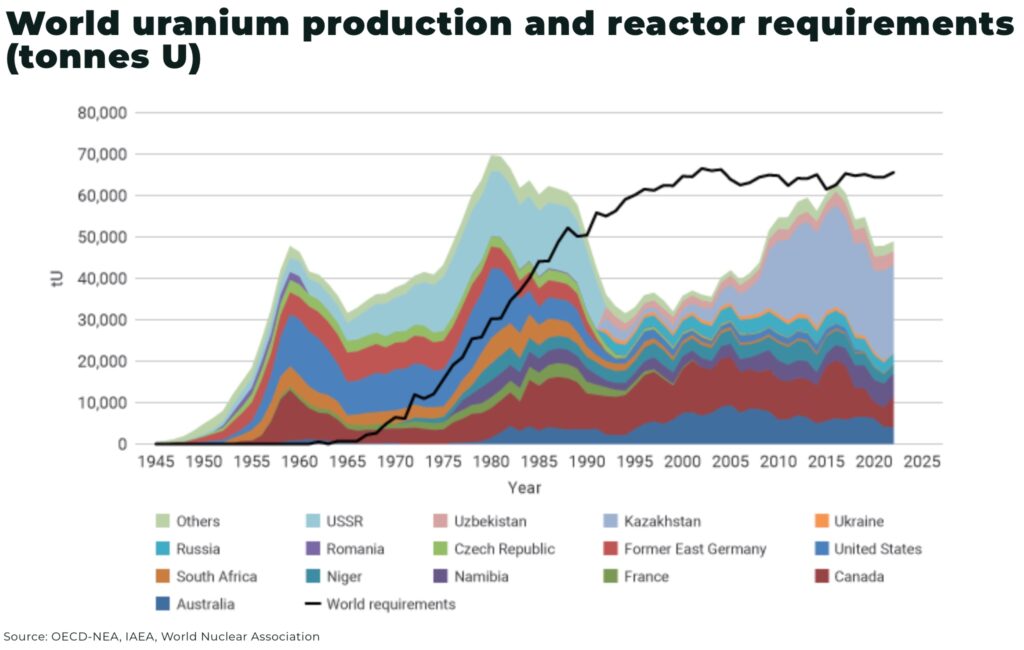

In 2020, long-term uranium contracting volumes hit historic lows, with utilities relying on stockpiles and opportunistic spot purchases as prodution fell as low as 47,731 tU. That dynamic has now flipped:

In 2025, industry analysts report long-term contract volumes have nearly double the average annual rate seen during the 2018-2022 period, as utilities re-enter the term market.

Spot prices, above $82/lb in September, are drawing headlines, but it’s the term price, pushing $83/lb in September, that reflects true utility sentimen.

And, as we’ve highlighted in our reports, this is no short-term trend:

- global nuclear fuel requirements exceed primary mining production by approximately 40-50 million pounds U3O8 annually

- there are currently 70 new reactors under construction worldwide, 110 planned, and 320 proposed

- global reactor requirements for uranium in 2025 are estimated at 68,920 tU, with requirements rising to over 204,000 tU by 2040 in the World Nuclear Associations “Upper Scenario” forecast

- secondary supply of uranium is tightening

- geopolitical risks threatening supply chains are rising (from China cornering supply to Kazakhstan, to sanctions on Russia)

- the two world’s largest, established uranium mining companies — Cameco and Kazatomprom — are warning they will not meet their production targets

Risk is critical to understanding the US utility position as US reactors rely heavily on foreign sources of uranium: in 2024, Canada was the top source at 36% of total deliveries, followed closely by Kazakhstan and Australia with 24% and 17% of total deliveries respectively.

Western utilities, particularly in the US and EU, are no longer willing to rely on short-cycle spot buying. The need for fuel security is too great — especially as China builds a record number of reactors and has started to “aggressively” stockpile uranium — and the memory of being outbid by financial funds (as happened with Sprott’s uranium trust) is still fresh.

Utilities are prioritizing projects in politically secure allied regions, especially where permits and infrastructure are already in place, to lock in greater long-term contractual certainty.

“Across the board, there’s utility activity everywhere,” said John Ciampaglia, CEO of Sprott Asset Management. “You’re starting to see more of these companies where utilities are willing to go to these earlier-stage companies and sign long-term offtake agreements to help them come to market… It’s important because these are capital-intensive projects, and there’s a demand signal from the utilities.”

Too late for utilities

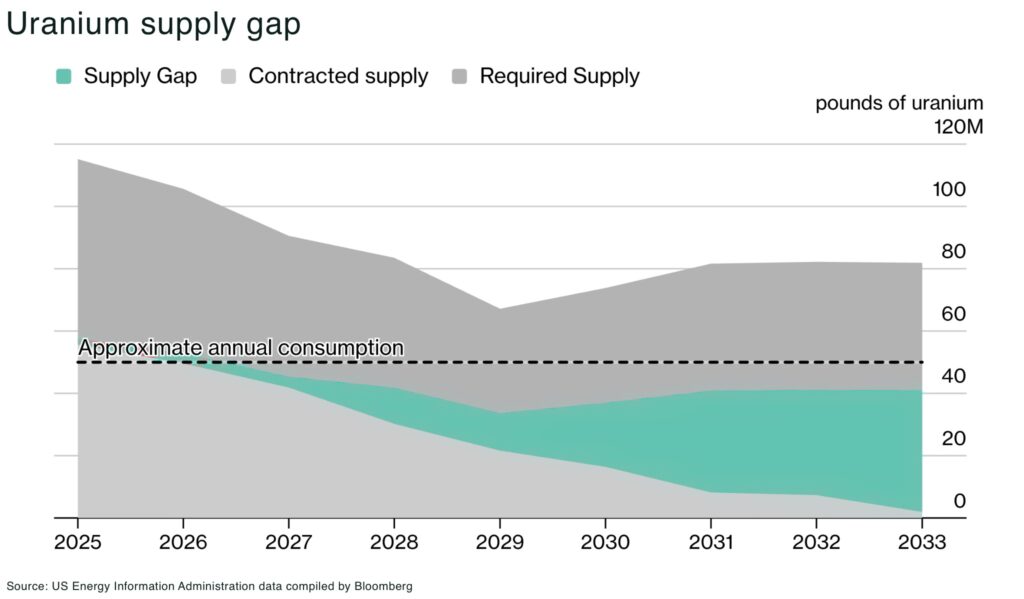

Are utilities already behind the curve? US nuclear operators face growing fuel shortfalls over the next decade, warns the US Energy Information Administration.

Utilities signed fewer contracts for delivery in 2024 as prices surged, with some utilities deferring purchases to avoid locking in at elevated levels. But that caution is now exposing them to longer-term risk: the projected supply gap has ballooned to 184 million pounds through 2035 — more than three years of total US reactor demand, according to the EIA.

Canada: the West’s geopolitical supply realignment

The sharp rebound in term contracting underscores a new era in utility behaviour. For over a decade, procurement decisions were tactical; now they are strategic. Utilities are chasing assured delivery, not spot discounts, and that shift is unlocking capital for a new generation of developers.

Supply risk means a renewed focus on politically aligned supply chains. Utilities are moving to secure long-term access not just to production-ready projects, but also advanced exploration assets in safe jurisdictions — and that can mean investing in new uranium production projects.

For the West this means Canada, which has proposed a deeper critical mineral alliance with the US in response to President, prioritizing uranium among key strategic fuels. In particular, uranium reserves in Saskatchewan’s Athabasca Basin, which contains the world’s largest high-grade uranium deposits, with grades up to x100 greater than the average ore grade deposits elsewhere in the world.

“We think we’ll see more of these development companies bring their production to market in the next few years, helped in part by capital from the utility. This is a very strong backdrop in terms of pricing. Obviously, the demand is there, and utilities are willing to write checks to get these projects to market,” said John Ciampaglia, CEO of Sprott Asset Management.

What it means for developers and explorers

Producers like Cameco and Kazatomprom will capture the bulk of near-term contracts. But the tightening supply picture is also lifting developers — NexGen, Denison, Global Atomic — and increasingly, the most promising juniors.

F3 Uranium Corp (TSXV: FUU, OTCQB: FUUFF) is one such case. Its Patterson Lake North (PLN) project, located just north of NexGen’s Arrow deposit, has delivered high-grade hits (eg, 20.5% U₃O₈ over 5.5m) and confirmed structural continuity along strike. The 2025 winter program expanded the JR Zone and made new discoveries at the Broach and Tetra Zones. A 3,000m diamond drilling fall program has just been announced.

If long-term contracts keep rising, and if a maiden resource follows this year, F3 could position itself as a viable offtake target, especially for utilities looking to lock in future Tier-1 feedstock.

“We’re seeing the beginnings of a structural re‑rating of uranium assets. For the first time in more than a decade, utilities are back in the market writing long‑term offtake deals instead of waiting on the spot curve. That confidence is what enables developers like F3 to finance and advance new Tier‑1 projects in Canada’s Athabasca Basin — the heart of Western nuclear fuel security”

— Dev Randhawa, CEO of F3 Uranium Corp

Conclusion: term contracts are the real bull signal

For over a decade, uranium investors chased spot price rallies and speculative ETF flows. But the return of utility term contracting is a fundamental shift, a signal that drove the last secular bull market in the mid-2000s.

As procurement cycles lengthen and geopolitical fragmentation accelerates, utilities are rethinking their fuel strategy. The market is no longer oversupplied. The risk is now under-supply, and developers and advanced juniors are back on the radar.