Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

US President Trump’s recent Executive Orders on nuclear energy aim to expand America’s nuclear energy capacity from approx 100 GW today to 400 GW by 2050, including having 10 new large reactors under construction by 2030, accelerated deployment of small modular reactors (SMRs) and coal-to-nuclear conversions.

If realized, this would at least double U.S. uranium demand by the mid-2030s and potentially quadruple it by 2050 — from more than 43 million pounds U₃O₈/year in 2023 to an estimated 150 million pounds/year.

The challenge is that US domestic production is still below 2 million pounds/year.

Canada, specifically the Athabasca Basin, is emerging as the most credible source to fill it.

US supply: nowhere near sufficient

US production of uranium concentrate (U3O8) in the first quarter of 2025 totaled 310,533 pounds U3O8 — the highest since 2018 — but still at historic lows. In 2024, total US production was 676,939 pounds, but US reactors consumed approx 45 million pounds/year, which means domestic output covers less than 5% of existing demand. And that’s before the new demand from the proposed nuclear capacity comes online.

President Trump is working to fast track uranium mines in the US, for example:

- the Department of the Interior approved its first fast-tracked mining project, Anfield Energy’s Velvet-Wood mine, in Utah, under newly established emergency procedures, with a completion timeline of 14 days for an accelerated environmental review by the Bureau of Land Management. The combined Velvet and Wood historical mines are currently estimated to contain 4.6 million pounds U3O8 of measured and indicated resources and inferred resources of 552,000 pounds U3O8

- Uranium Energy (UEC) announced in August 2024 the restart of production at its Wyoming in-situ recovery (ISR) projects, supported by strong uranium pricing and state-level backing

UEC’s Wyoming hub holds an estimated 67 million pounds in resources, but production is expected to scale gradually, constrained by labor and infrastructure availability. - other developments include two mines in New Mexico are being considered for streamlined permitting, as well as a uranium mining boom in Texas

However, it’s highly unlikely that this new domestic supply will exceed 5-7 million pounds a year by 2030, leaving a supply gap of, at least, more than 40 million pounds/year under Trump’s proposed buildout.

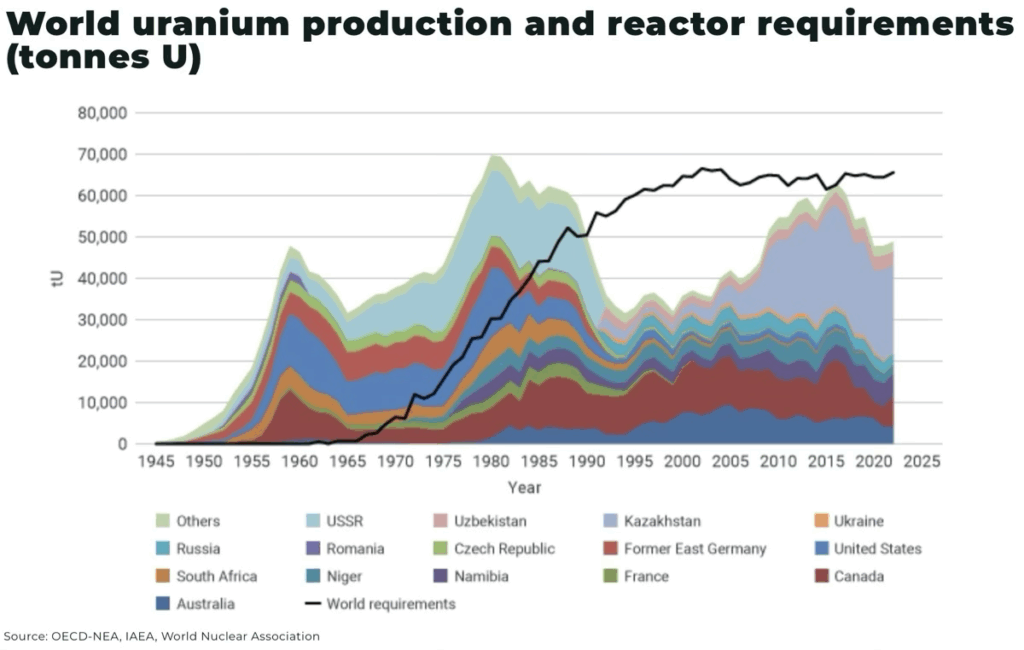

Global supply: volatility incoming

The rest of the world is also not standing still in expanding it’s own nuclear capacity.

Approximately 60 reactors are currently under construction worldwide, with plans for at least 110 more. For context, there are around 440 nuclear reactors operating globally today. And, global nuclear generation is on track to hit an all-time high in 2025, with output expected to grow by 3% or more annually.

Yet, as we warned in our recent report The Great Uranium Disconnect, uranium mining project development for new supply is failing to keep up with projected demand.

Meanwhile, the ongoing global trade war is already putting immediate pressure on uranium supply to the US through tariffs and export controls, including:

- in July, Trump announced 25% tariffs on Kazakhstan — the world’s largest uranium producer (which plans to cutback on production in 2026) — with no notable carve out for uranium

- a 10% tariff on imports (including uranium) from Canada

- and a 25% tariff on all imports, including uranium, from Mexico

- and on Russia, President Biden authorized a ban in 2024 on unirradiated, low-enriched uranium (LEU) imports, with waiver options and quotas, with Republicans threatening a 500% tariff on countries that import Russian uranium

The supply gap is clear and DOE pilot programs, recent executive orders, and potential legislation have all emphasized allied supply chains, in particular, Canada, as a priority partner.

Investment Implications: Canada’s Strategic Leverage

With such a vast domestic supply deficit and tightening global market, Canada’s Athabasca Basin is fast merging as the key supplier to fill it.

- Canada is already the second-largest uranium producer globally and holds some of the world’s richest undeveloped reserves in the Athabasca Basin. The region is notable for:

- grades 10–100x higher than global average

- existing infrastructure and permitting (Cameco, Orano)

- new advanced-stage projects (NexGen’s Arrow, Fission’s PLS, Denison’s ISR Wheeler River)

Yes, there will be tariffs, but they are comparatively minimal against Kazakhstan’s 25%, as well as reduced transport and logistics, shipping, etc costs.

If just half of Trump’s proposed buildout proceeds on schedule, the Athabasca Basin would become a strategic pillar of Western nuclear fuel security.

“The US can’t meet its nuclear ambitions without Canada. And the Athabasca Basin is the only jurisdiction with the grades, scale, and proximity to reliably feed the projected demand for the West’s fuel cycle.

Companies like F3 offer what US utilities need: secure, high-grade supply — developed in a stable, allied nation with permitting experience and a long history of uranium production”

— said Dev Randhawa, CEO and Chairman of F3 Uranium (TSXV: FUU)

And US utilities have already begun revisiting long-term contracts with Canadian suppliers, and project developers have signaled renewed interest from US partners since early 2025.

Timelines and Procurement: Why Utilities Are Moving Now

The US grid watchdog warns time is already up with no spare supply for new data centers, manufacturing or industrial projects.

“There is simply no new capacity to meet new loads,” said Joe Bowring, president of Monitoring Analytics, which is the independent watchdog for PJM Interconnection, the grid that extends from Washington to Chicago. “The solution is to make sure that people who want to build data centers are serious enough about it to bring their own generation.”

New uranium mines typically take 7–10 years from discovery to production. That timeline is now out of sync with both US political ambitions and AI data center infrastructure growth.

Western utilities cannot afford to delay contracting. That urgency favors near-permitted, geopolitically safe projects, especially in Canada.

Conclusion

Trump’s nuclear expansion would create exponential demand increases on already tightening Western uranium supply for, at least, the next two decades.

The result is a bullish setup for Canadian uranium miners.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.