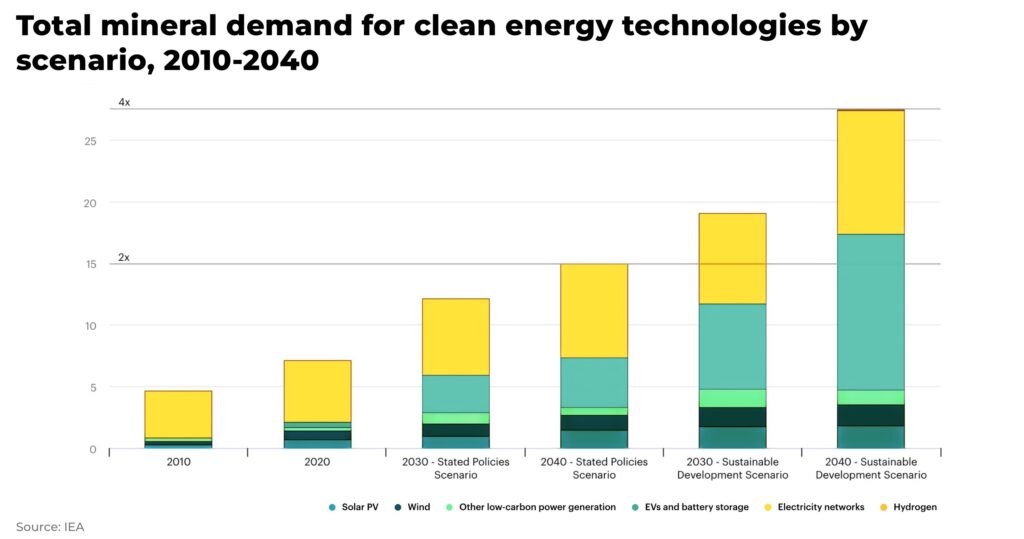

- demand for critical minerals forecast to be as much as x4 current demand by 2040

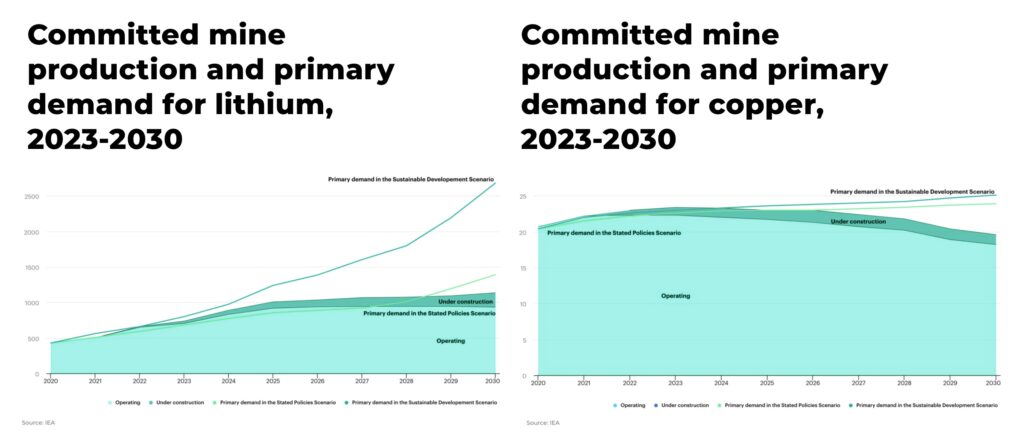

- the industry is struggling to build mines fast enough, so recycling will be essential for long-term supply

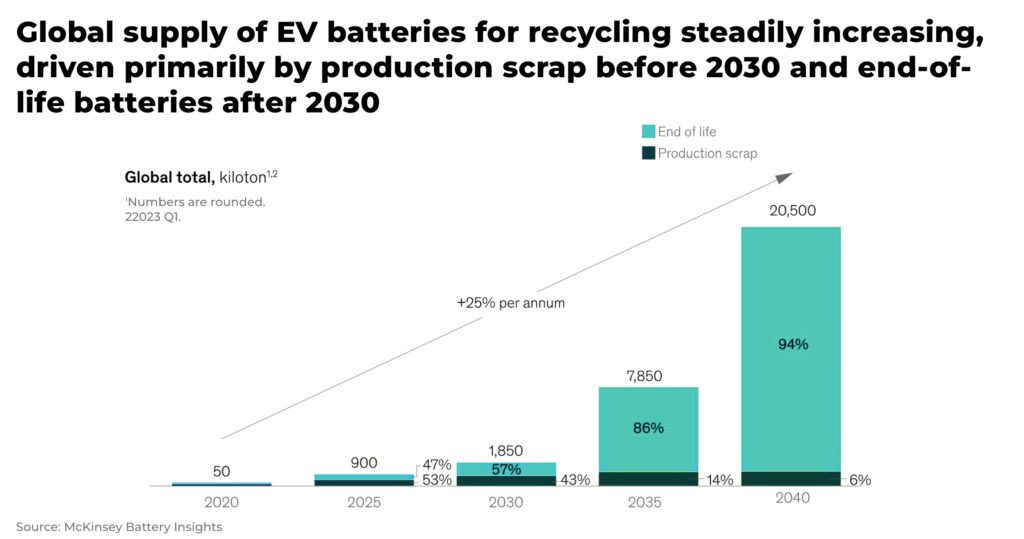

- it can take up 20 years before an electric battery to be ready for recycling

- there are not enough minerals available to scale recycling for the energy transition in the short-term

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Total demand for critical minerals needed for the global energy transition is forecast to be as much as x4 current demand by 2040, with demand from electric vehicles (EVs) and battery storage increasing over x30 times.

The challenge is supply.

The industry, as we have warned on The Oregon Group, is struggling to build mines fast enough to meet expected demand.

So, demand is turning to other sources of critical minerals, one of the most important of which is recycling — which can also often be more sustainable than mining.

By 2040, the entire global electric battery recycling value chain, is forecast to be worth US$95 billion. This will be driven by the price of metals, anticipated increase in electric battery demand, and regionalization of supply chains.

The Department of Energy estimates recycling could “provide one-third of United States cathode material needs for lithium-ion batteries by 2030,” up from just 5% in 2019.

Governments across the world are incentivizing recycling projects with tax rebates and other financial support to encourage investment.

But there’s one big problem: there are not enough secondary stock of metals currently in circulation that can be recycled to meet such an increase in demand.

Not only are there not enough minerals, but it can also take up to 10-20 years before an electric battery being put out into the market today to reach the end-of-life and be ready for recycling. For example, Tesla’s Model 3 was the best selling electric vehicle in the US in 2019, selling 158,925 units. That same year, Elon Musk tweeted that the battery should last between 300,000-500,000 miles.

The IEA estimates by 2040, recycled copper, lithium, nickel and cobalt from used batteries could reach 10% of global demand.

We still need mining.

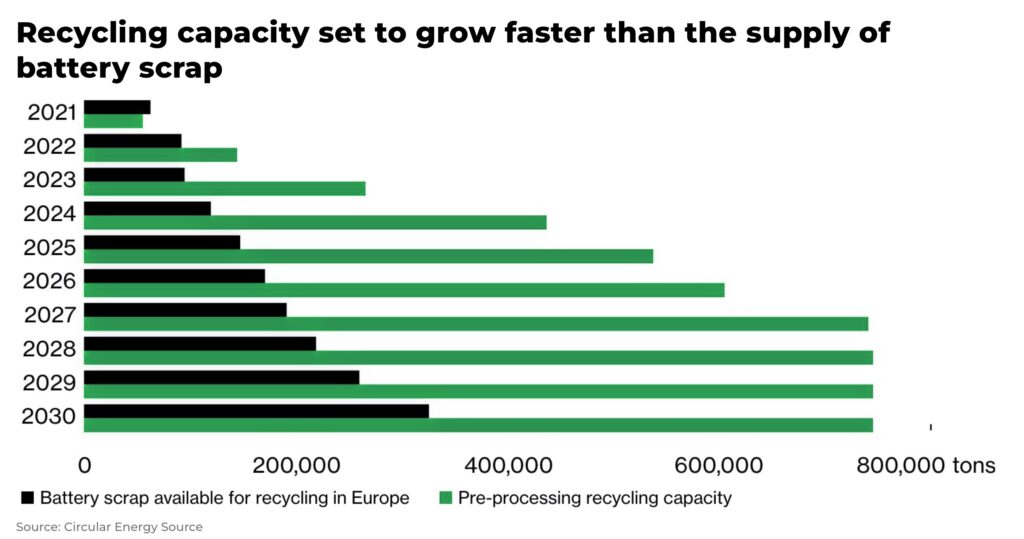

For example, the EU’s new Critical Raw Materials Act has mandated that at least 15% of the EU’s annual consumption of critical minerals must come from recycling by 2030.

The European Recycling Industries Confederation (EuRIC), although welcoming the act, warns that pragmatic targets are needed.

“Recycling targets can drive sustainability but they’re not a silver bullet… You need to have a market, basically” — said Emmanuel Katrakis, secretary general of EuRIC, the European Recycling Industries Confederation.

Eurometaux, a trade association representing non-ferrous metals producers and recyclers in Europe, suggests precious metals in electric batteries won’t be widely available until 2035-2040.

“Basically, what we’re doing now is adding materials into our urban mine that will be there in 15 years’ time to capitalise on” — Chris Heron, director for communications and public affairs at Eurometaux.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

And different countries will have different speeds at which they will be able to bring a sustainable recycling industry online. China and South Korea are ramping up their recycling policies to gain an industrial advantage, including taking scrap from other markets.

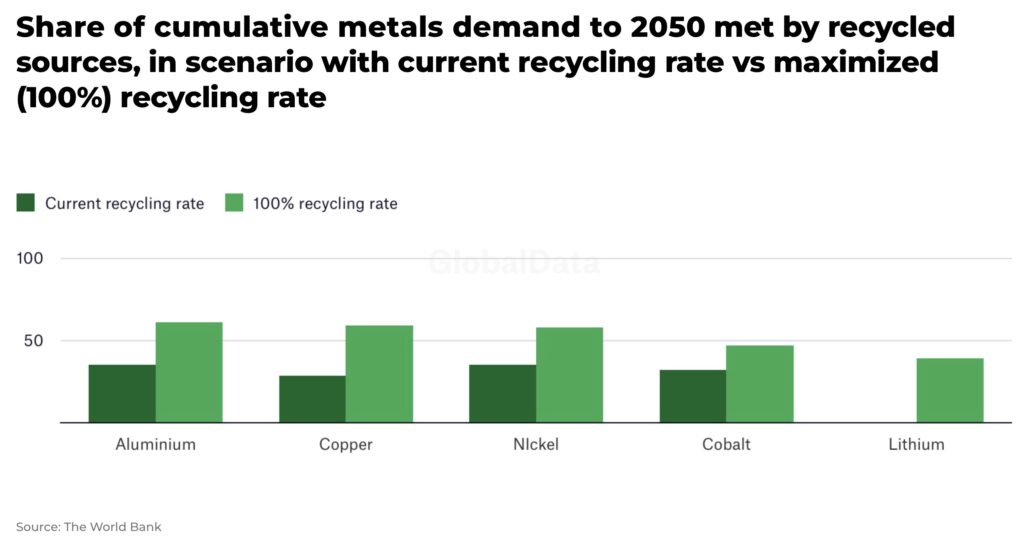

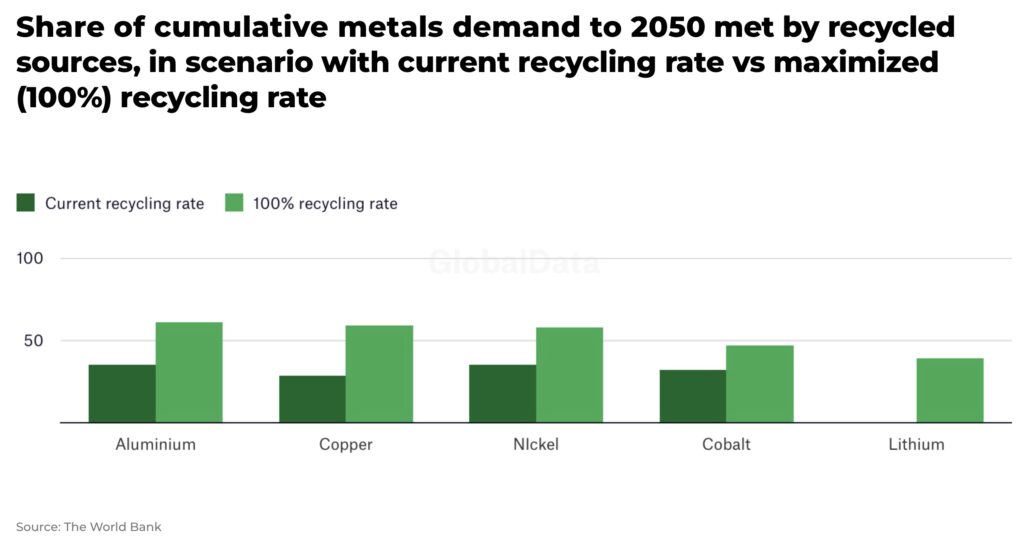

The World Bank has modeled the share of metals that can come from recycling by 2050 if there was to be 100% end-of-life recycling. Aluminium, copper, and nickel would still only see secondary supplies reach 60% of demand.

And recycling is not always as cost-efficient as mining.

Although technology is making significant advances to increase recycling rates, it is still both cheaper and easier to mine some metals due to the need to use hazardous chemicals and significant heat sometimes needed to “unblend” minerals in magnets, batteries and touchscreens. This is particularly so with rare earths and lithium.

“At present, the challenges of recycled battery raw materials seem insurmountable… Firstly, the cathode, which contains critical metals in the EV pack, is overpackaged with pack materials such as casings, interconnects, cooling channels and others. The result is a tedious recycling process with little value”

— Wood MacKenzie, Recycling alone can ease raw materials supply pressure but cannot meet demand

This is not to say that recycling will be essential for the energy transition, as well as a big opportunity for investors.

Recycling capacity is forecast to grow 270% in 2023, compared to last year, according to Benchmark’s battery recycling forecast. Already this year, the US Department of Energy has committed a US$2billion loan to Redwood Materials for the construction of a battery recycling plant in Nevada.

There is also increasing collaboration between recyclers and miners as companies take advantage of new opportunities in a circular economy and technology transfer.

For example, Glencore announced a partnership with FCC Ámbito and Spanish energy firm Iberdrola to provide lithium-ion battery recycling services in Spain and Portugal.

To make such investments work, the recycling industry is expecting a significant amount of used metals to come onto the market within a timeframe that makes such investments financially viable.

This means more mining, a lot more mining, and quickly.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.