- demand for carbon credits grown x3 since 2019

- move than 20% of the world’s largest public companies, representing sales of over $14 trillion, now committed to net-zero

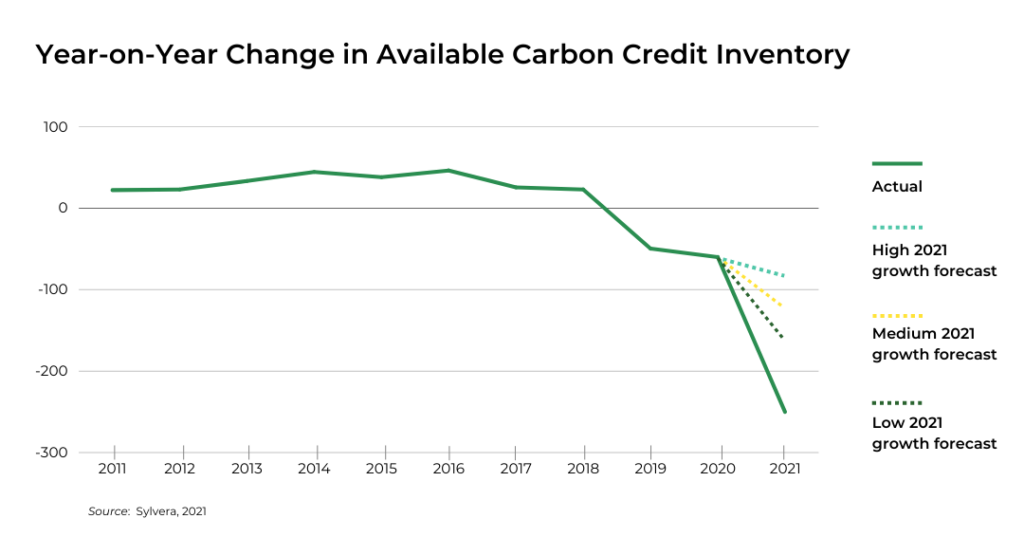

- inventory of voluntary carbon credits fell by approx 50% between Jan- Dec 2021

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Carbon credit demand has tripled in the last three years — and is not slowing down. In fact, our research suggests that the voluntary carbon credit sector is headed for a major supply/demand imbalance that most investors have yet to wake up to.

Let’s break it down: over 20% of the world’s largest public companies, representing sales of over $14 trillion, have now committed to net-zero. In response, the voluntary carbon credit markets hit a record $1 billion transactions last year, with both offsetters (companies using credits) and speculators jumping in to buy credits.

The carbon markets are even shaking off the shock of the war in Ukraine. In the European Carbon Credit market, prices initially tumbled from highs of $97 per tonne to $58, but quickly recovered to over $80 per tonne — prices we saw only last December — and they are still climbing.

If demand is anything remotely like the forecasts, carbon credit prices are set for sustained upwards curve for some years to come.

Anthony Milewski, The Oregon Group.

And this is just the tip of the proverbial iceberg. In March, the US Securities and Exchange Commission, proposed rule changes requiring companies to disclose their risks related to climate change and their greenhouse gas emissions. Fortune has said it “could be the biggest change to corporate disclosures in the U.S. in decades” and we think they are understating the case. If the proposal becomes law, the number of companies looking to offset their carbon emissions and alleviate their disclosures is going to soar.

And this is all happening because in order to limit global warming to 1.5°C, as set out in the Paris Agreement, it’s going to require a reduction of at least half global net emissions by 2030.

That’s also why, at COP26 in Glasgow, over 200 countries agreed the final text for Article 6 of the Paris agreement, laying the foundations for international carbon credit exchanges and a global voluntary carbon market. National voluntary carbon markets are currently siloed with very little exposure between them, but Article 6 has the potential to help standardize the market and significantly increase liquidity.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

As each company goes through the time consuming process of developing their net zero strategy, most of them eventually realize that getting across the finish line is not possible without purchasing carbon credits to offset any emissions that remain after they have reduced in-house. Big industries like shipping, flights and mining have few other options to decarbonize their emissions and will almost exclusively rely on offsets.

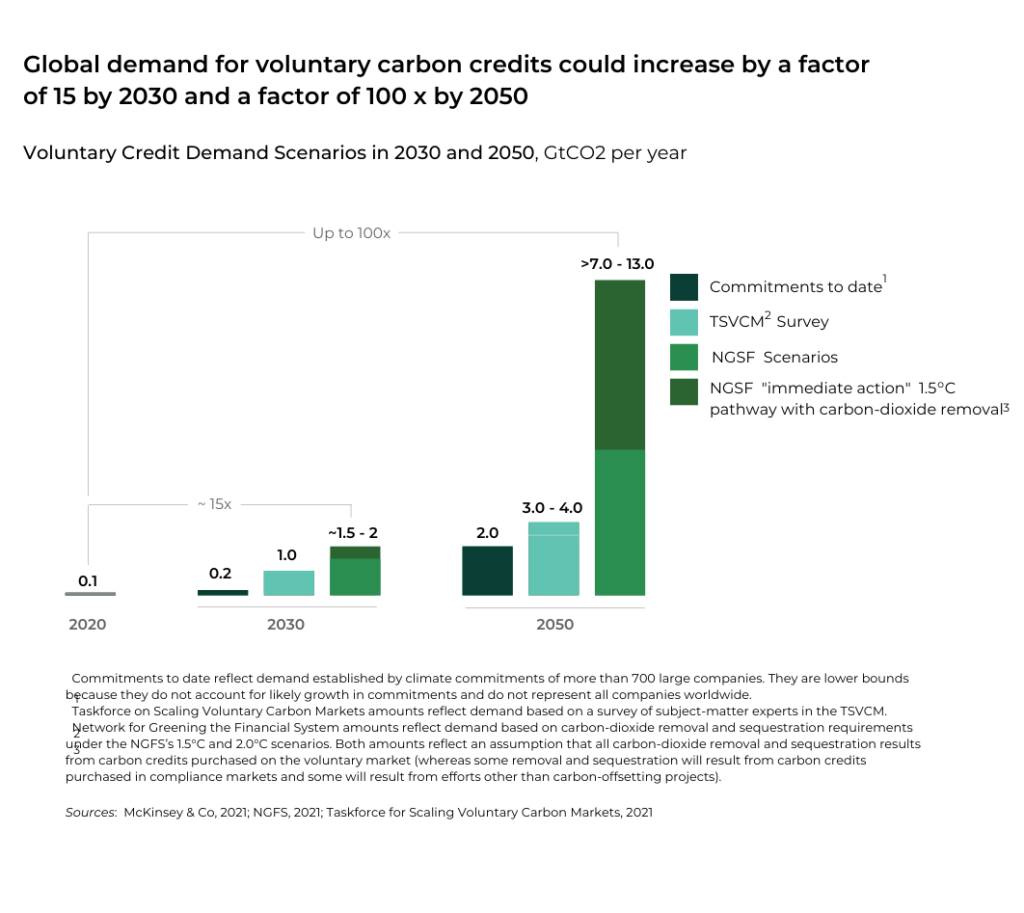

We are building towards what you might call a perfect storm of demand. And what might that look like in terms of numbers? Well, Mckinsey suggests demand for carbon credits could reach 2 gigatons of CO₂ by 2030, and up to as much as 13 gigatons by 2050.

But the big carbon credit supply crunch is coming.

Carbon credit projects take time to develop. Whether it’s reforestation, avoiding biome destruction , reduction of gases from landfills, or technology-based carbon removal from the atmosphere, the projects have to be set up, financed, organized, as well as validated and verified by one of the carbon registries such as VERRA or Gold Standard.

We spoke to Hannah Simmons of ERA, a leading carbon project developer responsible for one of Brazil’s most important projects, who put the timeline at one to five years for a new project to get up and running.

Until recently, one of the biggest problems was financing. However, with money pouring into the sector, getting funded is no longer a problem for established carbon project teams. The real ticking time bomb is people – specifically, a deficit of skilled workers.

It’s worth sharing a quote from Hannah during our conversation: “Climate science is complex, and the verification and validation process is incredibly involved. To succeed with these projects, you need a multidisciplinary team that brings together environmental engineers, data processing and modeling experts, people with strong legal, financial, and project management backgrounds. It’s hard because there just aren’t enough people out there that have these skills and work in the sector. I’ve had big funds offer a lot of money for us to set up additional projects, but it would require a major staff increase and the available hiring pool is just too small.”

Between January and December 2021, inventory of voluntary carbon credits fell by around 50% due to both constrained supply and exploding demand.

One of the leading carbon ratings providers, Sylvera, warns in their 2022 Carbon Credit Crunch report:

“As a result of the exploding demand for credits, the rapidly diminishing inventory of credits and buyers being forced to compete for more expensive nature-based credits, VCMs are experiencing significant price pressure.”

And then there’s the jurisdiction factor. The majority of nature-based carbon credit projects are located in just a handful of countries, such as Brazil, Indonesia, India, China, Columbia. Governments in these countries bring their own issues with access, bureaucratic and legal complexities. And, with most of the official conservation documentation only available in English, team members will need some understanding of English.

How does the manpower problem get fixed? Not easily. Enough funding and training courses will accelerate progress but as we know from other industries with manpower problems, like cybersecurity, it doesn’t happen over night.

Meanwhile, if demand is anything remotely like the forecasts, carbon credit prices are set for sustained upwards curve for some years to come.

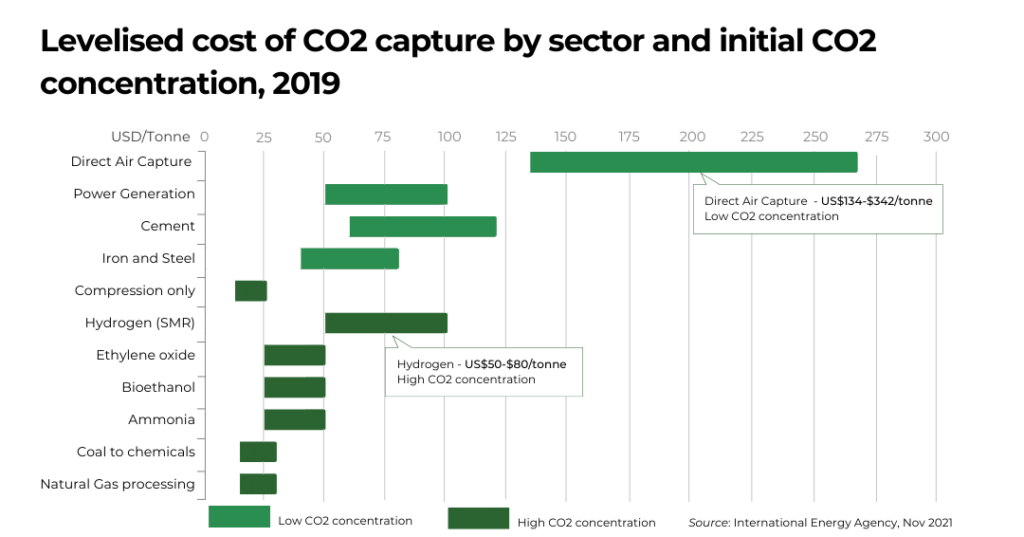

Where does it end? Our belief is that eventually, prices will be high enough to facilitate a market shift towards technology-based removal processes.

Technological carbon capture and storage is the holy grail of efforts to remove CO₂ from the atmosphere, but it remains at early stages of development and it’s prohibitively expensive to deploy. The ultimate goal of putting a price on carbon is to encourage companies to stop producing it, but unless all global emissions are stopped in the next few years — an impossible ask — then nation states will need to dramatically increase sequestration (aka removal and storage of carbon) to mitigate the worst effects of climate change. The question will then be: what sort of pricing is needed to incentivize the deployment of this technology. Estimates currently range up to as much as $350 per ton.

At that point the supply/demand metric will undergo rapid change.

But, for now, it’s all about the coming crunch.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.