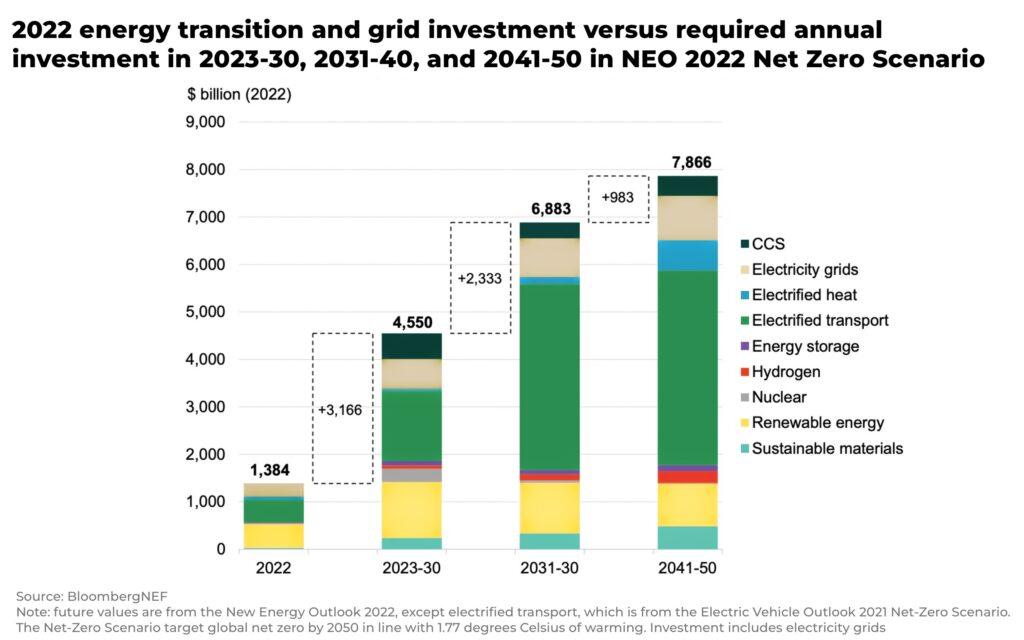

- investment in energy transition needs to triple to US$4.55 trillion every year until 2030

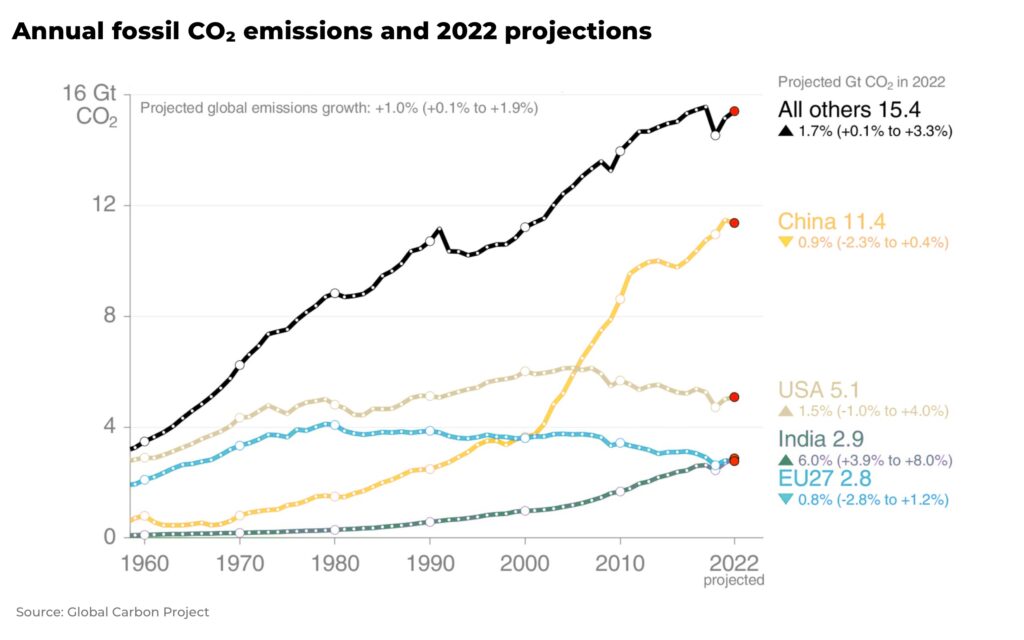

- China releases more CO₂ emissions than the US, EU and India combined

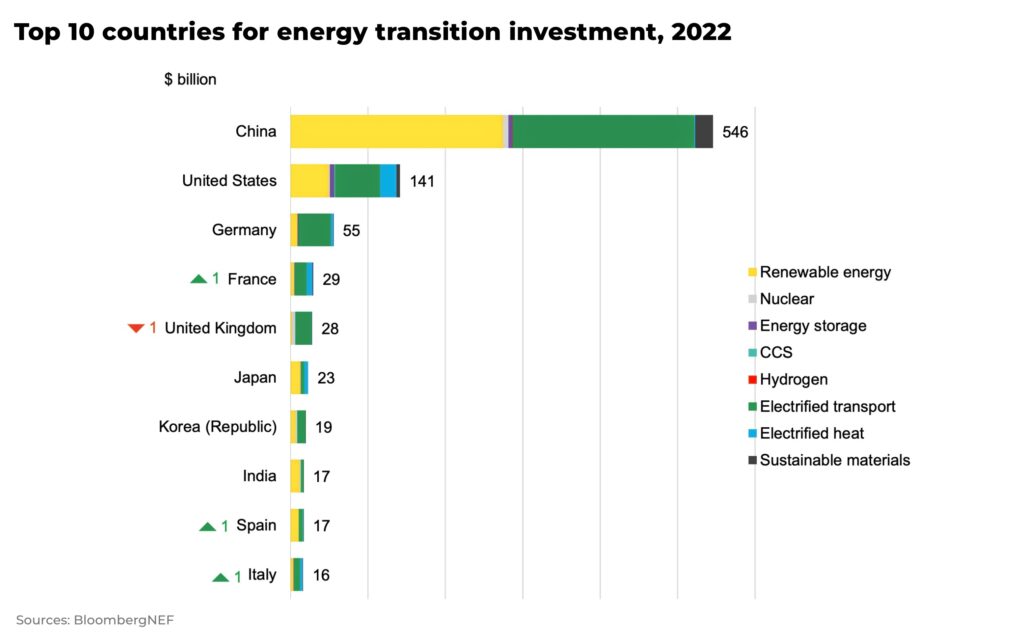

- China investment in energy transition hit US$546 billion in 2022, almost 50% of world’s total

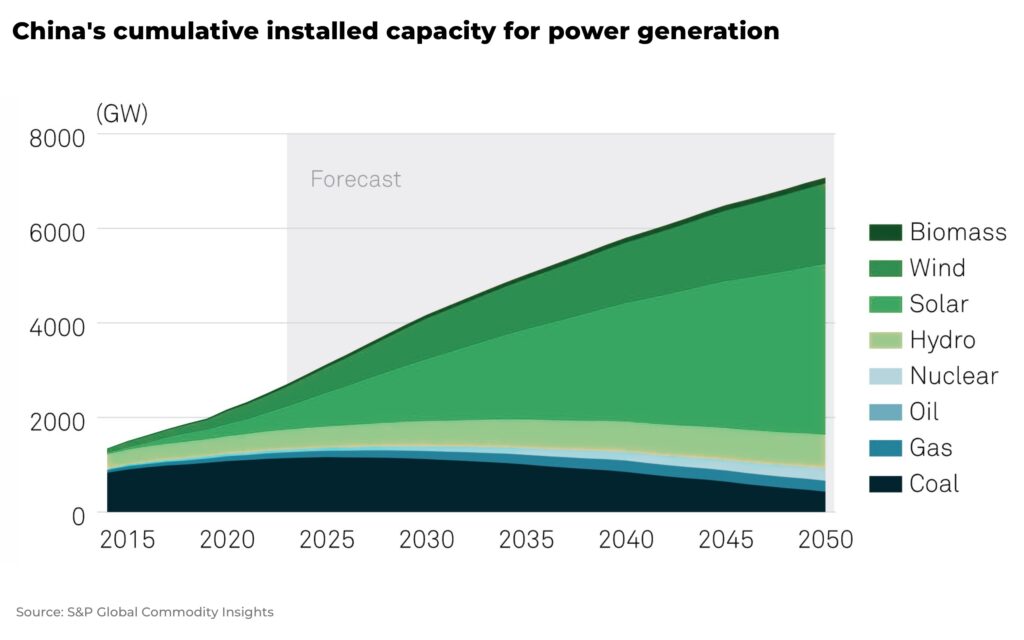

- China outpacing it’s own targets for renewable and electric vehicle adoption

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

US$1.1 trillion was invested globally in the green energy transition in 2022 — but it’s not enough. To meet global net-zero targets, investment needs to triple to US$4.55 trillion every year until 2030.

And it can’t be done without China.

There are four main reasons why China is central to the global energy transition:

- China is the world’s largest carbon emissions polluter

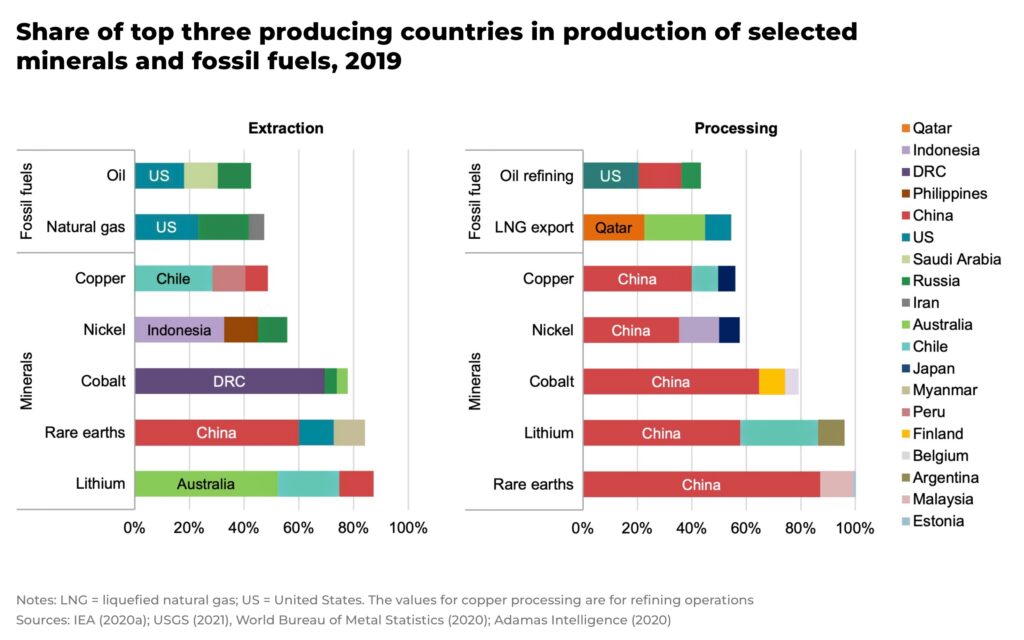

- majority of minerals essential for the energy transition are owned by, mined in and/or processed in, China

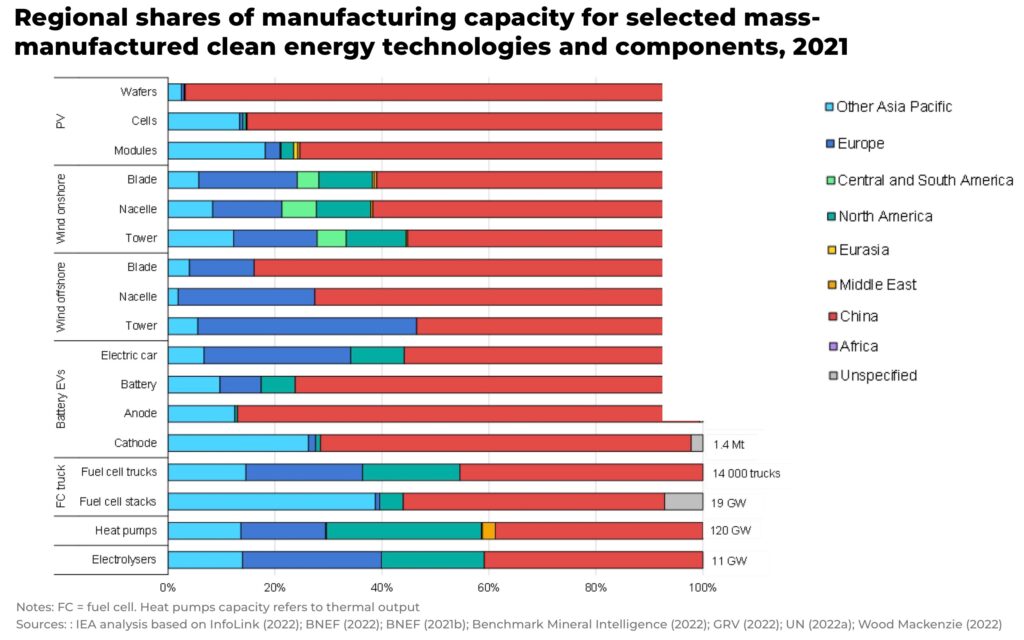

- China’s manufacturing plays a dominant role in the production of solar panels, wind farms, and electric vehicles — particularly in keeping the costs reduced

- the role of China’s economy in stimulating investment in the energy transition

For investors, the impact of China will be critical to how they position themselves in the market.

Carbon emissions

China releases more CO₂ emissions than the US, EU and India combined. Without China reducing its carbon emissions, the world will not realize its global net-zero targets.

These emissions in China are beginning to fall, and not just because of the impact of “Zero Covid” policies on the economy.

Investment in low-carbon power generation in China, according to official statistics, has increased wind and solar power generation 21% in 2022 to 1,190 terawatt-hours of electricity — almost the same as total residential power consumption in China of 1,340 terawatt-hours.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

And in 2022, 5.92 million electric vehicles were sold in the country, an 83% increase from 2021. 30% of all new passenger car sales were rechargeable.

China has set a target for 33% of it’s energy to come from renewable sources by 2025, up from 28.8% in 2020, in it’s latest five-year plan. These targets look set to be outpaced.

Critical Minerals

China holds a strategically dominant position in the extraction and processing of minerals critical for the energy transition.

Approximately 60% of all green metals refining capacity, except copper which is at 40%, is located in China, according to Goldman Sachs.

Chinese investment has facilitated billions of dollars’ worth of mining and processing construction across the world, as Western projects are delayed with investment and permitting challenges.

Just one example is Indonesia where, over the last 10 years, China has invested over US$14 billion into the country’s nickel industry to supply, not just the stainless steel industry, but the electric battery market. Indonesia is now the world’s largest nickel producer.

As we’ve highlighted, the West is now trying to play catch up, in particular trying to leverage the “green” mining and processing, compared to their Chinese counterparts. However, it can still take between 5-15 years to build a new mine in North America.

There are many countries and companies, particularly across South America, Africa and Asia that are seeing significant inflows of Chinese investment for raw materials. A few examples, in Congo for cobalt, Chile for lithium, and Indonesia for copper.

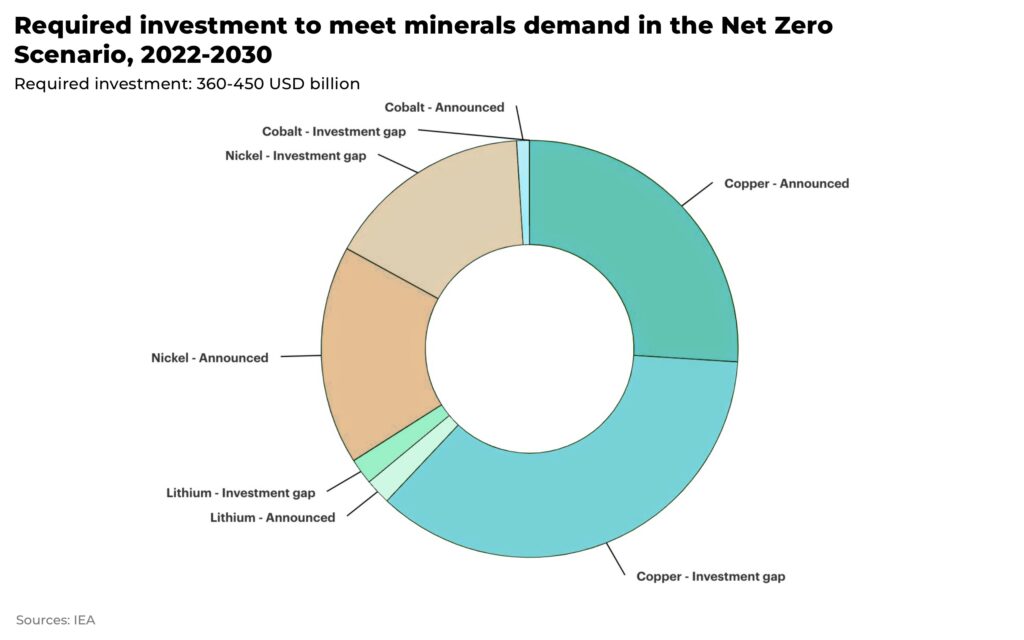

Mining capacity will need to scale significantly to meet this demand and, with long lead times on any new mines, investment of up to US$450 billion is estimated to be needed over the next three years to bridge the shortfall in supply.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

China’s green manufacturing

China’s investment in the energy transition hit US$546 billion in 2022, almost 50% of the world’s total.

According to Goldman Sachs, to give an idea on scale, the total renewable capacity stock of the US is 333 GW, but the annual addition of renewable power capacity in China is forecast to have been 150 GW in 2022.

China accounts for 70% of solar and battery supply chain and 50% of wind turbines.

Even these figures are not enough or fast enough.

Stimulating investment

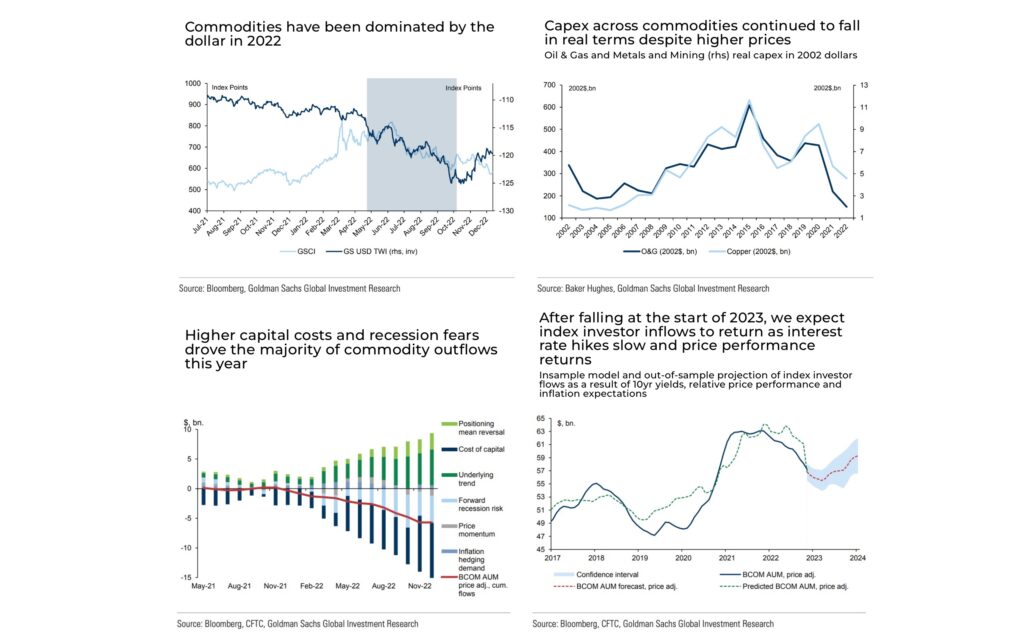

Investment in extraction and production of critical minerals necessary for the energy transition is low (inflation, high dollar, lack of demand)

The huge demand by China’s economy for raw materials can have a significant impact on commodity prices. The stimulus after the global financial crisis in 2008 meant prices rose dramatically, just as “zero-Covid” policies depressed prices.

China is now in the process of reopening its economy after Covid. As we anticipated, it would take longer to rebound than many expected, but economic activity is now beginning to increase significantly (official manufacturing PMI hit 52.6 in February 2023, the highest since April 2012, when it hit 53.5)

Goldman Sachs estimates that China will reach its national targets for renewable energy installation five years in advance. This will accelerate demand for critical minerals — particularly minerals that are processed in the country — such as copper, nickel, cobalt and lithium.

If demand for commodities increases, it will put pressure on prices. Rising prices and returns means more capital will flow into the market.

With many metals’ inventories low, this price rise could happen quickly.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The long-term trends

“The pathway detailed in the Net Zero Emissions by 2050 (NZE) Scenario remains narrow but still achievable”

— IEA, Roadmap to Net Zero Emissions by 2050

The trends are clear: China is investing hundreds of billions to reduce its carbon emissions and strategically control critical extraction and processing supplies of the green energy transition market.

The energy transition is set to accelerate in both the US and EU with recent legislation (the Inflation Reduction Act and Net-Zero Industry Act, respectively), but they simply cannot bring on enough capacity fast enough without China.

With so much financial and political capital invested, it would take a very significant event for China’s renewable policies to change course now.

There are also significant geopolitical headwinds as China, America and EU look to secure their supply chains and control the energy transition marketplace.

For investors and the energy transition, this is not zero-sum competition. Competition between China and the West is encouraging both new opportunities for investment, as well as pressure on critical commodities.

So what does this all mean for investors?

The energy transition is not possible without China. Its role in reducing global carbon emissions, its strategic position in critical minerals processing and investment, and its dominance in renewable manufacturing make it an essential player in the transition to a low-carbon future.

Investors who understand this and position themselves accordingly will be well-positioned to benefit from this fast-moving opportunity.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.