Key Takeaways

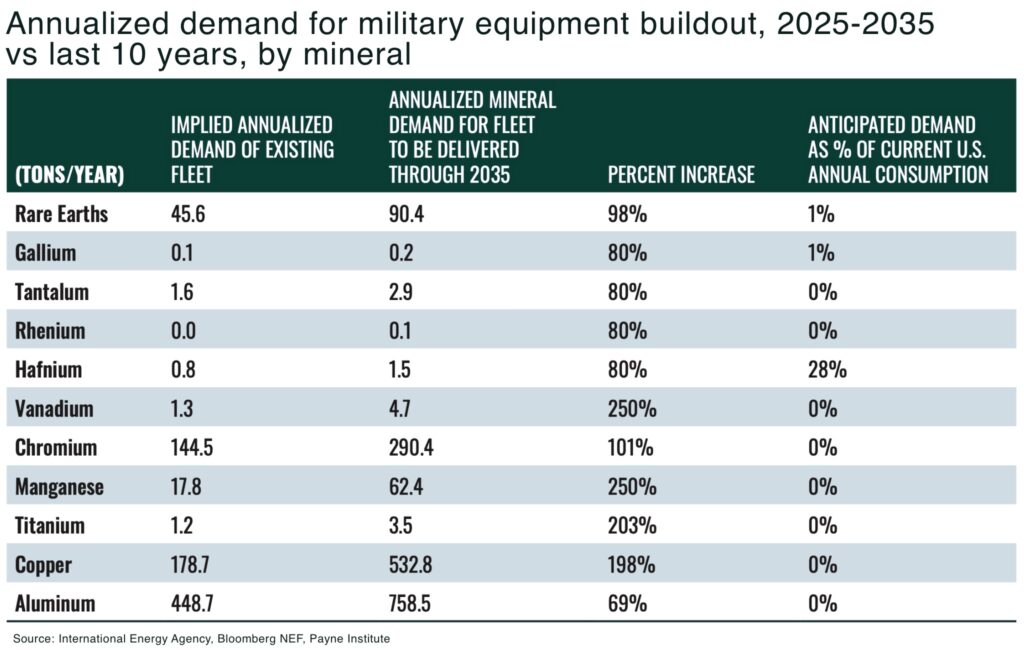

- global defense spending jumped 9.4% in 2024, pushing potential demand for vanadium, manganese, titanium, and copper up to 250% higher by 2035

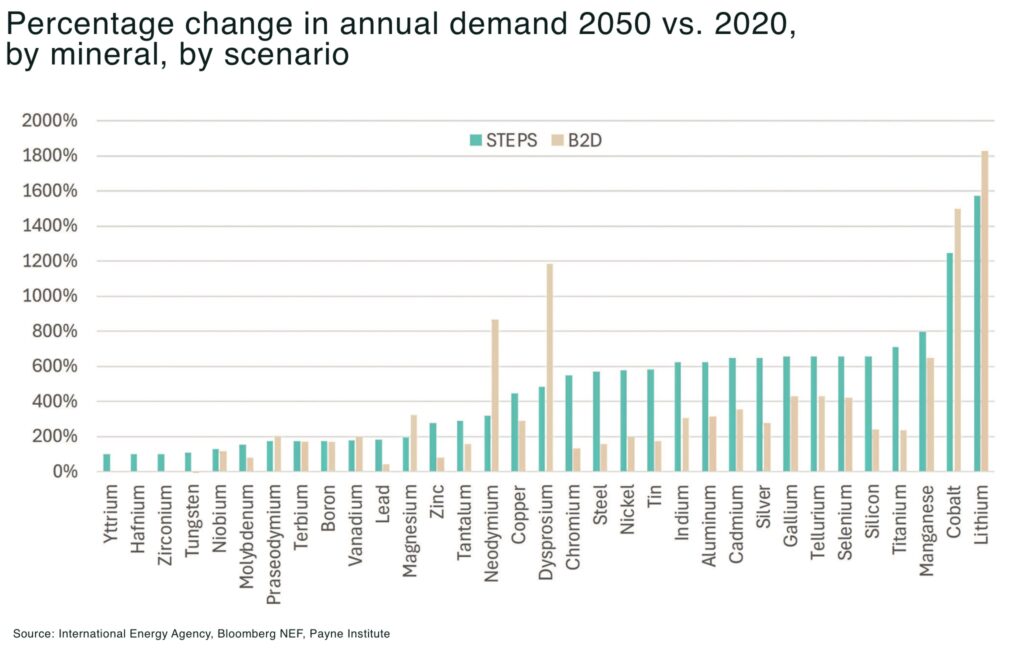

- energy transition and AI data centers could raise demand for 16 critical minerals by 400% or more by 2050

- the US exported 530,000 tonnes of copper scrap in 2023, one-third of its demand, 40% to China. Recycling could cut import reliance to 14%

- recovering just 10% of byproducts from US mine

The estimated demand growth for ten key critical minerals for defense through 2035 is between 80%-250%, rising on average 135% over the next decade from defense, and more than 400% by 2050 for 16 critical minerals needed for power generation and battery storage, according to the latest State of Critical Minerals Report 2025 by Payne Institute.

Yet, the US still exports a third of its copper demand as scrap and discards byproducts that could replace imports of 27 minerals. Recycling and recovery will be as crucial as new mines in meeting the supply gap.

Energy transition meets mineral bottlenecks

“No minerals, no megawatts” is more than a slogan. Modeling from the Colorado School of Mines shows shortages in 13 minerals, including lithium, cobalt, and rare earths, could shift US power generation by 25% or more by 2035. In practice, lost solar and wind capacity would be replaced by gas and coal.

Meanwhile, the International Energy Agency projects demand for minerals tied to renewable power and batteries to grow more than 400% by 2050. AI adds further strain, with data centers intensifying copper and rare earth demand.

Energy vs Minerals

- 13 minerals critical to US power buildout

- 25%+ swing in generation mix if supply shocks hit

- Solar could fall 10% on higher mineral prices

Defense Demand Surges 🚀

Wars in Europe and the Middle East pushed global defense spending to $2.4 trillion in 2024. That translates directly into mineral demand.

The Payne Institute estimates a 250% jump in vanadium and manganese demand, 200% for titanium and copper, and 80–100% for gallium, tantalum, and rhenium by 2035 . Hafnium is the outlier: jet engine needs could consume nearly 30% of U.S. supply.

These volumes are small relative to commercial markets, but defense buyers require purity and secure sourcing—often at premium cost. That creates opportunities for domestic producers of byproduct minerals like gallium, where modest U.S. support—$15 million annually—could secure supply .

Scrap and Byproducts: Untapped Supply ♻️

While attention often focuses on opening new mines, overlooked opportunities lie in waste. In 2023, the U.S. exported one-third of its copper demand as scrap, mostly to China. If processed domestically, imports could fall from 45% to just 14% .

Byproduct recovery offers an even bigger prize. Research shows that capturing less than 10% of critical minerals currently discarded in U.S. mining could eliminate imports of 27 of the 50 minerals on the USGS critical list . Tailings, mine waste, and acid drainage represent additional potential sources.

Box-Out: Supply Opportunity

- 27 minerals could be domestically sourced via byproduct recovery.

- $150m capex at Nyrstar’s Tennessee smelter could unlock U.S. gallium supply.

- Copper scrap recycling alone could slash imports by two-thirds.

China’s Dominance Remains the Strategic Risk 🇨🇳

Despite U.S. efforts, China controls most refining capacity for critical minerals. It has tightened export controls on gallium, germanium, rare earth magnets, tungsten, and others since 2023. Its vertical integration—access to ore, refining, and downstream demand—makes it difficult for competitors to displace.

The U.S. and EU are responding with tariffs, subsidies, and new trading platforms. Washington’s Section 232 tariffs on copper highlight how fast markets react: CME copper prices jumped 30% over LME when a 50% tariff was floated in mid-2025 .

Why It Matters 🌍

The drivers of mineral demand—clean energy, defense rearmament, and AI—are accelerating simultaneously. Supply remains fragile, dominated by China, and investment in Western mining is hampered by low prices and slow permitting.

For investors, the opportunity lies in domestic recyclers, byproduct processors, and diversified miners aligned with government incentives. For policymakers, the priority is resilience: build refining, enforce traceability, and invest in recovery from waste.

The numbers are stark. Defense and AI demand could push critical mineral consumption up by 135% in a decade, while energy transition needs quadruple by 2050. Without action, supply shortages will reshape markets, geopolitics, and the pace of the energy transition itself.