Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

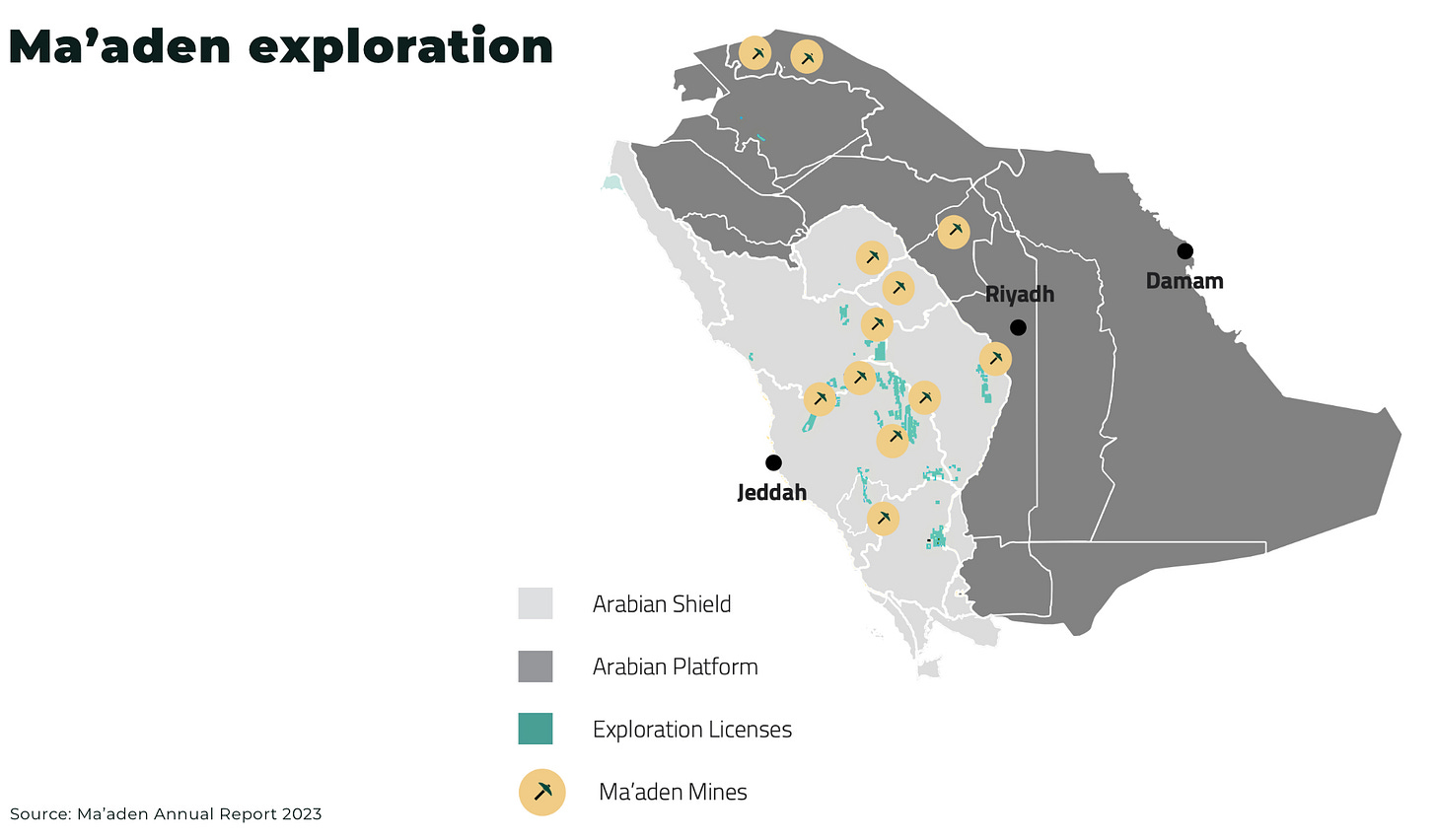

Saudi Arabia, already the world’s largest oil exporter, is making an ambitious pivot to become a global mining player, by tapping into the country’s estimated US$2.5 trillion in unexplored mineral resources.

And, the plan — named Vision 2030 — is not holding back on the investment needed for such a strategy:

- increase Saudi Arabia’s mining industry’s GDP contribution from US$17 billion in 2024, to US$75 billion in 2035

- Ma’aden, the Saudi-state mining company, anticipates substantial growth with US$56 billion in CapEx until 2040, totalling US$69 billion if sustainability and ESG are included.

- allocated US$182 million to a exploration incentive program, already granting an additional 33 mining licenses — the “largest of its kind anywhere in the world”, according to Bob Wilt, Ma’aden CEO

In January 2025, Saudi Vice Minister of Mining Affairs, Khalid al-Mudaifer, announced a US$100 billion investment opportunity in new mineral investment projects, with US$20 billion already in the final engineering phase or under construction.

In February 2025, Ma’aden raised US$1.25 billion from its debut Islamic bond sale as the company looks to fund a huge expansion program over the next five years.

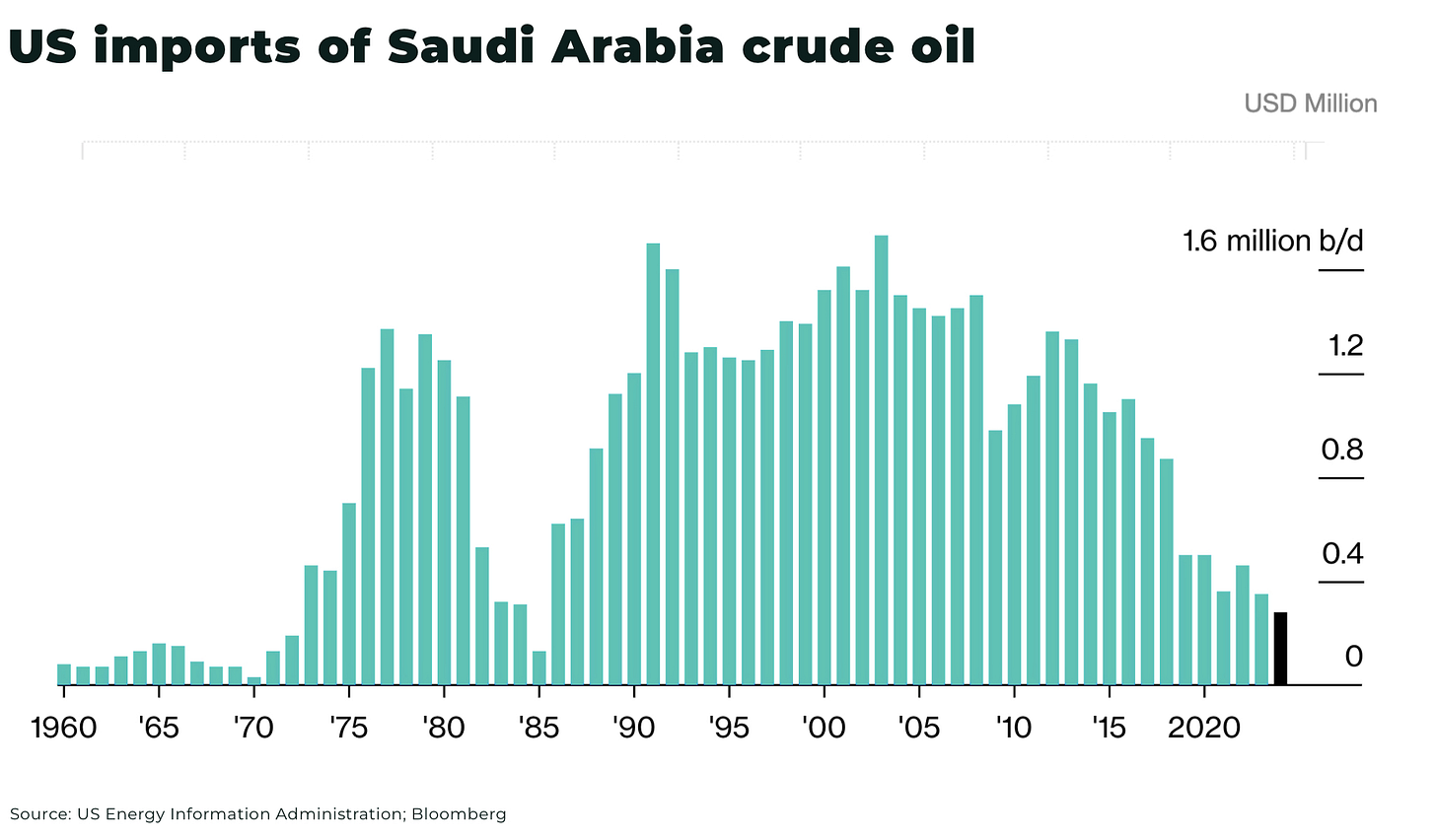

The reasons for the new mining developments include new revenue streams and economic diversification, particularly from oil dependence which faces significant headwinds with high oil production in US and Canada, as well as electric vehicle sales.

Key minerals and metals under consideration include:

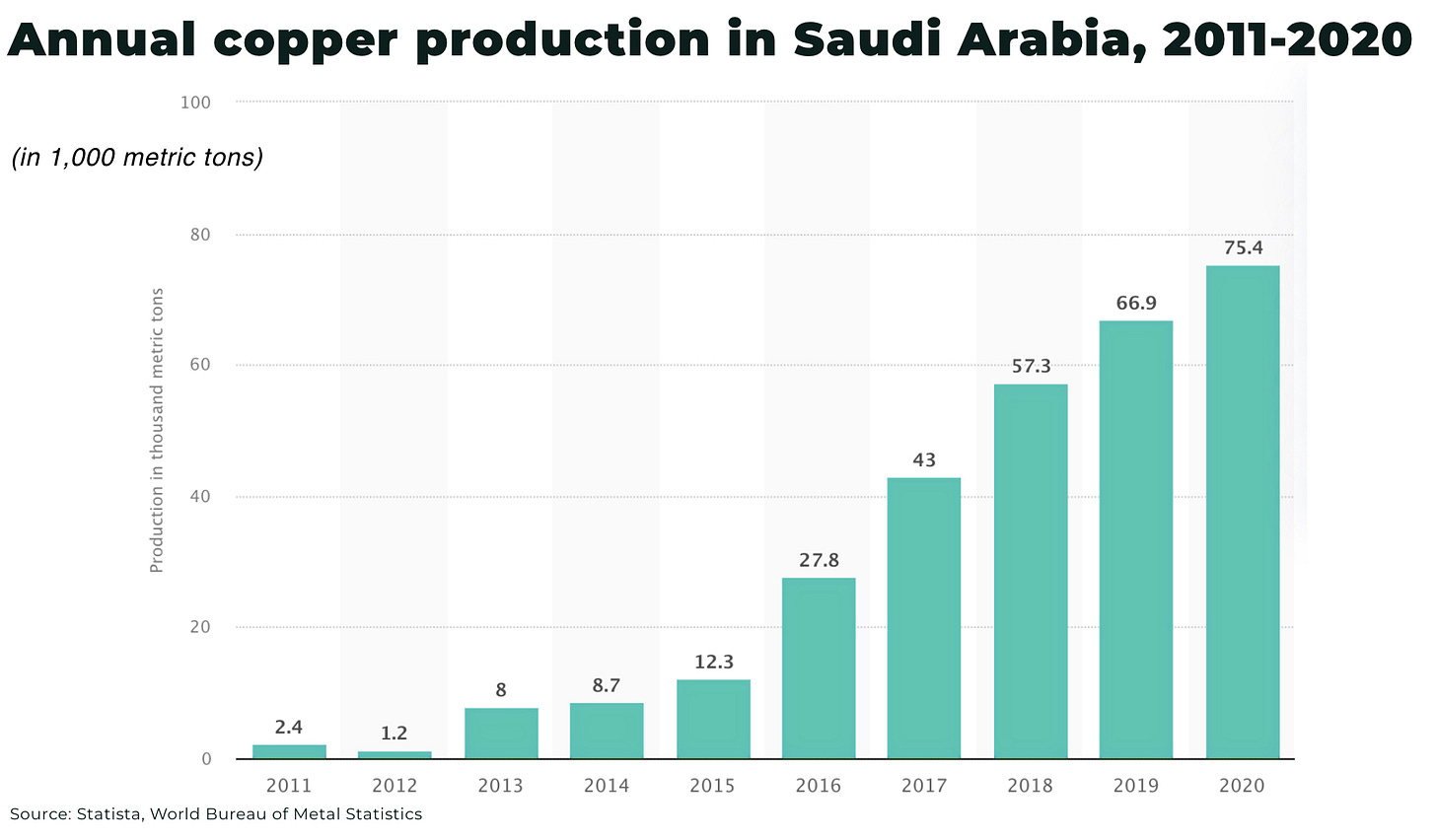

- Copper: significant deposits of copper are already being mined, with a estimated value at US$136 billion, and plans to expand output

- Lithium: Saudi Arabia’s state-owned oil giant, Aramco, has found significant concentrations of lithium in its oil and gas fields, aiming to produce commercial quantities by 2027

- Rare Earth Elements (REEs): the Saudi’s increase in the valuation of mineral resources from US$1.3 trillion to US$2.5 trillion is partly attributed to new discoveries of rare earth elements, valued at US$63 billion, which the country has significant reserves of REEs and plans to develop these to meet growing global demand

- Cobalt: The country seeks to secure cobalt supplies through investments in mining projects and the development of domestic refining capacity

- Nickel: Saudi Arabia is exploring opportunities to develop its nickel resources to become a major supplier

- Zinc: the Khnaiguiyah site, with an estimated value of US$86 billion, is expected to produce 100,000 tons a year of zinc

- Lead: there are plans to explore new deposits

- Niobium: valued at US$84 billion

- Gold: Saudi Arabia is already an established as a gold producer, with the volume of gold reserves in Mansourah and Massarah estimated to be seven million ounces, with an annual production capacity of 250,000oz. The government aims to significantly expand its gold output

- Silver: bids have been invited for new exploration licenses for silver ores across the Kingdom

- Uranium: Saudi energy minister, Prince Abdulaziz bin Salman, announced plans to enrich and sell uranium — “We will do a “yellowcake”.”

- Phosphate: Saudi Arabia is already a significant phosphate producer, with a current gross value of US$1,245 billion, and intends to expand this sector substantially. The Phosphate 3 project will boost phosphate production by 50%.

- other minerals include: bauxite (valued at US$21 billion), magnesium, manganese, and iron ore and limestone deposits collectively valued at US$345 billion

“Copper is the biggest in scope metal at the moment, the one that stands out”

— Khalid bin Saleh Al Mudaifer, Vice Minister of Industry and Mineral Resources for Mining Affairs, at PDAC 2025

The figures above represent estimates of the in-situ value of these resources. However, Saudi Arabia’s strategy involves not only mining these reserves, but also developing downstream processing and manufacturing industries. This includes the production of batteries, electric vehicle components, and other high-value products as the country positions itself as a hub for major markets from the US to EU, India to China, Africa to Japan.

For example,

- in 2023, Saudi Arabia bought a 10% stake in Vale’s base metals unit for US$2.5 billion

- in 2024, Glenore announced it was part of a project to build Saudi Arabia’s first copper smelter, with a planned capacity of 400,000 tpy of copper cathode production

- Saudi Arabia has announced plans to develop the world’s largest grid-scale battery energy storage project (to 15.1 GWh) with China’s BYD Energy Storage

- Saudi Arabia plans to develop its steel industry with projects implemented jointly with Turkish and Chinese companies, for example, a new US$5 billion steel plant in Saudi Arabia by Türkiye’s Tosyali

- Vedanta Copper, a subsidiary of India’s Vedanta Limited, will invest US$2 billion in copper-processing facilities in Saudi Arabia

By market cap, Ma’aden may be ranked among the top ten global mining companies, but there are significant challenges to what is essentially setting up a modern, large-scale mining industry from scratch.

Specialized infrastructure will be required to support large-scale mining operations, particularly in the remote desert regions.

Saudi Arabia will need to compete globally for talent, as well as develop a domestic, experienced workforce.

And, water scarcity in the desert is a significant issue for any potential mining and processing projects. Depending on the project, between 400 to 2 million liters of water are estimated to be needed per kilo of lithium.

Arguably, most importantly, the biggest obstacle to developing a meaningful mining and processing industry is oil.

Saudi Arabia’s petroleum sector accounts for approximately: 87% of budget revenues, 42% of GDP and 90% of export earnings.

Known as the “resource curse” or “Dutch disease,” when one industry so dominates a country’s economy, it can prove very difficult to pivot. The reason is that this overwhelming dependence creates structural barriers to diversification, including capital allocation priorities, infrastructure and workforce skills.

However, of all the pivots Saudi Arabia can attempt, an expansion into mining — which shares so many of the same traits as the oil industry, in particular, a natural resource export model — is arguably the most viable.

The joint venture between the kingdom’s state oil giant, Aramco, with Ma’aden, as well as establishing Manara, a venture between Ma’aden and the kingdom’s sovereign wealth fund — gives the kingdom’s ambitions a significant head-start.

“We don’t claim to have all the resources or abilities, so we’ve created Manara to make sure we can reach out for the resources that we need… We have to be doing it as fast and furious as possible.”

— Saudi Energy Minister Abdulaziz bin Salman

And international agreements and investments are already being made with, for example, a critical mineral partnership with the UK, a stake in a Pakistan copper and gold mining project, discussions with Congo and Egypt, etc

Conclusion

Saudi Arabia is unlikely to replicate its oil dominance in the metals and mining sector — especially in rivaling the role of Australia, Canada or Indonesia anytime soon. Yet, with oil-funded capital, a strategic geopolitical position, and substantial mineral reserves means Saudi Arabia has the potential to become a pivotal player.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.