- copper demand forecast to double by 2035

- many of world’s copper mines have “peaked”, with declining production and ore grades

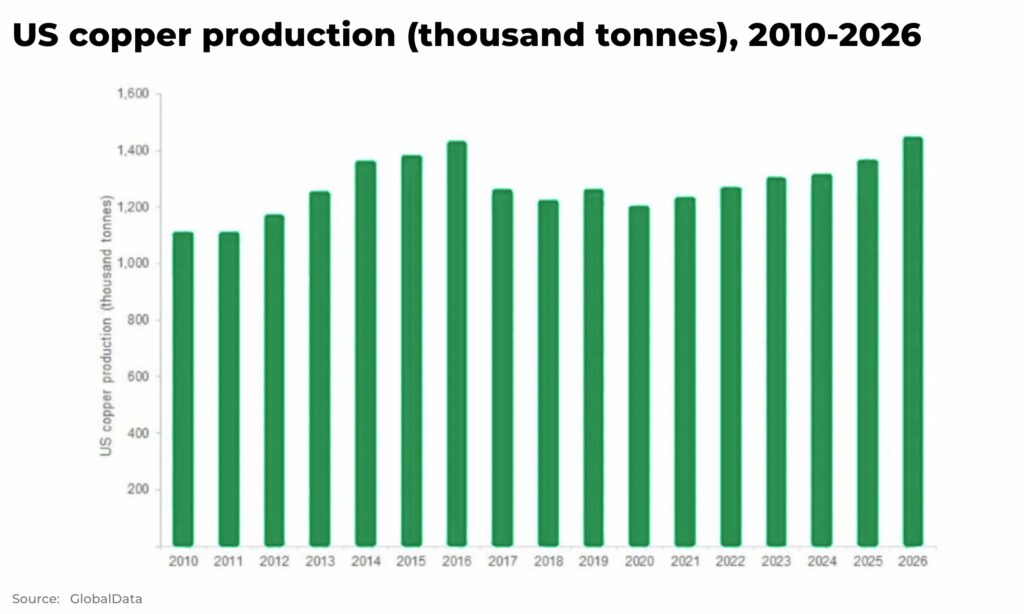

- US copper producers well-positioned to take advantage of opportunity

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

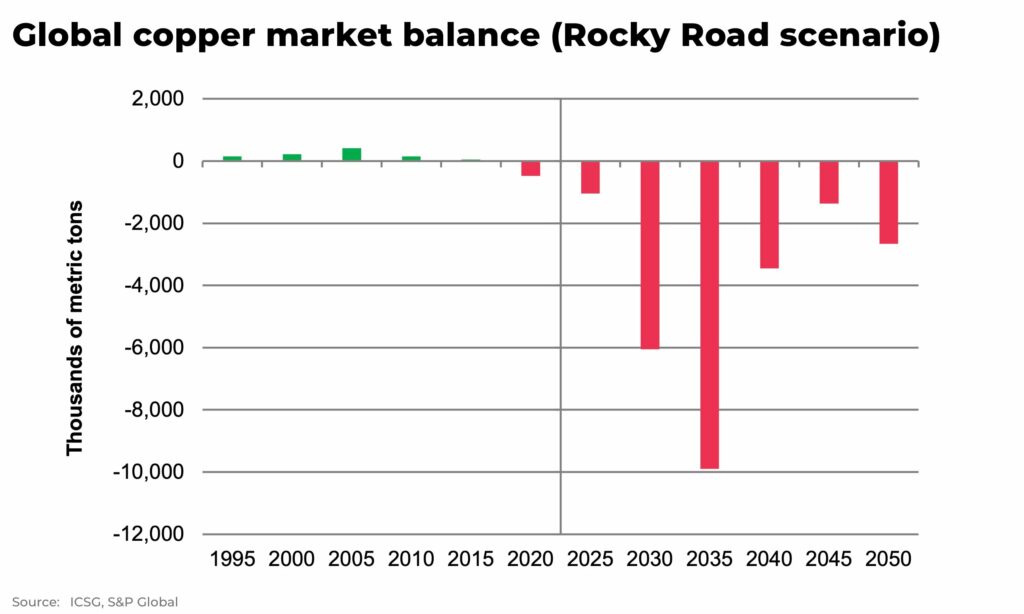

The energy transition will need more copper than all the world has consumed from 1900-2021. Copper demand is forecast to double from 25 million metric tons in 2022 to 50 million metric tons by 2035.

The problem (and opportunity for investors): supply is struggling to keep up.

Protests in South America and China’s economy reopening, may mean supply may slow and demand rise faster than expected (read our analysis on what the end of zero-Covid in China means for commodities).

Copper and the Energy Transition

Copper is critical to the energy transition due to its electrical and thermal conductivity properties.

Copper demand for solar cells could triple by 2040, copper demand for wind power could more than double, and copper demand for electric vehicles (EVs) is anticipated to increase from 185,000 tonnes in 2017 to 1.74 million tonnes by 2027, that is a 9.4x increase. Not to mention the vast EV charging infrastructure and upgrades to national grids needed.

“This market is going to tighten under any scenario, and that’s going to be reflected in pricing. Is that going to be enough to stimulate a supply-side response? That is the open question”

— John Mothersole, Director of Research, Pricing and Purchasing, S&P Global Market Intelligence

Mining is back, can it come back to the US?

In 1966, the US was both the largest producer of newly mined copper and the largest consumer. Combined with US companies’ control (before nationalization) of copper mines in South America, the US controlled 45% of the world’s production.

Today, the US is the world’s fifth largest copper producer:

- Chile, 27%

- Peru, 10%

- China, 8%

- DRC, 6%

- US, 5%

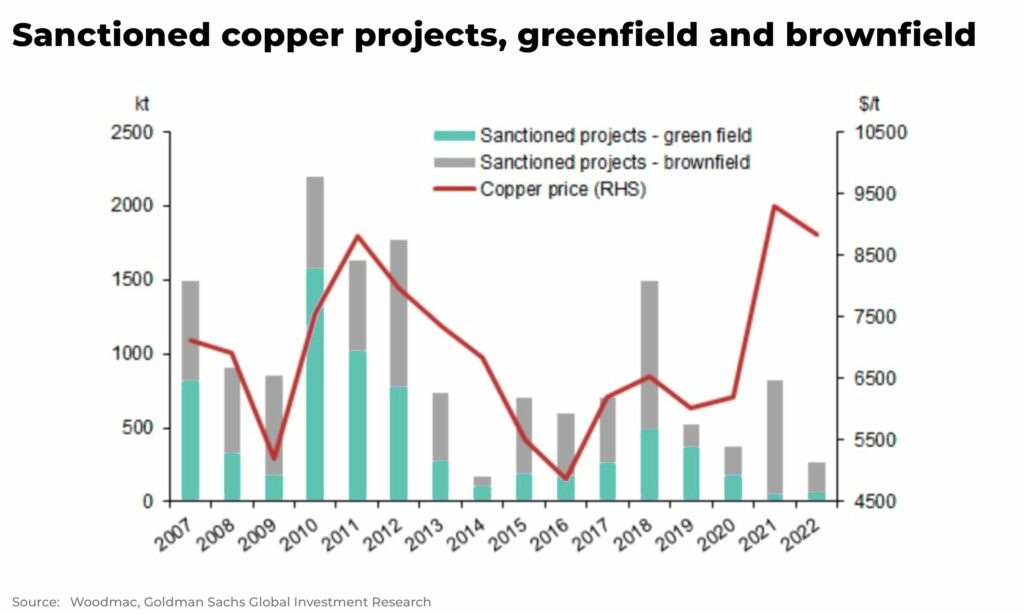

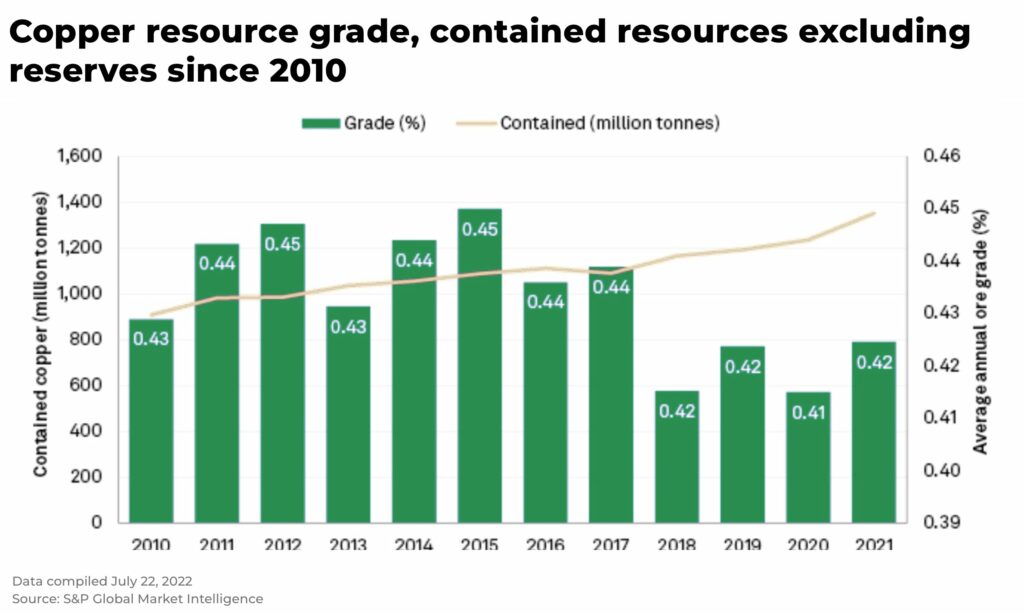

However, production at some of the world’s major copper mines may be about to, or have already, peaked, with ore quality and reserves declining. For example, according to reports, the world’s largest copper mine in Chile, Escondida, will grow at a slower rate this decade than previously hoped.

And copper mine approvals are falling as well, further tightening future supply:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The US has set out ambitious clean energy targets — to cut greenhouse gas emissions by 50% from 2005 levels by 2030 — and to do it with technologies, workers and minerals.

This would secure both jobs and supply chains.

To do this, the Biden administration invoked the Defense Production Act last year to increase domestic production of critical minerals and metals. The Inflation Reduction Act, passed in 2022, is one of the most important pieces of legislation in recent US history to encourage investment in the renewable energy market, as well as tax breaks for companies investing in the mining of critical metals and consumers purchasing electric vehicles. And, again, in October, Biden announced US$2.8 billion in grants to boost production of electric vehicles and the minerals used to build them.

This is not all just about copper, but the direction of travel is clear. US officials — including three senators — have also begun to call for copper to be added to the US critical metals list.

And US copper producers — with the sixth largest copper reserves in the world — are well positioned to take advantage of the opportunity.

After significant turbulence in the US copper industry in the 1970s-80s (when many copper companies were bought by oil companies, and then sold again as international competition increased). The surviving US companies began to restructure and invest in new technological efficiencies that allowed them to compete globally.

The increase in US copper output has been driven by the country’s two largest copper producers, Freeport-McMoRan Inc and Rio Tinto, who accounted for 66.8% of the total production in 2021 with 821.6kt of copper, up from 783.2kt in the previous year.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

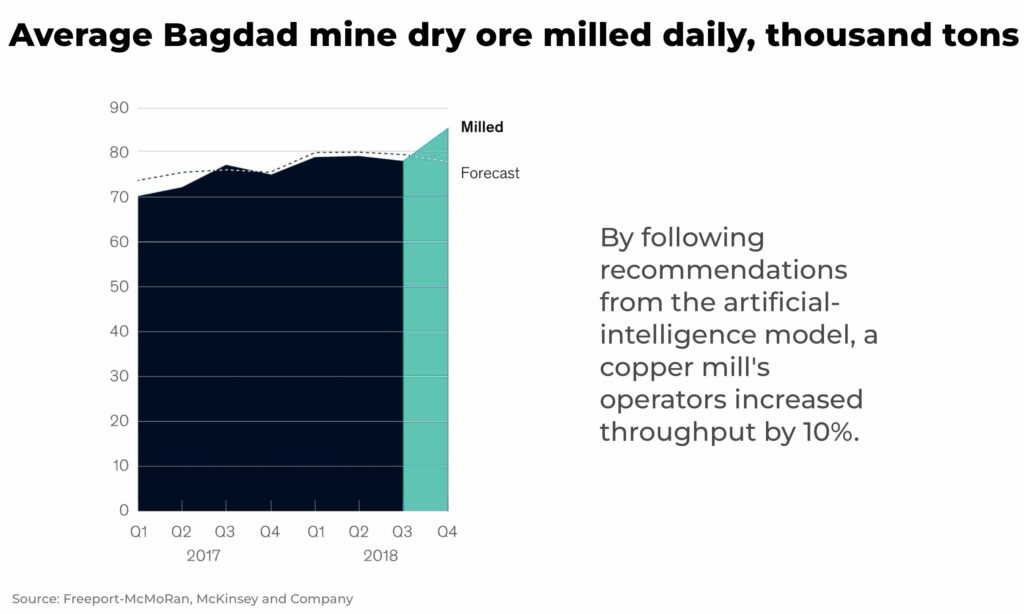

For example, a partnership on Artificial Intelligence between Freeport-McMoRan and McKinsey improved the copper output from one mill by 10%, while its copper-recovery rate rose by one percentage point and its operations became more stable.

The environmental challenge

The US has some of the strictest environmental standards in the world. This means that any new mining capacity must meet significantly higher standards than their counterparts in most other places in the world

This is both a challenge and advantage.

Permitting new mines in the US can take between 7-10 years, sometimes longer, adding both time and costs. In contrast, permitting can take just two years in Canada or Australia.

Perhaps the most high-profile example is the Resolution project in Arizona. The mine has the potential to become the largest copper mine in North America and supply 25% of US copper demand. Over US$2 billion has already been invested, but progress has stalled after approval was withdrawn over environmental concerns and local community protests.

Officials in the US have already begun to call for reduced permitting times for domestic mining projects.

But, as recent copper mine shutdowns in South America have shown, environmental and community concerns are not just a challenge in the US.

And, as we argued in our report on the supply of nickel, once these mines do become operational, their high environmental standards will allow them to sell their production for a premium to renewable and electric vehicle companies desperate for “clean” metals.

Brownfield versus Greenfield

And US producers are not waiting around for permits.

Many brownfield sites are working to expand and improve already existing operations with new technology. With mine expansion, ore grades gradually decline but, in turn, reserves are increasing.

How to get exposure

For investors interested in getting exposure to the forecast copper boom in the American market, there are a variety of ways.

Exchange-Traded Funds (ETFs) provide direct exposure to the market, such as COPX which provides investors access to a broad range of copper mining companies. Each ETF will offer its own strategy and exposure to the price of copper (eg from companies that earn revenue directly from copper).

Downstream investments include companies that process the copper, including smelters, electric vehicle manufacturers and even the expansion of America’s copper recycling capacity.

And, of course, investing in copper mining stocks directly. There are plenty of options, but we’ve provided three options that cover the range from macro to micro.

Freeport-McMoRan Inc (NYSE:FCX); Freeport is a leading global copper producer, operating seven open-pit copper mines in North America, with significant undeveloped reserves and resources, including a portfolio of potential long-term development projects.

Arizona Sonoran (TSE:ASCU); a copper mining company with a 100% ownership of the Cactus Mine, located in the Arizona Copper Belt. The Cactus Project is a scalable, low capital intensity project, with an 18 year mine life and generates over ~$1B free cash flow over life of mine (US$3.35/lb Cu price). In particular, Arizona Sonoran was recently awarded for its environmental excellence in reclaiming and revitalizing the Cactus Mine, by the Arizona Department of Environmental Quality.

US Copper Corp (TSX.V:USCU; OTCQB:USCUF); a preliminary economic assessment of US Copper’s Moonlight-Superior Copper Project in California indicated a resource of 252 million tons at 0.25% copper and an inferred resource of 109 million tons at 0.24% copper. They are now working on an expansion drill program to include two more deposits of up to 73 million tonnes of .41 copper.

Stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.