Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

G7 leaders have agreed a new, draft strategy to secure global supply chains for critical minerals in response to China’s growing use of export restrictions, according to a draft communique seen by Reuters and Bloomberg.

Importantly, the draft suggests the mineral market should reflect the real costs of responsible extraction, processing, and trade of critical minerals.

“We have shared national and economic security interests, which depend on access to resilient critical minerals supply chains governed by market principles… Non-market policies and practices in the critical minerals sector threaten our ability to acquire many critical minerals, including the rare earth elements needed for magnets, that are vital for industrial production”

— according to the draft seen by Bloomberg, which is still subject to changes before its adoption by leaders

The document has not yet been approved by US President Trump.

The move comes after China enforced export restrictions on a range of critical minerals in response — from rare earths to antimony, gallium to tungsten — to US tariffs and sanctions.

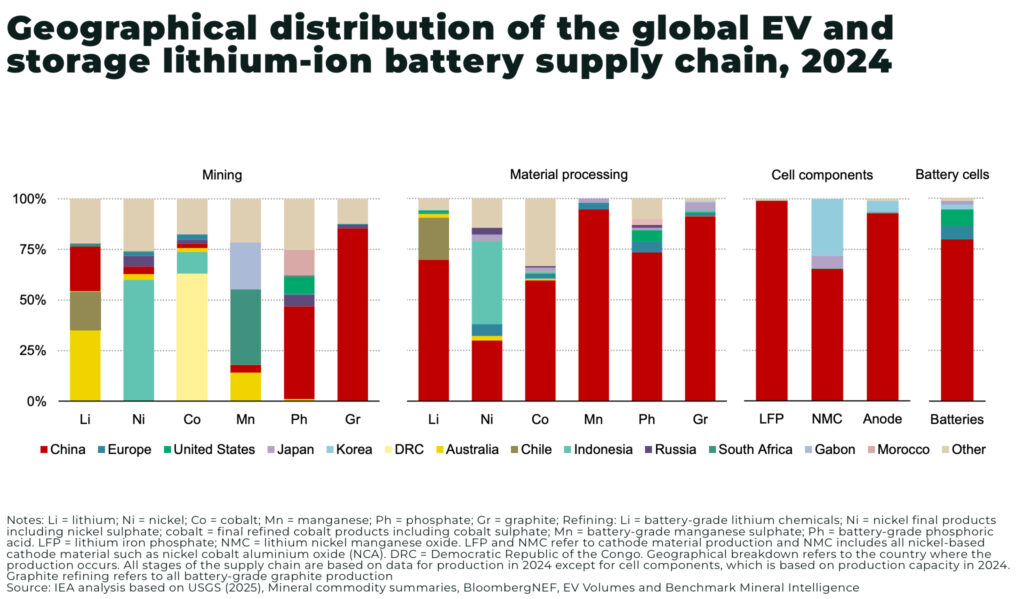

China dominates much of the world’s critical mineral mining and processing, with the IEA warning this dominance may increase, for example:

“In 2035, China is set to supply over 60% of refined lithium and cobalt, and around 80% of battery-grade graphite and rare earth elements. By 2030, China is set to supply 70% of battery-grade manganese sulphate and 75% of purified phosphoric acid”

The West wants to secure critical mineral supply chains — not with massive state subsidies, significant to China — but with market forces. The challenge: the geographical concentration of critical mineral mining and refining continues to increase, and is expected to increase further by 2030.

One of the solutions suggested is bifurcation, a premium on critical minerals produced in the West with expensive environmental regulation. But, will consumers pay an environmental premium?

Or, in other words, can you turn critical minerals into free range eggs?