- Chevron earned US$6.3 billion in Q1 2022, four times Q1 2021; ExxonMobil earned 3x higher than Q1 2021

- reserve life in the oil industry reduced from 50 years in 2014 to 25 years today

- 14% of oil industry budget allocated to renewables in 2021, vs 4% in 2019

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

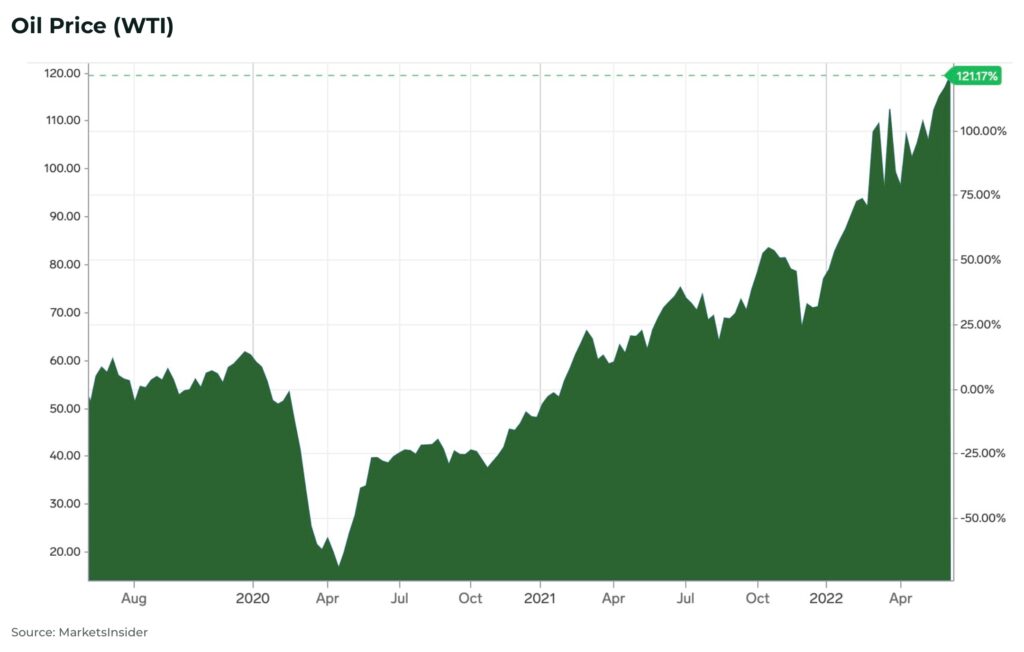

The world’s most valuable company is no longer Apple, but the oil giant Saudi Aramco. Tech stocks are down and the price of oil is up, well over US$100/barrel.

Chevron earned US$6.3 billion in the first quarter of 2022, four times what it made in the same period last year. ExxonMobil earned US$5.5 billion, nearly three times higher than in 2021. Energy intelligence group Rystad Energy expects profits to soar by 70% this year to $834 billion.

The price of Brent crude spiked over US$130/barrel when Russia invaded Ukraine in February, but it was already rising steadily throughout 2021 from lows of $30/barrel in early 2020.

There are bigger problems than the war in Ukraine that will keep the oil price high and may well drive it much higher. The International Energy Agency is calling it the “biggest oil supply shock in decades.”

What’s driving this rise?

Obviously, there was fear of a Russian invasion in Ukraine — US intelligence agencies had been warning about it for months. Russia is not only the world’s third largest oil producer behind the United States and Saudi Arabia, but also the world’s largest exporter of oil to global markets. The repercussions are still being felt as the war drags on with the EU agreeing to ban 90% of Russian oil imports by the end of the year.

Then there’s Covid. Perhaps one of the best signals that the pandemic is over is that Netflix is down and petrol prices are up. People are going back outside again, consumers are driving (demand for gasoline rose to 8.9 million bpd in May, the highest since December, according to the EIA) and spending their money on goods. China is also now beginning to ease its covid restrictions in the economic hub of Shanghai and other industrial regions. Demand is bouncing back from historical lows during the depths of the global lockdowns.

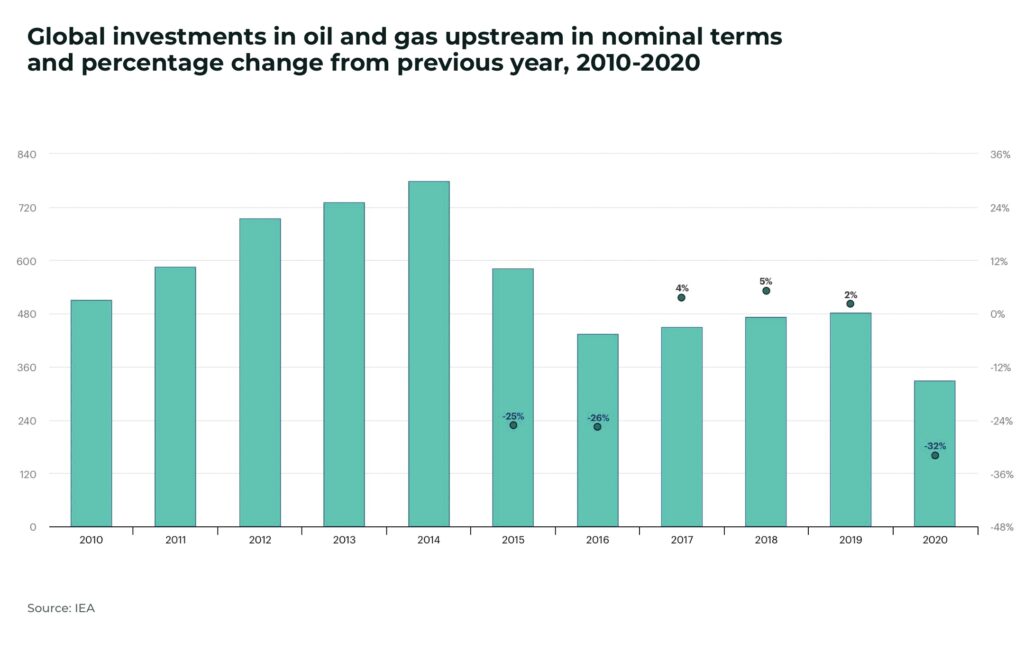

Problems with supply mean this new price range could be here for the long-term as — wait for it, here’s comes the oil pipeline analogy — there are no major exploration and production projects coming down the funnel, due to a significant lack of global investment over the last decade.

“We have exhausted all of the spare capacity in the system, and now we are no longer able to cope with supply disruptions like the one we are currently witnessing because of the Russia-Ukraine conflict”

Michele Della Vigna, head of Goldman Sachs’ natural resources research in EMEA

Goldman Sachs estimates the oil industry has lost the equivalent of Saudi Arabia’s daily output, 10 million barrels per day, because of delays in investments in new projects. This has halved the reserve life in the oil industry from 50 years in 2014 to 25 years today.

One of the main driving forces for this underinvestment is climate change. As governments, finance and business are under pressure to meet their net-zero targets, investors are reluctant to underwrite the scale of the projects needed. This tightening in investment was made all the more acute by the coronavirus pandemic which pulled oil prices down to US$30/barrel.

But renewables simply don’t yet have the capacity to make up the shortfall. And nothing else seems to be having much effect either.

The US and its partners in the International Energy Agency will release 240 million barrels from emergency oil reserves over a six-month period, including the largest-ever release of oil from the US Strategic Petroleum Reserve.

Discussions are ongoing about softening oil sanctions to Europe from Venezuela, which holds the world’s largest petroleum reserves, but its oil industry is in such a state of disrepair after years of neglect and corruption that, even if all sanctions were removed today, it could take years to significantly increase exports.

And, with a stalled agreement over the nuclear deal with Iran, which holds the fourth largest oil reserves in the world, there is little immediate future for oil sanctions to be lifted.

After direct calls from President Biden and other leaders to raise production, OPEC+ have agreed to increase output to 648,000 barrels per day, from 432,000, for July to August — 50% more than previously planned. But the rise has so far had a negligible impact on global prices.

These high oil prices are hitting consumers at the petrol pump which means, with rising energy and food prices, supply chain concerns, and inflation rising at fastest rate for forty years, there is a serious risk of severe economic slowdown. A recession would dampen demand for oil in the short-term, but doesn’t solve the supply issue which will take years of project investment and development.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

So, there will be volatility in the price of oil as production fluctuates, an economic slowdown hits Western economies, as well as the possibility of further covid lockdowns in China. But if the price has stayed steady over US$100/barrel with all of the above factored in, then what will the price of oil look like as economies start opening up again and supply struggles to meet demand?

“We have only one hope that we don’t have big trouble in the oil markets in summer, which is hoping … that the Chinese demand remains very weak” — Faith Birol, executive director of the International Energy Agency, at Davos this month.

Shortly after the above statement, China began to relax its covid restrictions and the price of oil rose above US$120/barrel.

For investors in oil this is good news.

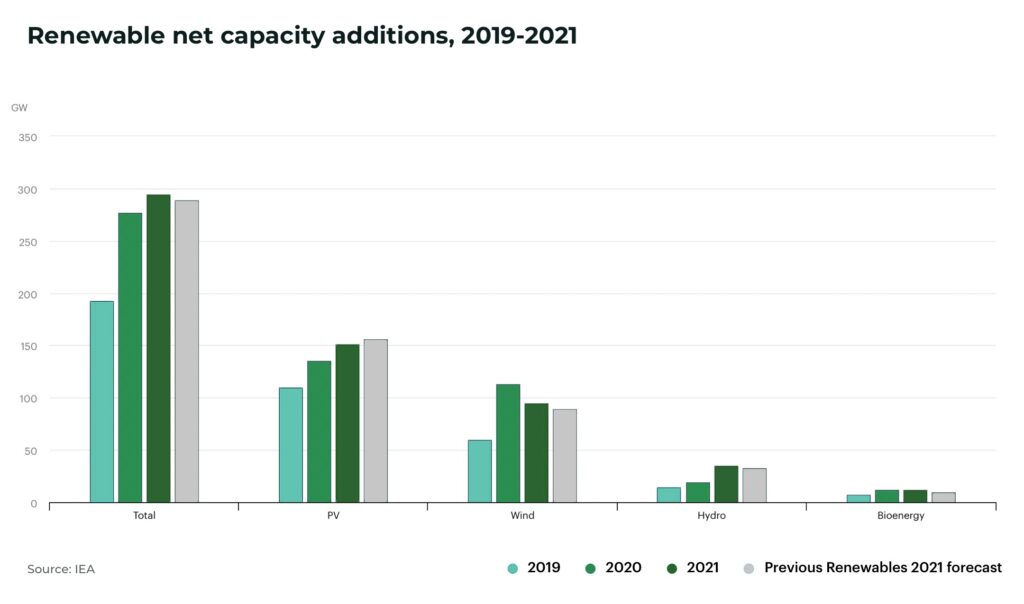

And, for investors in the climate transition there is also good news as global economies desperate to ease the cost of energy and their dependence on the geopolitical instability of oil, continue to push renewables.

President Biden is invoking the Defence Production Act to accelerate domestic production of clean energy technologies, including solar panels, just as the US grid announced it hit a record of more than 200 gigawatts of renewable energy capacity last year.

The IEA is expecting renewable power to break global records in 2022 despite higher costs and supply chain bottlenecks. In particular, this growth will be driven by strong support in Europe, China and Latin America. China’s installing renewable energy capacity so fast its own electricity grid can’t keep up.

These investments will help drive the cost of clean energy down, as investment in fossil fuel projects struggles to compete against the priority of governments and companies to meet their climate change targets.

The G7 — the world’s largest economies — have announced they will stop the funding of any overseas fossil fuel development at the end of 2022, shifting tens of billions of investment into clean energy sources.

Even the oil industry is turning, with Goldman Sachs estimating 14% of the oil industry’s budget was allocated to renewables in 2021, against 4% in 2019.

Oil is back, but this will only accelerate the clean energy transition.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.