- global fertilizer market set to increase to US$240 billion by 2030

- fertilizer prices rose 80% in 2021, and 30% at start of 2022

- Agtech raised record US$52 billion in 2021, double the investment in 2020

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The global fertilizer market is forecast to grow 12% in 2022 to be worth more than US$193 billion, in comparison with 2021 — and increase to US$240 billion by 2030.

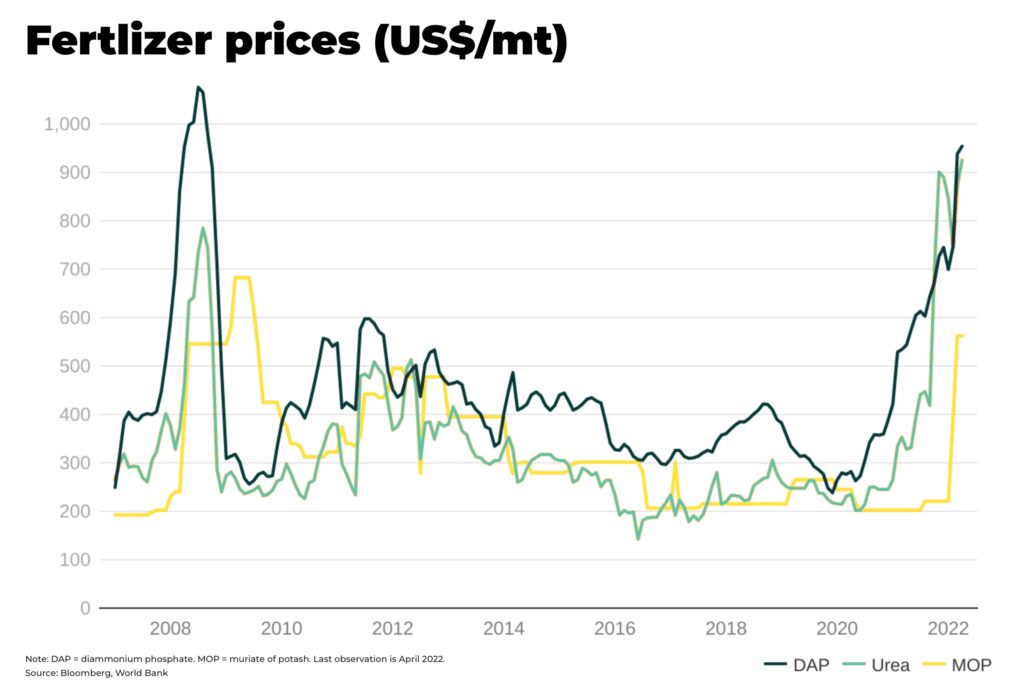

The primary chemicals that make up artificial fertilizer — nitrogen, phosphorus and potassium (or potash) — are soaring in price. Fertilizer prices have risen another 30% since the start of 2022, after a surge of 80% last year.

The reason is a substantial crunch in supply and costs, as demand continues to increase.

It is difficult to overstate the importance of fertilizer, which is essential to agriculture and growing crops to feed the world’s population. Without fertilizer, the International Fertilizer Association estimates we would be able to feed only half the world’s population.

“Global fertilizer prices are at near record levels and may remain elevated throughout 2022 and beyond”

— USDA FAS, International Agricultural Trade Report

The major drivers behind the current crisis:

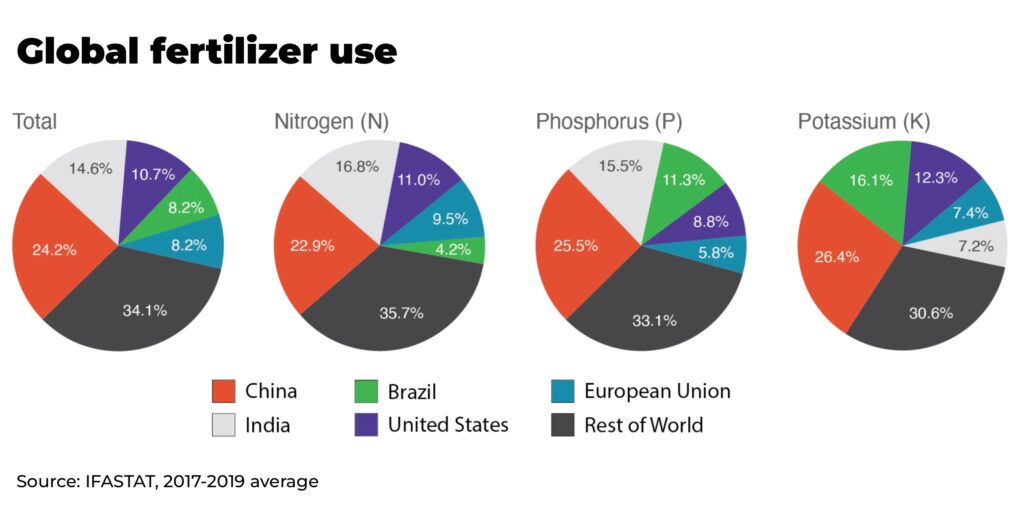

Population growth and richer economies, particularly in Asia, have significantly increased food demand. Not just quantity, but quality. In 1961 China consumed only 3.6kg/year meat per person, but it is now the largest consumer of meat in the world, expected to have a per capita meat consumption of 35.6kg a year by 2031.

The Covid pandemic and economic lockdowns created supply chain problems with labour shortages and travel restrictions disrupting fertilizer production and transport.

The Russian invasion of Ukraine and subsequent sanctions sent fertilizer prices soaring. Russia and Belarus, which has backed the invasion of Ukraine, account for 20% of the world’s fertilizer supply, including more than 40% of global exports of potash. The West has not sanctioned Russian or Belarusian fertilizer directly, but the war and sanctions on banks and other businesses have severely disrupted transport and supply. Russia has also introduced a quota system for exports “to prevent a domestic shortage,” says Moscow.

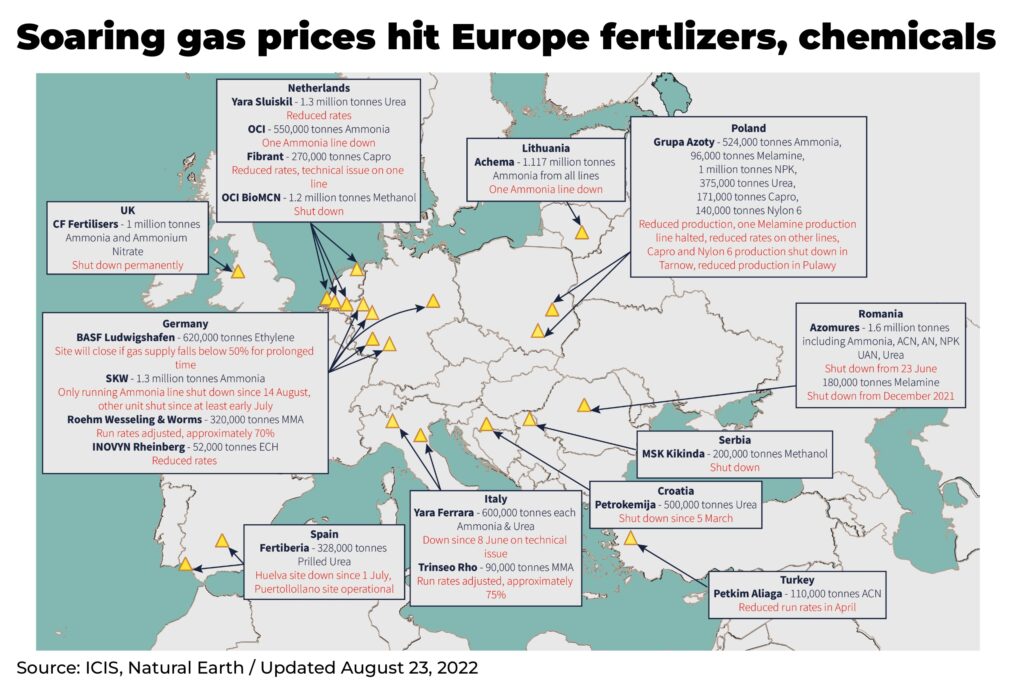

The invasion also sent natural gas prices to record levels as Russia shuts off significant gas exports to Europe (read our analysis on rising natural gas prices). This is a problem as natural gas is used to make nitrogen based fertilizer and, with the costs of natural gas so high, many fertilizer plants, especially in Europe, are forced to stop production — an estimated 25% of nitrogen capacity in Europe is currently down.

“The energy environment will be subjected to high prices and high pressures, which will impose pressure on fertilizers. For short term and medium term (at least for the next two years), we will see high fertilizer prices”

— World Bank, Commodity Markets Outlook, 2022

Severe weather has disrupted production, particularly in China — the world’s largest producer of fertilizer — where a record heatwave forced authorities to impose electricity rationing, forcing some fertilizer production plants to reduce production. China, similar to Russia, suspended exports of fertilizer in the first half of 2022 and are currently exporting on a quota system.

The problems are acute, but this is no short-term problem. Many of the big orders for fertilizer would have been made last year, so they would have avoided the recent spike in prices. Instead, the new costs will roll into next year, especially if the war in Ukraine continues.

“If European farmers import more products from other exporters, then for the more fragile agricultural markets in sub-Saharan Africa, South Asia and parts of Latin America, this will make the global market tight”

— IFA, Director of Market Intelligence, Laura Cross.

The knock-on effects are numerous and severe. Fertilizer prices account for nearly one-fifth of US farm cash costs, so if farmers cut fertilizer usage because of costs, with a fall forecast to be at least 7%, the harvest will be smaller. (read our analysis on inflation)

And, while farmers in richer countries will be supported by governments — for example, US$250 million investment has been announced by USDA to support American-made fertilizer — in many developing countries there will be no support.

There will be a see-saw as prices for both fertilizer and natural gas swing between rising demand and tight supply, versus an economic downturn where businesses and consumers look to cut costs. But, especially if the war in Ukraine continues, we expect volatility to continue for several years.

So, supply is tight and demand is rising. How can investors get exposure?

Firstly, countries that are big producers of fertilizer and not impacted by Western sanctions, such as Canada and the US, offer security. However, you must pick your stocks carefully: N2O is almost 300 times more potent than CO2 over a 100-year period, leading the Canadian government (and others, such as the Netherlands) to set a 30%reduction of greenhouse gases from fertilizer application by 2030. Because of the impact of nitrogen-based fertilizers on climate change, we expect demand for potash to increase – again, putting Canada which sits on the world’s largest reserves of potash, in the spotlight.

Nutrien (NTR:TO) is a Canadian global player that is planning to boost production by 40% compared to 2020, to 18 million tonnes of potash production.

The Mosaic Company (NYSE:MOS) is the world’s largest combined producer and distributor of phosphate-based crop nutrients, with reported revenue of $5.4 billion.

CF Industries Holdings (CF:NYSE) is a US based manufacturer of agricultural fertilizers.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Israel Chemicals Limited chart (ICL:N) is the sixth largest potash producer in the world and is betting on a new type of fertilizer called “Polysulphate.”

But, as prices rise, many farmers will be looking to efficiency to save money. This is where Agtech — agriculture technology — comes in, which just raised a record $52 billion in 2021, double the investment in 2020. (read more on our introduction to Agtech)

In particular, startups developing biological replacements for artificial fertilizers and pesticides — so called biofertilizers, biopesticides, biofungicides, biostimulants — for crops raised just over $892 million worldwide 2021.

Pivot Bio’s has raised $430 million for it’s gene-editing technology enabling microbes that convert atmospheric nitrogen to enrich the soil organically, thereby potentially reducing the use of nitrogen-based fertilizers significantly.

Kula Bio raised $10 million last year for its technology harnessing bacteria to remove nitrogen from the air and store in the soil organically.

Anuvia Plant Nutrients manufactures bio-fertilizer, promising to control the release of nutrients as plants grow, as well as restoring carbon to the soil.

High fertilizer prices also allow quality manure-based fertilizer products to compete. Companies like Chonex boast a sustainable product created with technology that allows a high-quality product that reduces need for artificial fertilizer.

Some the major players such as Bayer and Corteva are also investing heavily in the development of biofertlizers.

Investment in fertilizer has plenty of room to grow.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.