Critical Minerals and Energy Intelligence

Oil

The natural gas and LNG (liquified natural gas) market spiked into global significance after Russia’s invasion of Ukraine and the subsequent restrictions on exports.

Since 2022, the LNG market has seen historic volatility, as the US became the world’s largest exporter of LNG, Qatar invest billions, and Europe and Asia compete over prices.

Prices have fallen since the highs of the invasion, but the scale of the logistical challenges and investment opportunities are still only just taking shape with global LNG and natural gas markets expected to remain tight and volatile, especially with Europe’s storage needs and reduced Russian pipeline flows driving higher LNG imports. North America’s export surge will be crucial, but any supply disruptions or extreme weather could quickly tip the balance, fueling price swings and intensifying competition between Europe and Asia. Geopolitical tensions, infrastructure constraints, and environmental regulations will continue to shape market dynamics for the foreseeable future.

Oil Insights

What is oil?

Oil, or crude oil, is a naturally occurring liquid fossil fuel formed from ancient organic matter buried and transformed under heat and pressure over millions of years. It is a complex mixture of hydrocarbons and other organic compounds, extracted from underground reservoirs and refined into fuels such as gasoline, diesel, jet fuel, and petrochemical feedstocks. Oil is the world’s most traded commodity and remains the backbone of global energy and transportation systems.

Why is oil important?

Oil is vital for the global economy and modern life. It powers transportation (cars, trucks, ships, planes), generates electricity, and is a key raw material for countless products, including plastics, fertilizers, chemicals, and pharmaceuticals. Oil markets are closely linked to geopolitics, economic growth, and energy security. Despite the push for decarbonization, oil remains indispensable for sectors where alternatives are limited or still emerging.

Supply and demand dynamics

Demand trends

-

global oil demand reached a record high of over 103 million barrels per day (bpd) in 2024 and is forecast to grow further in 2025, though at a slower pace than in recent years

-

the International Energy Agency (IEA) projects demand will increase by 730,000 to 1 million bpd in 2025, with Asia, especially China and India-driving nearly 60% of this growth, mainly for petrochemicals and transportation fuels

-

however, demand growth is slowing compared to previous years, due to economic uncertainty, trade tensions, and the increasing adoption of renewable energy and efficiency measures

Supply trends

-

world oil supply is also rising, with OPEC+ and non-OPEC countries both increasing output. OPEC+ members, after voluntary cuts in 2023–24, are now raising production targets, while the U.S., Canada, Brazil, and Guyana are leading non-OPEC supply growth

-

US oil production is at record highs, but growth is expected to slow in 2025 due to lower prices and policy-driven trade frictions

-

sanctions on Russia and Iran have yet to cause major supply disruptions, but geopolitical risks remain elevated

Market volatility

-

oil prices have been volatile in 2025, pressured by increased supply, economic headwinds, and trade disputes. OPEC+ policy shifts and US tariffs have contributed to downward price swings, impacting producer revenues and investment

-

the outlook is clouded by macroeconomic uncertainty, ongoing trade tensions, and evolving energy transition policies, making the market highly sensitive to new developments

Oil remains a cornerstone of the global energy system, driving economic activity and underpinning modern infrastructure. While long-term demand faces headwinds from decarbonization and efficiency gains, oil’s role in transport, industry, and geopolitics ensures it will remain a critical commodity for years to come.

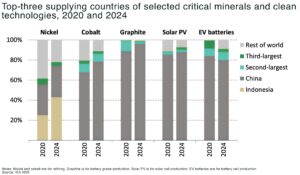

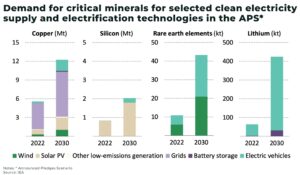

The next energy shock won’t be oil — it’ll be critical minerals, warns IEA

Key takeaways The International Energy Agency’s World Energy Outlook 2025 redefines energy security for the electric age: not oil or gas, but critical minerals are

Namibia’s oil boom: the race for Africa’s new energy frontier

Namibia is one of the world’s most significant oil frontiers, with estimated offshore reserves of 20 billion barrels and a remarkable success rate, similar to

Trump orders Federal Agencies to fast-track critical mineral and energy funding

President Trump has signed a new Presidential Memorandum instructing over a dozen US federal agencies to streamline and accelerate the funding process for energy infrastructure

Namibia: Africa’s new oil frontier

Namibia is one of the world’s most significant oil frontiers, with estimated offshore reserves of 20 billion barrels and a remarkable success rate, similar to

Can the US match China’s critical mineral stockpiles?

China’s strategic reserves of critical minerals, including copper and nickel, are estimated to be more than 35% to 133% of the country’s annual demand. This

A record of 500GW of renewable energy to be added in 2023

Investment in clean energy has increased 40% since 2020, with a record of more than 500GW of renewable generation capacity added in 2023 alone, according