- production and processing of critical minerals more globally concentrated than oil and natural gas

- US completely reliant on imports for 12 critical minerals and more than 50% dependent on foreign sources for additional 31

- growing geopolitical tensions and realignment has allowed critical minerals to be weaponized

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The vulnerability of critical minerals to geopolitical power is not new — but is now flashing red.

Critical minerals are increasingly leveraged for political power, moving from trade wars to hot wars. The critical mineral wars are here.

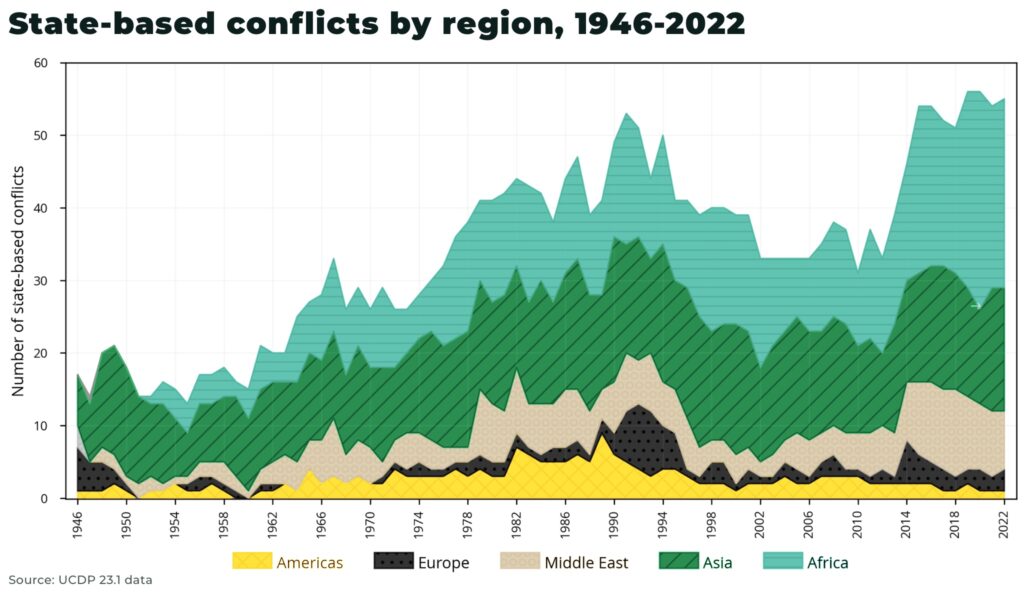

This may sounds like a truism — just like the sky is blue, so there will be more conflicts and they will be driven by resources. We argue that critical minerals will play, not necessarily an exclusive cause in some conflicts, but a more central role.

How should investors, now finding themselves on the frontline of a global battle for commodity security, prepare?

The end of 30 years of globalization

Global investments, arguably since the fall of the Soviet Union in 1991, have been underpinned by hyper-globalisation, driven by the security umbrella of American power and the historical growth of China’s economy. These two factors, as highlighted by Nial Ferguson’s “Chimerica”, have worked in tandem.

Of course, there have been conflicts over commodities (eg the first Iraq War), but since the fall of the Soviet Union in 1991, religion and ethnic division have played a more prominent role in many global conflicts (eg the Balkans, Ethiopia-Eritrea, 9/11, and Syria), and many international interventions driven by concerns over human rights (eg Rwanda).

This is now changing.

The Great Financial Crisis rocked global financial markets, national lockdowns during the Covid pandemic exposed the vulnerability of global supply chains, and Russia’s invasion of Ukraine highlighted risks in globalized energy markets.

And, while politicians and the media have focused on one disaster after another, the crisis that is critical mineral supply has escalated.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Mineral supply goes critical

Critical minerals are essential for the production of everything from electric vehicles to smartphones, military hardware to solar panels and wind turbines.

Global investment in the energy transition hit a record US$1.11 trillion in 2022, up 31% from 2021.

- in the US, energy transition investment increased 11% year-on-year to $141 billion in 2022

- China, US$550 billion in 2022

- Europe, US$227 billion in 2022

And, with trillions already invested in sunken costs, policy made law, decades worth of permits for infrastructure agreed — excepting a black swan event — the energy transition is hard-wired into the global economy.

The stakes to secure the economy and energy of the future are very high, and higher every year.

A major challenge is that the fragility of global supply chains for critical minerals are being exposed, just as demand is expected to increase significantly, driven by the energy transition, a growing global middle class, and technological development. For example,

- copper demand expected to double by 2035

- nickel demand expected to increase x3 times by 2030

- lithium demand to double by 2030

- silver demand for solar panels expected to rise x7 by 2030

- uranium at the start of a 10-year bull market

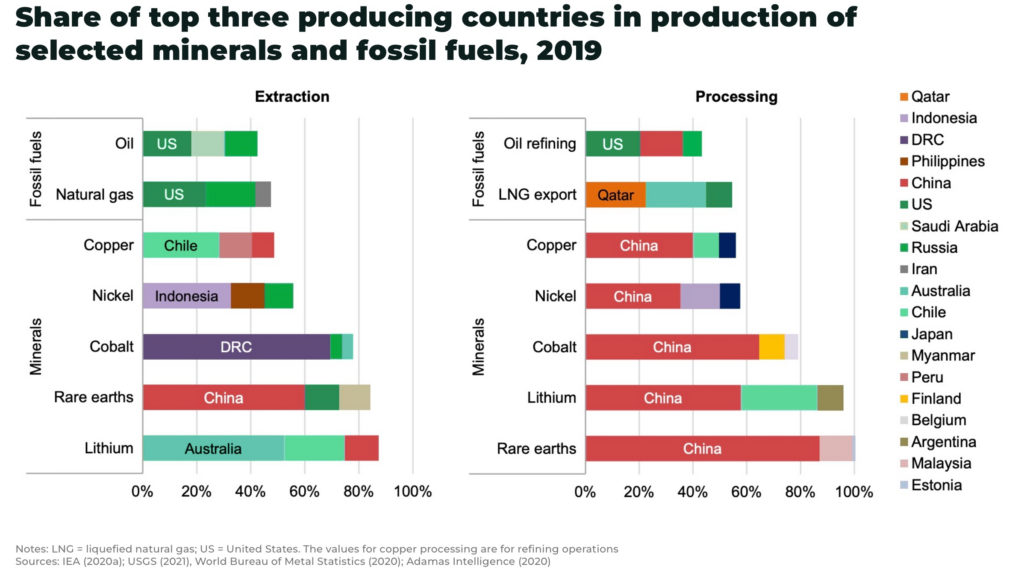

But, production and processing of critical minerals is now more globally concentrated than oil and natural gas, creating a new vulnerability in the global economy that is ripe for exploitation.

For example,

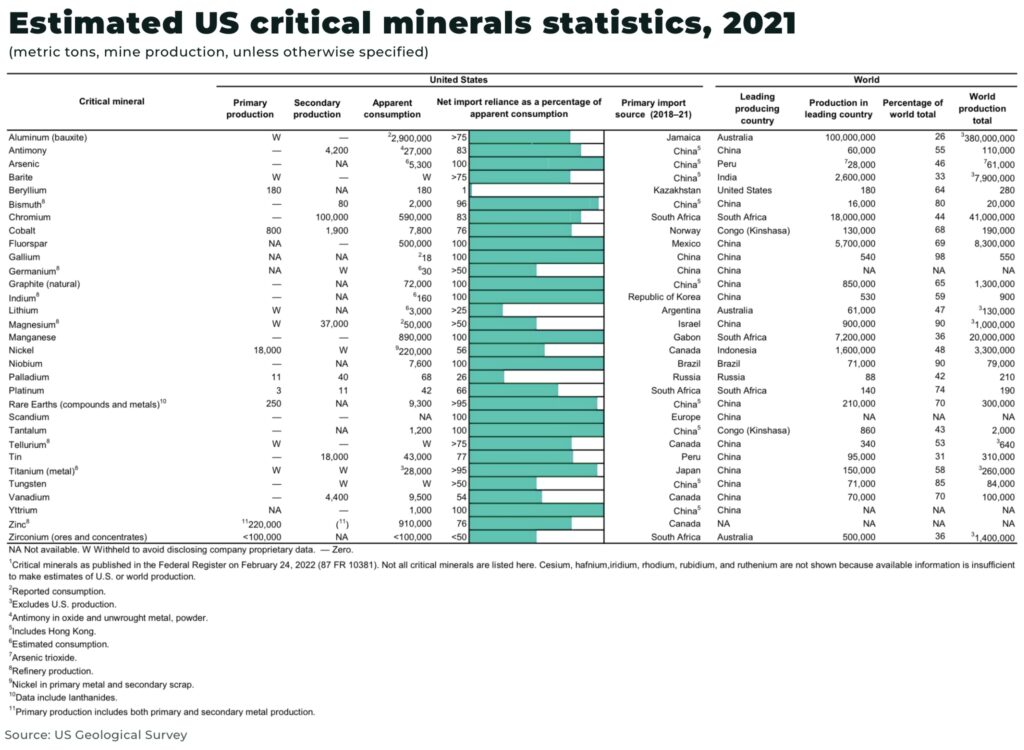

- lithium, cobalt and rare-earths, the top three-producing nations control 75% of global output

- China processes 50-70% of global lithium, 90% of rare earths, and 35% of nickel supply

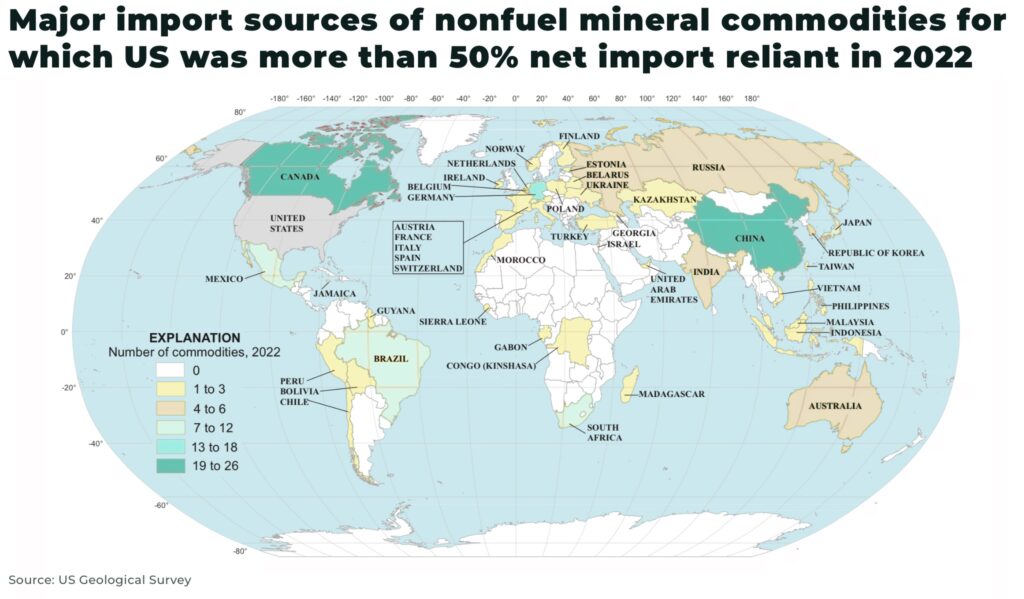

- of the 50 mineral commodities identified in the “2022 Final List of Critical Minerals,” the US was 100% net import reliant for 12, and an additional 31 critical mineral commodities (including 14 lanthanides, which are listed under rare earths) had a net import reliance greater than 50% of apparent consumption

In short: nervous over national security, countries are scrambling to secure their energy and resource supplies.

This is exacerbating existing tensions between geopolitical rivals, from the US to China, Europe to Russia, India to Africa. This is especially so as economies struggle with inflation/deflation and high interest rates in the West.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Critical mineral exploitation

Growing tensions and the geopolitical realignment has allowed commodities — including critical minerals — to be weaponized.

For example, US semiconductor and technology investment bans in China; Russia cutting off natural gas supplies to Europe; food prices rising with access to Ukraine’s Black Sea ports closed; India’s ban on rice exports raising prices; Indonesia’s restrictions on nickel exports to stimulate local investment; and China’s recent ban gallium and germanium exports.

Tensions and conflict, in turn, help to push commodity prices higher, further escalating tensions between consumer and producer — and the risk of more conflict.

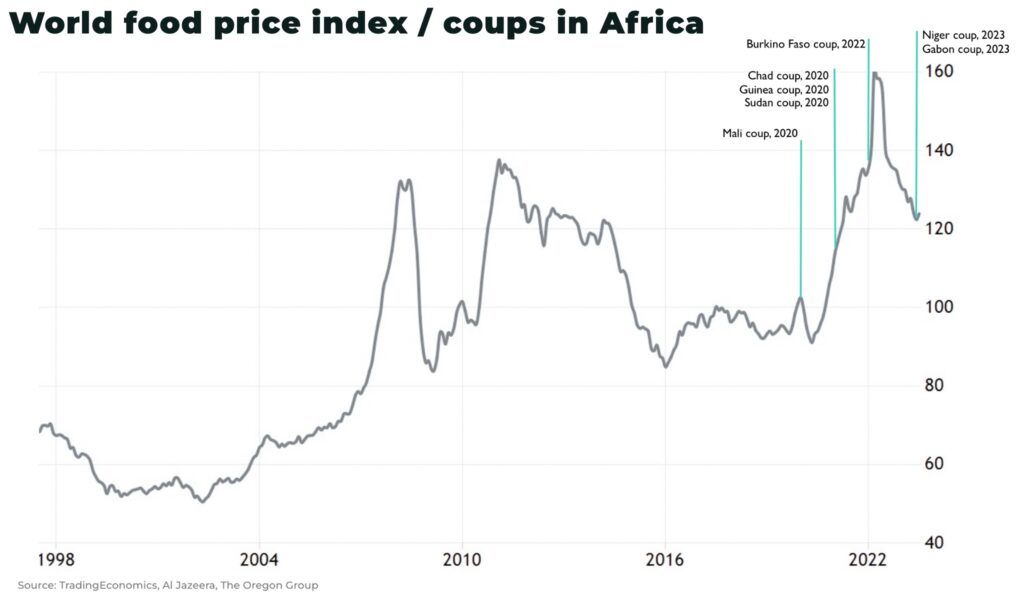

For example, since food prices started rising dramatically in the last few years, due to Covid, labour and freight costs, and the Ukraine war, the number of coups in Africa has risen dramatically. Just since the collapse of the Black Sea deal in August, allowing Ukraine to export grain, we’ve seen two military coups in Niger and Gabon.

And this conflict has an adverse impact on other commodity prices:

- Gabon is a member of OPEC, producing 200,000 barrels of oil a day

- Niger is 7th largest exporter of uranium in the world

- Guinea has world’s largest reserves of bauxite, essential for aluminium

- Chad and Sudan are both large oil exporters

- Burkina Faso and Mali are large uranium exporters

According to an IMF paper on “Macroeconomic shocks and conflict”, a negative terms-of-trade shock significantly increases the incidence and intensity of conflict.

“Our estimates indicate that a negative shock equivalent to one percent of GDP leads to an increase of 0.05 conflict events per one million people. The estimate of 0.05 events per one million people can explain 1.6 percent of the average conflict incidences that countries in our sample experience. Notably, the explanatory power of ToT shocks is twice as large for Low-Income Countries (LICs) and Fragile and Conflict-affected States (FCS)”

— IMF, Macroeconomic shocks and conflict

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

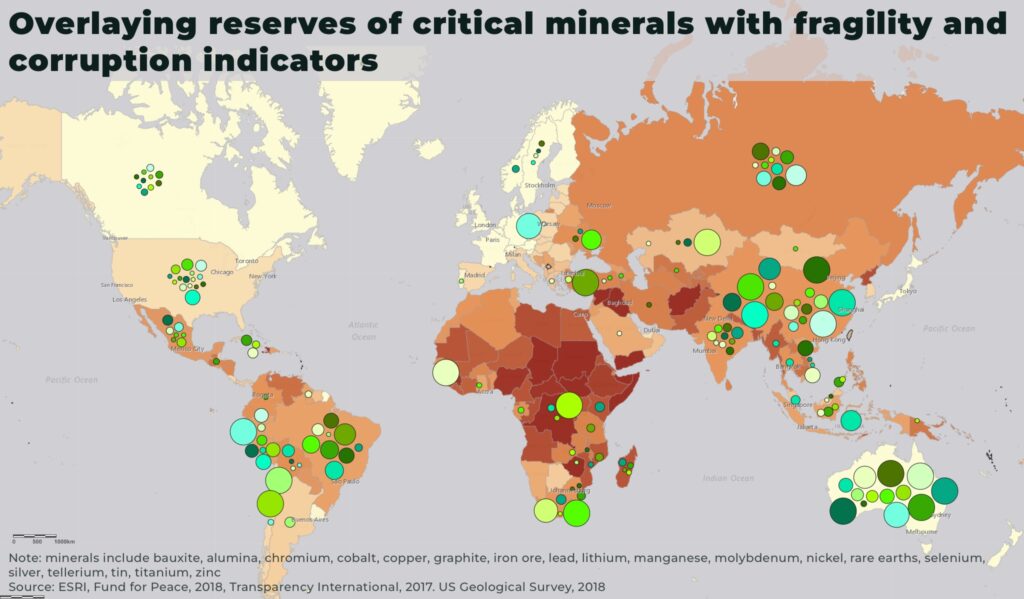

The map below highlights the challenge for securing critical mineral supply chains, with reserves of minerals essential for the energy transition — from copper to manganese, nickel to tellurium — overlaid on countries ranked by their fragility and corruption index.

Competing global powers

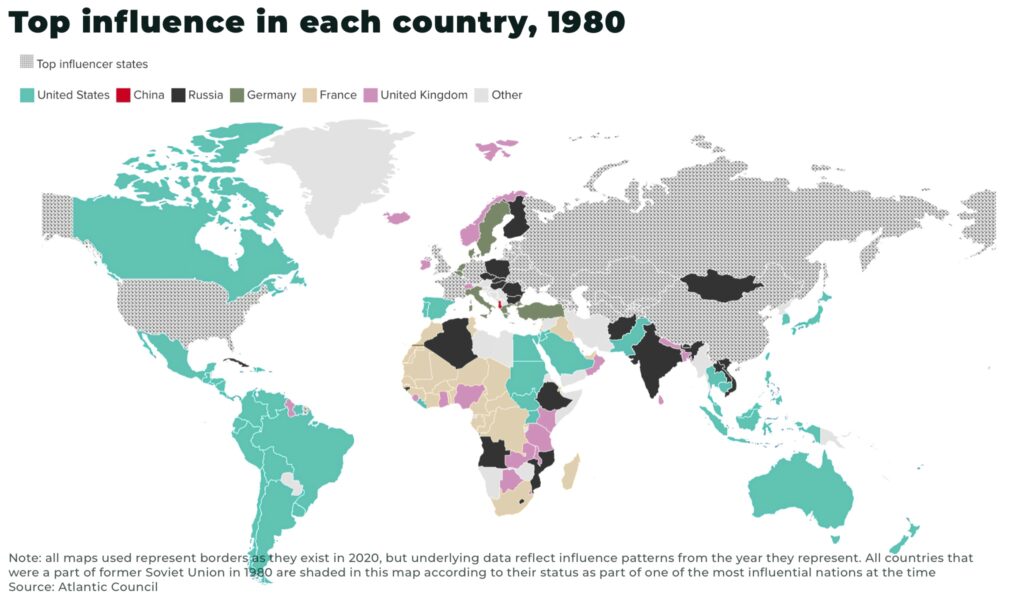

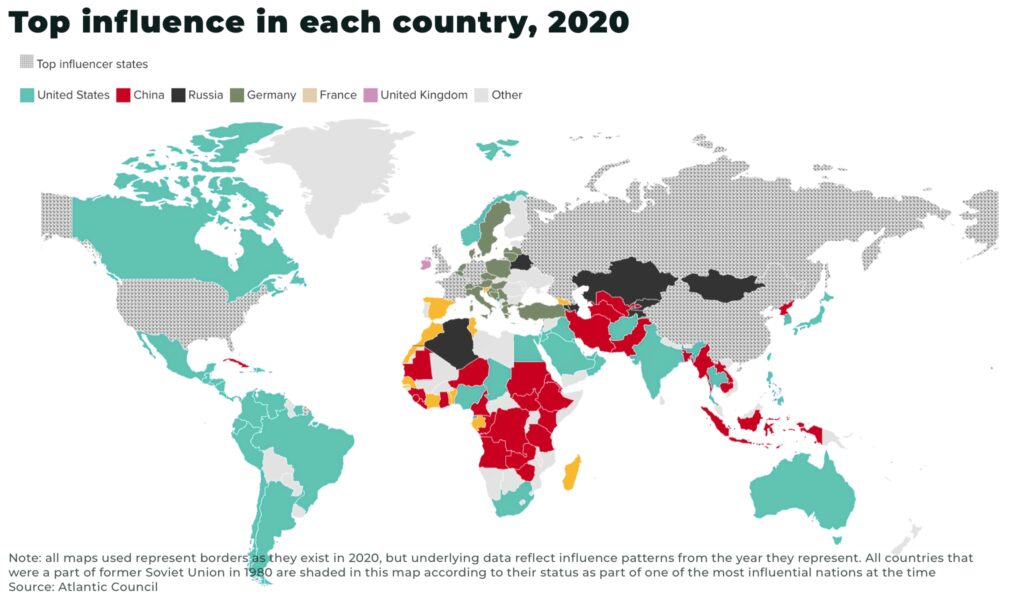

What’s been missing in many conflicts since the fall of the Berlin Wall, and the subsequent end of the US-USSR rivalry, is geopolitical blocs competing for regional influence.

This has now changed, but instead of ideology (although, plenty of Cold War competition was over resources as well), the new rivalry is increasingly focused on supply chains. And it’s arguably critical minerals where the West is most vulnerable.

Since the fall of the USSR, there were few guarantors of security that armed opposition groups around the world could turn to for support, giving the USA significant influence in pushing back against regimes that threatened their interests, the so-called unipolar moment.

This dynamic has now changed.

The US has largely withdrawn from many of it’s major overseas military engagements, for example, in Iraq and Afghanistan. It’s a precedent that largely overshadows its growing list of about 800 military bases and commitments elsewhere around the world.

Russia and China have stepped in to provide alternative source of support for regimes, for example, through China’s Belt-and-Road initiative and Russia’s Wagner group.

According to a report by the Atlantic Council, Chinese influence has surpassed America’s in 61 countries, a shift driven by economic and diplomatic investments.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

When does a trade war become a “hot” war?

The complexities in relationships between countries are too complex to predict who, why, how, events might tip from a trade war into armed conflict.

However, we no longer think it’s a matter of if, but when control of critical mineral supply will be leveraged by local and international factions for financial and diplomatic gain, sparking retaliatory measures by their rivals to secure their own supply.

(See our report: Niger crisis is a warning, commodity conflict is coming)

To illustrate our concerns, we have provided some potential examples below. Please note, these are not necessarily forecasts, but rather a way to help investors stay alert to potential crises.

- a military coup in a country with a significant production of critical minerals, and threatening to cut supply or nationalise investment; for example, see our report: Niger crisis is a warning, commodity conflict is coming

- international sanctions of a critical mineral or technology against a country that pressures them to act; for example, the US sanctions on superconductor technology to China, and now China’s retaliatory export ban of critical minerals gallium and germanium

- knock-on effects of conflict or rising commodity prices elsewhere impact regional stability elsewhere; for example, the war in Ukraine is destabilizing commodity and critical mineral prices from food prices to uranium exports, oil to aluminium

- other factors, including anything from local disputes to an international accident, spark a conflict in a region with control over critical mineral supply, quickly giving security of the critical mineral supply urgent priority for other factions; for example, an incident in the Strait of Hormuz between Iran and the US

So what can investors do to prepare for a possible conflict over critical minerals? Here are a few things to consider:

- invest in diversified portfolios, to reduce your exposure to any one commodity or country

- focus on companies that are vertically integrated, to reduce risk of supply disruptions as they have greater control over the production process, from mining to refining

- invest in companies developing new technologies, that allow them to stay ahead of potential disruptions

- keep a close eye, not just on prices, but geopolitical developments, especially risks to critical minerals

To paraphrase President John F. Kennedy’s quote “Secure peace, by preparing for war” — secure your investments by preparing for war.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.