- Russia’s 11 million shells fired against Ukraine in 2022 contain same amount of copper as 10% of UK’s total wind turbine capacity

- US Department of Defense used 750,000 tons of minerals in 2017, when it faced no major military conflict

- US is 100% net import reliant for 12 critical minerals, and had net import reliance greater than 50% of apparent consumption for 31 others

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Over the summer last year, Ukraine fired — on a daily basis — up to 7,000 artillery rounds, much of it supplied by the US and Europe. Russia fired an estimated 11 million artillery shells in 2022.

Most of these are 155mm shells, with a varying amount of metals depending on design, manufacturer, etc — but can contain, at least, an estimated 0.5kg of copper, depending on the shell and manufacturing process.

To put in perspective, just for Russia’s 11 million shells in 2022, that’s 5500 tonnes of copper. Or, the same amount of copper in 1,170 wind turbines, roughly 10% of the same number of wind turbines in the UK. And that’s just Russian shells.

Copper demand is already forecast to increase by more than 100% by 2035, from current production of 25 million metric tons (MMt) to 50MMt. But, as we warn in our latest report, we expect a copper supply shortfall of at least 10 million mt after years of underinvestment in the industry amidst falling ore grades.

And many of the demand and supply forecasts are not taking into account any significant increases in military demand.

Because the market is so tight, any increase in demand — especially military demand, which often takes priority — has the potential to have significant impact on the market.

And we’re not just talking about copper.

Military demand ramping up as stocks depleted

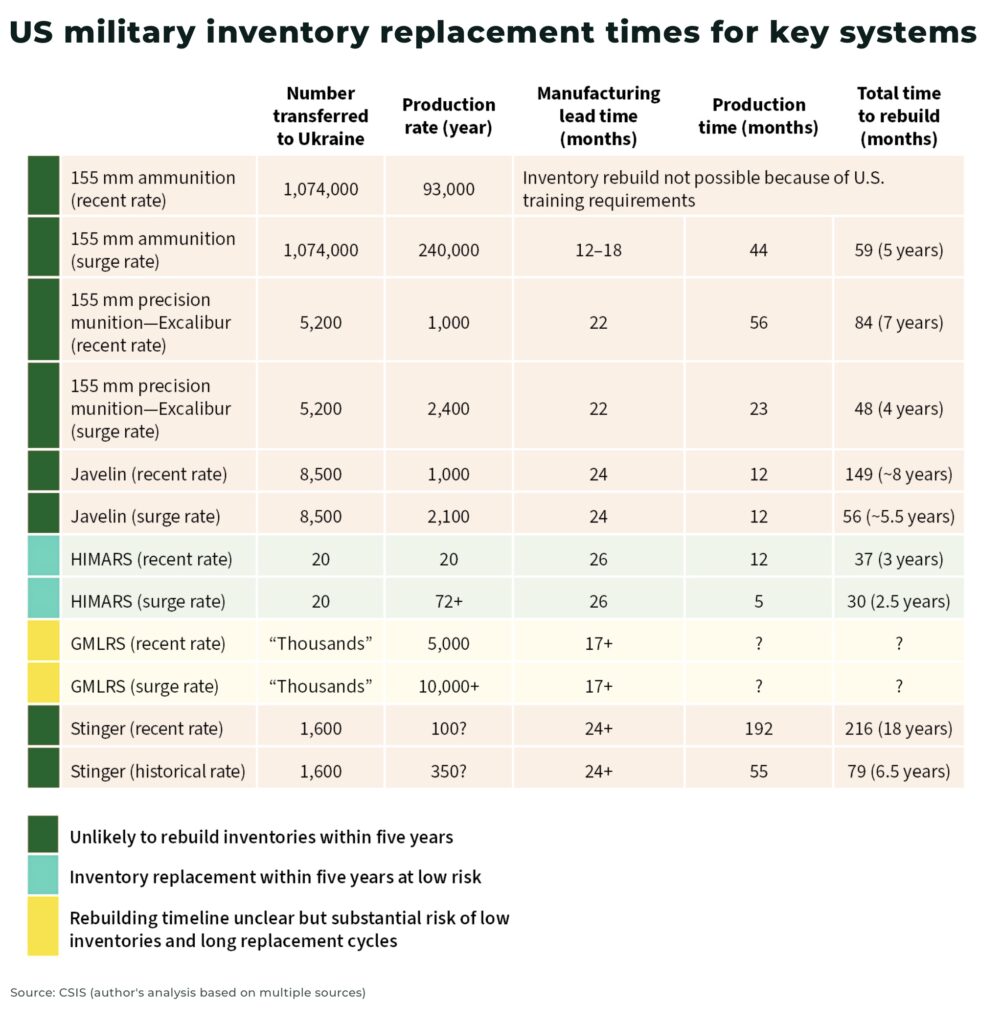

Exact figures on how much ammunition and equipment remains in military inventories, as well as costs and minerals needed, is highly classified. However, there are numerous reports that give some insight into the seriousness of the shortage unfolding.

The US Department of Defense (DoD) used 750,000 tons of minerals, for everything from ammunition to aircraft carriers, in 2017 when the US faced no major military conflict.

Now, the US military is preparing to support two wars with allies — supporting Ukraine and Israel — soon after ending two other wars in Iraq and Afghanistan, while also maintaining commitments to more than 750 bases in at least 80 countries, as well as a military deterrence against China.

In CSIS war games, a war in the Taiwan Strait between the US and China, the US used more than 5,000 long-range weapons in just three weeks of fighting.

But stockpiles of weapons and ammunition are running low, with the US supply of 155mm artillery rounds so low that Biden administration decided earlier this year to send controverisal clusterbombs instead.

“The bottom of the barrel is now visible… We give away weapons systems to Ukraine, which is great, and ammunition, but not from full warehouses. We started to give away from half-full or lower warehouses in Europe”

— Admiral Rob Bauer of the Netherlands, the chair of the NATO Military Committee and NATO’s most senior military official, said during a discussion at the Warsaw Security Forum

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Analysis by the Centre for Strategic and International Studies (CSIS) highlights the problem: significant amount of weaponry has been sent to Ukraine already with, not only stocks running low, but production time to rebuild potentially taking from 3-18 years depending on the equipment.

The US aims to increase production of artillery shells to about 100,000 shells in 2025, from the current rate of 28,000 per month (up from 14,000 per month six months ago).

To help meet production targets, the US Army is reportedly planning to invest US$18billion over the next 15 years to modernize it’s industrial base, with US$2.5billion invested in 2023 alone.

The US has committed over $15.2 billion in security assistance to Ukraine since January 2021.

The latest US$2.1 billion Ukraine Security Assistance Initiative — separate from previous presidential drawdowns that is drawn down from DoD stocks — plans to procure munitions directly from industry rather than delivering equipment. This includes:

- anti-aircraft ammunition: 30mm and 23mm, artillery rounds: 130mm and 122mm, grad rockets: 122mm, rocket launchers and ammunition, mortar systems and rounds (120mm, 81mm, 60mm) tank ammunition: 120mm, javelin anti-armor systems, anti-armor rockets, precision aerial munitions, about 3,600 small arms and more than 23,000,000 rounds of small-arms ammunition, additional munitions for National Advanced Surface-to-Air Missile Systems

- 7 tactical vehicles to recover equipment, 8 heavy fuel tankers and 105 fuel trailers, armored bridging systems, 4 logistics support vehicles, trucks and 10 trailers to transport heavy equipment

- 9 counter-unmanned serial system 30mm gun trucks, mobile counter-unmanned aircraft system, or C-UAS, 10 laser-guided rocket systems, secure communications equipment, 3 air surveillance radars

We are focused on the US, as it is the world’s leading arms manufacturer, but this is a trend across the Western world and beyond.

- in Europe, a dozen countries including Germany and Poland, have delivered up to 223,000 artillery shells, 2,300 missiles, and promised to deliver up to 400,000 rounds of ammunition, with approximately 70,000 estimated to be 155mm. But with a 12 month deadline, only 30% has reportedly been delivered

- in a high-intensity conflict, the UK would run out of ammo in 8 days, Germany after two days

- Germany reportedly needs over US$20billion worth of orders to replenish military stocks, but only 10% of this demand will be contracted by the end of 2023

- France has ordered the country’s military contractors to plan a “war economy” strategy to increase production, including over US$2billion worth of munitions

- NATO is expected to ask its members to raise its ammunition stockpiles

- Russia has a reported capacity to produce up to two million artillery rounds a year and 200 tanks

- and China, according to the latest US DoD report, “continues to modernize equipment and focus on combined arms and joint training in effort to meet the goal of becoming a world class military”

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Critical minerals needed

Secure critical mineral supply chains are essential to sustain any significant military.

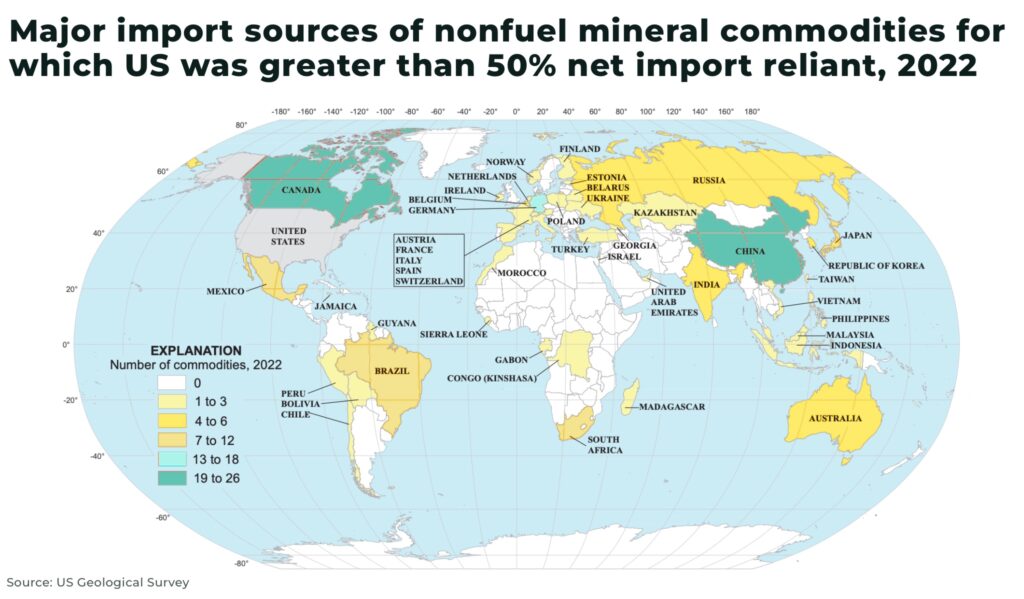

The challenge: the US identified 50 critical minerals in 2022 but was 100% net import reliant for 12, and had a net import reliance greater than 50% of apparent consumption for 31 others.

In other words — as highlighted by recent export ban on gallium and germanium by China, which supplies 54% of all US Germanium — the US military critical mineral supply chain is extremely vulnerable.

“These minerals are absolutely essential to our national security and the security of our allies”

— US Senator John Barrasso, ranking member of the Senate Committee on Energy and Natural Resources

Some examples to highlight the importance of critical minerals to any modern military:

- copper: used in wide-range of military applications, from wiring to guidance systems, ammunition to naval vessels

- nickel: essential to produce stainless steel, used across armour plating in tanks, aerospace alloys, ships, and military batteries

- uranium: used in the production of nuclear fuel for nuclear submarines and aircraft carriers

- lithium: lithium batteries are found in nearly a significant number of weapon systems used by the US military, particularly for portable equipment and satellites

- rare earths: used in a variety of military applications, from strong alloys in aircraft engines to sensors, magnets and lasers; for example, in Javelin missiles and F-35 fighter jets

- antimony: an essential mineral in the production of armour-piercing bullets, night-vision goggles, tracer ammunition, and much more

The list goes on, from Germanium in infrared devices, to aluminium for aircraft, silver in Apache helicopters.

As we highlighted in our analysis on the US Military and Critical Minerals: The New Arms Race, the US is investing hundreds of billions to secure supplies.

US stockpile

The Defense National Stockpile Center (DNSC), founded after World War I, maintains an emergency stockpile of critical commodities, but the market value of the inventory has fallen 98% from US$9.6billion in 1989 (at the height of the Cold War) to US$888 million in 2021 — and could be insolvent by 2025.

Europe’s military stockpiles, judging by reports, are in an even worse state.

Critical mineral military demand

So, what do the current levels of stockpiles, global conflict and geopolitical tensions mean for critical mineral demand?

Military mineral orders and projections are highly classified, but it’s possible to judge the scale of the demand from the military budgets ramping up to try and resolve the massive shortfall:

- the National Defense Authorization Act authorizes US$816.7 billion — in absolute terms, one of the highest since World War II — to the Defense Department for 2023, including US$1billion to boost critical mineral stockpiles (in particular, doubling the value of Rare Earths)

- about US$1.2 billion in contracts are underway to replenish US military stocks for weapons sent to Ukraine, including about US$352 million in funding for replacement Javelin missiles, US$624 million for replacement Stinger missiles, and US$33 million for replacement HIMARS systems

- US$1.2 billion in contracts are underway for equipment promised to Ukraine under USAI, including 155mm ammunition, Switchblade unmanned aerial systems, radar systems and tactical vehicles

- the Infrastructure Investment and Jobs Act appropriated US$7 billion for battery supply chains, including critical mineral production

- the Inflation Reduction Act in 2022, included a 30% tax credit for investments in battery material projects and a 10% tax credit for critical mineral production costs

- according to Tim Gorman, a spokesperson for the Department of Defense (DoD), the Pentagon is awarding contracts at an “unprecedented pace”

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Some examples of the impact of the growing demand from the military for critical minerals include:

- a US$37.5 million agreement between the DoD and Graphite One (Alaska) to fast-track a domestic graphite mine

- two awards — US$24.8 million and US$15.5 million — by the DoD to Perpetua Resources to secure a domestic source of antimony

- a US$90million agreement to secure lithium production between the DoD and Abermarle

- a US $20.6 million agreement between the DoD and Talon Nickel to increase domestic nickel production

And there are many more.

Slowly, then all at once

The US military has identified numerous active national security threats on a scale much larger than anything the USA has managed since the end of the Cold War.

However, the global economy and supply chains have shifted significantly in the meantime.

We see the US military shifting it’s position and capacity to secure it’s critical mineral supply gaining more momentum than it has for arguably the past 30 years.

However, the US military America’s largest government agency, and it will take time.

And, if there’s another geopolitical crisis, it will happen all at once. And, as the US ramps up, so will other countries.

Exposure for investors

As we mentioned at the top, any increase in military demand for critical minerals has the potential to have an outsized impact on already tight and price — especially because it will need to be a secure supply of minerals.

Private investment increasingly looks to be a key driver to finance the US critical mineral strategy, with the US working with a network of mining and technology firms to help encourage investment in up to 15 global critical-minerals projects.

Security will arguably be the most important factor for any investor looking to gain exposure to military demand for critical minerals. For example, a secure location for the mineral deposit and mine, allied with the US, as well as ease and security for exports (see our analysis on mining and US supply chains in Australia and Canada).

Demand will particularly focus on the minerals that the US is 50-100% reliant on for imports, from gallium to manganese, titanium to cobalt.

And, particularly if another crises occurs sooner rather than later, there will be a demand to secure existing mines rather than developing new ones. See our analysis: The critical mineral wars are coming.

Stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.