- sales of electric vehicles forecast to rise over 10x by 2030

- electric vehicle sales growth has potential to create demand for cobalt, lithium, nickel worth US$300 billion by 2030*

- by 2030, demand could outstrip supply in cobalt by 32%, nickel by 22% and lithium by 13%

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

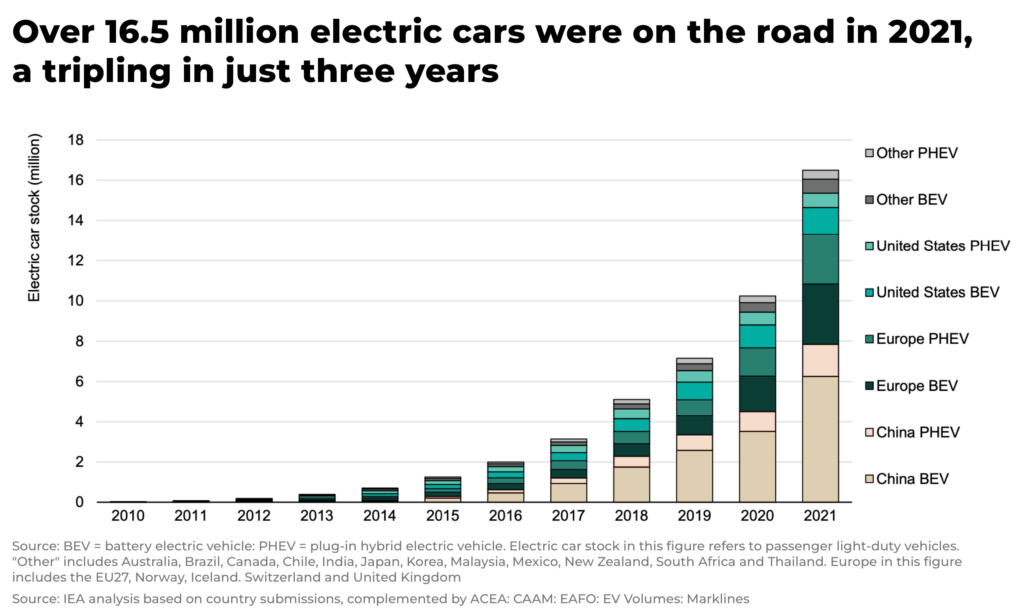

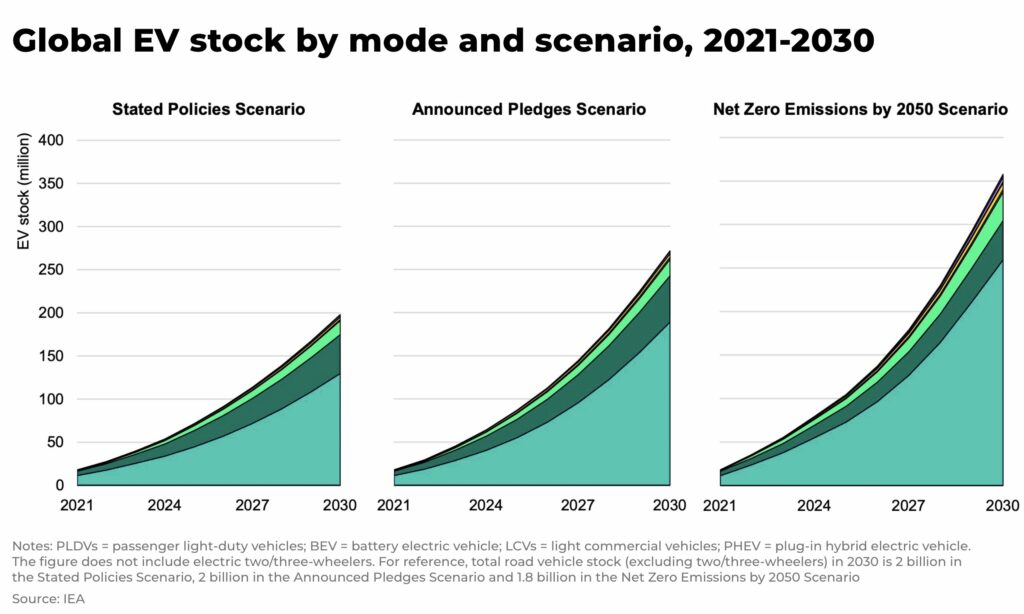

The proportion of electric vehicles (EVs) sold globally are forecast to rise more than tenfold from 3% in 2020 to 32% by 2030. This could rise to 58% in 2040.

We calculate this growth has the potential to create demand for cobalt, lithium and nickel worth $300 billion in 2030 at today’s prices.*

It is a commodities story that will help define this century.

And, so far, war in Europe, fears of recession, rising living costs and higher interest rates have not derailed soaring demand for EVs.

Sales of electric vehicles

Sales have been driven by carbon-conscious consumer sentiment and governments pledging to slash carbon emissions in the fight against climate change. In particular, policies such as the US Inflation Reduction Act and the European Green Deal, which promise trillions of dollars to decarbonize significant parts of the developed world economies.

This combination of sentiment, investment and momentum represent a change that will be difficult to reverse.

The challenge is how to deliver the EVs at the speed and cost at which consumers demand.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

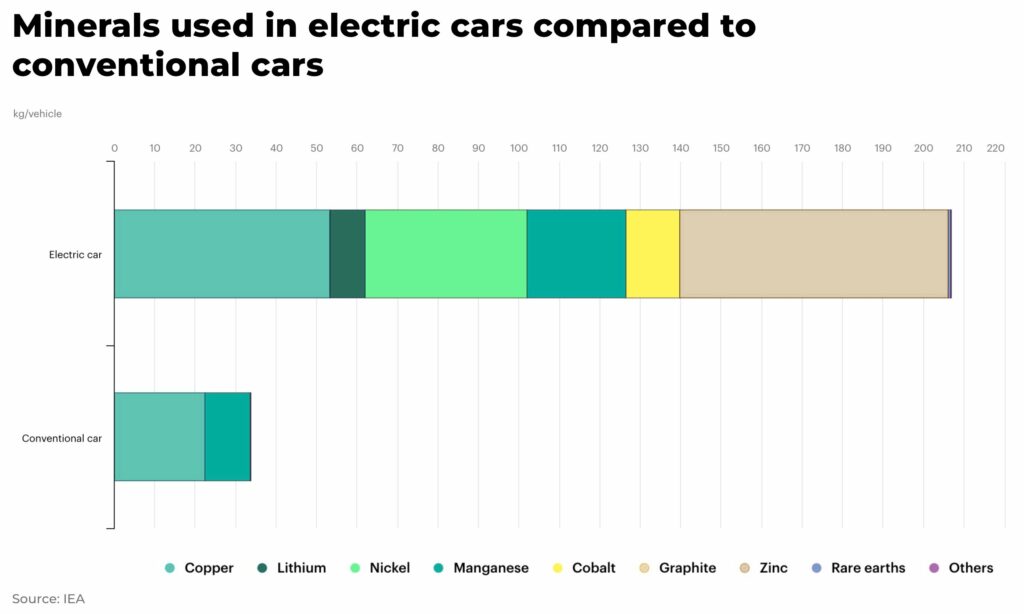

What metals are in an electric battery?

Electric battery demand is driven by electric cars which account for 85% of the projected total by 2030.

The main minerals that are essential in an electric battery include:

- Copper

- Lithium

- Nickel

- Manganese

- Cobalt

- Graphite

- Zinc

- Rare earths

Tight metals markets for electric vehicles

Even as growth in the auto sector as a whole has stalled due to a shortage of components, higher fuel prices and costly credit, sales of EVs have surged.

Overall sales at Ford dipped last year, for example, but consumers bought 45% more of its electric SUV Mustang E than the previous year.

Such is the rate of growth in EV demand that consultancy EY has pulled forward its forecasts of when EV sales in the US, Europe and China will outstrip those of vehicles powered solely by internal combustion engines.

“Despite a series of finance and energy related headwinds in the last 12 months, the EV revolution continues to gain momentum and the point at which we think EVs will come to dominate the marketplace has actually moved forward”

— Randall Miller, EY Global Advanced Manufacturing & Mobility Leader

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

This is already having a significant impact on demand and the price for metals.

Lithium — a critical component of electric batteries — is the obvious example, with prices hitting $80,800 per tonne in November 2022, a rise of over 1,000% since the start of last year.

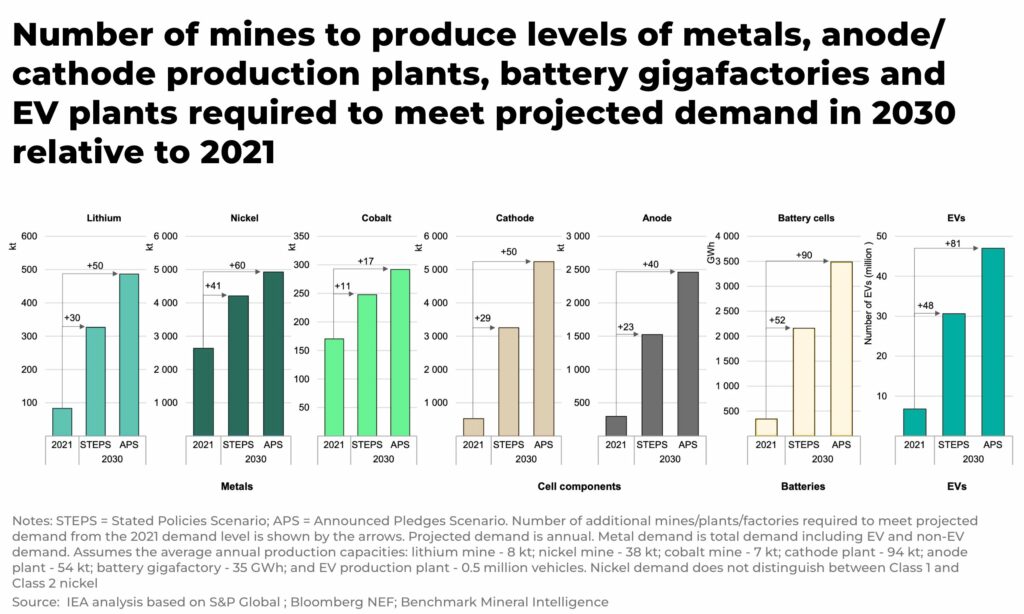

By 2030, Goldman Sachs predicts demand will outstrip supply in cobalt by 32%, in nickel by 22% and in lithium by 13%. McKinsey estimates demand for lithium could rise as much as x8 between 2021 and 2030, between 3.3 million and 3.8 million tonnes.

And it’s likely supply of these critical metals, such as cobalt, lithium and nickel will remain tight for years to come.

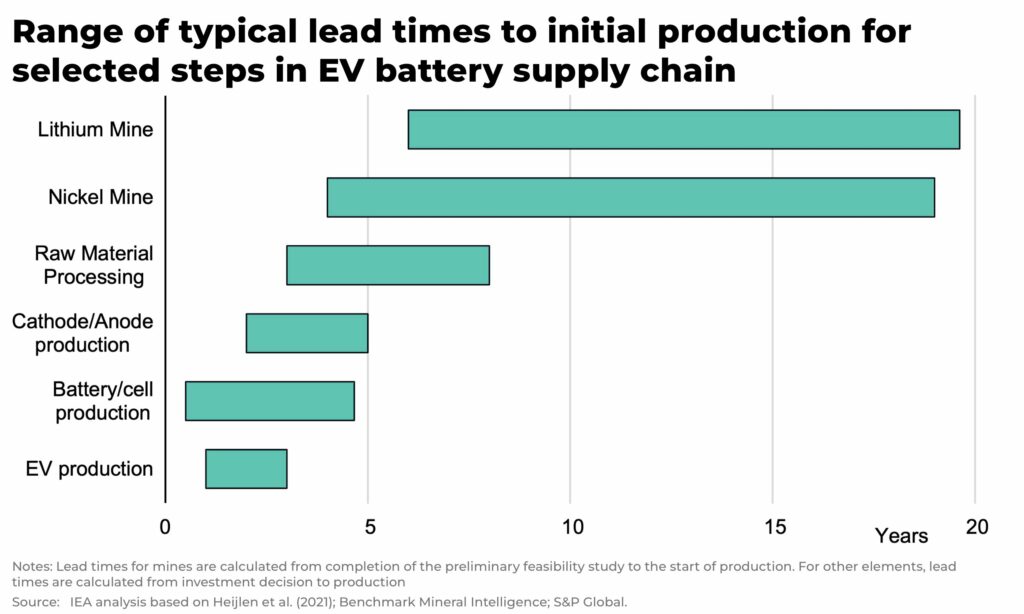

Despite significant government support and huge investment by companies in securing supply chains, it can still take up to 6-15 years — depending the metal — to construct a new mine and processing plant; the war in Ukraine and sanctions against Russia have impacted supply chains and costs (eg through inflation); and there is rising demand for metals to be sourced sustainably, as we outlined in our analysis on how nickel’s environmental challenge offers an opportunity to the West.

Looking at the market opportunity between now and 2030, exposure can be found upstream in significant producers of lithium, cobalt and nickel; in companies developing projects; in index funds and ETFs linked to electrification; EV manufacturers; or in well-placed processors in the middle of the supply chain.

In the short-term, the market opportunity for investors interested in exposure to the forecast growth in the price of metals remains wide open. There will, of course, be volatility (ending of EV subsidies in China, fears of recession in the West). But the change is happening faster than almost anyone predicted. So we see that volatility to the upside in the medium to long term.

*This estimation of market size is based on current lithium carbonate prices of around $66,000 per tonne multiplied by 3.8 million tonnes, the top of McKinsey’s estimated volume of demand in 2030, or $251 billion; plus Fastmarkets’ estimated demand of 1.4 million tonnes of nickel for EV batteries in 2030, at current prices of $29,000 per tonne, or $41 billion; plus the IEA’s estimated demand for cobalt of 174,000 tonnes under stated policies in 2030, at current values of around $39,000 per tonne, or $6.8 billion.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.