Critical Minerals and Energy Intelligence

LNG / Natural Gas

The natural gas and LNG (liquified natural gas) market spiked into global significance after Russia’s invasion of Ukraine and the subsequent restrictions on exports.

Since 2022, the LNG market has seen historic volatility, as the US became the world’s largest exporter of LNG, Qatar invest billions, and Europe and Asia compete over prices.

Prices have fallen since the highs of the invasion, but the scale of the logistical challenges and investment opportunities are still only just taking shape with global LNG and natural gas markets expected to remain tight and volatile, especially with Europe’s storage needs and reduced Russian pipeline flows driving higher LNG imports. North America’s export surge will be crucial, but any supply disruptions or extreme weather could quickly tip the balance, fueling price swings and intensifying competition between Europe and Asia. Geopolitical tensions, infrastructure constraints, and environmental regulations will continue to shape market dynamics for the foreseeable future.

LNG / Natural Gas Insights

Latest News

What is natural gas?

Natural gas is a non-renewable, naturally occurring hydrocarbon gas mixture, primarily composed of methane (70–95%), with smaller amounts of other gases such as ethane, propane, and traces of carbon dioxide and nitrogen. It is colorless, odorless (an odorant is added for safety), and highly flammable, formed over millions of years from the decomposition of organic matter deep beneath the Earth’s surface. Extracted via drilling, natural gas is processed and transported through pipelines or liquefied (LNG) for shipping.

Why is natural gas important?

Natural gas plays a crucial role in the global energy system, accounting for over 25% of U.S. energy consumption and a significant share worldwide. Its key advantages include:

versatility: used for electricity generation, heating, cooking, industrial processes, and as a chemical feedstock

cleaner burning: when burned, natural gas emits about half the carbon dioxide and far fewer pollutants than coal, making it a popular “bridge fuel” for reducing emissions during the energy transition

energy security: LNG (liquefied natural gas) enables countries to diversify supply sources and respond to disruptions, as seen in Japan’s pivot to LNG after the Fukushima disaster

grid flexibility: gas-fired power plants can ramp up and down quickly, complementing variable renewable energy sources like wind and solar

Supply and demand dynamics

Supply

global production: natural gas is produced worldwide, with major exporters including the U.S., Russia, Qatar, and Australia

LNG expansion: the US is leading global LNG supply growth in 2025, with new projects boosting export capacity and reshaping trade flows

geopolitical risks: supply is vulnerable to geopolitical events, such as reduced Russian pipeline flows to Europe and export policy changes in major producing countries

Demand

global trends: global natural gas demand reached an all-time high in 2024 and is forecast to grow by about 1.5% in 2025, with Asia accounting for one-third of incremental demand

regional shifts: Europe’s LNG imports are rebounding in 2025 after a sharp drop in 2024, driven by reduced Russian pipeline gas and the need to refill storage

sectoral use: the residential and commercial sectors are the main drivers of demand growth in 2025, while industrial and power sector demand growth is limited by higher prices and renewable energy expansion

market volatility: the market remains tight and volatile, with prices sensitive to weather, storage levels, and geopolitical developments

Natural gas remains a vital energy source due to its versatility, lower emissions profile, and role in energy security. However, its markets are increasingly shaped by shifting demand patterns, expanding LNG trade, and ongoing geopolitical and supply risks.

Is this the “shale moment” for critical mineral mining in the US?

A quiet revolution is underway in the bedrock of the global economy. The mining and processing of critical minerals — from lithium to rare earths,

The critical mineral wars are coming

The vulnerability of critical minerals to geopolitical power is not new — but is now flashing red. Critical minerals are increasingly leveraged for political power,

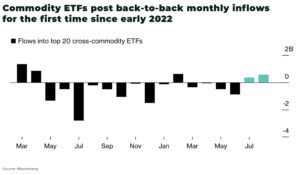

Commodity ETFs post first back-to-back inflows since Q1 2022

20 of the world’s largest broad-based commodity exchange traded funds (ETFs) have seen positive net investments of US$1 billion over July-August, 2023 — after almost a

Australia’s mining industry pivots to US investors

It’s no exaggeration to describe Australia as one of the most important mining countries in the world, as well as arguably the most attractive destination

Natural Gas production hits monthly record highs in US Permian basin

Natural gas production from largest shale field in the US, the Permian basin in Texas and New Mexico, has climbed to record highs every month

Temperatures forecast to “mild” for Europe in November, easing natural gas prices

A black swan to gas markets after the start of the Ukraine war was a mild winter, but Europe is experiencing a record mild winter